If You Want To File A Petition With The Us Tax Court

- 400 Second Street, NWWashington, DC 20217

- You have 90 calendar days from the date of your CP3219N to file a petition with the Tax Court. The last day to file a petition is stated in your CP3219N. If the CP3219N is addressed to a person who is outside of the United States, the deadline to file a petition with the Tax Court is extended to 150 days from the date of the CP3219N.

- If you file a petition, attach an entire copy of the CP3219N to the petition.

- The Tax Court has simplified procedures for taxpayers whose amount in dispute, including applicable penalties, is $50,000 or less per tax year. You can find these simplified small tax case procedures from the U.S. Tax Court.

How Late Can You File

The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return’s original due date. By not filing within three years of the due date, you might end up missing out on a tax refund because you can no longer claim the lucrative tax credits or any excess withholding from your paycheck.

Irs Free File Software And Fillable Forms

Filers with adjusted gross incomes of $64,000 or less can make use of the IRS’s list of free filing software linked from its website. The IRS has arranged for free use of 12 popular preparing services that include familiar names such as TurboTax, H& R Block, and TaxAct, subject to some simple limitations.

Image source: Getty Images.

In general, filers must meet one of the following criteria to use the IRS Free File:

- Earn less than $64,000 in adjusted gross income.

- Qualify for the Earned Income Tax Credit.

- Earn an income as an active duty member of the U.S. military.

Importantly, not all services are created equal. Some offer completely free federal and state returns, while some preparers only offer free federal returns. Save time by using the Look Up Tool to find the best completely free software for you based on your income, age, and the state in which you reside.

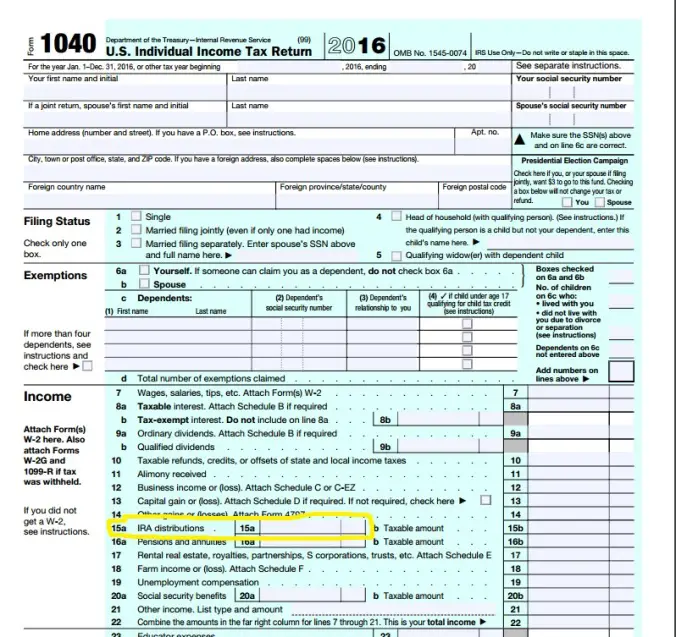

If you earn more than the $64,000 limit, the IRS has a solution. Its Fillable Forms tool allows you to complete common tax forms including the 1040, 1040A, and 1040EZ electronically . It’s completely free, the only caveat being that it won’t help you with your state taxes, and it assumes you have some familiarity with paper tax forms.

Read Also: How Do Day Traders Pay Taxes

Individual Tax Forms And Instructions

We offer several ways for you to obtain Maryland tax forms, booklets and instructions:

You can also file your Maryland return online using our free iFile service.

Do Not Send

- Federal forms or schedules unless requested.

- Any forms or statements not requested.

- Returns by fax.

- Returns completed in pencil or red ink.

- Returns with bar codes stapled or destroyed.

Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form. You must have the Adobe Acrobat Reader 4.1 , which is available for free online. You can also print out the form and write the information by hand. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process.

IMPORTANT: The Acrobat Reader does not allow you to save your fill-out form to disk. To do so, you must have the full Adobe Acrobat 4.1 product suite, which can be purchased from Adobe. Maryland fill-out forms use the features provided with Acrobat 3.0 products. There is no computation, validation or verification of the information you enter, and you are fully responsible for the accuracy of all required information.

Individual Income Tax Forms

For additional information, visit Income Tax for Individual Taxpayers> Filing Information.

Note: The instruction booklets listed here do not include forms. Forms are available for downloading in the Resident Individuals Income Tax Forms section below.

| Booklet |

|---|

| Instructions for filing personal state and local income taxes for full- or part-year Maryland residents. |

| Worksheet for resident taxpayers who were required to reduce their federal itemized reductions. |

| Instructions for filing personal income tax returns for nonresident individuals. |

| Worksheet for nonresident taxpayers who were required to reduce their federal itemized deductions. |

You May Like: When Are Tax Returns Due This Year

File Form 7004 Based On The Appropriate Tax Form Shown Below:

| IF the form is … | AND the settler is … | THEN file Form 7004 at: |

|---|---|---|

| 706-GS | A resident U.S. citizen, resident alien, nonresident U.S. citizen, or alien | Department of the Treasury |

|

AND your principal business, office, or agency is located in … |

THEN file Form 7004 at: |

|

|---|---|---|

| 10411120-H | Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury |

Nonrefundable Renters Credit Qualification Record

Tip: e-file and skip this page! The tax software product you use to e-file will help you find out if you qualify for this credit and will figure the correct amount of the credit automatically. Go to ftb.ca.gov to check your e-file options. You can claim the nonrefundable renterâs credit using CalFile.

If you were a resident of California and paid rent on property in California, which was your principal residence, you may qualify for a credit that you can use to reduce your tax. Answer the questions below to see if you qualify. For purposes of California income tax, references to a spouse, husband, or wife also refer to a California Registered Domestic Partner , unless otherwise specified. When we use the initials RDP they refer to both a California registered domestic âpartnerâ and a California registered domestic âpartnership,â as applicable. For more information on RDPs, get FTB Pub. 737. Do not mail this record. Keep with your tax records.

Were you a resident of California for the entire year in 2017?

Military personnel. If you are not a legal resident of California, you do not qualify for this credit. However, your spouse/RDP may claim this credit if he or she was a resident during 2017, and is otherwise qualified.

- YES.

Don’t Miss: Who Gets Child Tax Credit 2021

Refund Or No Amount Due

Line 115 â Refund or No Amount Due

Did you report amounts on line 110, line 112, or line 113?

- No

- Enter the amount from line 96 on line 115. This is your refund amount. If it is less than $1, attach a written statement to your Form 540 requesting the refund.

- Yes

- Combine the amounts from line 110, line 112, and line 113. If the result is:

- Less than line 96, subtract the sum of line 110, line 112, and line 113 from line 96 and enter on line 115. This is your refund amount.

- More than line 96, subtract line 96 from the sum of line 110, line 112, and line 113 and enter the result on line 114. This is your total amount due. For payment options, see line 111 instructions.

Irs Free File And Other Resources

IRS Free File is available to any person or family with an adjusted gross income of $73,000 or less in 2021. Leading tax software providers make their online products available for free. Taxpayers can use IRS Free File to claim the Child Tax Credit, the Earned Income Tax Credit and other important credits. IRS Free File Fillable Forms is available for taxpayers whose 2021 AGI is greater than $73,000 and are comfortable preparing their own tax returnso there is a free option for everyone.

Online Account provides information to help file an accurate return, including Advance Child Tax Credit and Economic Impact Payment amounts, AGI amounts from last year’s tax return, estimated tax payment amounts and refunds applied as a credit.

Taxpayers can also get answers to many tax law questions by using the IRS’s Interactive Tax Assistant tool.

Additionally, taxpayers can view tax information in several languages by clicking on the “English” tab located on the IRS.gov home page.

Recommended Reading: Where’s My Tax Refund

Overpaid Tax Or Tax Due

To avoid delay in processing of your tax return, enter the correct amounts on line 94 through line 97.

If you received a refund for 2016, you may receive a federal Form 1099-G. The refund amount reported on your federal Form 1099-G will be different from the amount shown on your tax return if you claimed the refundable California Earned Income Tax Credit. This is because the credit is not part of the refund from withholding or estimated tax payments.

Line 94 â Overpaid Tax

If the amount on line 92 is more than the amount on line 64, your payments and credits are more than your tax. Subtract the amount on line 64 from the amount on line 92. Enter the result on line 94.

Line 95 â Amount You Want Applied to Your 2018 Estimated Tax

Apply all or part of the amount on line 94 to your estimated tax for 2018. Enter on line 95 the amount of line 94 that you want applied to your 2018 estimated tax.

An election to apply an overpayment to estimated tax is binding. Once the election is made, the overpayment cannot be applied to a deficiency after the due date of the tax return.

Line 96 â Overpaid Tax Available This Year

If you entered an amount on line 95, subtract it from the amount on line 94. Enter the result on line 96. Choose to have this entire amount refunded to you or make voluntary contributions from this amount. See âVoluntary Contribution Fund Descriptionsâ for more information.

Line 97 â Tax Due

If this applies to you, see instructions on line 113.

Here’s How To File State And Federal Tax Returns Online Completely And Truly Free

It’s not just false advertising. You really can file your taxes for free. Thanks to tools from the IRS, tax preparers, and the time of nearly 100,000 volunteers, there are a number of free ways to to file your taxes online in 2017. But where you should go depends on your income, age, tax status, and the complexity of your federal and state tax filings.

Here are several ways to file your taxes that are truly and completely free to use.

You May Like: Where To File California State Tax Return

Irs Free File Online Options

Do your taxes online for free with an IRS Free File provider.

If your adjusted gross income was $73,000 or less, review each providerâs offer to make sure you qualify. Some offers include a free state tax return.

Use the IRS Free File Lookup Tool to narrow your list of providers or the Browse All Offers page to see a full list of providers. After selecting one of the IRS Free File offers, you will leave the IRS.gov website.

Notices For Past Due Tax Returns

You may receive one or more of the below notices if you have not filed your tax return.

If the IRS files a substitute return, it is still in your best interest to file your own return to take advantage of all the exemptions, credits and deductions to which you are entitled. The IRS will generally adjust your account to reflect the correct figures.

Understanding Your CP2566R NoticeWe previously sent you a CP63 notice informing you we are holding your refund until we receive one or more unfiled tax returns. Because we received no reply to our previous notice, we have calculated your tax, penalty and interest based on wages and other income reported to us by employers, financial institutions and others.

Understanding Your CP3219A Notice We received information that is different from what you reported on your tax return. This may result in an increase or decrease in your tax. The notice explains how the amount was calculated and how you can challenge it in U.S Tax Court.

Understanding Your LT3219B Notice This Statutory Notice of Deficiency notifies you of our intent to assess a tax deficiency and of your right to petition the U.S. Tax Court to dispute the proposed adjustments. We made these adjustments because we received information from third parties that doesnt match the information you reported on your return.

Don’t Miss: What Is Tax Resolution Services

Request A Copy Of Previously Filed Tax Returns

To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax. Please include your name, address, Social Security number, the tax year you are requesting and your signature. If you are requesting a copy of a joint return, include the information for both taxpayers and their signatures.

Mailing address:

The following information on your correspondence will help us generate a quick response to your inquiry:

Tax Return Filing Dates In 2022

Below are the estimated dates for key tax filing activities and deadlines. These will be updated as the IRS provides more information and you can subscribe to get notified of the latest updates.

Stay In the Know:or follow us on , and

An important point to note is that while you can file your taxes anytime after the beginning of the year, the IRS will not process any returns until IRS e-File goes live. This includes returns filed via the main tax software providers or directly via the IRS website for lower income filers. The IRS also reiterated that filing your taxes electronically is the most accurate way to file a tax return and the fastest way to get a refund. It is expected that more than over 80% of tax returns will be e-filed in the latest tax year.

Once your return is accepted the IRS processes your refund based on the IRS E-file Refund Cycle Chart. Exact refund dates are based on IRS processing times and can be found in IRS Publication 2043 and IRS Topic 152 for both e-filed and mailed returns. After filing and assuming your tax return is on order you should receive your federal refund between 8 and 21 days. If you did not select the electronic deposit option, getting a paper check mailed to you adds about a week. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date.

Also Check: Is Life Insurance Tax Deductible For Self Employed

Can I Still File My 2017 Taxes

A 2017 tax return can be e-filed using TurboTax at any time on or before October 15, 2018. After that date the 2017 can return can only be printed and mailed.

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on

A 2017 tax return can only be printed and mailed, it cannot be e-filed.

Print, sign, date and mail the tax return to the IRS. Include with the mailed return any forms W-2 and 1099 which have taxes withheld. Go to this IRS website for mailing addresses

There are no penalties for filing a tax return after the due date if filing for a tax refund or there are no taxes owed.

Read Also: Do I Pay Taxes On Social Security

How Health Coverage Affects Your 2017 Federal Income Tax Return

Important:

These pages provide information for completing your 2017 taxes

- If you still haven’t filed your 2017 taxes, or filed but failed to “reconcile” your premium tax credit, use the information on these pages. Some links may point to IRS information about 2017 taxes, so read any IRS pages you land on carefully.

- If you need information on 2018 taxes, which are due in April 2019, start on this 2018 tax page.

You shouldâve already filed your 2017 taxes, but if you havenât, you should do so immediately. When you file your taxes for the 2017 tax filing year:

- Youâll provide additional information when you file your 2017 federal income tax return.

- You may have to complete one or two new tax forms.

- You may have to use a tax tool to find 2017 Bronze or Silver premiums to complete your tax return.

- If you didnât have 2017 health coverage, you may have to get a health coverage exemption or pay a fee with your tax return.

Recommended Reading: How To Organize Tax Documents For Accountant

Free File: About The Free File Alliance

The Free File Alliance is a group of industry-leading private-sector tax preparation companies that provide free online tax preparation and electronic filing only through the IRS.gov website. IRS Free File is a Public-Private Partnership between the IRS and the Free File Alliance. This PPP requires joint responsibility and collaboration between the federal government and private industry to be successful.

Recommended Reading: Do I Pay Taxes When I Sell My Car