How To File Quarterly Taxes For Llc

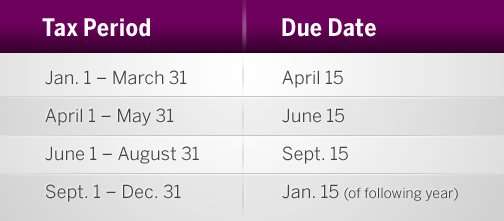

If you have an LLC, you need to know how to file quarterly taxes for the LLC. You will need to pay quarterly taxes as well as annual taxes, and it is important that you know when the quarterly taxes are due to prevent additional tax implications, as even underpaying can lead to tax penalties. Quarterly tax payments are due on the following dates:

;April 15

;September 15

;January 15

Since an LLC is a unique business structure that is created by state statute, you will need to be fully aware of what is required of you depending on the state in which you register your LLC. You have many choices when it comes to taxes. You can choose to be taxed as a corporation, sole proprietorship, or a partnership.

With that being said, if you form a single-member LLC, it will be automatically taxed as a sole proprietorship. You can elect to be taxed as a corporation or as a disregarded entity. In order to be treated as a corporation, you will have to file IRS Form 8832;and elect to be taxed as such. If you want to be taxed as a disregarded entity, you can only do so if your LLC doesnt require an Employer Identification Number . Businesses with no employees and no excise tax liability need not obtain an EIN. In this case, the single-member uses his or her own personal social security number on the tax documents.

What Are Estimated Quarterly Taxes

The United States has a pay as you go tax system. This means that you must pay taxes when you receive income, as opposed to paying it all at the end of the year. However, you do not have to pay taxes every time you receive income. Instead, you can make tax payments in quarterly installments.

The IRS says, if the amount of income tax withheld from your salary or pension is not enough, or if you receive income such as interest, dividends, alimony, self-employment income, capital gains, prizes, and awards, you may have to make estimated tax payments. Estimated tax is used to pay not only income tax but other taxes such as self-employment tax and alternative minimum tax.

Changes In Income Or Exemptions

If your expected Virginia adjusted gross income changes during the year, re-compute your estimated tax to determine how much your remaining payments should increase or decrease.

A change in income, deductions or exemptions may require you to file an estimated payment later in the year. If you file your state income tax return and pay the balance of tax due in full by March 1, you are not required to make the estimated tax payment that would normally be due on Jan. 15.

If you file your return after March 1 without making the January payment, or if you have not paid the proper amount of estimated tax on any earlier due date, you may be liable for an additional charge for underpayment of estimated tax.

Recommended Reading: How To Know Tax Id Number

Who Doesnt Need To Pay Quarterly Taxes

You can avoid having to pay quarterly taxes if you receive a monthly salary and wage. You can do this by filing the Form W-4 with your employer, asking them to withhold a more significant proportion of your salary so that they can pay quarterly taxes on your behalf. If you look inside the W-4 form, you will see a special line that asks you to enter the amount you want your employer to withhold.;

Generally, you are exempt from paying quarterly taxes if you meet the following conditions:;

- You expect to owe less than $1,000 on your return.;

- You had no tax liability for the prior year ;

- You were a U.S. citizen or resident for the whole year ;

- Your prior tax year covered a 12-month period ;;;

How Do I Make Estimated Quarterly Tax Payments If My Income Fluctuates

The IRS allows you to make estimated quarterly payments based on your income for each quarter. To calculate that, you need to use the Annualized ES Worksheet for the tax year in question. This form requires similar information as Form 1040-ES, but it breaks everything down quarterly rather than annually.

Recommended Reading: Do You Have To Claim Social Security On Taxes

Dont Miss This Quarterly Tax Payment Deadline

- Third-quarter estimated tax payments are due on Sept. 15 for income from self-employment, small businesses, gig economy work, investments and more.

- Filers with an adjusted gross income below $150,000 may avoid penalties by paying 90% of taxes for 2021 or 100% of 2020 levies.

- Victims of Hurricane Ida may postpone Septembers quarterly payments until Jan. 3, according to the IRS.;

There’s an important deadline approaching for the self-employed, small business owners, gig economy workers, investors and other filers on Sept. 15.

Because income taxes are pay-as-you-go, filers without withholdings must make estimated payments four times every year, and Sept. 15 is the last call for the third quarter.

Someone with an adjusted gross income below $150,000 may avoid penalties by handing over at least 90% of their 2021 taxes or 100% of 2020 levies by each quarterly deadline, including Sept. 15, 2021, and Jan. 18, 2022.

“This, of course, is merely an estimate as the year is still ongoing,” said Thomas Scanlon, certified financial planner and certified public accountant at Raymond James in Manchester, Connecticut.

The pandemic negatively affected millions of Americans’ livelihoods in 2020, so it’s possible paying 100% of last year’s taxes won’t be enough to cover liability for 2021.

More from Personal Finance:Here are some strategies to pay off that big credit card debt

However, if someone can’t afford to make quarterly tax payments, they still will owe the balance at tax time.;

Due Dates For 2021 Estimated Quarterly Tax Payments:

- Q1: Thursday, April 15, 2021;

- Q2: Tuesday, June 15, 2021

- Q3: Wednesday, September 15, 2021

- Q4: Tuesday, January 18, 2022

If you file your federal income tax return by the last day of January, you can skip the mid-January payment. Instead, you can make that payment and any remaining amount due on January 31.

These due dates only apply if your business uses the calendar year. Therefore, if you use a different fiscal period, your due dates may vary.

Don’t Miss: How To File Federal Taxes For Free

Who Should Make Estimated Quarterly Tax Payments

People who aren’t having enough withheld. The IRS says you need to pay estimated quarterly taxes if you expect:

-

You’ll owe at least $1,000 in federal income taxes this year, even after accounting for your withholding and refundable credits , and

-

Your withholding and refundable credits will cover less than 90% of your tax liability for this year or 100% of your liability last year, whichever is smaller.

» MORE:;Learn how FICA and withholding taxes work on your paycheck

The self-employed.;Independent contractors, freelancers and people with side gigs are prime candidates for estimated quarterly taxes, says Bess Kane, a CPA in San Mateo, California. Thats because theres no tax automatically withheld on their income, she explains.

Landlords and investors .;People with rental income and investments might need to pay estimated quarterly taxes, too even if their employers withhold taxes from their paychecks.

Those might not always be calculated into their withholding amount, and then they come up short and end up having to pay an estimated tax penalty and don’t even know what estimated taxes are, says Thomas Mangold, a CPA in Austin, Texas.

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.

Don’t Miss: How Much Can You Get Back In Taxes

Send An Estimated Quarterly Tax Payment To The Irs

Now that youve figured out your quarterly tax payment, all you have to do is pay Uncle Sam! There are several ways you can go about paying your quarterly taxes:

-

Pay online. You can go to the IRS payment page and set up online payments for your taxes using a bank account or a debit card.5

-

Pay by phone. You could enroll for free in the Electronic Federal Tax Payment Service and use their voice response system to pay your taxes over the phone.6;;

- Pay by app.;This is the 21st century, after all, so now you can pay your taxes through the IRS2Go app right on your phone or tablet.7;What a time to be alive!;

- Pay by cash or check. You can go really old-school and pay in-person at your local IRS office or mail in a check or money order.8

And there are a couple more things you need to remember. First, remember the taxes above are just an estimate. You still need to file an annual tax return along with everyone else, showing what you actually made during the year. And second, if business is going well and you see that your income is going to be higher or lower than you thought it would be, you can always adjust your estimated taxes each quarter. If not, you might end up paying more on Tax Day if you underpaid or get a tax refund if you overpaid, just like everyone else.

You still need to file an annual tax return along with everyone else, showing what you actually made during the year.

When Is A Verbal Agreement Legally Binding

For any contract to be binding, there are four major elements which need to be in place. The crucial elements of a contract are as follows:

Therefore, an oral agreement has legal validity if all of these elements are present. However, verbal contracts can be difficult to enforce in a court of law. In the next section, we take a look at how oral agreements hold up in court.

Recommended Reading: How Much Is California State Tax

Want To Go Easier On Yourself Get Bonsai Tax

If the topic of taxes gives you a major case of the heebie-jeebies, first — take a deep breath, second — remember that you have options to dramatically simplify the process with modern, smart digital accounting tools — tools like Bonsai Tax: a bookkeeping app designed specifically for the tax needs of freelancers like Amazon Flex delivery drivers.

If You Stay Organized You Dont Have To Get Organized

The best way to prepare for quarterly taxes is to keep track of all your business mileage and expenses with well-kept records. Then, the more deductions you have, the lower your taxable income will be, and the less youâll owe to the IRS. Everlance is the #1 app for tracking mileage & expenses.

With Everlance, you can automatically capture your car mileage and business expensesâwhich likely equal thousands of dollars of deductions. When preparing for taxes, download your mileage and expense records. Then, hand them over to your accountant or import them directly into your tax preparation software. Money saved! ð

Read Also: How To File 2016 Taxes

How Do I Figure Out How Much I Owe In Quarterly Taxes

Alright, its time to dust off your calculator and crunch some numbers! Heres a step-by-step process to help you figure out how much youll need to pay in estimated quarterly taxes. Remember, this is just an estimate. Depending on your income, the tax year, your filing status and eligible deductions, your quarterly taxes will vary.And dont get us started on state income taxes!

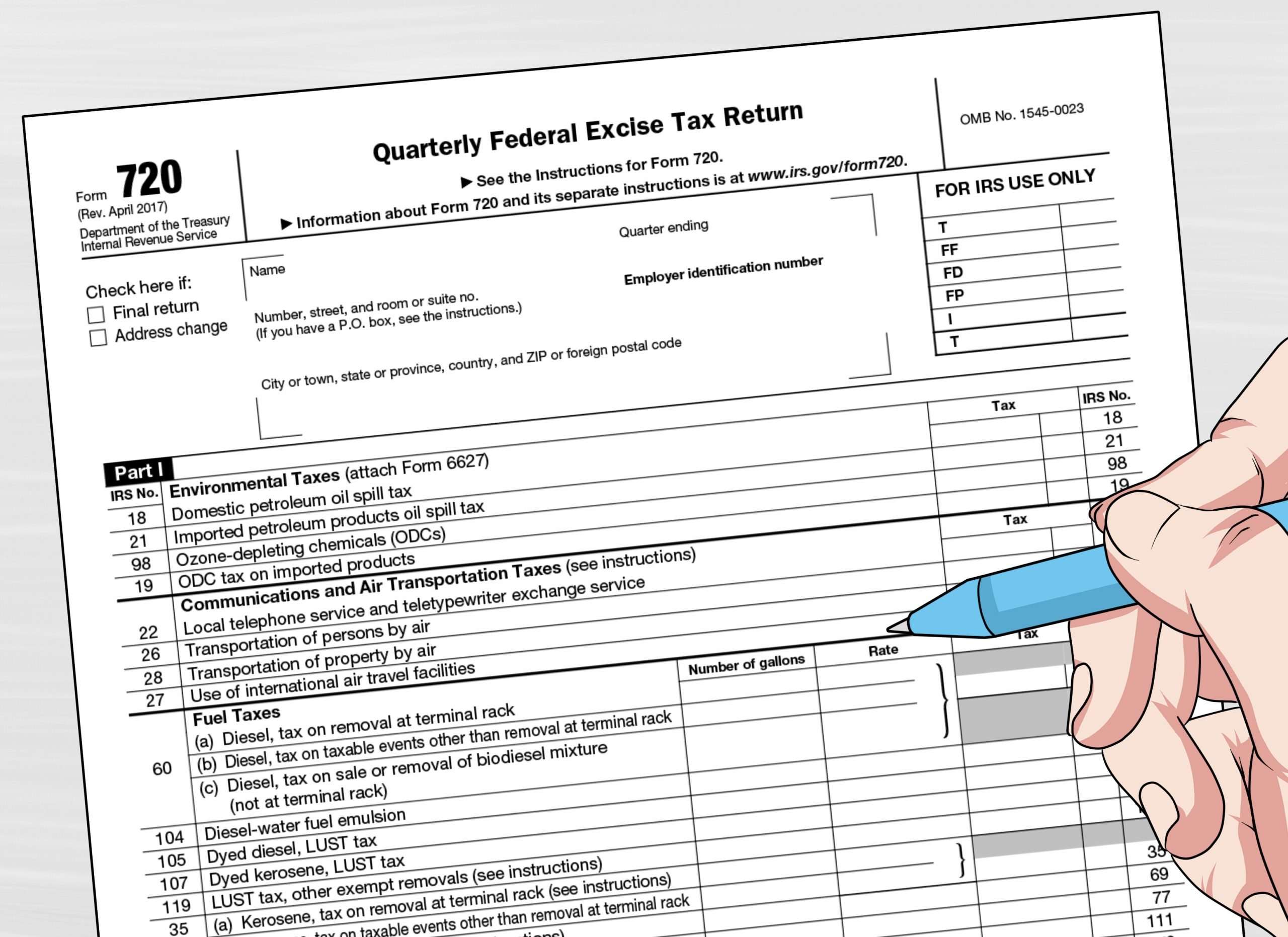

How Do I File Quarterly Taxes

Youll need IRS Form 1040-ES to file quarterly taxes. Send your completed form and payment to the appropriate address. You can also pay your taxes online.

Its important to file and pay your quarterly taxes. If you dont and you owe more than $1,000 at tax time, the IRS will hit you with an underpayment penalty.

The IRS assesses the underpayment penalty if you dont file your estimated taxes quarterly and if you dont pay enough estimated taxes for the year. If your income increases and you think you didnt estimate your taxes high enough, make sure to adjust throughout the year to avoid the penalty.

Don’t Miss: Do You Pay State Taxes On Unemployment

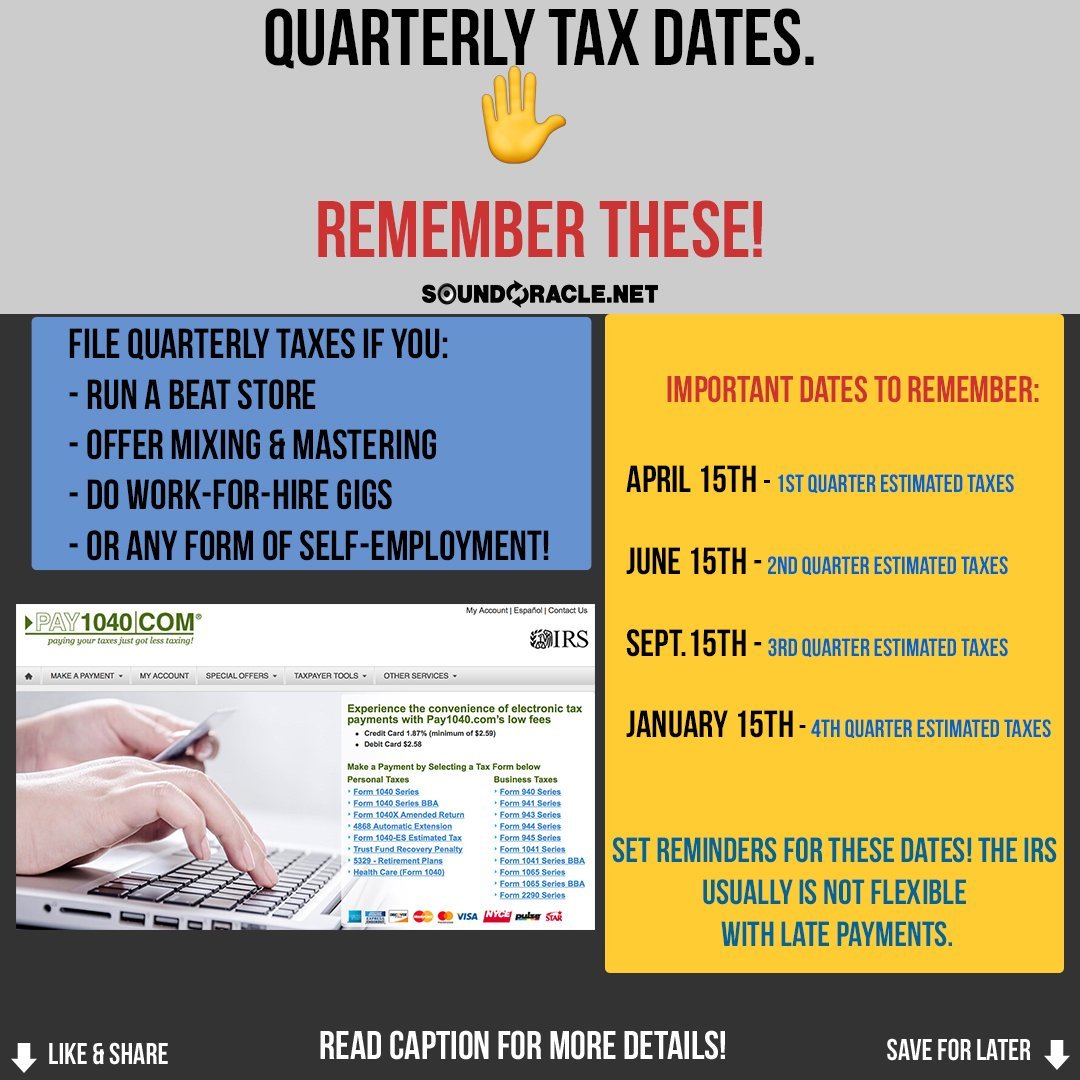

Why File Quarterly Taxes

The most important reason to file quarterly taxes is that the IRS requires all small business owners to do so. Well talk more about the requirements for those who have to file quarterly in a minute. But failing to file quarterly taxes if you meet those requirements can get you in trouble during an audit.

The other major reason to file quarterly taxes is that it makes your tax burden easier in April. If youre making $50,000 a year and are paying a 15 percent tax rate, youll be paying $7,500 in taxes each year. Those payments will be much easier to manage in $2,000 installments than in one big chunk every spring.

How To Make An Estimated Payment

We offer multiple options to pay estimated taxes.;

- Individual online services account.;If you don’t have an account, enroll here. You’ll need a copy of your most recently filed Virginia;tax return to enroll.

- 760ES eForm. No login or password is required. Make sure you choose the correct voucher number.;

- ACH credit.;Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

See all options to file and pay estimated taxes.

Electronic filing requirement

You must submit all of your income tax payments electronically if:

- Any installment payment of estimated tax exceeds $7,500 or;

- Any payment made for an extension of time to file exceeds $7,500 or;

- The total income tax due for the year exceeds $30,000.;

If any of the thresholds above apply to you, all future income tax payments must be made electronically.This includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed.

Beginning July 1, 2021, the requirement to pay electronically will apply if:

- Any installment payment of estimated tax exceeds $2,500 or

- Any payment made for an extension of time to file exceeds $2,500 or

- The total income tax due for the year exceeds $10,000.

Recommended Reading: Do I Have To Pay Taxes On Social Security Income

Do You Have To Pay Taxes On All Amazon Flex Income

American taxpayers are legally required to pay taxes on all income, period! This means that you need to pay income on all earnings made from being an Amazon Flex driver, regardless of how much it was.

Now, you are supposed to receive a 1099-NEC from Amazon Flex, but if, for whatever reason, it does not make it into your mailbox, you are still required to report that income on Schedule C of IRS form 1040 .

Schedule C serves as a hub for reporting all independent contractor income and expenses, accounting for your “Profit or Loss from Business”.

Remember: you only receive 1099s once you’re crossed a certain earnings quota from a client or a company — but you still need to report all income to the IRS — even the lower sums that do not warrant an issuance of a 1099 — on Schedule C.

Penalties For Under-Reporting/Mis-Reporting Income To The IRS

It is recommended to report all 1099 income to the IRS, as, chances are, the IRS received a copy from your client/employer and, now that their software “red-flagged” your account for something “fishy”. The IRS will catch a missing 1099 and they will be getting in touch to clarify any discrepancies they find.

Getting Your 1099 From Amazon Flex

When you sign up as a driver for Lyft, DoorDash, or Amazon Flex, you need to fill out a W-9 form which provides the company with your information, so that they can issue you a 1099.

If you earn at $600 per tax year driving for Amazon Flex, expect a 1099-NEC form in the mail from them by late January/early February of the following year .

Make sure they have your most recent address so that the form does not get lost in the mail .

Don’t Miss: How To Grieve Property Taxes

You Are Exempt From Paying Quarterly Taxes If:

*Note: To have no tax liability would mean your âtotal taxâ was $0 or you didnât have to file an income tax return. This is rare unless you are a low-income individual or household. Along with this, you must have been a US citizen for the whole year and your last year’s taxes must have been a 12-month period.

When Are Quarterly Taxes Due

If youre one of the many Americans who need to file quarterly, circle these deadlines on your calendar or set reminders on your phone so you dont forget to pay on time! If youre late on a payment, youll be hit with penalties each month that could go as high as 25% of your unpaid taxes.2;In a traditional tax year, here are the quarterly deadlines.

| When You Get Paid |

|---|

Read Also: Are Taxes Due By Midnight May 17