Understand Which Tax Deductions And Credits You Can Take

One thing that I will emphasize if you are doing your own taxes is to understand the following:

- The tax deductions you are eligible for

- The tax credits you are eligible for

Why is important you understand credits and deductions?

So you dont pay the IRS more than you have to.

Before we go into some possible tax deductions and tax credits, lets actually discuss the difference between these 2 terms.

| The Tax Term |

|---|

|

– Your dependents |

|

| Savers Tax Credit |

For 2020, you can take the Savers Tax Credit if your adjusted gross income is $66,000 for:– Married filing jointlyFor 2020, you can take the Savers Tax Credit if your adjusted gross income is $49,500 for:– Head-of-householdFor 2020, you can take the Savers Tax Credit if your adjusted gross income is $33,000 for:– Any other filing status |

| Residential Energy-Efficient Property Credit |

If you have a house and youve invested money to make it more energy saving and energy efficient, this tax credit may apply to you to help offset some of those expenses. |

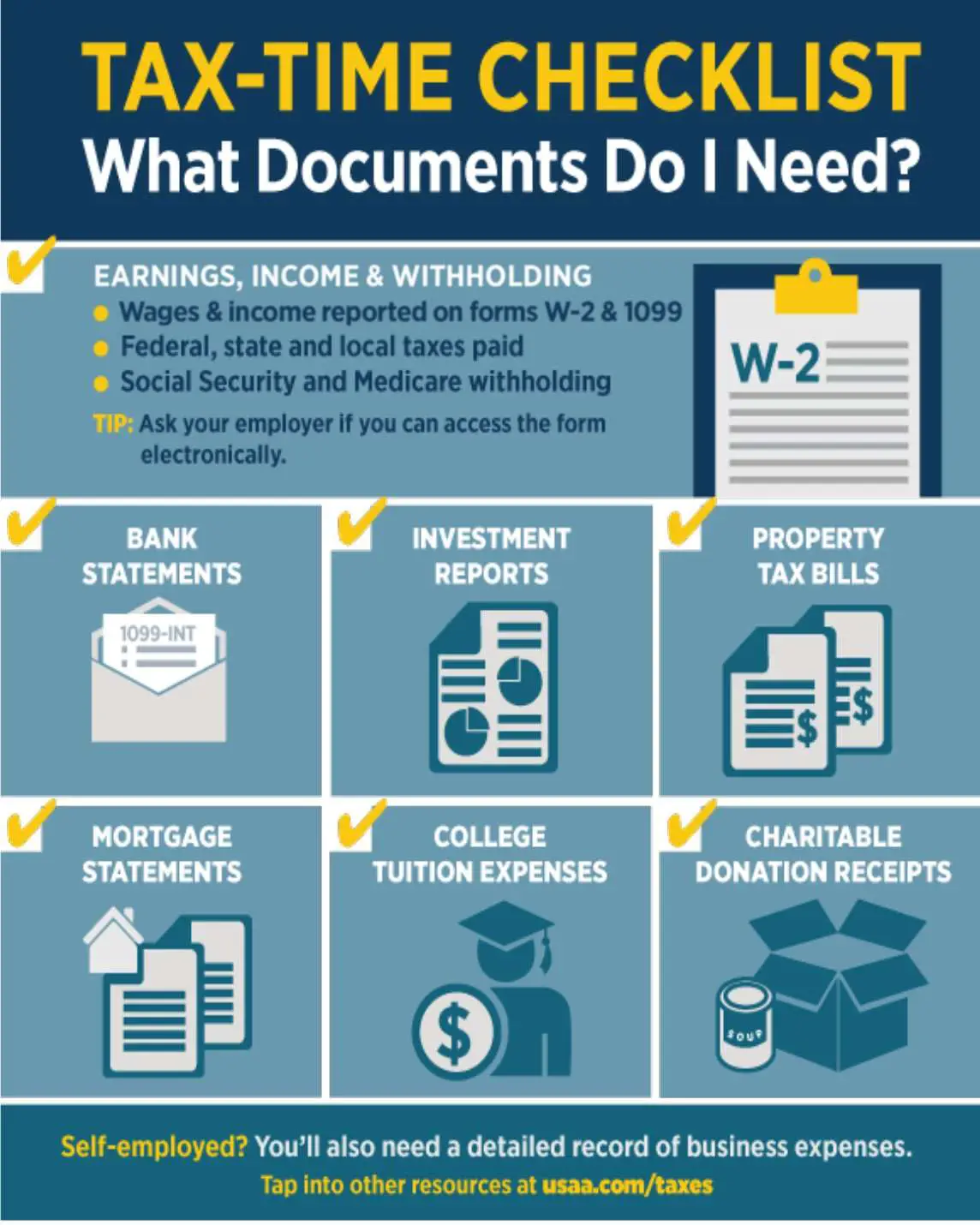

As you can see, its very important to track your expenses throughout the tax year, keep receipts and store these in a safe area so you can use them when its time to pay your taxes.

Child And Dependent Care Credit

The Child and Dependent Care Credit is a federal tax benefit that can help you pay expenses for child or adult care that is needed to work or to look for work. The 2021 American Rescue Plan temporarily expands the credit for tax year 2021 , making it fully refundable. This means the credit can provide money back even if you dont owe taxes. It is worth up to $4,000 for one dependent or up to $8,000 for two or more dependents. Learn more here.

You Have A Bank Account In France Or Monaco

You can use the same means of payment that are available to taxpayers resident in France.

Direct online payment

This is the preferred means of payment as you can be certain that your payment will be duly received by the right tax department.

Online payment does not involve bank cards rather, it is a very flexible direct debit system. You issue a web-based payment order with the advantage that your bank account will be debited at least 10 days after the payment deadline listed on your tax notice .

In addition, you have five extra days after the payment deadline to use the online payment system.

Taxes that can be paid online:

- Income tax, only to pay an entire advance tax payment that was unable to be debited

- Residence tax and the public broadcast licence fee

- Property tax and related taxes

- Property wealth tax that is declared at the same time as your income

- Tax on vacant residential premises

- Residence tax on vacant residential premises

- Street sweeping tax

You may pay online only if you have a bank account in France or in one of the 36 countries that comprise the Single European Payment Area .

Livret A savings accounts may not be debited unless authorised by your bank. Debits are also not allowed from other type of savings accounts .

You can pay online from your personal account or using the online payment system. You will need your tax notice.

Monthly direct debit

Direct debit on the due date

Payment by cheque

Recommended Reading: Why Is My Taxes Still Processing 2021

Where Do My Taxes Go

Every year, Council determines the amount of money needed to fund operation of the Town of Canmore. A municipal budget funded through property taxes benefits your community in a variety of ways and is vital to the ongoing health of any community. The tangible benefits provided by the Town of Canmore can be categorized into the seven Ss:

We provide for the safety of residents and visitors through police and fire response along with education and enforcement of bylaws. In addition, we protect the community from flooding and fire through steep creek hazard mitigation and FireSmart practices. Prevention, emergency preparedness and emergency social supports are key to community safety.

We work towards sustainability of our community by diverting residential and commercial food waste and recycling. We research and monitor opportunities for solar installation on municipal facility rooftops as a way to conserve and procure energy. As we implement, monitor, and report actions related to energy and climate protection, we also conserve resource including prioritizing wildlife co-existence through attractant reduction programs.

Streets and roads are maintained in the winter and summer and rehabilitated through capital funding and are part of an overall transportation network including bridges, sidewalks, paved pathways, and parking lots. This also includes pavement markings, signage, street lighting, and traffic signal light maintenance. Funding fare-free local transit.

File With A Free Netfile

The CRA doesnt let just anyone file online through NETFILE. For your own protection, make sure youre using a certified tax software like TurboTax. This ensures your information is secure.

The CRA thoroughly vets any organization that offers tax filing services and software. And rightly so. Certified software is the trusted way to file with accuracy and confidentiality.

Youll also want to take advantage of the CRAs Auto-fill my return service, which lets you automatically fill in details from your CRA account into your return. This greatly reduces the time youll spend filling out forms manually no thanks and helps you import your information correctly.

With TurboTax, you can seamlessly and securely auto-fill your info from the CRA and more. As well as easily add claims and deductions to your return with our step-by-step process.

Recommended Reading: How To File Previous Years Taxes

How To Get The Payment

- There is no need to formally apply.

- If you meet all of the SATC eligibility criteria, you automatically qualify to receive the one-time $500 payment via a cheque sent by mail to the residence listed on your 2021 tax return.

- To update your mailing address, please contact the SATC administration centre by email at or by phone at 1-800-667-6102. To update your address, you must provide the following information:

- Your full legal name

- Your Social Insurance Number and

- Your address as it appears on your 2021 tax return.

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Also Check: How To Calculate Capital Gains Tax On Property

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Set Up A Cra My Account

To file online youll need to set up a CRA My Account, which works together with NETFILE, the electronic filing service used by the CRA.

If you havent signed up for a CRA account already, you can do so in two ways:

Recommended Reading: How Much Money Can You Make Without Paying Taxes

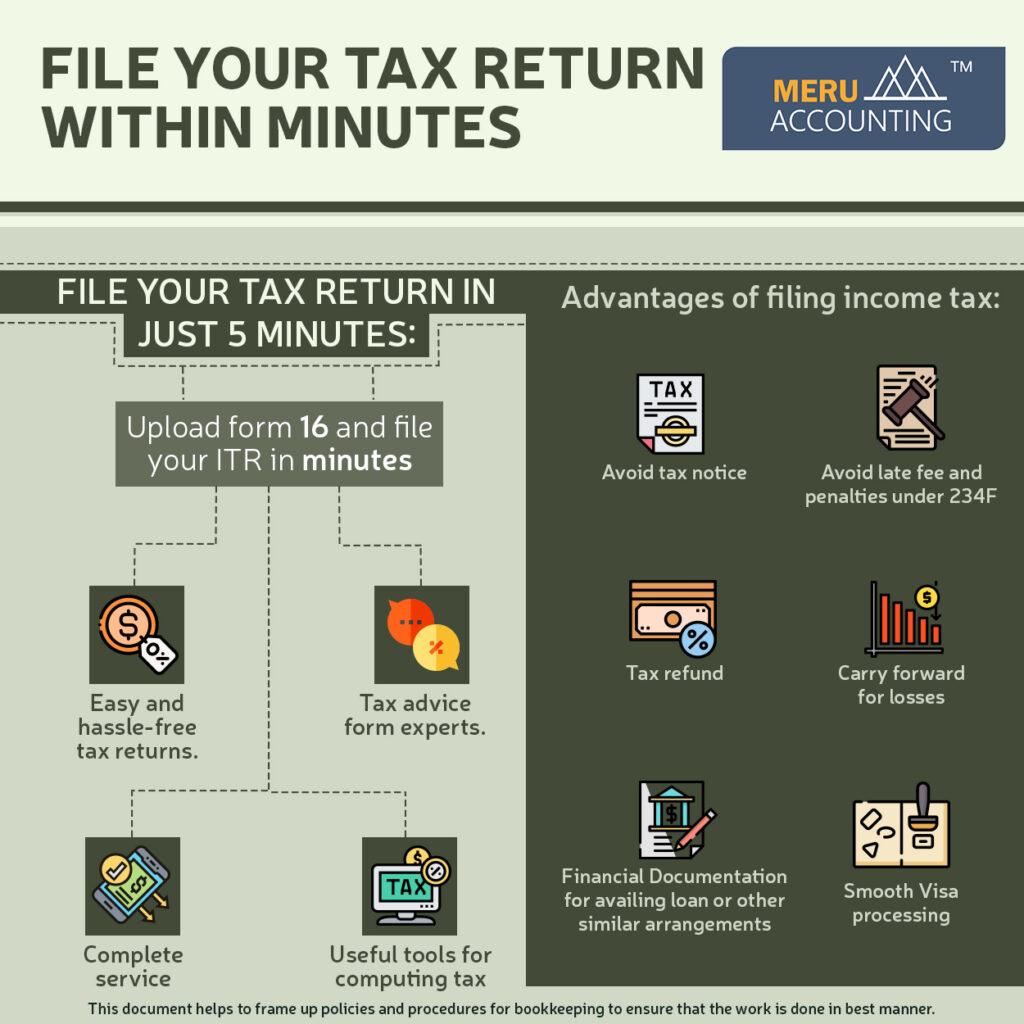

How To Do Your Own Taxes

Tax time may not be the most enjoyable time of the year. But it is important to get them filed on time. At first glance, it can seem somewhat overwhelming to tackle this project on your own. Luckily, it doesnt have to be! Once you know the basics of how to do your own taxes, it will seem much more manageable.

So today we will take a closer look at just that: how to do your own taxes!

Free Tools To Help With Taxes

The IRS provides free publications, forms, and tools to help taxpayers:

-

Help and Resource Center – Learn about the many free services and resources that the IRS offers to taxpayers.

-

Interactive Tax Assistant – Use this tool to find answers to your general tax questions.

-

Tax Tools – Find interactive forms, calculators, and other helpful tools.

-

Choose a Tax Preparer – Get tips for finding a tax preparer with the credentials and experience to handle your tax needs. Learn how to file a complaint if your preparer has acted improperly.

-

Forms and Publications – Get tax forms and instructions. You can also search for specific titles or product numbers. The IRS also offers forms and publications for taxpayers with visual impairments.

Don’t Miss: How Do I Fix My Rejected Tax Return

Can I File My Taxes Online For Free

Yes, and yes. If your return is simple, TurboTax will connect you directly to the CRA through NETFILE, a system that lets you input your tax details and file your return digitally.

A simple return may include a number of common scenarios. Heres a list.

- Employment income

- Caregiver tax credit

- COVID-19 benefits & re-payments

As well, it can also involve additional benefits and credits like the age amount, social assistance, and disability amounts.

Maybe your return is more complicated. Items like claim donations, interest-based income, investment and employment expenses, or anything related to self-employment, may require more expertise.

The good news is you can use one of our other tailored products, like TurboTax Deluxe, Premier, and Self-Employed. Whatever your unique tax situation, we have the product to help you file to perfection.

This year, all of TurboTaxs product options are free for those 25 and under.

This includes all our product options at all levels of assistance, from doing your taxes yourself to using our Live Assist & Review and Full Service options. Well automatically direct you to the service that suits your level of tax complexity so you can file with accuracy and peace of mind.

Can I Get Help With My Tax Questions

TurboTax is always ready to help! Heres how.

Advice and answers as you go

Let an expert take taxes off your plate. Consider using TurboTax Assist & Review for this filing year. With this option, one of our tax experts will be happy to help you fill your forms out and review your return line by line to make sure you arent missing anything.

24/7 TurboTax community support

Take advantage of the TurboTax self-serve support community. Here you can get the answers you need by interacting with our other TurboTax users and discussing tax-related topics. solve your tax questions by connecting with other TurboTax users.

Which TurboTax should I use?

Find which TurboTax product is right for you. Whether you’re filing on your own, with expert help or handing off your taxes, we’ve got you covered.

Recommended Reading: How Do I Get My Pin For My Taxes

How To Do Your Own Taxes: Step

Disclosure: This post may receive compensation from partners listed through affiliate partnerships, at no cost to you. This doesnt influence our ratings, and the opinions are our own. Learn more here.

In this article

If you are thinking about doing your own taxes for the 2020 year, its very important to get things right the first time around.

Why?

Because doing your own taxes can be all of the following:

If you find yourself making any mistakes on your tax returns then you may see some serious consequences .

But no pressure!

Before we check out my guide on how to do your own taxes and avoid basic, rookie mistakes, lets take a look at some questions that may need answering before you hit the tax returns.

How Much Does A Tax Preparer Make And Whats The Average Salary For The Role

The amount of money a preparer can make is largely dependent on whether theyre a sole practitioner or work for a public accounting firm, the number of clients they can handle, and the geographical location of their practice.

So, while many first-year tax preparers may claim a starting salary around the $50,000, year one staff might be somewhere between $30,000-$40,000 at a different firm. And if youre serving as an intern, you might not make anything.

While the salaries of most regional firms will be set before you walk through the doors for your interview, the amount of money a sole practitioner can make is limitless . So, then the questions become: how many clients can you get? How much work can you get through? What kind of software can boost your efficiency and increase throughput?

Some people begin their careers at firms to get the first two years of experience. And then they break away and start a local firm. This allows you to get high-quality training to boost your skills out of the gate.

Several national and seasonal businesses also offer training to their preparers.

You May Like: How Can I File My Past Years Taxes

Using An Online Tax Software Program

As a final option, you can use online tax software programs to file your own taxes. Although you may need to pay to use an online software program, it might be worth it if you have a complex tax situation.

Most tax software programs walk you through the filing process with prompts along the way. It can be helpful to see these prompts. You might see something that helps you notice easily forgettable details of your tax year.

A few good options include:

Cash App Taxes

Cash App Taxes offers free tax filing via a simple and easy-to-use interface. Taxes can be filed from your computer or phone.

TurboTax

You can use TurboTax to file your basic return for free. However, you may need to upgrade to a paid version if you have a complicated situation.

H& R Block

H& R Block is another well-known tax software program that can help you file basic returns for free. However, their paid options are very affordable if you need more help.

Simply choose the software that you are most comfortable working with. Doing your own taxes will be much easier if you pick a method that feels easy to you.

Use A Software Package To Print And Mail Your Return

You can print your return from your home computer using income tax preparation software, and sending the printed return to CRA. See the CRA list of tax software packages approved for NetFile.

When mailing your tax return, you will have to also include many supporting documents.

Although our Tax Calculators are intended as planning tools, and do not include every available tax credit, they can be used to check most tax returns.

Read Also: Where Can I Get My Taxes Done By Aarp

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2022 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $34,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $68,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct qualified charitable donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

You May Like: When Do Child Tax Credits Start

Irs Free File Online Options

Do your taxes online for free with an IRS Free File provider.

If your adjusted gross income was $73,000 or less, review each providerâs offer to make sure you qualify. Some offers include a free state tax return.

Use the IRS Free File Lookup Tool to narrow your list of providers or the Browse All Offers page to see a full list of providers. After selecting one of the IRS Free File offers, you will leave the IRS.gov website.

Why Should I Get An Itin

Some of the benefits to getting an ITIN include:

1. Filing taxes.

This can serve as proof of good moral character in immigration cases. Filing taxes can be helpful in your immigration case if you are able to adjust your status in the future.

2. Opening a personal bank account.

In somecases, an ITIN can be used as a substitute for an SSN to open a personal checking or savings account. A bank account is a safe place to store your money and allows you to establish a financial history.

3. Building credit.

Some credit cards require you to have an established bank account to apply. By developing a good credit history, you may be able to do things like buy a house,purchase a car, or borrow money to start a business in the future.

4. Claiming tax credits.

Filing taxes also means that you can claim tax credits that you are eligible for. These credits can reduce the amount of taxes you owe or can provide you a tax refund that can be put towards things like the cost of raising kids or to cover daily living expenses. Learn more about specific tax credits available if you have an ITIN.

5. Purchasing health insurance.

When you purchase health insurance for your US-born children through the Health Insurance Marketplace, you may be eligible for the Premium Tax Credit , which can help lower how much you spend on insurance. To get the PTC, parents with ITINs are required to file their taxes.

6. Securing identification.

Read Also: How Much Do I Need To Make To Pay Taxes

Recommended Reading: How To Contact Credit Karma Tax By Phone