Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax ReturnPDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

Wheres My State Tax Refund Nebraska

Its possible to check your tax refund status by visiting the revenue departments Refund Information page. On that page, you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

I Still Dont Have My Refund What Should I Do Next

If you have waited the maximum number of weeks it should take to process a refund, we encourage you to check the status of your return or refund online one more time before contacting the Department.

Please note that our tax examiners do not have information about the status of your refund beyond what is available to you from our website. Although the Department is always available to answer your questions and concerns, calling us will not speed up the process. If you would still like to contact the Department, you may reach us at:

Phone: 828-2865 or .

Our staff is working hard to process your return. Our precautions may increase processing time, and we would like to ask for your patience as we strive to provide the protection you have come to expect and deserve.

We appreciate your patience and welcome your feedback to help us continue to improve our services.

Also Check: How To File Hsa On Taxes

Wheres My State Tax Refund Wisconsin

Wisconsins Department of Revenue has an online tool, called Refund 123, that allows you to see the status of your tax refund. To use the tool, enter your SSN, the tax year and the amount of your return in whole dollars.

Refunds for taxpayers who filed electronically are typically issued within three weeks. Paper returns will take longer to process. The states fraud and error safeguards may also delay the processing of your return for up to 12 weeks.

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

You May Like: What Do College Students Need To File Taxes

Will Calling You Help Me Get My Refund Any Faster Or Give Me More Information

IRS representatives can research the status of your return only if:

- It’s been more than 21 days since you received your e-file acceptance notification,

- It’s been more than 6 months since you mailed your paper return, or

- The Where’s My Refund? tool says we can provide more information to you over the phone.

What Is The Meaning Of Irs Tax Return Status

The IRS has three different messages which can explain your tax return status. If you have received a status, that means the IRS has a tax return, and they are working on it. The second status is approved, which means that your return has been confirmed. And the last one is sand which means your refund is on its way.

Don’t Miss: How Do Tax Preparers Collect Fees

Wheres My State Tax Refund Hawaii

Hawaii taxpayers can visit the Check Your Individual Tax Refund Status page to see the status of their return. You will need to provide your SSN and the exact amount of your refund.

Refunds can take nine to 10 weeks to process from the date that your tax return is received. If you elect to receive your refund as a paper check, you can expect it to take an additional two weeks. If you e-filed and have not heard anything about your refund within 10 weeks, call the states Department of Taxation.

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

Also Check: How To Get Comps For Property Tax Appeal

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Is filed on paper

- Needs further review in general

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit. See Q& A below.

- Includes a Form 8379, Injured Spouse AllocationPDF, which could take up to 14 weeks to process

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return. If were still processing your return or correcting an error, neither Wheres My Refund? or our phone representatives will be able to provide you with your specific refund date. Please check Wheres My Refund? for updated information on your refund.

When Will You Receive Your California Inflation Relief Payment

- to copyLink copied!

- to copyLink copied!

- to copyLink copied!

In the coming weeks, taxpayers in California are expected to begin receiving payments promised in response to rising gas prices and the cost of living.

Earlier this year, the state legislature and governor agreed to send Californians who file income tax in the state making less than $500,000 a year payments between $200 and $1,050 depending on income and family size. You can find out how much you qualify for here. Eligibility is based on 2020 tax filings.

A spokesperson for the California Franchise Tax Board Tuesday said the payments will be distributed through direct deposits and mailed debit cards.

Californians who received the Golden State Stimulus and who filed their tax return electronically and received their tax refund through direct deposit will have payments issued to their bank accounts starting Oct. 7 through Oct. 25. The remaining will have payments deposited between Oct. 28 and Nov. 14, according to state officials. The Franchise Tax Board expects 90% of the direct deposits to be issued in October.

Debit cards will be mailed between Oct. 25 and Dec. 10 for those who received the Golden State Stimulus but did not electronically file or receive a refund through direct deposit. The rest will be mailed by Jan. 15, according to the Franchise Tax Board.

Also Check: When Will Tax Refunds Be Issued

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Recommended Reading: Do Seniors Have To File Taxes

I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.

Claiming A Vermont Refund

To claim a refund of Vermont withholding or estimated tax payments, you must file a Form IN-111, Vermont Income Tax Return. You have up to three years from the due date of the return, including extensions, to file a claim for overpayment of tax due.

If the information on your return does not match the information available to the Department, your refund may be delayed. The Department may be waiting for information from your employer or the IRS for data verification. If we need additional information from you before issuing your refund, we will contact you in writing with instructions on how to respond either online through myVTax or in writing.

For tips on how to avoid the filing errors which commonly delay refunds, see Where’s My Vermont Income Tax Refund?

If you have an unclaimed refund from other tax years, find out how to claim it.

If you chose direct deposit for your refund, you may see your refund a few days after your status has been updated to Weve released your refund. Your financial institution may have additional processing times. If you chose to receive your refund by check, then it may take a few weeks to receive your refund by mail.

Don’t Miss: Can You Write Off Moving Expenses On Your Taxes

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

What Are The Major Tax Refunds This Year

After the first spread of the novel coronavirus in the United States of America, the federal government announced several tax reforms and new financial reliefs.

Nowadays, there are several things that you can track for your tax refund this year. As usual, if you have overpaid your taxes in the year 2021, then you are eligible to receive that money back as a tax refund.

Apart from that, if you are a parent, you could also receive child tax credit money. The government announced that they are going to release 3600 U.S. dollars per child.

You can also expect reimbursements for the money you spent on childcare-related expenses last year. Many people also missed their third stimulus payment, which can also be claimed in your tax refund.

These are the few major tax refunds that you can expect this year. Other than that, if you are eligible for an unemployment insurance claim, then you can also expect that in your tax refund.

Read Also: What Happens When You Owe Back Taxes

Wheres My State Tax Refund Michigan

Checking your refund status is possible through the Michigan Department of Treasury. Just visit the Wheres My Refund? page. Michigan requires you to enter slightly different information than most other states. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income.

Michigan says to allow four weeks after your return is accepted to check for information. This assumes you filed electronically. If you filed a paper return, allow six to eight weeks before checking.

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Read Also: How To Check Income Tax Refund

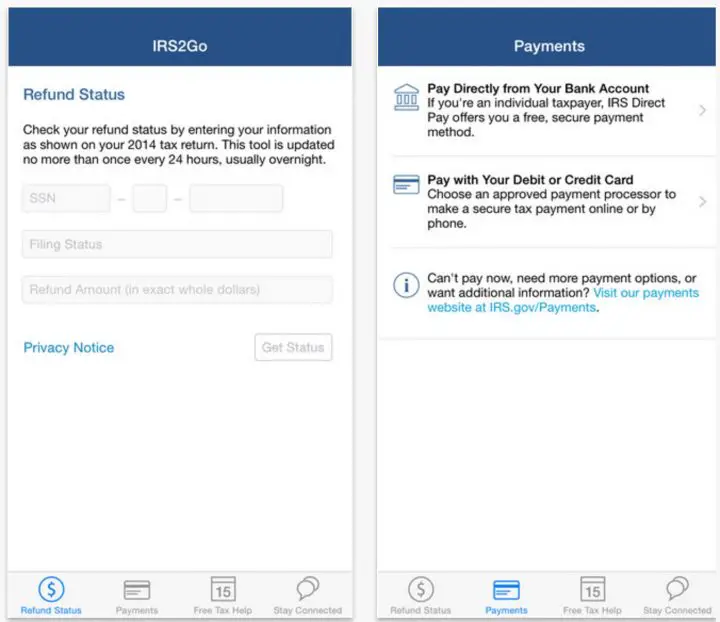

Check The Status Of A Refund In Just A Few Clicks Using The Wheres My Refund Tool

IRS Tax Tip 2022-26,February 16, 2022

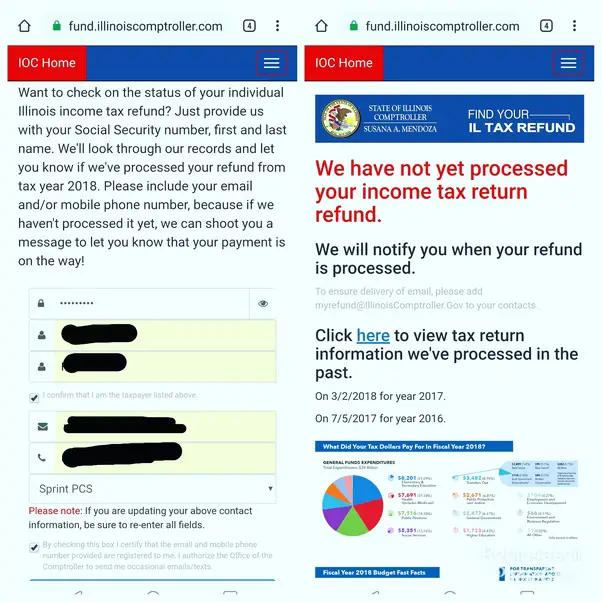

Tracking the status of a tax refund is easy with the Where’s My Refund? tool. It’s available anytime on IRS.gov or through the IRS2Go App.

Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.

Wheres My State Tax Refund Kentucky

Check the status of your Kentucky tax refund by visiting the revenue departments Wheres My Refund? page.

If you e-filed and opted for direct deposit, you can expect your refund in two to three weeks. Getting a refund as a paper check will take three to four weeks. If you filed a paper return, your refund will take significantly longer to arrive. The state says it could take eight to 12 weeks.

The Wheres My Refund Page only allows you to check the current years tax return. The status of previous tax returns is available if you call 502-564-4581 and speak to an examiner. It may take more than 20 weeks to process prior year tax returns.

You May Like: How To Get Tax Exempt Status

Where Is My Refund

Where is my refund? It is the first portal to check your tax refunds. If you are a desktop user, then kindly click on the button given below, and it will take you to the official web page IRS, where you can easily check all of your tax refunds.

The refund webpage is not very hard to find the page on the official website of the Internal Revenue Service. You can simply visit the official website of IRS.Gov and click on the refund button at the header. It will directly take you to the refund page.

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

Don’t Miss: When Will Child Tax Credit Start

When Should You Call The Irs For Your Tax Refund

Internal Revenue Service, also known as IRS, has given an option to contact them under some circumstances. They have mentioned these reasons on its official website, and if you fall under any of these reasons, you should contact them.

If you have filed your income tax return and it has been more than 21 days, you should call the IRS for your tax refund. Apart from that, if you are trying to check your tax refund using the wheres my refund tool and the tool tells you to contact, you should contact the IRS for your tax refund.

Usually, the Internal Revenue Service contacts you by mail if they need any further information to process your income tax return.

You should expect a natural delay if you mailed a paper return or responded to an IRS inquiry about your return.