Here’s A Few Things For Taxpayers To Know About Filing State Tax Returns Through Free File

- Most people make less than the $72,000 income limit. So, most people can use Free File.

- Generally, taxpayers must complete their federal tax return before they can begin their state taxes.

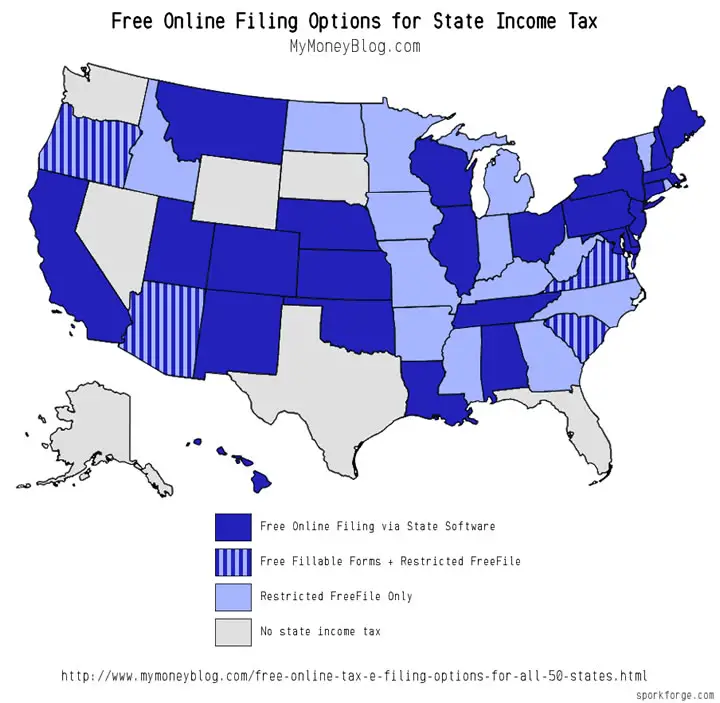

- More than 20 states have a state Free File program patterned after the federal partnership. This means many taxpayers are eligible for free federal and free state online tax preparation.

- The states with a Free File program are Arkansas, Arizona, Georgia, Idaho, Indiana, Iowa, Kentucky, Massachusetts, Michigan, Minnesota, Missouri, Mississippi, Montana, New York, North Carolina, North Dakota, Oregon, Rhode Island, South Carolina, Vermont, Virginia and West Virginia, plus the District of Columbia.

- IRS Free File partners feature online products, some in Spanish. They offer most or some state tax returns for free as well. Some of them may charge so it’s important for taxpayers to explore their free options.

- Free File partners will charge a fee for state tax return preparation unless their offer says upfront the taxpayer can file both federal and state returns for free. Taxpayers who want to use one of the state Free File program products should go to their state tax agency’s Free File page.

- Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming don’t have an income tax. So, IRS Free File for a federal return may be the only tax product people in those states need.

What Happens If You File Taxes Late

If you are getting a refund, there is no penalty, according to H& R Block. Then again, not getting your money from the IRS might be punishment enough.

If you owe the IRS, the penalties kick in. TurboTax says penalties can reach 5% of the amount owed for each month you are late. The maximum amount taxpayers can be penalized is 25% of the amount due, according to TurboTax.

Recommended Reading: File State And Federal Taxes For Free

Irs Free File Is Now Closed

Check back January 2023 to prepare and file your federal taxes for free.

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Also Check: Where Do I Mail My Irs Tax Return

Online Taxes At Oltcom

Online Taxes at OLT.com would like to offer free federal and free state online tax preparation and e-filing if

- Your Federal Adjusted Gross Income is between $16,000 and $72,000, regardless of age, or

- You are Active Duty Military with FAGI of $72,000 or less.

FreeTaxUSA is offering free 2021 federal and Montana tax filing if:

- Your Adjusted Gross Income is $41,000 or less, or

- You served active duty military in 2021 with an AGI of $73,000 or less

Taxact: Best Online Tax Software

TaxAct provides one of the best ways to file your taxes independently and confidently. Even if you have a more complicated tax situation, TaxAct makes it easy to organize and file documents using its innovative online platform and free advice from tax professionals.

TaxAct has helped over 85 million tax filers since 2000 file their documents online. With its easy-to-navigate tax software and knowledgeable CPAs , TaxAct helps taxpayers easily file their own taxes for the maximum refund.

Advantages

Whether you need tax advice from a certified public accountant or just want an easier way to file federal and state taxes, TaxAct has everything you need. However, its advantages extend beyond innovative DIY tax software:

- Active-duty military can file for free.

- TaxAct offers a $100,000 accuracy guarantee.

- Tax filers can enjoy unlimited access to their returns for seven years.

- TaxAct Bookmarks make it easy to navigate tax returns.

- It offers a calculator that helps you easily calculate your returns.

Pricing

Taxpayers can enjoy free tax software for simple federal filing and professional tax advice. However, TaxAct offers three other services for federal and state filing, including:

$46.95 Deluxe: The Deluxe filing option is ideal for those with children and loans. It also comes with expert tax advice but can cost more, depending on state filing.

$69.95 Premier: Those with investments can use the Premier tax filing software.

Don’t Miss: How To Pay Oklahoma State Taxes

How To File Your State Tax Return For Free

As you have probably noticed, many places offer a free filing of a Federal return but dont offer free state filing.

But there are a few ways to get your state income tax returns done for free and in this article, I am showing you free file programs that I found

TurboTax has rolled out their TurboTax FREE file program where you can get your Federal, State, and filing all done free.

They still offer paid options for more complicated tax returns, but if you dont have too much craziness going on with your taxes you will probably be eligible for their free program.

TurboTax has a long history of offering free Federal returns but people were always asking Is TurboTax free for state filing? and now the answer is a yes!

I personally love how simple and intuitive TurboTax is to use. You just answer their simple questions and they tax care of the rest.

You can read more about the details of who is eligible on their website and get started on the TurboTax Website.

Jackson Hewitt: Recommended For Back Taxes And Unfiled Returns

Jackson Hewitt is one of the best tax software options for year-round tax concerns. From preparing for the upcoming tax filing season to resolving IRS issues, Jackson Hewitt offers a wide range of services.

Its online software is one of the best for unlimited state returns due to its low one-time filing fee, so you can file multiple state tax returns without additional fees.

Jackson Hewitt allows tax preparers to file online independently or with the help of a professional. With multiple pop-ups and office locations, you can easily find a Jackson Hewitt tax pro.

Advantages

Jackson Hewitt offers affordability and flexibility for federal and state tax filing. You can also enjoy the following advantages when using these tax services:

- Jackson Hewitt offers free assistance for IRS audits.

- Tax filers can take advantage of the Lifetime Accuracy Guarantee, which protects against unexpected interest or penalties.

- It allows you to use its online tax software, drop-off, or in-person services.

- It provides assistance for unfiled returns, back taxes, and other IRS-related issues.

- Jackson Hewitt tax pros offer free refund rechecks to ensure you receive the maximum refund.

Pricing

Although the company has a reputation for affordability, how much you pay depends on your chosen service.

With Jackson Hewitt, you have the following options:

You May Like: How Much Tax Should I Be Paying Per Paycheck

Irs Free File Online Options

Do your taxes online for free with an IRS Free File provider.

If your adjusted gross income was $73,000 or less, review each providerâs offer to make sure you qualify. Some offers include a free state tax return.

Use the IRS Free File Lookup Tool to narrow your list of providers or the Browse All Offers page to see a full list of providers. After selecting one of the IRS Free File offers, you will leave the IRS.gov website.

Here’s How Free File Works:

Read Also: How To Do Crypto Taxes

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.8 million electronically filed returns in 2021. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Departments most popular filing methods.

Dont Miss: Penalty For Not Paying Taxes Quarterly

How To Choose A Good Online Tax Preparation Software

If you decide to file your tax return on your own, finding a reputable online resource is essential. The best tax software will make it easy to file while ensuring you get the maximum refund.

If you are looking for the best tax software to use this upcoming tax return season, consider the following factors.

You May Like: Are Medical Premiums Tax Deductible

Can I Pay My Tax In Installments Over Time

If you find yourself owing more than you can afford, you should still file a return.

- Even if you dont enclose a check for the balance due, sending in your return protects you from the late-filing penalty that otherwise would keep digging you deeper into a hole.

- Attach a Form 9465 Installment Agreement Request to your tax return asking the IRS to set up a monthly payment plan to pay off what you owe.

About 2.5 million taxpayers are paying off their bills under such an arrangement and recently the IRS made it easier to qualify. In the past, before the IRS would okay an installment plan, the agency demanded a look at your financesyour assets, liabilities, cash flow and so onso it could decide how much you could afford to pay.

- Thats no longer required in cases where the amount owed is under $10,000 and the proposed payment plan doesnt stretch over more than three years.

- You can also now apply online for the installment agreement. More details are available on the IRS website

Dont think the IRS is a patsy, though. You may be better off if you can borrow the money to pay your bill, rather than go on an installment plan which means, effectively, borrowing from the IRS.

In an attempt to help Canadians struggling with record-high inflation and soaring rental prices, the Canadian governments one-time payment of $500 to eligible renters is taking applications starting Monday.

Heres what we know about the top-up to the Canada Housing Benefit.

Get A Discount On Software

Tax software providers might offer free state filing for U.S. military members and reservists, or for taxpayers with very simple returns. Certain conditions typically apply for a taxpayer to receive free tax filing.

For example, TaxSlayer has free options for both state and federal returns, but only for basic 1040 returns, and you only get one free state filing, as of 2022. TurboTax will permit free state tax filing, and it can handle slightly more services such as W-2 income, Earned Income Tax Credit , and some dividends and interest payments . H& R Block permits free state tax filing for taxpayers with simple returns, and it covers W-2 and EITC situations.

Also Check: Why Do I Owe Taxes When I Make So Little

How Do You File Your Basic Federal Taxes For Free With Minimum Fuss With Taxact

No fuss is something we take seriously. Weve streamlined our tax software to make filing your taxes a breeze.

To file your basic federal tax return for free this year, follow these eight steps:

Taxpayers Can Access Irs Free File In Four Easy Steps:

Also Check: How Much Can You Make And Not File Taxes

Types Of Tax Software

Tax software providers all have unique features. However, you can generally find two types of tax software: interview-based and form-based.

Interview-based tax software is one of the easiest ways to file your own tax return. It works by using a question-and-answer system. These questions help the system identify crucial information, placing it in the right spots on the tax form for you so that you do not have to know where specific information has to be on a form.

Conversely, form-based tax software requires you to fill out the documents. However, it allows you to do this online, making the entire process significantly easier.

Related Content:

Who Should Use A Tax Preparation Service

You should consider using a tax preparation service if you do not have the time or do not want to complete your own taxes. Tax professionals have the knowledge and experience to adequately assist with federal and state filing.

When looking for a tax preparer, ask the following questions:

- Do you have a Preparer Tax Identification Number?

- What experience do you have in tax preparation and filing?

- What documents do you need from me?

- What fees can I expect?

Asking these questions and taking the time to find a reputable CPA can help boost your confidence come tax day.

Recommended Reading: Do I Have To File State Taxes In California

When Is The Tax Filing Deadline

The final tax deadline for the US is Monday, April 15th. However, you should aim to file your taxes earlier, so you can take the weight off your mind. You can file your taxes with TurboTax the moment you get the relevant forms from your employer for this tax year.

Even if the IRS is not yet accepting filings, TurboTax will keep your tax return on file and submit it at the earliest possible opportunity.

Go Straight To The State

Several states offer a way to file taxes directly through their state website or e-file system. Pennsylvania, California, and Massachusetts, for example, offer tax-specific sites, typically through their Department of Revenue.

These programs come with quirks and rules, however, and some states impose restrictions on who can file for free. Residents of more than 20 states and Washington, D.C. are able to file for free through their state’s partnership with the Free File Alliance. Taxpayers in the remaining states can file for free via state-provided forms.

Read Also: What Are Taxes Used For

Can I File My Taxes For Free With Turbotax

TurboTax free file service is for simple tax returns only. See if you qualify!

More complex tax affairs will require you to purchase the upgraded service. There are three paid packages you can take advantage of.

Furthermore, youll be able to enjoy the benefits of specialist support and the chance to take advantage of filing your state taxes at the same time.

However, even with the free service, you get the guarantee of 100% accuracy with no mistakes. Plus, you can still take advantage of the live chat feature, which is run by professional tax preparers who know what theyre doing. You always have a limited amount of support, even with the free service.

What Does Tax Software Include

The best tax software will consist of multiple features to make filing taxes online easy and fast. The most common features you will come across include the following:

- Customer support: While the software’s design is to help you file independently, most will offer support from tax experts to help if you have questions.

- Long-term tax return storage: Most software providers store your income tax returns in the cloud so that you can easily access them later.

- Suggestions for tax deductions and credits: Most tax software will make suggestions for which deductions and credits you might qualify for.

- Electronic filing: Instead of submitting physical papers, you can submit your tax return online, which is faster and more secure.

- State returns: All free tax software offers federal returns, and most offer state tax filing for an additional charge.

- Diagnostic services: The best tax software will alert you if your document is missing information.

Don’t Miss: How Do I Pay My New York State Taxes