Above The Line Is The Place To Be

As a business owner, you should focus your tax planning and tax deductions on above-the-line deductions because:

The tax code doesnt steal your above-the-line deductionsyour tax benefit is the full amount.

You deduct your above-the-line deductions and also your itemized deductions or standard deduction.

Above-the-line deductions release tax deductions otherwise trapped or disallowed by the various AGI limitations.

As a business owner or investor, here are some of the more important above-the-line deductions:4

Business Expenses like wages, office supplies, and rent

Losses from the sale of property

Contributions to health savings accounts

Half of your self-employment taxes

Contributions to some IRAs and retirement plans

Self-employed health insurance deduction

Domestic production activities.

Where Can I Find My Prior Year Agi

AGI;is a tax term that;stands for;adjusted gross income.;Your adjusted gross income is used as the basis for lots of things, like calculating your tax bill when you file your income tax return. It also;decides;how much you can claim for certain tax;credits and deductions. For example, you can deduct up to 10% of your AGI for unreimbursed medical expenses;and up to 60% of your AGI for charitable donations.;;;

In some cases, your AGI could;even be used to;determine;your eligibility;for;benefits issued from the;U.S.;government.;;

The Significance And Implications Of Agi

Your AGI;is;often the starting point for calculating your tax bill. From there, youll make various adjustments and subtract your allowable deductions to find the amount on which youll pay tax: That’s your taxable income.;Youll see the term;adjusted gross income repeated throughout your tax forms.

AGI is the basis on which you might qualify for many deductions and credits. For example, you may be able to deduct unreimbursed medical expenses, but only when they’re more than 7.5% of your AGI. So the lower your AGI, the greater the deduction.

Your;state tax return;might also use your federal AGI as a starting point.;If you file taxes online, your software will calculate your AGI.

Recommended Reading: Where Do I Mail My Taxes In California

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

So What Is Adjusted Gross Income On Your W

The answer is its not. However, weve heard this question before as taxpayers ask for help with their taxes. Lets face it, tax terminology can get a little confusing. When it comes to talking about income, there are several terms that sound similar, but they have their own definitions and purposes. Understanding a bit more about these terms can help us better understand what Adjusted Gross Income is and what it isnt.

Don’t Miss: How To File Pa State Taxes

How To Calculate Your Agi

Here’s how you work out your AGI:

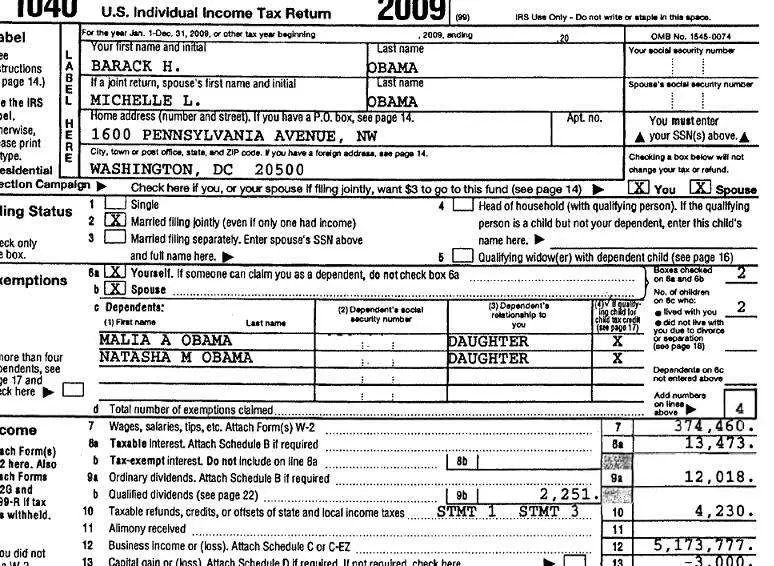

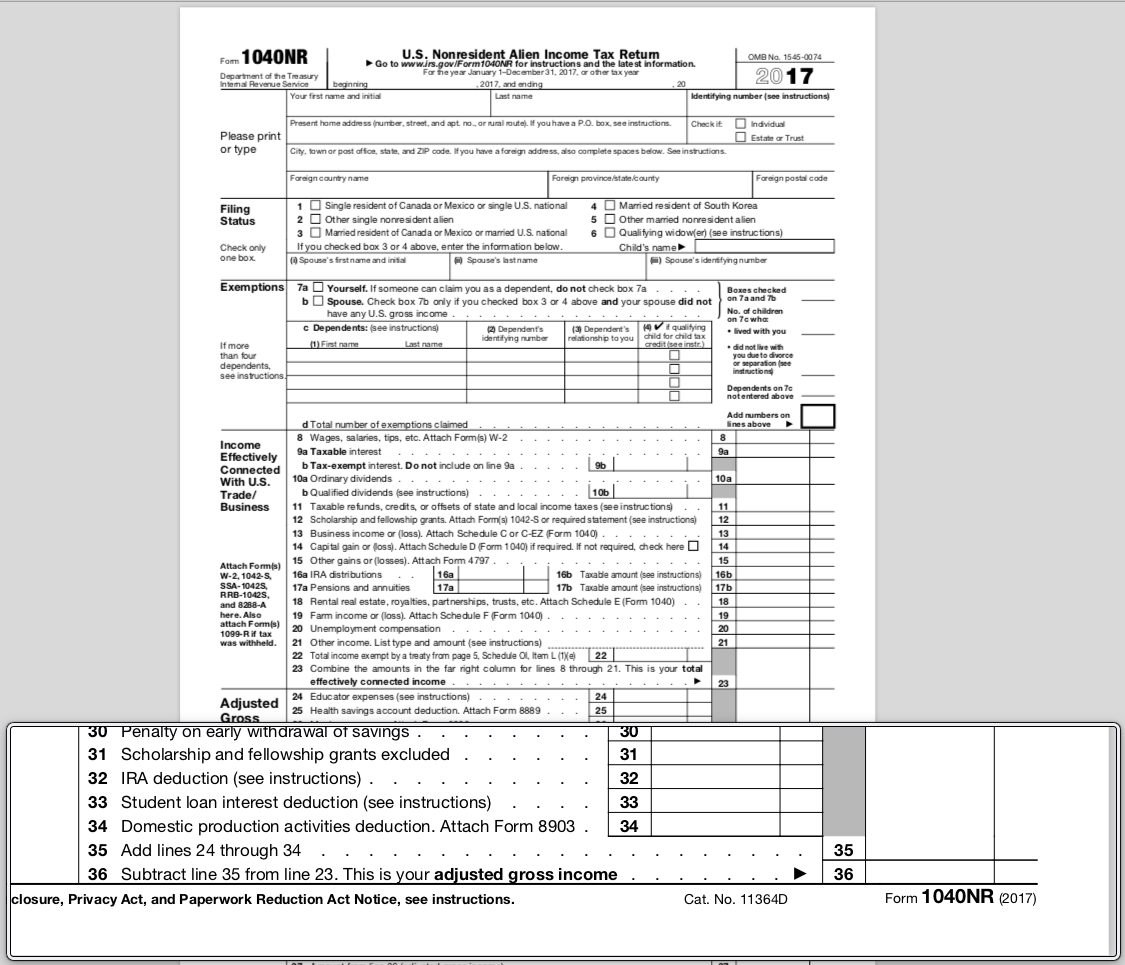

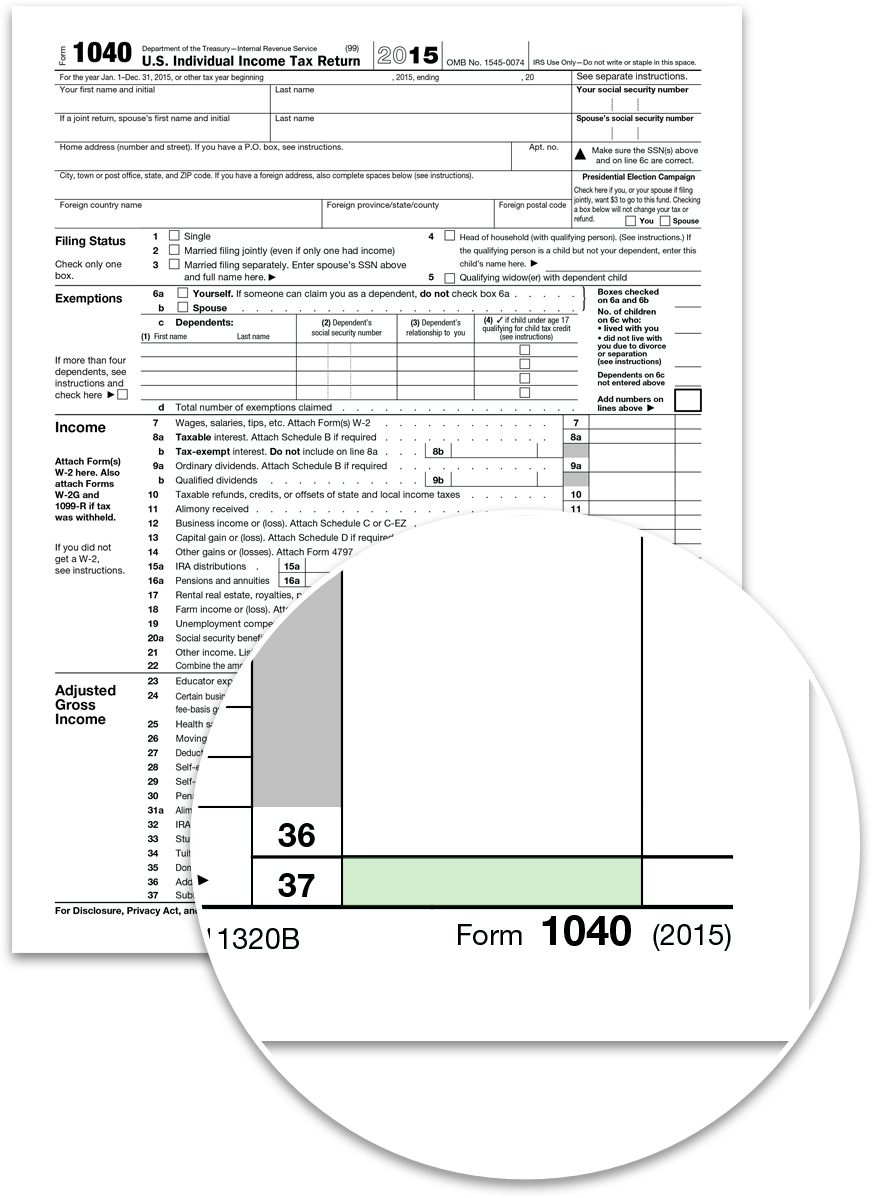

- Start with your gross income. Income is on lines 7-22 of Form 1040

- Add these together to arrive at your total income

- Subtract your adjustments from your total income

- You have your AGI

Above-the-line deductions include the following:

- Educator expenses

- Certain job expenses of performing artists

- Unreimbursed job expenses of state and local officials paid on a fee basis

- Health savings account deduction

- 50% of the self-employment taxes you paid

- Contributions you made to retirement accounts. Contributions include SEP, SIMPLE, 401 and other qualified retirement plans

- The amount you paid for health insurance during the year. This‰;number is limited to your net self-employment income.

- Any penalty you paid on the early withdrawal of your money from a savings account

- Alimony paid

- Tuition and fees

- Domestic production activities deduction

Self-employed workers can take advantage of above-the-line deductions. If you increase these deductions, you can lower your taxes.

How Can I Find My Agi If I Dont Have My Prior Year Return

If you do not have last years tax return,;you can get a copy of your transcript from the IRS.;Start by visiting their site;here. From there, you have two options:

- Use the;Get Transcript Online;tool to view your AGI.;

- Use;Get Transcript by;Mail,;or;call 800-908-9946 to request a Return Transcript. Allow 5 to 10 days for delivery.;

If you didnt file your taxes last year and you need to, use TaxSlayer to file a prior year return.;The;information;you;provide;will be;entered into;the;forms, and the calculations will be done for you. ;

Read Also: How To Know Tax Id Number

How Your Adjusted Gross Income Affects You

Your adjusted gross income is typically the basis for your taxes, not your gross income. The adjusted gross income is a more accurate look at your actual income, which is why it often is considered more heavily. Your adjusted gross income is what will also qualify you for tax deductions and tax credits, which are figured by your income.

Some tax credits and deductions will benefit you more if your adjusted gross income is lower, which is why you want to calculate it properly. For example, if you itemize your deductions, you’ll reduce your medical and dental expenses by 7.5 percent of your adjusted gross income. That means you can only deduct the amount that exceeds 7.5 percent of your adjusted gross income, so the lower that number is, the more of your expenses you can deduct.

These tax credits and deductions will affect your taxable income, and you want to get that adjusted gross income to a place that’s not only correct, but that will maximize your tax return.

Your adjusted gross income is also typically the basis for your state tax return, which is why it’s important to start your federal return first to get that number. Once you’ve completed your federal return and gotten to your adjusted gross income , you can move on to your state tax returns using the numbers you’ve already found.

Net Income Vs Adjusted Gross Income : An Overview

All income starts with gross income, which is the total of all the money you make in a year. This includes salaries, wages, bonuses, capital gains, and interest income. As we know from our paychecks, this is not the money that we take home and put into our bank accounts. Our gross income is subject to taxes and often other deductions, which reduce gross income to arrive at net income: our take-home pay.

Adjusted gross income also starts out as gross income, but before any taxes are paid, gross income is reduced by certain adjustments allowed by the Internal Revenue Service . This reduces gross income, and therefore, the amount of taxes that are paid.

Recommended Reading: Why Do I Owe So Much State Taxes

What Is My Agi On My 2019 Tax Return

; asked:;“What is my AGI on my 2019 tax return?”

The 2019 tax return is the current-year tax return.;

What stage is your 2019 return in?; Is your 2019 return still in preparation?;;; If so, the following steps will tell how to see the AGI in your unfiled return.

NOTE:; If your 2019 return has already been filed, then skip the below and see my follow-up comment in the next section that follows this posting.

In an unfiled return you can view your 2019 AGI figure on the Tax Summary or on a preview of your in-progress Form 1040.;;

Are you still preparing your 2019 return?; If so, here’s how to look at the Tax Summary and also how to preview the Form 1040 and Schedules 1-3 prior to paying/filing.

- Log in and open your return.

- In the left menu column, choose TAX TOOLS, then choose TOOLS.

- In the Tools window, choose View Tax Summary.;

- When the Tax Summary opens, you can review the Summary.; It may have the info you want.

- Otherwise, to preview the Form 1040, look in the left menu column and choose Preview My 1040.

- That will show you the Form 1040 and schedules 1-3.

How Your Adjusted Gross Income Affects Your Taxes

Your adjusted gross income affects the extent to which you can;use deductions and credits to reduce your taxable income. For instance, consider the effect of AGI on medical and dental expenses for taxpayers who itemize.

Those who itemize can deduct only the amount of qualified medical and dental expenses that are higher than a certain percentage of their adjusted gross income. For 2020, this limit is once again 7.5% of your AGI. This means that if your medical and dental expenses dont exceed 7.5% of your AGI, you likely wont be able to deduct them at all.

AGI-related limits also apply to deductions for tuition and charitable contributions. You can generally deduct qualified charitable contributions you made only until the deduction amount reaches 50% of your AGI. Therefore, your AGI has a significant effect on which deductions and credits you can take, as well as how much theyre worth.

Your adjusted gross income is especially important if you live in a state that collects state income taxes. Many states use the AGI from your federal return as the starting point for state income tax calculations.

You May Like: How Do You Add Sales Tax

What Is Included In Agi

Adjusted gross income is your gross income which includes wages, dividends, alimony, capital gains, business income, retirement distributions and other income minus certain payments youve made during the year, such as student loan interest or contributions to a traditional individual retirement account or a

How Your Agi Impacts Your Dependents

MISHKANET.COM” alt=”Where do i find my agi on my taxes > MISHKANET.COM”>

MISHKANET.COM” alt=”Where do i find my agi on my taxes > MISHKANET.COM”> With the third stimulus check, your AGI is the main qualification for getting the money or not, due to a change in the rules and formula the IRS uses to calculate your payment total. If your AGI exceeds the limit, you won’t get a check. If it falls under $80,000 for single taxpayers , you’ll receive a full or partial check that includes up to $1,400 per dependent of any age you claim.;

Your AGI is also critical in your eligibility for the child tax credit. As with stimulus checks, your total will become lower on a sliding scale if you make a certain amount of money in 2021.

Read Also: How Much Does H&r Block Cost To File Taxes

Importance Of The Agi

Your AGI impacts many of the tax deductions and credits you can take at tax time. Thats especially important because deductions and credits can increase your tax refund or reduce the amount of taxes you owe. Depending on your filing status, you may be subject to an AGI limita dollar amount that limits the deductions you can takewhich usually applies to higher income earners.

Generally, the more deductions and credits you take, the lower your taxable income.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

What Is Agi Used For

AGI is one of the key metrics that determine how much income tax you owe, both at the state and federal levels. Once you calculate your AGI, you’re ready to take your allowable deductions and exemptions and figure out how much tax you owe.

The IRS also requires you to enter your prior year’s AGI when you e-file if you’ve prepared your own taxes. You’ll find your AGI on last year’s IRS Form 1040, line 8B.

AGI is the figure lenders are looking for when they ask for your income on a mortgage application. Your AGI provides insight into multiple sources of income, not just your wages. This helps your lender get a clearer picture of how large a loan payment you can afford each month, based on all of your monthly income. Your AGI is also relatively easy for a lender to verify by reviewing your past tax returns.

Applying for financial aid? AGI is the income used for the Free Application for Federal Student Aid . Overall, it’s never a bad idea to clarify what a credit card company, lender or even the IRS means when they ask you for income information. But, more often than not, your AGI is the number they’re looking for.

Also Check: How To Get The Most Out Of Tax Return

How To Calculate Modified Adjusted Gross Income

Written by: PeopleKeep TeamSeptember 22, 2020 at 2:52 PM

The Affordable Care Act offers premium tax credits to help eligible individuals and families purchase individual health insurance coverage through the Health Insurance Marketplace.

With the changes made through the American Rescue Plan, no American will ever pay more than 8.5%; of their household income for health coverage. The tax credits will cover the rest. The household income figure here is your modified adjusted gross income .

Your MAGI is a measure used by the IRS to determine if you are eligible to use certain deductions, credits , or retirement plans. The percentage of income you must pay for individual health insurance depends on how close you are to the federal poverty line based on modified adjusted gross income, not adjusted gross income . People whose modified gross income is less than 400% of the FPL are eligible for a premium tax credit Here’s a quick overview of how to calculate your modified adjusted gross income.

Note: Premium tax credits work with the qualified small employer health reimbursement arrangement , but you must report your HRA allowance amount to avoid tax penalties. They do not work with an individual coverage HRA . If your employer offers you an ICHRA allowance that allows you to purchase a plan that meets affordability criteria on the ACA marketplace or your state exchange, you lose your premium tax creditseven if you opt out of the ICHRA.

What Is Adjusted Gross Income

Adjusted Gross Income is simply your total gross income minus specific deductions. Additionally, your Adjusted Gross Income is the starting point for calculating your taxes and determining your eligibility for certain tax credits and deductions that you can use to help you lower your overall tax bill.

Read Also: How To Look Up Employer Tax Id Number

Understanding Adjusted Gross Income

As prescribed in the United States tax code, adjusted gross income;is a modification of gross income. Gross income is simply the sum of all the money you earned in a year, which may include;wages, dividends, capital gains, interest income, royalties, rental income,;alimony, and retirement distributions. AGI;makes certain adjustments to your gross income to reach the figure on which your tax liability will be calculated.

Many states in the U.S. also use the AGI from federal returns to calculate how much individuals owe in state income taxes. States may modify this number further with state-specific deductions and credits.

The items subtracted from your gross income to calculate your AGI are referred to as adjustments to income, and you report them on Schedule 1 of your tax return when you file your annual tax return. Some of the most common;adjustments are listed here, along with the separate tax forms on which a few of them are calculated:

- Alimony payments

- Tuition and fees

How To Calculate Your Adjusted Gross Income

Your most recent tax return can be a great help in calculating your AGI. In fact, if you’re looking for your most recent AGI, it’s listed on your last tax return . If you need a more current number or your tax return isn’t handy, here’s a quick guide to calculating your adjusted gross income:

Add up your income. Total up all sources of taxable income. These include wages, self-employment income, unemployment benefits, tips, investment dividends, taxable interest, taxable alimony, royalties, capital gains, income from real estate investments and any other income that is not tax-exempt. What doesn’t qualify as gross income? The list of exceptions is relatively long. It includes life insurance benefits, some Social Security benefits, scholarships and some employee benefits.

Gather up your adjustments. Check out all the options for above-the-line deductions, which include student loan interest, tuition, retirement account contributions and educator expenses. Add up all the adjustments that apply.

Subtract your adjustments from your gross income to get your AGI.

Here’s an example of how this math works:Gross income:

Recommended Reading: How Fast Can You Get Your Tax Refund

What Is Modified Agi

According to the IRS, for most taxpayers MAGI is simply adjusted gross income before subtracting deductible student loan interest.

If youre filing Form 1040 and itemizing so that you can take certain deductions, you may have to calculate your MAGI. It too can be a baseline for determining the phaseout level of some;credits and tax-saving strategies, and sometimes the formula for MAGI can depend on the type of tax benefit it applies to.

About the author:Tina Orem is NerdWallet’s authority on taxes and small business. Her work has appeared in a variety of local and national outlets.Read more

Differences Between Agi Magi And Taxable Income

Your AGI is not the income figure on which the IRS will actually tax you. Your final income number, or taxable income, comes from subtracting even more deductions from your AGI.

For the 2020 tax year, the vast majority of taxpayers will likely use the standard deduction rather than itemize deductions.;Under current laws, the standard deduction will be $12,400 for single filers and $24,800 for married couples filing jointly.

Modified adjusted gross income, or MAGI, is another term related to taxable income and adjusted gross income. MAGI comes into play when youre trying to figure out whether you qualify for certain deductions. For instance, if your MAGI is above certain income limits and you have a workplace retirement plan, you may not be able to take the full deduction for contributing to an IRA.

To calculate your MAGI, you have to add certain deductions, such as student loan interest, back to your adjusted gross income. If you didnt claim any of these deductions, your AGI and MAGI should be the same.

Read Also: Do I Have To Pay Taxes On Social Security Income