Check Your Refund Status Online In English Or Spanish

Where’s My Refund? – One of IRS’s most popular online features-gives you information about your federal income tax refund. The tool tracks your refund’s progress through 3 stages:

You get personalized refund information based on the processing of your tax return. The tool provides the refund date as soon as the IRS processes your tax return and approves your refund.

It’s Fast! – You can start checking on the status of your return sooner – within 24 hours after we receive your e-filed return or 4 weeks after a mailed paper return.

It’s Up-to Date! – It’s updated every 24 hours – usually overnight — so you only need to check once a day. There’s no need to call IRS unless Where’s My Refund? tells you to do so.

It’s Easy! – Have your tax return handy so you can provide your social security number, filing status and the exact whole dollar amount of your refund.

It’s Available! – It’s available 24 hours a day, 7 days a week.

Find it! – Download the IRS2Go App by visiting the iTunes app store or visit Google Play or

Página Principal – ¿Dónde está mi reembolso? at IRS.gov

If you do not have internet access, call IRS’s Refund Hotline at 1-800-829-1954.

Caution: Don’t count on getting your refund by a certain date to make major purchases or pay other financial obligations. Even though the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days, it’s possible your tax return may require more review and take longer.

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

How Long It Takes The Irs To Issue A Refund

The IRS issues most tax refunds in fewer than 21 calendar days. However, that doesnt mean you should count on your refund to hit your bank account or mailbox within three weeks. The IRS says the fastest way to get a refund is to use IRS e-file and direct deposit.

If you opt to receive your refund electronically, it will likely take additional time for your bank to post your refund amount to your account. Weekends and holidays, for example, may extend the time between when your refund leaves the IRS and shows up in your account.

If you filed a tax refund with an Earned Income Tax Credit or an Additional Child Tax Credit claim, this may affect the timing of your refund as well. EITC/ACTC filers will receive their refunds by the first week of March at the earliest , depending upon when they filed their returns.

Recommended Reading: Do You Pay Taxes On Life Insurance Payment

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Read Also: How Much Are Annuities Taxed

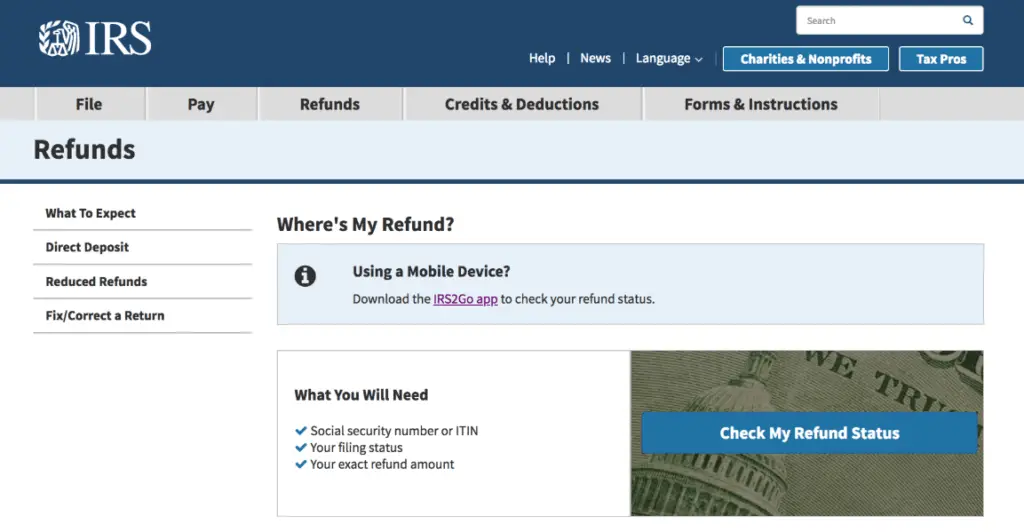

Use The Irswheres My Refund Online Tool

Since 2003, the IRS has provided an online tool that lets you track the status of your refund electronically. You can access the tool, called Wheres My Refund?, as soon as 24 hours after you e-file your tax return . You can also download the IRS2Go app to track your tax refund on your mobile device.

Youll need the following information to check the status of your refund online:

- Social Security number or ITIN .

- Filing status .

- Exact amount of the refund listed on your tax return.

Once you input the required data, youll encounter one of three status settings.

The IRS updates refund status once a day, usually overnight.

What Is A Marginal Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.

For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $41,000 of taxable income, however, much of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

You May Like: How Do You Pay Owed Taxes

How To Track Your State Tax Refund

State taxes work a little differently than federal taxes, because each state manages their system a little differently. To check the status of your state tax refund, youll need the same information you need to check your federal tax refund: your Social Security number and your refund amount.

Your states tax website should have an option on the page to track your taxes, similarly to the federal system. Most states pages will say Wheres My Refund? Follow the prompts there to track your state tax refund.

The amount of time it takes to get your refund also varies by state, and some take several weeks. Once youve crossed the amount of expected time it takes, then you potentially have the option to call your state tax office to locate your return, get a status update and an idea of when you might receive your refund. You can find all this information on your states local tax page.

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Recommended Reading: How To Get Tax Exempt Status

Claiming Property Taxes On Your Tax Return

OVERVIEW

If you pay taxes on your personal property and owned real estate, they may be deductible from your federal income tax bill. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas, and some agencies also tax personal property. If you pay either type of property tax, claiming the tax deduction is a simple matter of itemizing your personal deductions on Schedule A of Form 1040.

Apple Podcasts | Spotify | iHeartRadio

Request Electronic Communications From The Department

The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. To ensure that you receive future communications in the Message Center of your Online Services Account Summary homepage, create your account now, before filing your next return.

You May Like: Does Coinbase Help With Taxes

How Long Will You Have To Wait For Your Federal Refund

The IRS usually issues tax refunds within three weeks, but some taxpayers have been waiting months to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy. If there is an issue holding up your return, the resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to its website.

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

Still No Tax Refund Why Your Irs Money Is Delayed And What To Do About It

The tax agency still has an unprocessed backlog of 8.5 million individual returns, and refunds are taking months to arrive.

If you see “IRS TREAS 310” on your bank statement, it could be your income tax refund.

It’s nearly fall and the IRS is still facing a massive backlog that’s causing stress for taxpayers. At the start of this month, the IRS announced it had 8.5 million unprocessed individual returns, including 2020 returns with errors and amended returns that require corrections or special handling. Refunds normally take around 21 days to process, but the IRS says delays could be 120 days.

To add to that, the IRS has also been busy with stimulus checks, child tax credit payments and refunds for tax overpayment on unemployment benefits. The “plus-up” stimulus adjustments and the third advance monthly check of the child tax credit — which goes out on Sept. 15 — could give families some financial relief, but an overdue tax refund would be an even bigger help for those who need it to cover bills and daily expenses.

In most cases, taxpayers just have to continue to practice patience — it’s not easy to reach the tax agency by phone these days. The best solution is to track your refund online using the Where’s My Refund tool or check your IRS account. We’ll show you how. We can also tell you what to do if you received a “math-error notice” from the IRS. This story is updated frequently.

Recommended Reading: How Much Time To File Taxes

What An Irs Treas 310 Transaction Means

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment . This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see TAX REF in the description field for a refund.

If you received IRS TREAS 310 combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

How To Use The Where’s My Refund Tool

To check the status of your 2020 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

Recommended Reading: How Much Taxes Get Taken Out Of Your Paycheck

Log In Or Create An Account

Once you’ve logged in to your Online Services account:

Filing Information sample form: Field 5: State/ProvinceField 6: Zip/Postal CodeField 7: Filing Method Option 1: Gross Weight Method Option 2: Unloaded Weight MethodField 8: Number of Vehicle Records to Report

Header cel: Electronic notification optionsBills and Related Notices-Get emails about your bills.Other notifications-Get emails about refunds, filings, payments, account adjustments, etc.Header cell: Receive email

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Read Also: How To File Federal Taxes Electronically

Taxes Paid Through Escrow Accounts

If you pay your real property taxes by depositing money into an escrow account every month as part of your mortgage payment, make sure you don’t treat the entire payment as a property tax deduction.

Generally, only the amount that the bank or lender reports to the Internal Revenue Service , often noted on Form 1098, qualifies for the deduction. Thats because, the amount you must pay to an escrow account is adjusted yearly to be as close as possible to the precise amount due, but its rarely exactly the same amount.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier is designed for you. Increase your tax knowledge and understanding all while doing your taxes.

The Irs2go Mobile App

You can access the Where’s My Refund? tool from your laptop or desktop computer, or you can use IRS2Go if you prefer to use your mobile device. This app is available as a free download on iTunes, Google Play, and Amazon. You can use it to:

- Check your refund status.

- Make a payment if you owe taxes.

- Get free tax guidance.

- Retrieve security codes for certain online IRS services.

The IRS issued more than 111 million tax refunds in 2019, with the average being $2,869. Overall, more than 150 million individual tax returns were processed.

You May Like: When Are Irs Taxes Due

What Does An Irs Treas 310 Transaction Mean

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment . This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see TAX REF in the description field for a refund.

If you received IRS TREAS 310 combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

The’where’s My Refund’ Online Tool

The IRS indicates that it issues most refunds within three weeks if you choose direct deposit and you’ve e-filed your tax return. Refunds can take six to eight weeks if you file a paper return.

The IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need. This will help speed refunds during the ongoing public health and economic crisis in 2021.

Go to Where’s My Refund? on the IRS website to check the status of your refund. The tool is updated every 24 hours. You’ll need some information at your fingertips:

- Your Social Security number or Employer Identification Number as it appears on your tax return

- The filing status you claimed on your return: single, head of household, married filing jointly, married filing separately, or qualifying widow

- The exact refund amount as shown on your tax return

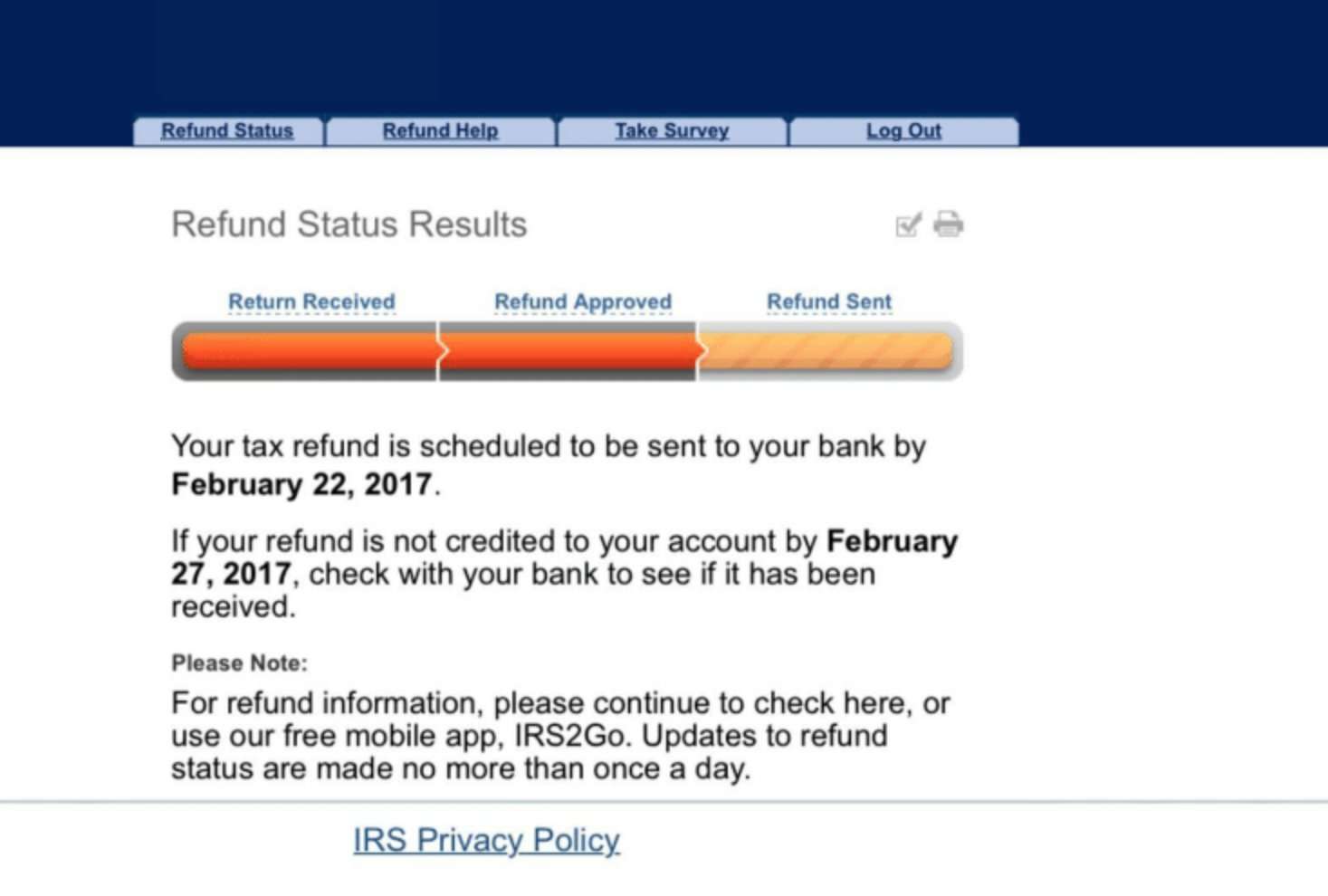

You’ll be redirected to a Refund Status Results screen when you plug in this information. This screen should say one of three things:

- Return received

- Refund approved

- Refund sent

You should see an estimated date for deposit into your bank account if your refund has been approved. There should also be a separate date for when you should contact your bank if you haven’t received your refund by then.

You can’t use the Where’s My Refund? tool to get information about your 2020-21 stimulus checks, also referred to as “economic impact payments.” Use the Get My Payment tool instead if you’re still expecting one of those checks.

Don’t Miss: When Do You Pay Quarterly Taxes