Where Can I Find My Agi On My Tax Return

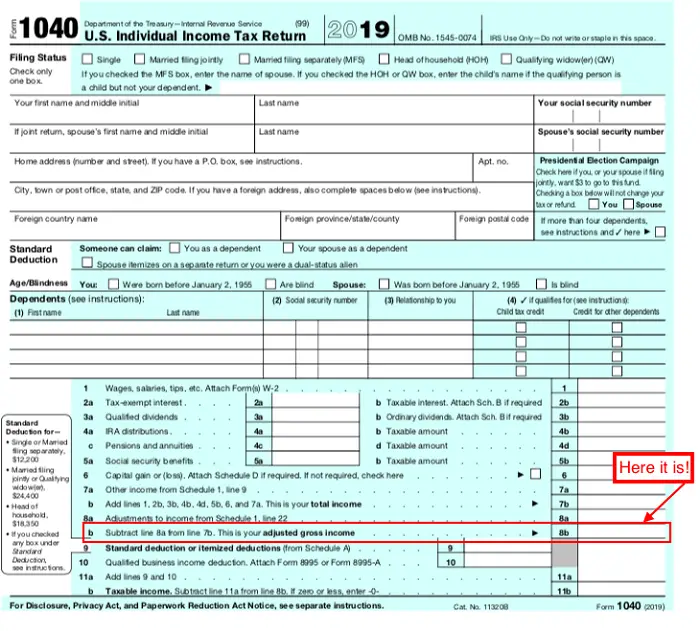

On your 2019 tax return, your AGI is on line 8b of the Form 1040. If you used a paid preparer last year, you might obtain a copy of last years tax return from that preparer.

How do I get Me AGI for last years tax return?

- You can find your AGI on last year s tax return . Youll find your Adjusted Gross Income on your original tax return , not your amended tax return . Heres how to find your AGI : 1040 long form: Youre AGI is on line 37. Form 1040A: Your AGI is on line 21. Form 1040EZ: Your AGI is on line 4.

Where Can I Find Last Years Adjusted Gross Income

The IRS recommends a few options for obtaining your prior-year AGI.

Preferred MethodYou should always retain a copy of your tax return.On your prior-year tax return, your AGI is on line 8b of the Form 1040.

- If you are using the same tax preparation software that you used last year, that software will likely have your prior-year tax return for you to access.

- If youre not using the same tax preparation software as last year, you may be able to access your prior-year software and view an electronic copy of your prior-year return.

- If you are a first-time filer over the age of 16 enter zero as your AGI.

- If you have an Identity Protection PIN, you should enter it when prompted by your software. It will serve to verify your identity, instead of your prior-year AGI or prior-year Self Select PIN. You can opt into the IP PIN program through the IRS online tool.

Alternative Methods

- If you do not have a copy of your tax return, you may use a Get Transcript self-help tool to get a Tax Return Transcript showing your AGI.

- Use the IRS Get Transcript Online tool to immediately view your AGI. You must pass the Secure Access identity verification process. Select the Tax Return Transcript and use only the Adjusted Gross Income line entry.

- Use Get Transcript by Mail or call 800-908-9946 if you cannot pass Secure Access and need to request a Tax Return Transcript. Please allow 5 to 10 days for delivery. Use only the Adjusted Gross Income line entry.

Importance Of The Agi

In addition to being used to verifying your identity, your AGI impacts many of the tax deductions and credits you can take at tax time. Thats especially important because deductions and credits can increase your tax refund or reduce the amount of taxes you owe. Depending on your filing status, you may be subject to a limit on your deductions based on your AGI which usually applies to higher income earners.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Read Also: How To Check Last Year Tax Return

What Is A For Agi Deduction Give Three Examples

What is a for AGI deduction? Give three examples. Examples include deductions for IRAs, Keoghs, or other self-employed qualified pension plans student loan interest moving expenses one-half the self-employment tax self-employed health insurance deduction penalty on early withdrawal of savings and alimony paid.

What Is My Agi On My 2019 Tax Return

asked: What is my AGI on my 2019 tax return?

The 2019 tax return is the current-year tax return.

What stage is your 2019 return in? Is your 2019 return still in preparation? If so, the following steps will tell how to see the AGI in your unfiled return.

NOTE: If your 2019 return has already been filed, then skip the below and see my follow-up comment in the next section that follows this posting.

In an unfiled return you can view your 2019 AGI figure on the Tax Summary or on a preview of your in-progress Form 1040.

Are you still preparing your 2019 return? If so, heres how to look at the Tax Summary and also how to preview the Form 1040 and Schedules 1-3 prior to paying/filing.

- Log in and open your return.

- In the left menu column, choose TAX TOOLS, then choose TOOLS.

- In the Tools window, choose View Tax Summary.

- When the Tax Summary opens, you can review the Summary. It may have the info you want.

- Otherwise, to preview the Form 1040, look in the left menu column and choose Preview My 1040.

- That will show you the Form 1040 and schedules 1-3.

Dont Miss: Doordash 1099 Form

Recommended Reading: How Much Do You Get Back In Tax Returns

Where Do I Find My Last Years Agi

For tax years 2020 and 2021, your AGI is calculated on page 1, line 11 of your Form 1040 or 1040-SR. Your AGI for tax year 2019 is on Line 8b.

Simply look at the printed copy of last years return to find your adjusted gross income. If you filed with TaxSlayer, you can also log in to My Account to view this info on your prior year return.

When you return to TaxSlayer to file your tax return each year, your AGI is pulled forward and entered into your current tax form.

Where Do I Find The Agi On My Tax Return

How do I get Me AGI for last years tax return?

- You can find your AGI on last year s tax return . Youll find your Adjusted Gross Income on your original tax return , not your amended tax return . Heres how to find your AGI : 1040 long form: Youre AGI is on line 37. Form 1040A: Your AGI is on line 21. Form 1040EZ: Your AGI is on line 4.

Don’t Miss: Are Roth Ira Contributions Tax Deductible

Where Can I Find My Prior Year Agi

AGI is a tax term that stands for adjusted gross income. Your adjusted gross income is used as the basis for lots of things, like calculating your tax bill when you file your income tax return. It also decides how much you can claim for certain tax credits and deductions. For example, you can deduct up to 10% of your AGI for unreimbursed medical expenses and up to 60% of your AGI for charitable donations.

In some cases, your AGI could even be used to determine your eligibility for benefits issued from the U.S. government.

Do You Pay Taxes On Adjusted Gross Income

There are a couple of more steps after calculating AGI before you can reach your taxable income.

First, youll need to subtract your standard deduction or itemized deductions. Next, you may subtract the qualified business income deduction if you have self-employment or pass-through business income.

Your tax bracket and income taxes is based on your taxable income not adjusted gross income.

Recommended Reading: How Much Does Unemployment Take Out For Taxes

Examples Of Common Adjustments

There are several adjustments to income that can reduce your AGI in a given tax year. As of 2022, these include:

- Contributions to a qualified tax-deferred retirement plan, such as a traditional IRA.

- Educator expenses, up to the annual maximum.

- Student loan interest, up to the maximum allowed.

- Half of the self-employment tax you paid.

- Self-employed health insurance premiums.

Calculate Your Modified Adjusted Gross Income

Now that youve figured out your AGI, youre finally ready to calculate your modified adjusted gross income. The IRS phases out credits and deductions as your income increases. So by adding these factors back to your AGI, the IRS determines how much you really earned, giving you your MAGI.

According to Internal Revenue Code ), you should add the following to your AGI to determine your MAGI:

- Any amount excluded from gross income in section 911

- Examples include untaxed foreign income, non-taxable Social Security Benefits, tax-exempt interest, and housing costs for qualified individuals

- Any amount of interest received or accrued by the taxpayer during the taxable year which is exempt from tax

- Any amount equal to the portion of the taxpayers social security benefits.

- As defined in Section 86 ) which is not included in gross income under section 86 for the taxable year. This includes any amount received by the taxpayer by reason of entitlement to a monthly benefit under title II of the Social Security Act, or a tier 1 railroad retirement benefit.

If this looks confusing, the good news is that most people dont have any of the income described above, so its likely your MAGI is the same as your AGI.

Read Also: What Is $600 After Taxes

Subtract Adjustments To Your Income: Page Two

Adjustments to your income are all made above the line, meaning that the adjustments are taken off the top of your gross income to yield your adjusted gross income. The IRS treats you as a conduit for this income, as in the case of alimony, or is incentivizing you to save toward retirement or health care expenses, for example.

Adjustments to your gross income can vary depending on your unique situation and can be influenced by unexpected life events like jury duty, new employment, or a pandemic. Discuss your situation with a tax professional to make sure you can take full advantage of these adjustments.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Adjusted Gross Income: How To Find It On Your W2 Form

A guide to AGI

As Americans take the time to file their tax returns for the 2021 tax year, many complex terms come up in that process. Even if some of these terms are familiar, many have forgotten what they mean exactly. That’s often the case with Adjusted Gross Income, so we’re going to break down what exactly this is and how to find it through the W2 form.

Recommended Reading: How Do Day Traders Pay Taxes

What Do I Use For My Original Agi If My Filing Status Has Changed From Last Year

If your filing status changed from the previous year to “Married Filing Joint”, then each taxpayer will use their individual original AGI from their respective prior year tax returns.

If the change is from “Married Filing Joint”, then both taxpayers will use the same original AGI from the prior year’s joint tax return.

Can I File My Taxes Without Last Years Agi

If you cant find your prior-year AGI, you have a couple of options. Youll need to request a copy of a return for 2018 from the IRS, which you can do any of these ways: View or download a transcript of your return online at www.irs.gov. Call the IRS at 800-908-9946 and request a hard copy transcript be mailed to you.

Also Check: Are Home Renovations Tax Deductible

What Is Adjusted Gross Income Definition

Adjusted gross income, or AGI, is your total gross income minus certain tax deductions and other adjustments. Gross income includes such types of earnings as wages, dividends, alimony, government benefits, retirement distributions, capital gains and income from any other source. Adjusted gross income is calculated by subtracting such deductions and adjustments as alimony paid, retirement plan contributions, student loan interest and health insurance premiums.

Read Also: How Can I Make Payments For My Taxes

What Is A W

A W-2 form tells the amount of annual income you will receive along with the value of taxes deducted from the annual income. Your employer will send you as well as the Internal Revenue Service a W-2 after the end of the tax year .

A W-2 will give you a statement of your generated income and taxes withheld. This form is only for employers and not for those who are self-employed. Self-employed persons will have to use a different form .

You will receive your income-related information from the W-2 while the IRS will receive your wage and tax statement. That is why the information on a W-2 form must be accurate. Having a W-2 will help you get your tax returns back efficiently.

Recommended Reading: When Do You File Taxes This Year

How Can I Find Out My Agi If I Filed An Amended Return To Include Income I Forgot

You should use the AGI from your originally filed Form 1040, not your amended 1040-X.

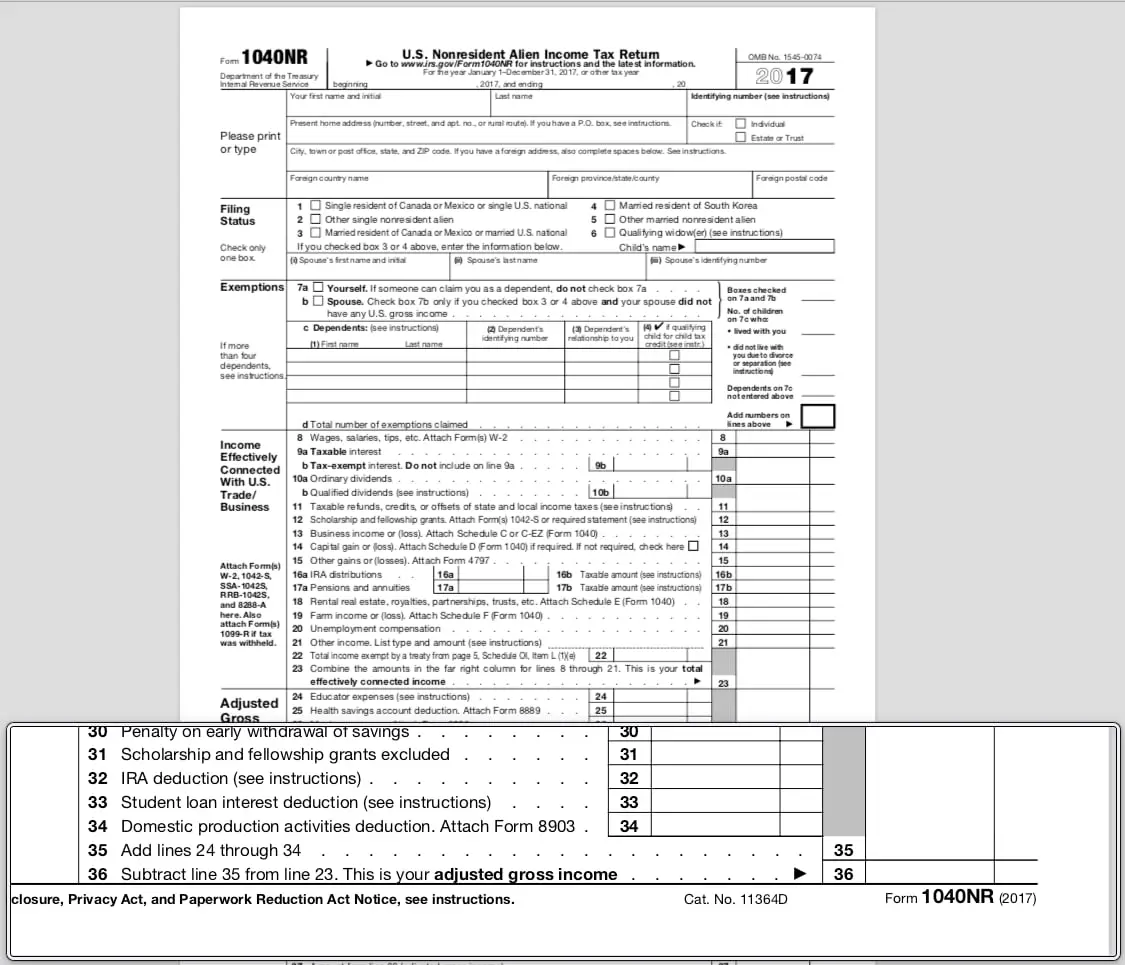

Your Adjusted Gross Income can be found on your 2017 Tax Return:

If you filed a:

- 2017 Form 1040: your AGI can be found on line 37

- 2017 Form 1040A: your AGI can be found on line 21

- 2017 Form 1040 EZ: your AGI can be found on line 4

If you do not have a copy of your 2017 Tax Return, you can order a free transcript online from the IRS by clicking here: Get My Transcript. Your IRS transcript will include your AGI from last year.

Once you find your correct 2017 AGI amount, please follow these instructions to correct it in TurboTax:

- Login to your TurboTax Account

- Click Take Me To My Return

- Click File from the left side of your screen

- Proceed, and make sure youve selected the option I want to E-file

- Continue through the screens and you will be given the opportunity to input your 2017 AGI

- Keep walking through the steps until you have re-transmitted your return

Please comment below if you need further assistance finding your AGI.

Adjusted Gross Income Or Agi Is An Important Concept For Taxpayers To Know

Adjusted gross income is an amount that takes your total, or gross income, and makes certain adjustments to determine your income for certain tax break qualifications.

However, this leaves some big unanswered questions. For example, what is the difference between adjusted gross income and taxable income? What tax breaks count as adjustments, and which are counted as deductions? And how can adjusted gross income affect your tax bill?

Adjusted gross income, commonly abbreviated as AGI, is one of the most important concepts for U.S. taxpayers to understand. In this article, we’ll take a closer look at adjusted gross income, how yours is determined, and why it matters so much to you.

Also Check: Who Must File An Income Tax Return

Lets Understand It Better With An Example

Suppose your final income is $100,000. Now calculate your specific expenses from the last year. Lets suppose those expenses are:

- Your student loan interest is $300

- Educator expenses are $700

- Your contributions to the retirement accounts are $10,000

- And your contributions to the health savings account are $5,000

Your total deductions will be $16,000. Now subtract deductions from your annual income , the value $84,000 will be your adjusted gross income.

What Is Agi Example

What Is AGI? Adjusted Gross Income, or AGI, starts with your gross income, and is then reduced by certain above the line deductions. Some common examples of deductions that reduce adjusted gross income include 401 contributions, health savings account contributions and educator expenses.

Recommended Reading: When’s The Last Day To Do Taxes

Analyzing The Effects Of Magi

A high MAGI can render you ineligible for certain deductions or credits. For example, if you are covered by a retirement plan at work, a high MAGI could limit or prevent you from claiming an IRA deduction. As of 2011, if you were married filing jointly with a MAGI of $110,000 or more, you could not deduct any IRA contributions. Similarly, the student loan interest deduction was off limits to married taxpayers filing jointly with a MAGI of $150,000 or more as of 2011.

References

What Is My Agi On My W2

How To Find AGI On W2? You can find your AGI on Box No 1 of your W2, this income is a combination of your Wages, Tips, Compensation and also addition of boxes of 2 to 14. so please do not add boxes 2-14 to box 1 of your w2 once again. Where Is Your Adjusted Gross Income On From 1040?

Also Check: How To Calculate House Tax

What Is Agi And How Is It Determined

Your total gross income includes all of your wages, salaries, dividends, interest, gambling winnings, retirement distributions, unemployment benefits — all of the money you bring in.

Your adjusted gross income equals all of that money minus income adjustments such as alimony, student loan interest payments and health savings account contributions. These income adjustments are not the tax deductions that determine your overall tax burden they are deductions to your income that set the standard level at which you can be taxed.

If you have adjustments to your gross income, you will record them in Part II of IRS Form 1040 Schedule 1. The IRS offers a thorough lesson on these adjustments to income here .

The Bottom Line: Understand The Significance Of Your Adjusted Gross Income To Your Taxes

Anything you can take off the top of your gross income translates into tax savings, so familiarizing yourself with IRS rules on how you can adjust your gross income is always a good idea. Remember, the more you can put away for the future and for health expenses, the less youll have to pay in taxes.

Are you interested in learning more about the tax advantages of homeownership? Use our Learning Center to find the answers to all your real estate-related questions.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Recommended Reading: How To Pay Unemployment Tax

Net Income Vs Adjusted Gross Income : An Overview

All income starts with gross income, which is the total of all the money you make in a year. This includes salaries, wages, bonuses, capital gains, and interest income. As we know from our paychecks, this is not the money that we take home and put into our bank accounts. Our gross income is subject to taxes and often other deductions, which reduce gross income to arrive at net income: our take-home pay.

Adjusted gross income also starts out as gross income, but before any taxes are paid, gross income is reduced by certain adjustments allowed by the Internal Revenue Service . This reduces gross income, and therefore, the amount of taxes that are paid.