Next Steps: Plan Ahead For Next Year

Filing accurate tax returns by the filing deadline and paying all the tax you owe on time goes a long way to help you avoid problems with the IRS. Dont wait to clear up your back taxes before getting a jump start on this years tax return.

Start a file for all your tax documents, such as income statements from your employer, interest statements from your bank or receipts for deductible expenses you hope to itemize. Having everything in one place will be helpful when its time to prepare your return.

You can use the IRS Tax Withholding Estimator to help ensure youre having the right amount of tax withheld from your paycheck. If you have too little withheld throughout the year, you could face a tax bill when you file next year. And if you withhold more than necessary, you could get a refund next year.

Sending In Your Tax Returns

In most cases, you cant submit old returns electronically. Instead, you need to mail them to the IRS or your state revenue department. Send your returns to the address on the tax return or tax return directions. If you receive a notice reminding you to file a return, use the address on that IRS letter.

If you are working with an IRS Revenue Officer, you should send the complete returns to that person. When in doubt, contact the IRS or state directly.

What If I Cant Afford To Pay Back Taxes

The IRS offers several options to assist taxpayers who cannot pay their tax liability. However, if you owe back taxes, its up to you to contact the IRS for assistance. If you do nothing, the IRS will continue to charge interest on your unpaid taxes.

Some options for individuals who cant afford tax payments include:

- Request to delay collections

- Apply for penalty abatement relief

- Request an installment agreement

In some cases, you may need professional help preparing an offer in compromise or other solution for your unpaid tax liability. Try to avoid tax settlement firms that claim to offer an easy solution to reduce your debt. These companies often charge high fees and make promises that are nearly impossible to keep.

Taxpayers in this situation should contact a qualified tax attorney who can evaluate their situation and provide a recommendation. The key is to get help as soon as possible to limit penalty charges and accruing interest. Ideally, this is before you receive notice from the IRS. The IRS has a directory of approved federal tax preparers that includes attorneys. It also offers Low-Income Taxpayer Clinics to help in this situation.

You May Like: How Do You Report Bitcoin On Taxes

Failure To File Taxes

If you fail to file your tax returns on time you may be facing additional penalties and interest from the date your taxes were due. Failure to file or failure to pay tax could also be a crime. The IRS recognizes several crimes related to evading the assessment and payment of taxes.

Under the Internal Revenue Code § 7201, any willful attempt to evade taxes can be punished by up to 5 years in prison and $250,000 in fines.

For most tax evasion violations, the government has a time limit to file criminal charges against you. If the IRS wants to pursue tax evasion or related charges, it must do so within six years, generally running from the date the unfiled return was due.

People may get behind on their taxes unintentionally. Perhaps there was a death in the family, or you suffered a serious illness. Whatever the reason, once you havent filed for several years, it can be tempting to continue letting it go. However, not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term.

Use A Tax Preparer Or A Software Program

Although optional, getting professional help can make the process easier. If you use a software program, make sure to use the application for that year. Most computer software such as TurboTax, dont allow you to file old tax returns online. Instead, you need to order a CD or download the software for the relevant tax year. A tax professional can handle everything generally with the software they use, including finding the right forms, for you. However, it is always best to check with the tax professional as some tax years may be unavailable.

Also Check: How Do You Paper File Your Taxes

Final Year Tax Return Filing

Another very common tax situation that involves a dual-status taxpayer is the situation in which a person gives up their US person status. Lets say a taxpayer relocates to the United States on an H-1B visa, becomes a Lawful Permanent Resident , and then gives up their status in March of the final year . For that final tax year, they would typically be considered a dual-status taxpayer as well. That is because the Taxpayer is only considered a US person for the first portion of the year . For the remainder of the year presuming they resided outside of the United States they would be considered a non-resident alien, and only subject to US tax on their worldwide income .

Be Aware Of Two Points In Going To These Sites:

The offers below are listed in alphabetical order, by company. To take advantage, read the descriptions, choose one of the offers, and click on the link. When you click, you will leave the Division of Taxation’s website.

1040NOW

With 1040NOW, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if:

- You live in Rhode Island and your federal adjusted gross income for 2021 was $32,000 or less.

Access 1040NOW’s dedicated Free File website by clicking on 1040Now’s Free File logo below. Otherwise, fees or charges may apply.

FreeTaxUSA

With FreeTaxUSA, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if:

- Your federal adjusted gross income for 2021 was $41,000 or less or

- You are active duty military with federal adjusted gross income for 2021 of $73,000 or less.

Access FreeTaxUSA’s dedicated Free File website by clicking on the logo below. Otherwise, fees or charges may apply.

Online Taxes at OLT.com

- Your federal adjusted gross income for 2021 was between $16,000 and $73,000 or

- You are active duty military with federal adjusted gross income of $73,000 or less.

Don’t Miss: How To File Tax Online In India

What Are Back Taxes

Back taxes refer to an outstanding federal or state tax liability from a prior year. Federal income tax returns are typically due each year on April 15 for the prior year. You may request an extension to file your taxes, which gives you another six months to file your return. However, even if your extension is approved, you must still pay your tax bill by the required due date. This is generally on April 15 for most individual tax filers.

Locate The Necessary Tax Forms

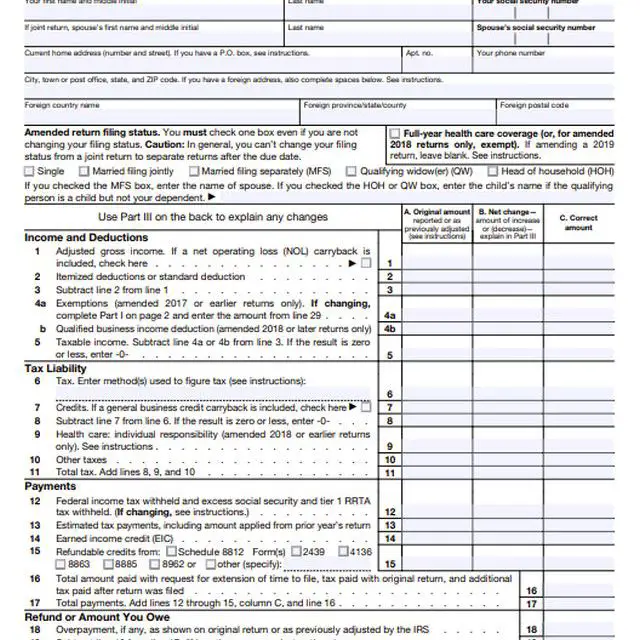

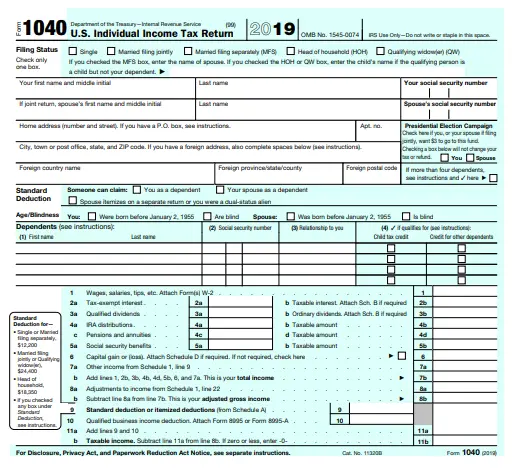

When filing back taxes, you need to use the tax forms from that year. For example, if you are preparing an individual tax return for 2015, you have to use Form 1040 for 2015. This is because the rules and credits may change from year to year. You can find most old forms online. If you cannot find one you need, contact the IRS or your states Department of Revenue. However, remember, if you are using software or a tax preparer, then you will not need to find the forms.

Don’t Miss: Do You Pay Taxes On Life Insurance Payment

How To File The Missed Returns For Fy 2020

The amendment made in the Finance Act 2016 stated that income tax returns must be filed within the end of the relevant assessment year, effective from the assessment year 2017-18. There is no provision for you to file the returns once you have missed the due date. The income tax department allows taxpayers to file returns post-deadline in some specific cases. The following ways help you file a condonation of delay request:

How Do I Catch Up On Unfiled Taxes

Once the IRS files a substitute for return, the IRS can begin collection efforts on the taxes even if you still have an unfiled tax return! The IRS can levy a bank account, garnish your wages, or file a federal tax lien. The IRS will also assess penalties and interest on your account for any unfiled tax returns.

Also Check: Are Refinance Points Tax Deductible

Reasonable Cause For Late Filing

You may request penalty relief due to reasonable cause, as an alternative to submitting late returns under this delinquent filer program. Request reasonable cause relief by attaching a statement to your delinquent return , signed by a person in authority, stating your reasonable cause for the untimely return.

Please note that if the request is denied, you will receive a penalty notice and the return will no longer be eligible for this delinquent filer program.

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

You May Like: How To Receive Child Tax Credit

If You Want To File A Petition With The Us Tax Court

- 400 Second Street, NWWashington, DC 20217

- You have 90 calendar days from the date of your CP3219N to file a petition with the Tax Court. The last day to file a petition is stated in your CP3219N. If the CP3219N is addressed to a person who is outside of the United States, the deadline to file a petition with the Tax Court is extended to 150 days from the date of the CP3219N.

- If you file a petition, attach an entire copy of the CP3219N to the petition.

- The Tax Court has simplified procedures for taxpayers whose amount in dispute, including applicable penalties, is $50,000 or less per tax year. You can find these simplified small tax case procedures from the U.S. Tax Court.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online To read, print, or download your transcript online, youll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Don’t Miss: When Are Va State Taxes Due

Belated Income Tax Return

- As per section 139 of the income-tax act, 1961, if any individual fails to file the income tax returns within the due date, he can file a belated return with the penalty prescribed by the income tax department.

- This belated return can be filed at any time before the end of the corresponding assessment year or before the completion of assessment by the tax authorities whichever is earlier. This scheme has been made applicable from the assessment year of 2017-2018. i.e from the financial year of 2016-17.

- This can be explained further with an example: the income tax return due date for the fiscal year 2017-2018 was 31 July 2018 and 30 September 2018. If a taxpayer fails to file the ITR on time for any reason, he has the option of filing a belated tax return before the end of the corresponding assessment year, i.e. before 31 March 2019.

Minimize Penalties And Interest

The IRS can penalize you if you dont file a return or pay any tax you owe by the deadline. Generally, the penalty for not filing is more than the penalty for not paying. You may also be charged interest on any unpaid tax balance.

Filing your back taxes and paying anything you owe may help limit the amount of interest and penalties youre subject to for missing the deadline.

Also Check: How Are Annuity Payments Taxed

How Far Back Can You File Taxes Uk

The last four tax years, if you are working and claiming a tax rebate under PAYE, will give you back overpaid tax.In the past, it was six years, then it was only four for HMRC.If you are claiming back only to the 2015/2016 tax year, you would have to wait till the 2019/2020 tax season if you were only claiming back to the 2019/2020 tax year.

You May Like: Calculate Doordash Taxes

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have $73,000 or less of adjusted gross income to qualify.

» MORE:See our picks for the year’s best tax filing software

Recommended Reading: What Is The Deadline To File Your Taxes

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

You Can File The Previous Years Income Tax Return Provided You Are Ready To Pay The Penalty A Step

You can file the previous years income tax return by e-filing it on the official website. You must register yourself with your Permanent Account Number, which will be your user id for future references. With the amendment made by the Finance Act 2016, belated income tax return filing before the end of the relevant fiscal year beginning with AY 2017-18. As a result, the deadline to file a late return for the fiscal year 2019-20 was March 31, 2021.

However, the Finance Bill 2021 has shortened the deadline for filing the late return even further. With effect from AY 2021-22, you can file the belated return three months before the end of the appropriate assessment year or before the assessment completes, whichever comes first.

Recommended Reading: How To Calculate 1099 Taxes

Do You Require Accounting & Taxation Assistance

Understanding the various tax credits and exemptions may be a tough subject to grasp.

This is especially true if youre beginning a business in Ireland and want to focus on running it as efficiently as possible. We have a page dedicated to common tax credits in Ireland, but please contact our Customer Services Team if you would want information on your unique case. Were always pleased to chat about the services youll need to get your company off to a good start!

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

Read Also: How Much Capital Gains Tax Will I Pay

File A Claim For Credit Or Refund

Did you know that in general, you must file a claim for credit or refund of any tax within three years from the time the return was filed, or two years from the time the tax was paid, whichever period expires later? Its true, and you may lose out on a credit or refund if you dont file a timely claim. A properly filed original or amended income tax return can serve as a claim for credit or refund.