Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Wheres My State Tax Refund North Carolina

Tracking your refund is possible by visiting the website of North Carolinas Department of Revenue and clicking on Wheres My Refund? You can expect processing of your refund to take, on average, six weeks from the date your return is received. If 12 weeks have gone by and you still havent gotten your refund, you should contact the Department of Revenue.

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once you return to the processing stage, your return may be selected for additional review before completing processing.

You May Like: Do Seniors On Social Security Have To File Taxes

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

You May Like: Does Contributing To Roth Ira Reduce Taxes

Wheres My California State Refund

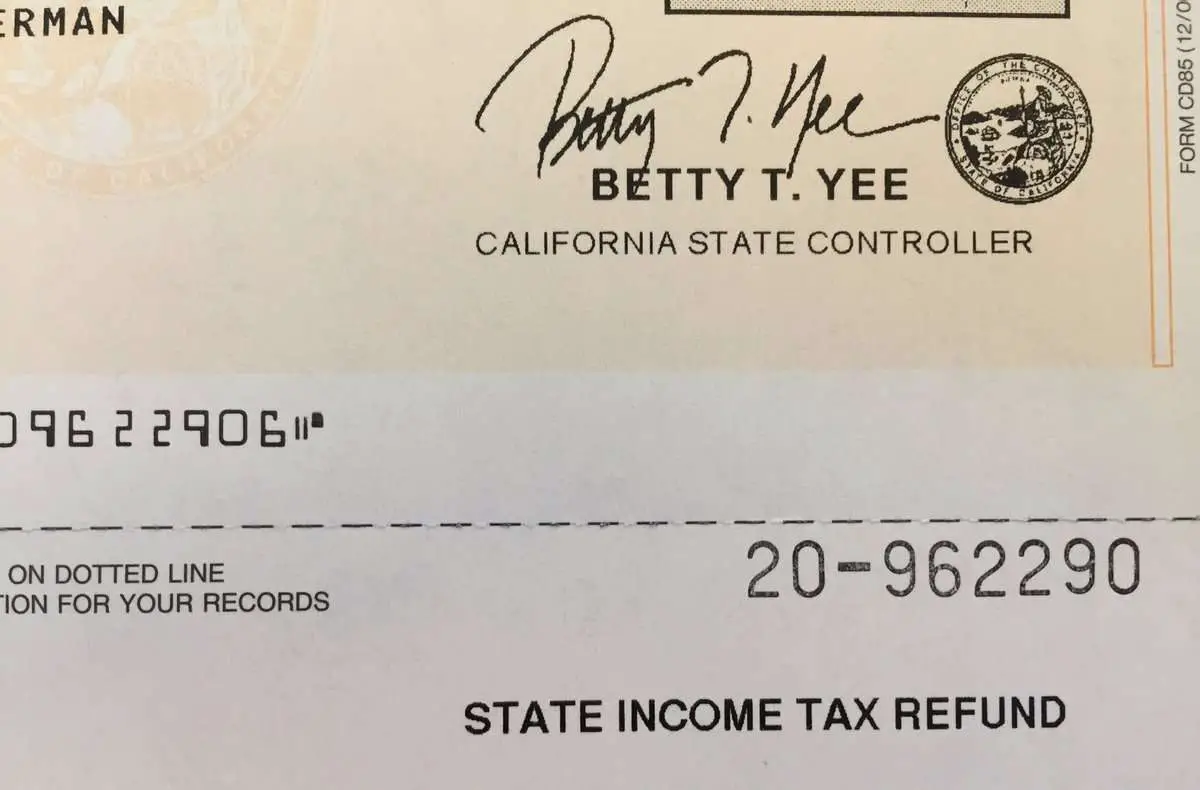

The State of California Franchise Tax Board is where you can find your CA tax refund status. Check the status of your California tax refund using these resources.

State: CaliforniaRefund Status Phone Support: 1-800-338-0505Hours: Mon. Fri. 7 a.m. to 5 p.m.Online Contact Form: 2020 State Tax Filing Deadline: May 17, 2021

Note: Please wait at least eight weeks before checking the status of your refund.

More Help With Taxes In California

Understanding your tax obligation is critical to optimizing your tax outcome. Thus, its critical to understand how to deduct California state tax from your federal taxes as an itemized deduction.

So, get help! Use Tax Pro Go, virtual tax prep offered by H& R Block. With this service, well match you with a tax pro with California tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest!

Taking California tax laws into consideration, we can make sure you are supported when it comes to taxes no matter where you file.

Related Topics

When can you take a meal allowance as part of business travel deductions? Learn more from the tax experts at H& R Block.

Read Also: How Can I Make Payments For My Taxes

How Can I Get Help

While the State of California Franchise Tax Boards online refund tracking tool may help you stay on top of your refunds status, it does have limitations. If you want to check the refund status of a past years return, you cant use the online tracking tool. And if you run into an issue with the online tracking tool say you dont see a refund status or it says you shouldve received a refund by now but you havent you can contact the FTB about your refund in three ways.

What Can Cause A Delay In Your Ca Tax Refund

If it takes a little while for your California state tax refund, there may be some delays. So what causes a delay?

Well, there are a number of different reasons that could cause a delay in your California state tax refunds. It may include some of the following, but are not limited to:

- Not choosing direct deposit

Also Check: Can I Use Bank Statements As Receipts For Taxes

Where To Check The Status Of Your Georgia State Income Tax Refund

To check the status of your California Tax Refund, you may visit their website at . Once youre on the webpage, you will be asked to provide the following details:

- Your Social Security Number or SSN

- The numbers in your mailing address

- Your Zip Code

- And the expected refund amount, provide this in whole dollars, no special characters

Once you have entered all the details, simply click on the Check Your Refund button to check the status of your refund.

How to Contact the California State Department of Revenue

You may also check your refund status offline. All you have to do is call the California State Department of Revenue to check your refund status.

Their hotline number is 1-800-338-0505, and their business hours are between 7:00 A.M. to 5 P.M. during Mondays through Fridays.

Although it is highly likely that the phone service representatives will have the same details as the website/portal. Please wait at least eight weeks before checking the status of your refund.

Need Information On Taxes You Already Filed

| Wheres my Refund? | Refunds can take up to 3 weeks to arrive. To check on the status of your federal refund, go to www.irs.gov and click on Wheres My Refund? To check on your California state refund, go to www.ftb.ca.gov and click on Refund Status. |

| Need a copy of your return? | Do you need a copy of your return or information from your tax return? Tax-Aid does not store copies of your tax return. You can now set up an online account which will allow you to view your tax history, track payments, view amount you owe and much more. Click here to find out more IRS.gov/account. |

| Need to make a payment? | If you owe, you can make a payment by credit or debit card. Click IRS.gov/payments to find out more. |

Recommended Reading: Do You Have To Claim Social Security On Taxes

How Do You Check If Youve Paid State Taxes

If you want to make sure your state taxes were paid, contact the California Department of Revenue to see if your payment was received. The contact information is as follows:

If you dont pay California income taxes, you will likely incur penalties and fees. This is the case when you dont:

- File on time

- Have enough taxes withheld from your paycheck

- Pay electronically when youre required

- Have insufficient funds to pay

View the California states Penalty reference chart for more information.

Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

You May Like: How To Appeal Property Taxes Cook County

Californians Love A Lot Of Things About Their State But Few Probably Include State Taxes On Their List Of Likes About The Golden State

California taxes the personal income of its residents to fund government operations and programs, like health and human services, as well as education. The cost for all those services is a state and local tax burden that the Tax Foundation says ranks as the sixth-highest in the nation.

If youre looking for tips on how to file your California state tax return, here is helpful information.

What If My Refund Is Different Than What I Expected

Even if you do your best to submit an accurate return, its still possible for the refund amount you actually receive to be different from what you were expecting. For example, the amount may change if you dont qualify for a tax credit you attempted to claim or the refund is put toward a past-due tax debt or other government agency debt, like child support.

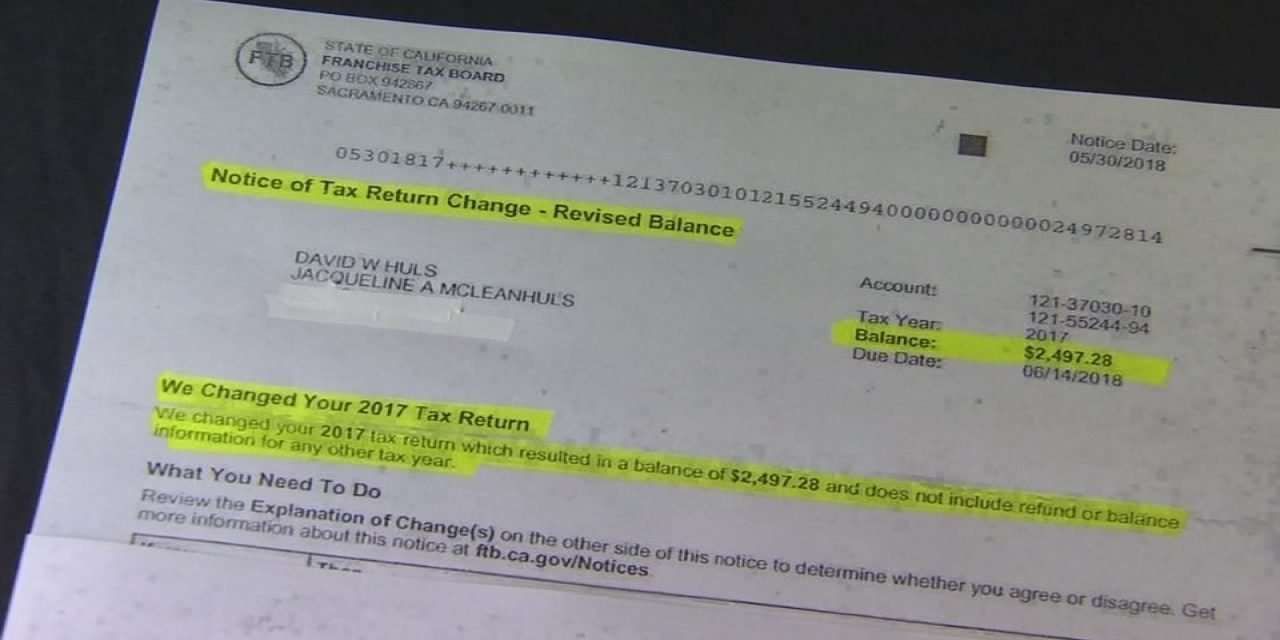

If the California Franchise Tax Board makes changes to your return, you should receive a letter in the mail called a Notice of Tax Return Change that explains the change and updated refund amount.

Recommended Reading: How To Calculate Tax In California

Taxable Income In California

The flip side is that you’ll have to pay taxes in California on some types of income that aren’t taxed at the federal level, such as foreign-earned income that you can exclude on your federal tax return. Interest earned on municipal, state, and local bonds from outside California is also taxable.

Alimony you receive is taxable income in California, although it’s no longer taxable at the federal level. Likewise, the spouse paying alimony or spousal support is entitled to a tax deduction for that amount.

Wheres My State Tax Refund Colorado

Taxpayers can check the status of their tax refund by visiting the Colorado Department of Revenues Revenue Online page. You do not need to log in. Click on Wheres My Refund/Rebate? from the Quick Links section. Then you will need to enter your SSN and the amount of your refund.

Colorado has increased its fraud prevention measures in recent years and and warns that it may need take up to 60 days to process returns. Returns will take longest as the April filing deadline approaches. This is when the state receives the largest volume of returns. The state also recommends filing electronically to improve processing time.

Read Also: How To Grieve Property Taxes

Understanding Your Refund Status

As you track the status of your return, you’ll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Respond to a letter Your refund was adjusted

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

You May Like: How Long Can You Wait To File Taxes

How Can I Track A California Tax Refund

Paying taxes is a fact of life for many who live or work in the most-populous U.S. state. The amount of state income tax you owe will depend on a number of factors, including your filing status, how much money you earn in a year, and what credits or deductions youre eligible to take.

If you overpay your state taxes during the tax year, you may be owed a refund when Tax Day comes around. If youve filed your state tax return and are expecting a California state refund, you can probably track its status through the State of California Franchise Tax Board. It offers a Wheres my refund tool thats similar to the IRS tool for tracking your federal income tax return. The tool will allow you to track the status of your most recent refund. If you want to check on refunds from prior tax years, youll have to contact the FTB.

To track your current tax refund, youll need several important pieces of information.

- Social Security number

- Numbers in your mailing address

- ZIP code

- Refund amount

When you click the Check Your Refund button on the website, youll first enter your Social Security number. Then youll enter the numbers in your mailing address. This refers to the digits before the street name so if you live at 104 Main Street, the numbers would be 104. Next, youll enter your ZIP code. Finally, youll enter the anticipated refund amount in whole dollars, which can be found on your most recent California tax return.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Recommended Reading: What Is Deduction In Income Tax

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Wheres My State Tax Refund North Dakota

North Dakotas Income Tax Refund Status page is the place to go to check on your tax refund. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. The refund status page also has information on how the state handles refunds.

The state advises not to call unless you check your refund status and it says to call.

Read Also: How To File Taxes Doordash

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Request Electronic Communications From The Department

The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. To ensure that you receive future communications in the Message Center of your Online Services Account Summary homepage, create your account now, before filing your next return.

You May Like: Where Do I Get Paperwork To File Taxes