Connecticut Governor Signs Budget With $600 Million In Tax Cuts

Governor Ned Lamont signed the fiscal year 2023 budget containing $600 million of tax cuts. The enacted law extends the gas tax holiday, the child tax credit, and increases the property tax credit. Governor Lamont described the bill as significant tax relief for Connecticuts lower and middle-earning families and retirees. The law:

- Suspends the states excise tax on gasoline through Nov 30, 2022

- Allows a $250 per-child tax credit for lower and middle-income families

- Increases the states earned income tax credit to 41.5% of the federal credit and

- Increases the property tax credit from $200 to $300.

Connecticut Specific Filing Details

You will need to file a Connecticut State Tax Return if you file a federal Form 1040 and your gross income for the 2018 taxable year exceeds the Gross Income Test below:

$12,000 and you are married filing separately

$15,000 and you are filing single

$19,000 and you are filing head of household or

$24,000 and you are married filing jointly or qualifying widow with dependent child.

Plus, even if you were a nonresident or part-year resident of Connecticut in 2018 and any of the following is true for the 2018 taxable year, you still must file a Connecticut State Tax Return if you had Connecticut income tax withheld and if you were a nonresident with Connecticut-sourced income who meets the Gross Income Test or had a federal alternative minimum tax liability.

Connecticut State Tax Payments

Connecticut has many income tax payment options. Find the option that works best for you below.

Due by April 18, 2022

Connecticut Department of Revenue Contact Information:Phone: -297-5962Phone: -382-9463 Online: Connecticut Department of Revenue ServicesEmail: [email protected]Connecticut Contact Form

Read Also: Can I File My Taxes Online

Who Must File Connecticut Income Taxes

Full-year residents of Connecticut must file a resident income tax return if they had Connecticut income tax withheld, made estimated tax payments to Connecticut, are claiming an earned income tax credit in Connecticut, had a federal alternative minimum tax liability, or pass Connecticut’s Gross Income Test, which means your income exceeds certain amounts:

- $12,000 if married filing separately

- $15,000 if filing single

- $19,000 if filing as head of household

- $24,000 if filing jointly or are a qualifying widower with a dependent child

Someone who changed their legal residence to or from Connecticut during the current tax year is considered a part-year resident and must pay Connecticut taxes on all income earned in Connecticut in the tax year. Nonresidents who earn any income from a Connecticut source or for performing work in Connecticut must file a Connecticut state income tax return.

Special accrual rules apply to part-year residents and there are directions for how to account for this on the part-year resident return form.

Estimated Payments And Amendments

If estimated payments are necessary, they can be paid online at drsindtax.ct.gov/AUT/welcomeindividual.aspx, or by mail to the DRS. When paying by mail, send vouchers and payments to:

PO Box 2932Hartford CT 06104-2932

If an error is discovered and an amendment is needed, taxpayers may use the form CT 1040X and mail it to:

PO Box 2978

Recommended Reading: How To Pay My Property Taxes Online

Need More Tax Guidance

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you get the support you need when it comes to filing taxes.

Need to check the status of your federal refund? Visit our Wheres My Refund page to find out how soon youll receive your federal refund.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Determining Your Ct State Tax Filing Status

Your CT state tax filing status will determine how you are taxed and which forms you must fill out. It differs from Federal tax filing status and may also differ from your immigration residency status.

The information below is provided as a general guide. For specific information about nonresident vs. resident for CT state tax purposes, refer to the CT Income Tax Instructions.

You are considered a nonresident CT state tax filer for the year if one or more of the below conditions are met:

- Your legal residence is outside of CT and you do not maintain a permanent place to live in CT for the entire tax year .

- Your legal residence is in CT but you do not maintain a permanent place to live in CT, and you do not spend more than 30 days in CT in the tax year.

You are considered a resident CT state tax filer for the year if one or more of the below conditions are met:

- CT was your permanent legal residence for the entire tax year

- You maintained a permanent place of abode in CT during the entire tax year and spent a total of more than 183 days in CT during the tax year.

Please note, nonresidents for immigration purposes who meet either of the above conditions are considered CT residents for CT income tax purposes even if federal Form 1040NR-EZ or federal Form 1040NR is filed for federal income tax purposes.

You May Like: When Will We Get Our Taxes 2021

How To File Your Connecticut State Tax

You can e-file your state tax return for free through the Taxpayer Service Center, or via paid or free tax software programs.

If youd prefer to file a paper return, you can and print your tax forms including Form CT-1040 from the DRS website and fill them out with a pen. Mail your CT-1040 return to:

If you expect a refund:

Department of Revenue Services

When You Need To Collect Connecticut Sales Tax

In Connecticut, sales tax is levied on the sale of tangible goods and some services. The tax is collected by the seller and remitted to state tax authorities. The seller acts as a de facto collector.

To help you determine whether you need to collect sales tax in Connecticut, start by answering these three questions:

If the answer to all three questions is yes, youre required to register with the state tax authority, collect the correct amount of sales tax per sale, file returns, and remit to the state.

Recommended Reading: How To Find Tax Identification Number

The Basics Of Connecticut State Tax

Whether you file on your own or have someone else prepare your state tax return, its important to know about deadlines, credits, tax rates and more.

If you are a resident of Connecticut for all or part of the tax year, you may be required to file a state income tax return depending on how much income you earn and if certain conditions apply to you. Part-year residents may also be required to file if they meet certain conditions.

Ct Nonresident Tax Filers

If you are a CT nonresident or part-year resident for tax purposes, complete CT-1040NR/PY this form is most often used by individuals who have lived and/or worked in multiple states or resided in CT for less than 183 days in that calendar year.

Options for filing your CT State Tax Return:

- For further assistance filling out your CT state tax return, nonresident tax filers may use Sprintax for an additional fee.

Don’t Miss: How Much Income To File Tax Return

Wheres My Refund Connecticut

To check the status of your Connecticut state refund online, go to

You will be prompted to enter:

- Refund amount

Then, click Next to see your refund status.

Your Connecticut refund status is available via phone: from anywhere, or in the Greater Hartford calling area call .

Generally, it takes 10 to 12 weeks to process paper returns and a shorter time to process e-filed returns.

Filing And Payment Deadline

For 2019 state taxes, the state has extended the filing and payment deadline. Connecticut residents now have until July 15, 2020, to file their state returns and pay any state tax they owe for the year.

Although this year is a bit different, typically April 15 is the due date for filing and paying your state taxes each year. But it will be extended to the following business day if the 15th falls on a weekend or holiday.

If you dont have enough information to file your Connecticut state tax return by the due date, you can request a six-month extension. That doesnt extend your payment due date, however, so be sure to estimate how much youll owe and pay that amount by the original filing deadline.

Don’t Miss: How To Keep Track Of Miles For Taxes

How To Register For A Connecticut Seller’s Permit

You can register for a Connecticut sellers permit online through the DRS. To apply, youll need to provide the DRS with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

- Products to be sold

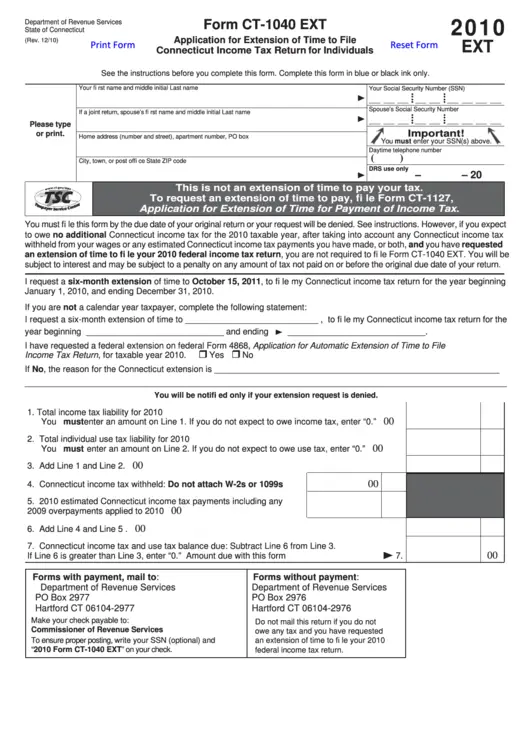

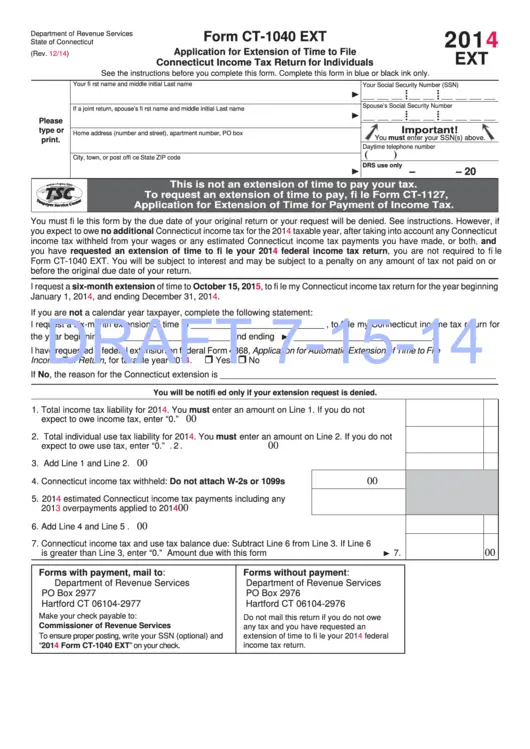

Connecticut State Tax Extension

Filing an Extension in Connecticut

The Connecticut Department of Revenue Services requires that you file for an extension if you cannot file your Connecticut income tax by April 15, 2022.

Exception: If you expect to owe no additional Connecticut income tax for the 2019 taxable year, after taking into account any Connecticut income tax withheld from your wages or any estimated Connecticut income tax payments you have made, or both, and you have requested an extension of time to file your 2019 federal income tax return, you are not required to file Form CT-1040 EXT. The Department of Revenue Services will automatically grant you a six-month extension of time to file your 2019 Connecticut income tax return. If you did not request an extension of time to file your federal income tax return, but you are requesting an extension of time to file your Connecticut income tax return, you must file Form CT-1040 EXT whether or not you owe additional Connecticut income tax.

An extension to file your return is not an extension of time to pay your taxes.

If You Owe

If you owe taxes, payment must be made by April 15, 2022 or penalty and interest will be assessed. If you cannot meet the filing deadline, you should apply for an extension. The extension allows additional time to complete and file your income tax return however, the extension does not provide additional time to pay the amount of tax owed.

Pay Online

Pay by Phone

Pay by Mail

Penalty and Interest on Tax Owed

If You Do Not Owe

Recommended Reading: What Are The Different Tax Forms

Can I File Without A Ssn/itin

If you do not have a social security and have not received your ITIN by April 15, you can file your return without the ITIN by attaching a copy of the federal Form W-7. The CT Department of Revenue Services will contact you upon receipt of your return. DRS will hold your return until you receive your ITIN and forward the information to them. If you fail to submit the information requested, the processing of your return will be delayed. Please refer to the CT Department of Revenue Services page for more information on this topic.

All Blogs Are Verified By Irs Enrolled Agents And Cpas

Do U.S. expats need to file Connecticut state taxes? Possibly. However, one thing for sure is that all US Citizens and Greencard Holders are required to report their worldwide income to the IRS regardless of where they live and work .

If you are no longer domiciled read on. If you still are domiciled in Connecticut, you will most likely need to file a state return every year!

Recommended Reading: How Much Tax Return Will I Get

The Connecticut Income Tax

Connecticut collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Like the Federal Income Tax, Connecticut’s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Connecticut’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below Connecticut’s %. You can learn more about how the Connecticut income tax compares to other states’ income taxes by visiting our map of income taxes by state.

Connecticut’s personal exemption incorporates a standard deduction, and is phased out for households earning over $71,000. An additional state tax credit, ranging from 75% to 0% of taxable income, is available based on your adjusted gross income.

There are -869 days left until Tax Day, on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 – you can start your online tax return today for free with TurboTax .

How Do I Pay Taxes Due

For e-filers, the most convenient way to pay taxes due is to set up an electronic funds transfer or credit or debit card payment at the time of filing. You may also send a check by mail. To file a paper return with a payment, you may also mail a check or make your tax payment online.

Before mailing a payment, check your tax booklet or the Mailing Addresses page of the CT.gov website to ensure you are sending your form to the correct PO Box.

If you have difficulty paying your Connecticut tax bill, the DRS offers installment agreements and payment assistance for qualifying taxpayers.

Read Also: What Is Adjusted Gross Income On Tax Return

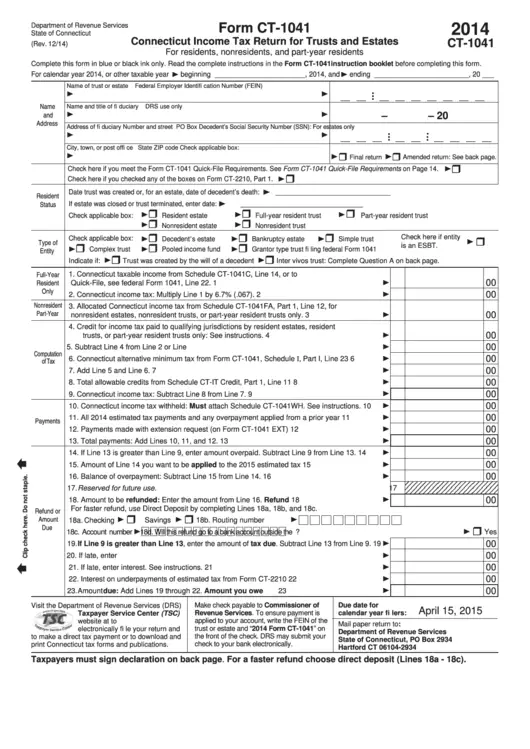

Ct Resident Income Tax Return

You must file a Connecticut resident income tax return if you were a resident of CT for the entire year and any of the following applies to you for the 2021 calendar year:

- You had CT income tax withheld

- You made estimated tax payments to CT

- You made an extension payment to CT

- You meet the gross income test

- You had a federal alternative minimum tax liability

- You are claiming the Connecticut earned income tax credit or

- You had a Pass-Through Entity Tax Credit amount which does not fully offset your CT tax liability.

If none of the above apply, do not file a CT resident income tax return.

State Income Tax Filing

The information on this page pertains to Connecticut State Income Taxes only. If you received income in other states besides CT, you may need to file a state income tax return in those states as well. See the ‘Income Tax Filing With Other States’ section at the bottom of this page for more information.

Also Check: How Do You Pay Owed Taxes

Ct Resident Tax Filers

If you are a CT resident for tax purposes, complete Form CT-1040.

Options for filing your CT State Tax Return:

- Use the Taxpayer Service Center E-filing website if you filed CT state income taxes the previous tax year.

- For further assistance filling out your CT state tax return, purchase commercial tax preparation software for individual use .

Connecticut Enacts State And Municipal Cannabis Taxes On Recreational Marijuana

The governor of Connecticut, Ned Lamont, has signed legislation legalizing the recreational use of marijuana effective July 1, 2021. The bill allows for three taxes on the retail sale of cannabis. State sales tax at the standard 6.35% state sales tax rate, 3% sales tax dedicated to city or town municipals, and an additional cannabis tax rate based on the THC content that will cost roughly between 10 to 15% of the sale price. State of Connecticut Governor News

Read Also: Why Tax Return So Slow

Where Do I Mail/e

E-filing can be done at no cost through TSC-IND, the Connecticut DRS portal for electronically filing, making payments and viewing your account. You may also file with commercial tax assistance software.

If you are filing a paper income tax return with a payment, mail it to: Department of Revenue Services, PO Box 2977, Hartford CT 06104-2977. To file a paper income tax return without a payment, mail it to: Department of Revenue Services, PO Box 2976, Hartford CT 06104-2976.

Checks should be made payable to: “Commissioner of Revenue Services” and include the tax year and form number in the memo.

Overview Of Connecticut Taxes

Connecticut has above average state income and sales taxes, and property taxes are likewise on the high side. But there are no extra income taxes or sales taxes at the local level in the state.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Also Check: How Does The Federal Solar Tax Credit Work

Do I Need To Report Treaty Income For Ct Income Tax Filing

Federal income tax treaty provisions are not recognized for CT state income tax purposes. Any treaty income reported on your federal 1040NR or 1040NR-EZ must be added to your federal Adjusted Gross Income on your CT-1040 . For complete information, refer to Special Instructions for Nonresident Aliens.