How To Find The Best Places To File Taxes Online

Most people want is to save as much of their hard-earned cash as possible for themselves and their families. This is where online tax software and accounting websites can come in to help you. Below I have given information on the best places to file taxes online. See more below.

People who read about Best Places To File Taxes Online read:

Disclosure: This post contains affiliate links and I will be compensated when you make a purchase after clicking on my links, there is no extra cost to you

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

Best For Ease Of Use: Jackson Hewitt

Jackson Hewitt

Jackson Hewitt gives you three easy ways to do your taxes with a professional through a Jackson Hewitt office or online, making the tax prep giant the best for ease of use.

-

6,000 office locations including 3,000 inside of Walmart stores

-

Appointments and walk-in tax preparation supported

-

Upload or drop-off forms to have your taxes prepared by a pro

-

Minimum tax preparation fee of $150 for federal returns

-

Pricing not clear and transparent on website

-

Not all preparers are CPAs

Jackson Hewitt makes tax preparation easy with several options to file either online or through a network of 6,000 locations, giving it the win for ease of use. If you want to have your taxes done while you shop for groceries, you may want to use one of the 3,000 locations inside of Walmart stores. Many locations have evening and weekend hours, so you can have your taxes done on a schedule that works for you.

For in-person tax prep, you can start by uploading your tax forms through the Jackson Hewitt website. You can even use your phones camera to take a photo and upload forms. If uploading proves to be problematic for you, head to a Jackson Hewitt location to drop off your tax documents and return later for your full tax review session. In-person meetings can be done by appointment or as a walk-in. Prices depend on how many forms are required to complete your return.

Read Also: Where Do I Mail My Taxes In California

Getting Ready To Do Your Taxes

If even thinking about filing your taxes has you breaking out in a sweat, youre not alone. Our tax code is lengthy and confusing, so its very common for people to dread doing their taxes. But just getting started can feel empowering, and theres no need to stress.

This year, start by getting a folder and collecting anything you think you might need. Also, review last years tax return. This will give you, or your CPA, an idea of what this years taxes will probably look like and will help you get ideas about the information you will need.

Once you know the forms and documentation you will need for this years taxes, commit to keeping track of these things in 2022. Being organized will make doing your taxes next year less stressful. For example, if you find out this year you need all your medical receipts from 2019, create a system for keeping track of those throughout 2022. That way you dont have to go digging next year.

Best Tax Software Providers

Promotion: NerdWallet users get 25% off federal and state filing costs. |

|

Promotion: NerdWallet users can save up to $15 on TurboTax. |

Promotion: NerdWallet users get 35% off federal filing. |

These star ratings are based on a tax provider’s free tier score. For more detailed scoring, see below. Providers frequently change pricing. You can verify the latest price by clicking through to each provider’s site.

You May Like: How To Calculate How Much Tax You Owe

How We Picked And Tested

Under the hood, every tax software platformeven those that tax pros usefills in the same IRS forms and uses the same math to calculate the amount you owe or the amount of your refund. But they dont all offer the same experience. The biggest differences among the tax-filing options lie in how thorough their questions are, whether they ask the right questions, and how pleasant or taxing the experience is.

For the 2020 filing period, we retested four major online tax appsH& R Block, TaxAct, TaxSlayer, and TurboTaxand two we hadnt tested before that are part of the IRSs Free File Program, FileYourTaxes.com and OLT. We decided not to retest Credit Karma Tax, our previous pick for filing simple returns, due to multiple negative reports we received regarding the programs accuracy and its ability to handle different tax situations, including filing state returns in more than one state. You can learn more about the reported issues with Credit Karma Tax in the Competition.

To test these apps, we created three fictional filers to represent a range of situations. These were the same ones we used previously, but slightly updated to include more common scenarios for many people in 2020things like getting unemployment income, not receiving their stimulus payments, or making charitable contributions.

Our fictional filers:

We proceeded with more common tax-filing situations. These are the key distinctions we considered during testing:

How Does Tax Software Works

Tax software programs generally use two types of interface to coach you through your tax return: an interview-style questionnaire or a form-based step-by-step guide.

Most tax preparation software programs also feature simple navigation tools that allow you to upload returns from prior years, W-2s and investment income documents. This can save you a substantial amount of time as the software automatically imports your information into your return.

Once youre done entering all your information, tax software programs often run a diagnostic to check for errors. Before you file, they verify that your information meets legal state provisions and check whether youre eligible for certain income adjustments or tax credits .

After you file, you can easily track the status of your tax refund through the company’s online portal or the IRS website.

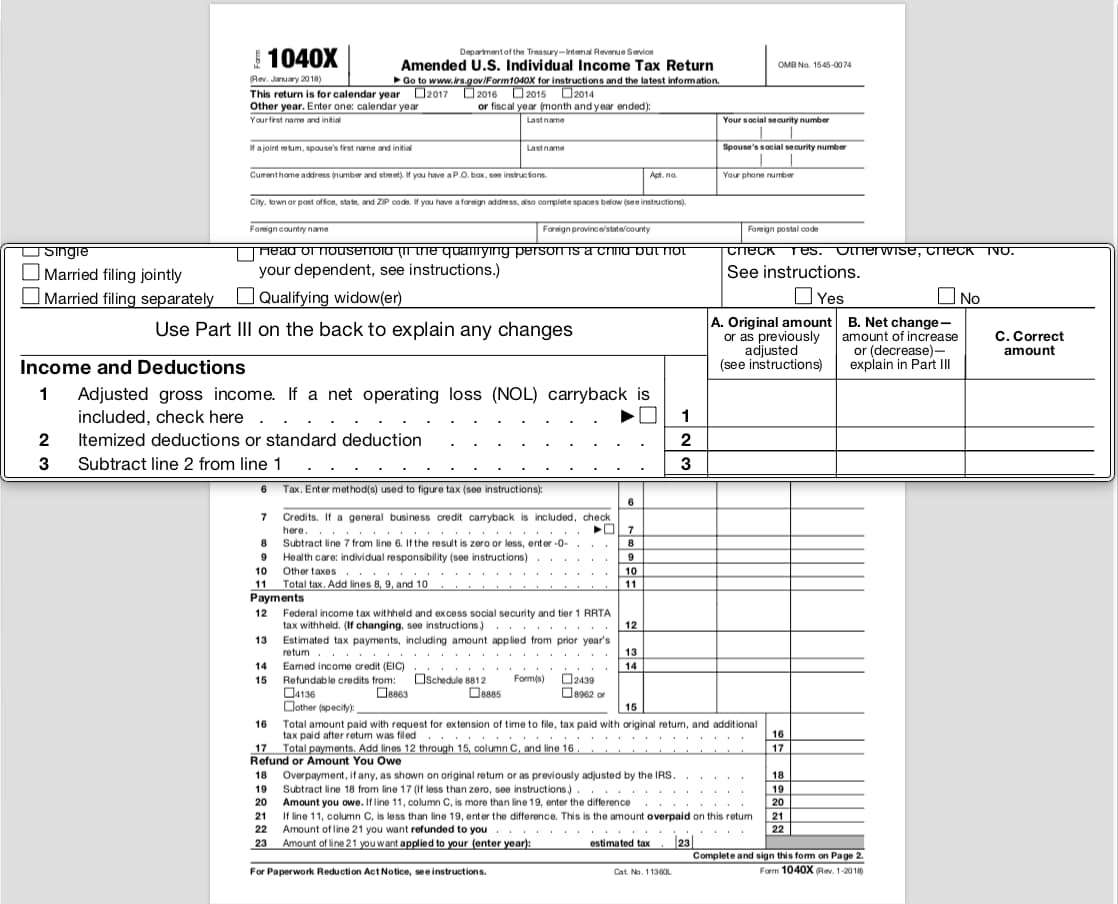

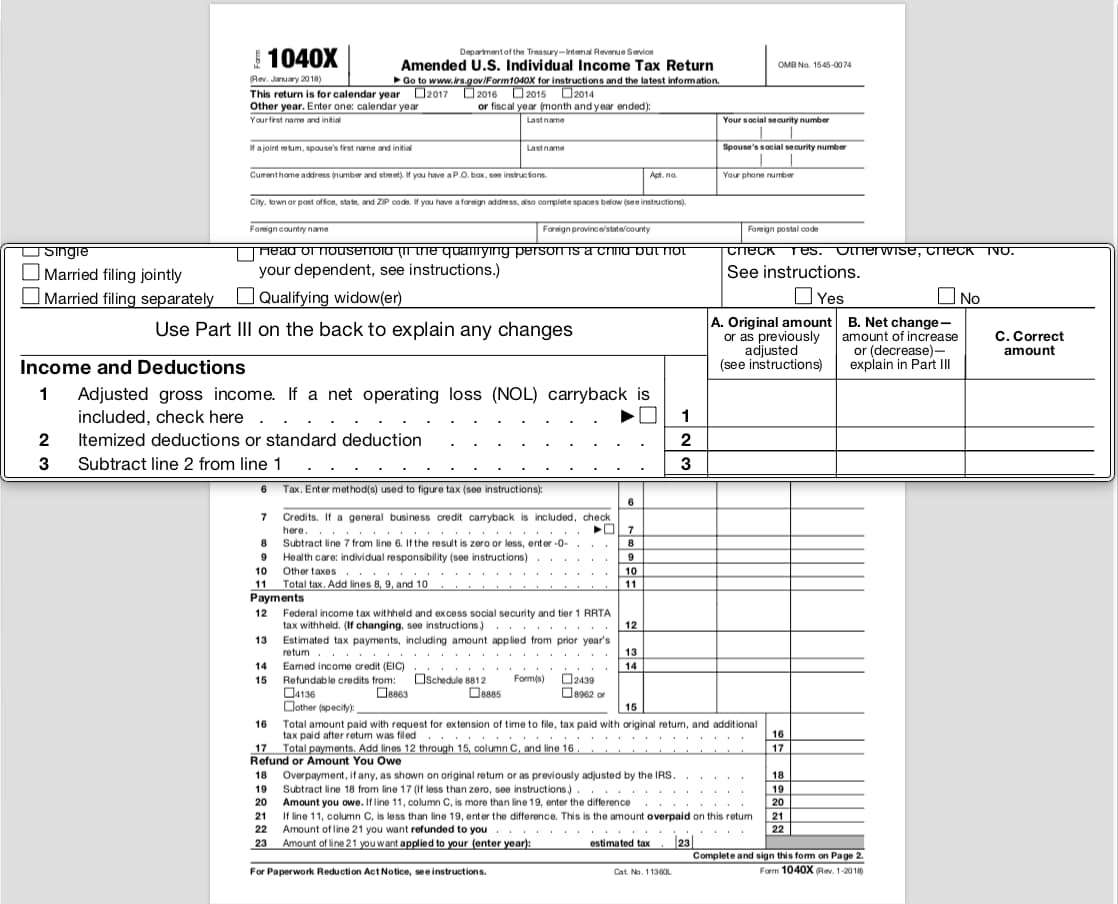

Recommended Reading: How To Amend 2020 Tax Return

Which Option Is Best For You

My honest and short answer is that it depends. For most of us, choosing online tax prep software will work perfectly well. Most people who have used online software will tell you it is very intuitive and thorough. If youre debating about a deduction, the software will walk you through the pros and cons. If you arent even sure of which forms you need, the software will explain. The process is incredibly comprehensive and educational.

However, if you simply feel more comfortable going to a licensed tax professional in person, theres nothing wrong with that.

That said, there are plenty of options that make it easy to file your taxes online. The point is that filing online is the way to go if you dont have an extremely complex financial situation. Remember that you can go through the process of preparing your taxes with an online software and if you arent satisfied when it comes time to fileyou dont have to pay! You can take the information and walk into an H& R Block or have a tax professional complete it for you.

The bottom line is that the more complex your financial situation is the more likely it is that you should use a professional, like a CPA, to help you with tax planning and filing your taxes. For the rest of us, filing online is the way to go.

Best Places To File Taxes For Cheap

This Article Contains Data About The Best Places To File Taxes For Cheap

Here are the options for Best Places To File Taxes For Cheap:

Disclosure: This post contains affiliate links and I will be compensated when you make a purchase after clicking on my links, there is no extra cost to you

On the off chance that you plan to file the new, streamlined 1040 tax structure for the monetary year 2019 with no different structures which means youre a normal W-2 labourer without substitute wellsprings of salary or conclusions to organize you should know three things.

To start with, 2019 documenting due date is Monday, April fifteenth. Second, regardless of whether you used to order reasonings in years past, you will not have to waste time with that this year in light of changes to the tax code: The standard finding has been about multiplied, to $12,000 for single filers and $24,000 for wedded couples. Lastly, you can file government returns for zero dollars because of free versions from five of the best tax programming organizations in the business.

Recommended Reading: What Is My Sales Tax Number

The Armed Forces Tax Council

The VITA program also offers a free tax filing benefit for military personnel. A volunteer can help you prepare your return for free. The volunteers are trained in tax issues that affect those who work for the Army, Navy, Air Force, Coast Guard and the Marine Corps. If youd rather do your own return online at home, Military One Source offers a free version of H& R Block At Home to military personnel. To learn more about these options, call the Military OneSource Tax Hotline at1-800-730-3802.

Best Tax Software Of 2022

Gabriella Cruz-MartínezClaudia Rodríguez HamiltonGabriel Rodriguez25 min read

| Best for Investors | Best for Multiple Ways to File | Best for Small Businesses | Best for Unlimited State Returns | Best Tax for Self-Employed Filers | |

| TurboTax by Intuit | |||||

|

Searches over 350 tax deductions |

Up to 50% less expensive than other software |

Tax professionals with an average of 10 years of experience |

Unlimited assistance from CPAs and other tax experts |

Online do-it-yourself tax service for a flat rate of $25 |

File student loan interest and education credits for free |

| Price |

$20.99 to $37.49 |

$49.99 to $109.99 |

|||

|

$0 to $89 per state |

$22.49 per state |

$0 to $44.99 per state |

$39.95 to $54.95 per state |

$25 unlimited state returns |

Searches over 350 tax deductions

$0 to $89 per state

Up to 50% less expensive than other software

$20.99 to $37.49

Tax professionals with an average of 10 years of experience

$0 to $44.99 per state

Unlimited assistance from CPAs and other tax experts

$39.95 to $54.95 per state

Online do-it-yourself tax service for a flat rate of $25

File student loan interest and education credits for free

The best tax software can help you file your federal and state tax returns easily and without having to shell out big bucks.

In fact, many online tax prep tools featured on this list are free for eligible customers and provide different levels of customer support for both novice and seasoned tax filers alike.

Also Check: Are Refinance Points Tax Deductible

Best Online Experience: Turbotax Live

TurboTax Live

TurboTax Live is an add-on to the TurboTax software that brings in a tax professional to complete your tax return for you.

-

Have your taxes prepared by a professional without leaving home

-

Four pricing tiers correlate to the complexity of your tax return

-

Option to start your taxes on your own and upgrade to a professional preparer

-

Self-employed taxes with one or more state can become expensive

-

No option for in-person support

-

Not all professional preparers are CPAs

TurboTax is perhaps best known as the largest provider of online tax preparation software and regularly ranks at the top of do-it-yourself tax program lists, but it also has a service where a tax professional takes care of everything for you online. It doesn’t matter where you are in the online process, if you’ve begun your return and find you need help, TurboTax Live can be elected and you can hand the return off at any time.

For the full-service TurboTax Live option, pricing ranges from $199 for basic returns to $389 for complex returns, with an additional fee for state taxes and multiple forms. This is in addition to the software costs, which range from $79 to $199.

Because its completely online, TurboTax is best for tax filers who are more comfortable with computers and technology. That also means there is no drop-off option. However, if you are a digital native, TurboTax offers the most seamless, easy-to-navigate digital experience with pricing competitive to other tax preparation services.

How Soon Can I Pay My Taxes

The IRS announced that it began accepting and processing tax returns for the 2020 tax year on Feb. 12.

Here are a couple of good reasons why it pays to file your taxes sooner rather than later:

- You can get your refund money faster

- If you forget to file your taxes by the deadline , any back taxes owed are still due on that date, in addition to late filing fees.

- You can avoid scams. The IRS warns about scammers stealing Social Security numbers to make off with people’s refunds. If you’ve already claimed your refund, a thief is going to be out of luck.

Recommended Reading: How Can I Keep My Tax Return From Being Garnished

How We Chose The Best Tax Software

When looking at tax preparation software, we first evaluated the types of features included in different pricing plans. We considered if they are IRS-approved, the states they service, and the tax situations they support, as well as whether they offer a maximum refund and accuracy guarantee. We also reviewed each software’s navigational tools and took into account if they offer free services for military members and free filing for federal and state returns.

Free Tax Software Companies Can Get You Even With Free Software Offers

Most of the companies on this list offer free federal filing for a subset of taxpayers. The trouble is that each company has different criteria for free filing. Some only offer free filing for a small subset of filers . Other companies offer free federal filing but require payment for state filing.

The so-called free-filing situation has become even more complex due to Covid-19. During the 2020 filing season, many companies expanded their Free offering to cover unemployment income and credits associated with the American Rescue Plan. While some companies have retained these expanded free offerings this year, others have reverted to the more restrictive options.

Whether companies have retained expanded offerings, many companies retain gotchas related to student loan interest deductions, retirement contributions, daycare expenses, and HSA contributions. Almost every major filing service requires an upgrade to the Deluxe tier when you start claiming these credits. This can feel like a super-frustrating money grab when you dont know you have to pay until youre an hour into the process and about to finish filing.

You May Like: Can You Pay Taxes In Installments

When You Should Hire A Cpa Or Tax Pro

When should you hire a CPA or tax preparer, and when can you do your taxes yourself? A look at the costs, advantages, and disadvantages of hiring a tax pro.

In recent years tax laws have undergone major revisions that could drastically affect the returns of people with complicated tax situations. If your tax needs take you beyond what TurboTax Deluxe can handle, you should seriously consider hiring a tax professional or getting live help from an IRS-certified volunteer rather than upgrading to TurboTax Premier or Self-Employed. A pro can not only capture all of your deductions accurately but also set you up for future tax strategies and savings.

A good tax professional can handle:

- self-employed filers and small-business owners with deductions, inventories, or employees

- investors with complicated portfolios and tax strategies

- income from partnerships or small companies with K-1 forms

- big life events such as getting married or divorced, sending kids to college, buying or selling a home, or receiving inheritance

- advice for future tax planning

With a tax professional, you dont have to do form-by-form price comparisons or hope that you fit inside an income or age captheyll take whatever you have, and most are clear up front about what theyll charge based on your specific situation.

The average cost of professional tax preparation ranges from $220 to $903 depending on the complexity of the returns.

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Don’t Miss: Can You Claim Child Support On Taxes