Im Trying To File My 1040 Form For My Federal Tax Return

Where are you having the problem in filing?

You complete your tax return by finishing all 3 Steps in the File section. In Step 3, to e-file your tax return, you must click on the large Orange button labeled “Transmit my returns now“.

After completing the File section and e-filing your tax return you will receive two emails from TurboTax. The first email when your tax return was transmitted and the second email when the tax return has either been accepted or rejected.

How To Report A 1031 Exchange On Your Tax Return

Youve successfully completed a 1031 like-kind exchange and deferred your capital gains tax on the sale of your former investment property – congratulations! The IRS still wants a report of every single exchange where you may have deferred your tax liability.

Reporting a like-kind exchange on your federal income tax is a step you cannot miss and should be viewed as part of the entire exchange process. Almost all states recognized 1031 exchanges and whether or not you need to report capital gains on your state report depends on where you live and where the exchange took place.

Fax 1040 Tax Form: Your Ultimate Manual For Easy Filing

We are only a few months shy from the dreaded tax season, which undoubtedly leaves so many working professionals stressed and exhausted. In order to make this daunting task a bit more manageable, its highly recommended to sort everything out as early as you can. Do not wait until the last minute to accomplish whatever it is you need to file your taxes.

In this article, we will provide you with a comprehensive guide that covers the basic things you need to know about filing your tax from understanding the process to learning how to fax 1040 Tax Form.

Don’t Miss: Can I File Taxes Separately From My Husband

Taxes Prepared In Person

Volunteer Tax Assistance

Free tax help is provided to taxpayers that meet certain income and/or other requirements. For more information, please visit Volunteer Assistance.

If you would like to get your taxes prepared in person, you also can use an authorized e-file provider. Note: The authorized e-file providers charge a fee to prepare and electronically file your Alabama and/or federal returns.

Below are some additional resources to help you to choose a tax return preparer.

IRS links

Who Should File A 1040 Tax Form

If you receive these types of income or losses, you may need to file a 1040 tax form:

- Self-employment income of $400 or more

- Income you receive as one of these:

- Partner in a partnership

- Beneficiary of an estate or trust

You must file a Form 1040 if you have any of these:

- Tips you didnt report to your employer.

- Youre eligible for the premium tax credit.

- Your employer didnt withhold Social Security and Medicare taxes from your pay.

- Youre repaying the first-time homebuyer credit.

- You have a foreign account.

- You received distributions from a foreign trust.

- You qualify for the foreign earned income exclusion.

- You qualify to exclude income from sources in Puerto Rico or American Samoa since you were a bona fide resident of either.

Recommended Reading: Do Veterans Pay Property Taxes In Florida

Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

Where Can I Find Form 1040

Form 1040 is not a tax statement or form that gets distributed to taxpayers. Unlike a W-2 or 1099 statement that is mailed by an employer or party you’ve contracted with, Form 1040 is available for download on the IRS website. In addition, free IRS filing platforms such as Free File Fillable Forms will provide digital copies. Last, some public courthouses or Federal buildings in your community may offer paper copies available for pick-up.

You May Like: How To Register For Tax Id

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

What You Need To Know

Before filing, you can learn more about the advantages of filing online. Electronic filing is the fastest way to get your refund. If you file online, you can expect to receive your refund within 2 weeks. If filing on paper, you should receive your refund within 6 weeks.

These forms are subject to change only by federal or state legislative action.

All printable Massachusetts personal income tax forms are in PDF format. To read them, you’ll need the free Adobe Acrobat Reader.

If you have any suggestions or comments on how to improve these forms, contact the Forms Manager at .

If you need information about the most common differences between the federal and Massachusetts state tax treatment of personal income, please visit our overview page.

Read Also: How Much Do You Need To Donate For Tax Deduction

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2022 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $34,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $68,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct qualified charitable donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Example For A Return Beginning With An Alpha Character:

To find Form SS-4, Application for Employer Identification Number, choose the alpha S.

Find forms that begin with Alphas:C, S, W

Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2022.

Read Also: How To File Your Taxes Online For Free

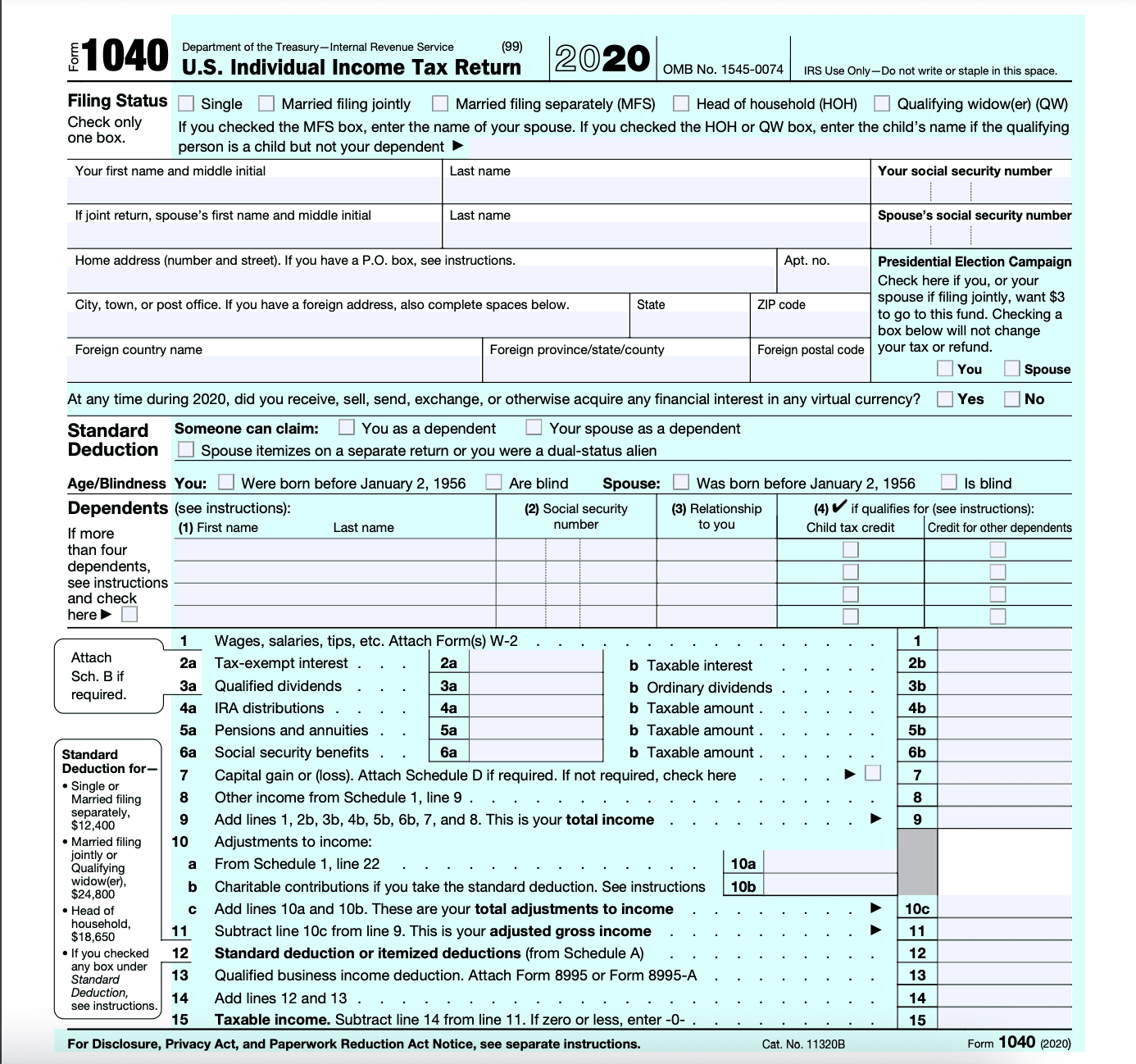

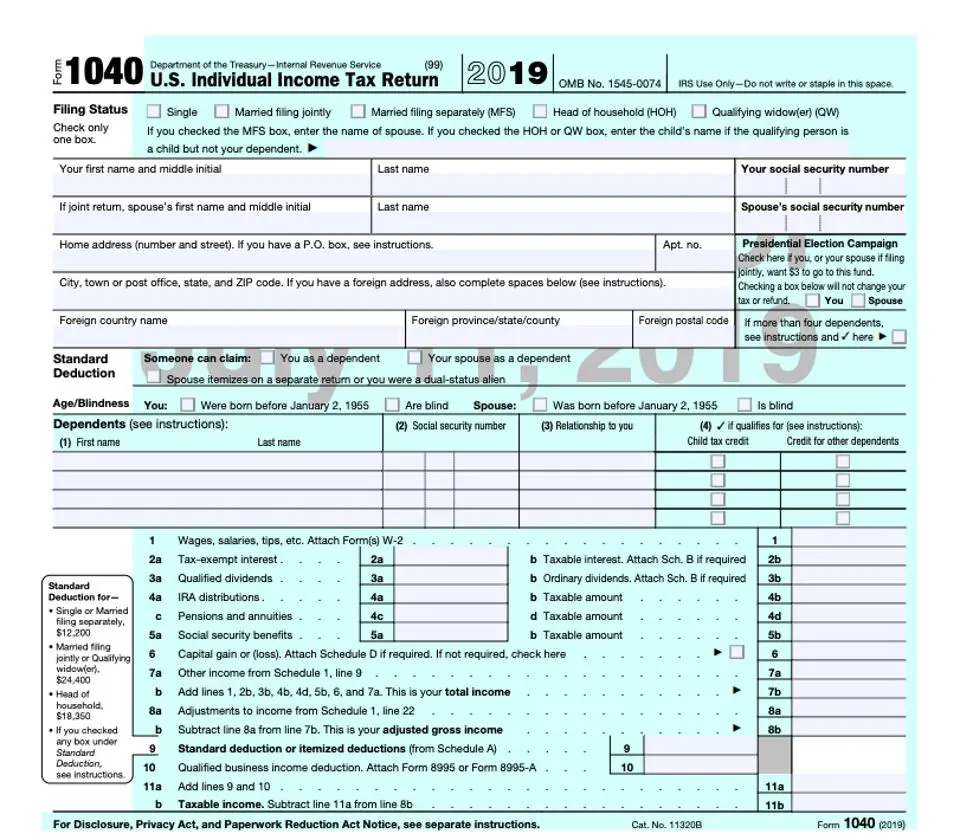

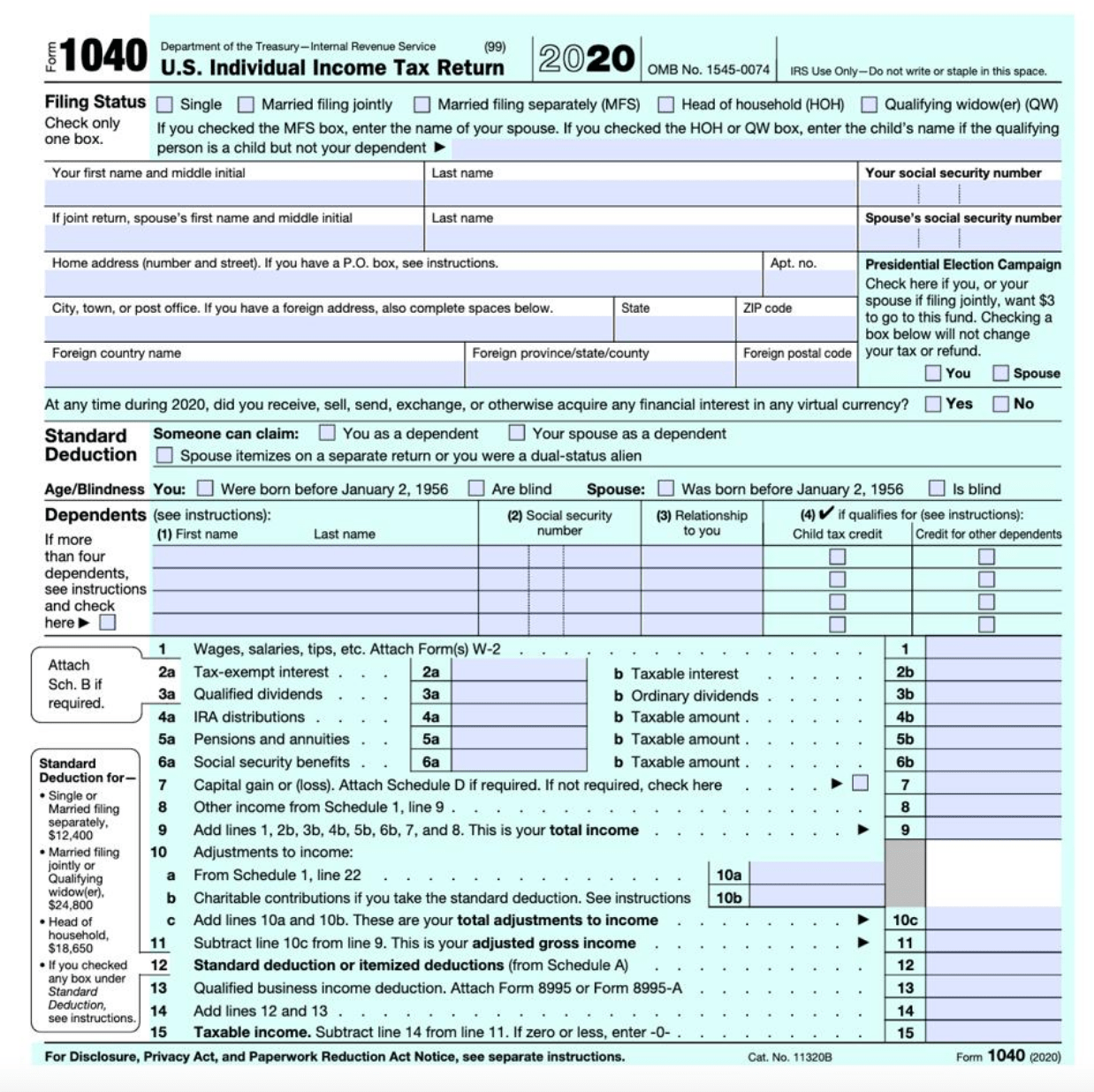

Standard Deductions On Form 1040

The 1040 income section asks taxpayers for their filing status. This filing determines the taxpayer’s standard deduction. New, higher standard deduction introduced with the Tax and Job Cuts Act. For the tax year 2021, which will be filed in 2022, the numbers are as follows:

- Single or married filing separately, $12,550

- Head of household, $18,800

An additional deduction may be taken by those who are age 65 or older or blind :

- Single and not widowed, $1,700

For tax year 2022 , these deductions are as follows:

- Single or married filing separately, $12,950

- or a qualifying widow, $25,900

- Head of household, $19,400

The standard deduction cannot be taken by an estate or trust, an individual who is filing a short return due to a change in accounting periods, an individual who was a nonresident alien part of the tax year, or a married individual whose spouse is filing separately and itemizing.

Receipts And Proof Of Expenses

The IRS does not require taxpayers to attach receipts or proof of expense payments claimed on tax returns, but you must hold onto receipts and copies of any other items used to prepare your return, and keep them handy. In the event a return you file is selected for an audit, youll need to show proof of your expenses to your examiner, or items you claimed could be disallowed.

Recommended Reading:

Also Check: How To Calculate Taxes On Stocks

Who Is Required To File

I just moved to Virginia this year. Do I have to file? If so, which form?

For information regarding the thresholds for filing in Virginia, refer to Who Must File on this website. The “What Form Should I File?” tool is helpful in determining which form you may need to file as a Virginia resident.

I am under the filing threshold but had Virginia tax withheld that I would like to have refunded. Am I still required to file?

Yes, to receive a refund you must file a return. For information on which form to file please refer to “What Form Should I File?”

I am an active duty Military member who is currently stationed in Virginia. Am I required to file?

Virginia taxes the taxable pay of military service personnel with a Virginia Home of Record. If you are a legal resident of another state who is currently stationed in Virginia, your military income is not taxable in Virginia. However, if you have non-military income from Virginia sources, such as an off-base job, you may be required to file a Virginia return.

I am a military spouse. Am I required to file?

If you were married to an active duty service member who was in Virginia pursuant to military orders and you were in Virginia solely to be with your spouse, you may be eligible for a Military Spouse Exemption in Virginia pursuant to the Military Spouse Residency Relief Act.

Is 1040 A Tax Return Transcript

Tax Return Transcripts show most line items from your tax return as it was originally filed, including any accompanying forms and schedules. This transcript does not reflect any changes you, your representative or the IRS made after you filed your return.

Recommended Reading: How To Find Out How Much Property Tax I Paid

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the Out of Country circle on Page 1 of Form D-400. Out of the Country means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

Choose The Right Income Tax Form

Your residency status largely determines which form you will need to file for your personal income tax return.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000.

If you lived in Maryland only part of the year, you must file Form 502.

If you are a nonresident, you must file Form 505 and Form 505NR.

If you are a nonresident and need to amend your return, you must file Form 505X.

If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents, you must file Form 515.

Special situations

If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan, using Form PV. Please refer to Payment Voucher Worksheet for estimated tax and extension payments instructions.

If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020. You should file Form PV only if you are making a payment with your extension request.

If you need to make certain changes to your original Maryland return that has already been filed and processed, you must file Form 502X for 2019 to amend your original tax return.

Read Also: What Expenses Are Tax Deductible For Self Employed

What Form Should I File

“What Form Should I File?” is an interactive tool to help you determine which Virginia tax form you should file depending on your individual circumstance. Please note you may be required to attach additional schedules to your return. Refer to the instructions for more information.

Begin using the “What Form Should I File?” tool.

Who Pays Estimated Tax

Not all revenue is about up in order that taxes are deducted on the supply. Independent contractors and freelancers, for instance, would not have tax deducted from their pay. Earnings from curiosity, dividends and lease, taxable unemployment compensation, retirement advantages, and the taxable a part of your Social Security advantages are different examples of revenue that isnt taxed on the supply. If you could have any such revenue coming in, then its best to pay the estimated tax.

Get each greenback you deserve with limitless tax recommendation from specialists who know self-employment taxes inside and outside. Whether youre a freelancer, unbiased contractor, small enterprise proprietor, or have a number of streams of revenue, TurboTax Self-Employed might help you uncover the industry-specific deductions you qualify for. Plus, you possibly can stand up to an extra $20 off whenever you file with TurboTax Self-Employed.

You May Like: How To Reduce Federal Taxes

Where To Send Returns Payments And Extensions

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The Balance / Lara Antal

Its usually best to go the extra mile when youre dealing with the Internal Revenue Service , even if it feels like a nuisance or a waste of time. Thats even more applicable if youre one of the few people who still files a paper or snail-mail tax return rather than filing electronically.

Following a few guidelines will ensure that your tax return goes to the proper address, that it gets there on time, and that you have proof of delivery.

Dont Miss: Door Dash 1099

You May Mail A Paper Return

Directions to print forms:

1. Click on the folders below to find forms and instructions. You can also search for a file. If you click on a folder and run a search, it will only search that folder.

2. Click a form to print it.

Note: Your browser may ask you to allow pop-ups from this website. Allow the pop-ups and double-click the form again. For the best user experience on this website, you should update your browser .

Mac Users: Safari may block pop ups on default. You can go to your Safari menu, preferences and then security to allow pop-ups.

You can also find printed forms:

- At your local District Office. See the CONTACT US link at the top of this page.

- At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or

- You can call 1-866-285-2996 to order forms to be mailed.

Browse or Search Forms

Recommended Reading: How To Track My Tax Refund Turbotax

Sign And Date Returns

If youre filing a joint return, you and your spouse must sign, even if only one of you generated income.

Both signatures should be on E-filed returns and paper returns

You can sign with your identification number for electronic filers, which is a unique five digits identifier that each taxpayer selects through their modified gross income.

Also Check: Pastyeartax.com Review