Two Ways To Check The Status Of A Refund

- Online via INTIME

- Inquiries can be made on refund amount from 2017 to the current tax season.

Note: If a direct deposit of your Indiana individual income tax refund was requested, once DOR initiates the deposit, our system will reflect the date the request was processed. Normally, it takes seven business days for your financial institution to receive and process the funds.

For more information on refunds, use INTIMEs secure messaging to contact DOR Customer Service.

Information regarding the $125 Automatic Taxpayer Refund issued in 2022 will not be displayed or available via INTIME. The ATR will be sent separately from your 2021 Individual Income Tax refund . More information is available on information page.

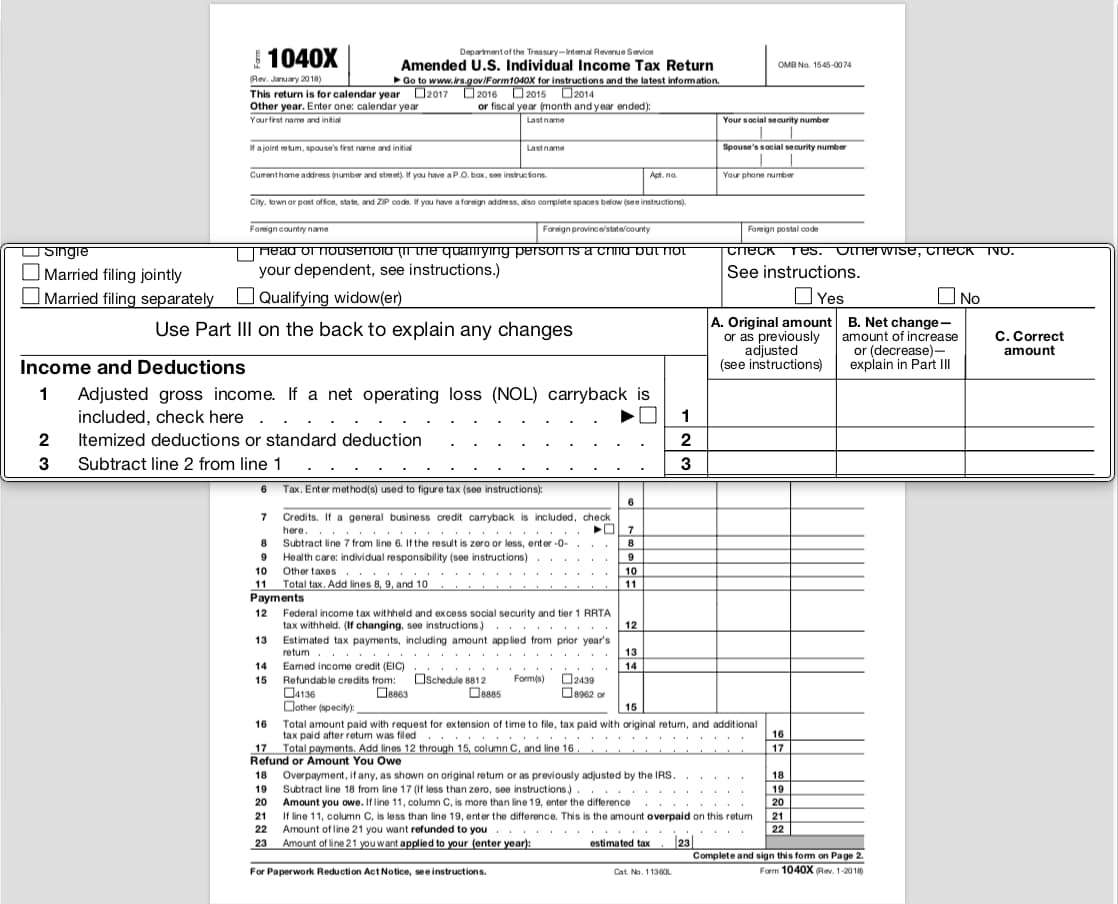

How Do I Check The Refund Status From An Amended Return

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

How Much Is The Payroll Tax Refund Per Employee

The Employee Retention Tax Credit is a refundable tax credit for eligible employers equal to 70% of the first $10,000 in qualified wages per employee per quarter that eligible employers pay their employees in 2021 and 50% respectively for 2020.

The maximum credit is $7,000 per employee per quarter for 2021 and $5,000 per employee per quarter for the first three quarters of 2021.

You May Like: Can I File My Past Taxes Online

What Is A Payroll Tax Refund

Typically, if you overpaid your taxes during the year, you may be entitled to a payroll tax refund.

This refund is issued by the Internal Revenue Service and is based on the amount of taxes that were withheld from your paychecks. The refund will be equal to the amount of taxes that were overpaid, minus any penalties or interest that may be owed.

In order to receive a payroll tax credit, you must file a tax return and include a copy of your W-2 form. The IRS will then issue a refund check, which will be sent to the address listed on your tax return.

Heres How People Can Request A Copy Of Their Previous Tax Return

IRS Tax Tip 2021-33, March 11, 2021

Taxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesn’t have this information here’s how they can get it:

Also Check: How To Find Sales Tax

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit or Child Tax Credit amounts. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset or different refund amount when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

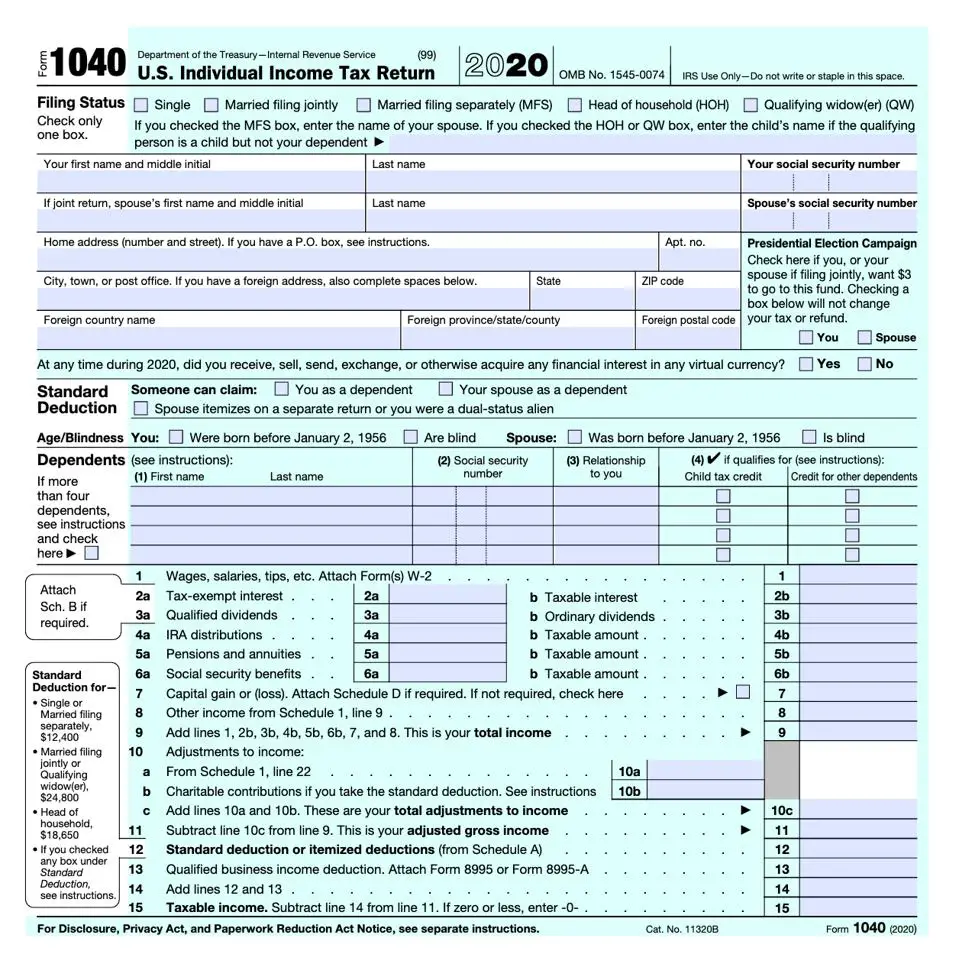

Sections Of The Main Tax Return

Being confronted with a tax return form can be a bit overwhelming. Here’s what you need to provide on each page.

- Page 1: Enter your personal details, including date of birth and telephone number.

- Page 2: This is a summary of your types of income for the year. You don’t need to fill in amounts – just tick the box that fits your circumstances. Read the instructions to find out which supplementary pages you need to fill in.

- Page 3: You can list your other sources of income, including savings and investment income, plus income from benefits, pensions and any other sources.

- Page 4-5: This page lists common forms of tax relief that may be available to you, including , Gift Aid and payments into registered pension schemes. If you claim child benefit, you may also need to fill in the section on the High-Income Child Benefit Charge.

- Page 6: Record any tax that has previously been refunded to you. HMRC will ask whether you refuse to have underpaid tax collected from your wages or pensions. You should also nominate a bank account for any tax refunds to be paid into.

- Page 7: Share the details of your tax adviser, if you have one, and any other important information.

- Page 8: Sign your tax return, and flag whether the figures are provisional and whether you’re enclosing supplementary pages.

Be more money savvy

Get a firmer grip on your finances with the expert tips in our Money newsletter it’s free weekly.

Read Also: How To Check My Tax Return

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return. We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.

Tax refund offsets – applying all or part of your refund toward eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim, and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to, you’ll need call the agency that made the claim.

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Recommended Reading: Is Us Tax Shield Legit

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

If I Owe The Irs Or A State Agency Will I Receive My Nc Refund

In some cases debts owed to certain State, local, and county agencies will be collected from an individual income tax refund. If the agency files a claim with the Department for a debt of at least $50.00 and the refund is at least $50.00, the debt will be set off and paid from the refund. The Department will notify the debtor of the set-off and will refund any balance which may be due. The agency receiving the amount set-off will also notify the debtor and give the debtor an opportunity to contest the debt. If an individual has an outstanding federal income tax liability of at least $50.00, the Internal Revenue Service may claim the individual’s North Carolina income tax refund. For more information, see G.S. §105-241.7 and Chapter 105A of the North Carolina General Statutes.

You May Like: How Long Can You Wait To File Taxes

Lodge Your Tax Return And Bas By The Deadline

Determine your tax lodgement date and file well in advance of the deadline. If youre unable to finish your taxes on time, you may be able to request a deferral. But deferring your lodgement date doesnt defer your payment date youll need a registered agent to help you if you cant pay your taxes.

If a tax agent requests a payment deferral on your behalf and the ATO approves that request, payment will be due on your deferred lodgement date.

You may lodge your taxes by mail, digitally via myTax, or through a registered agent.

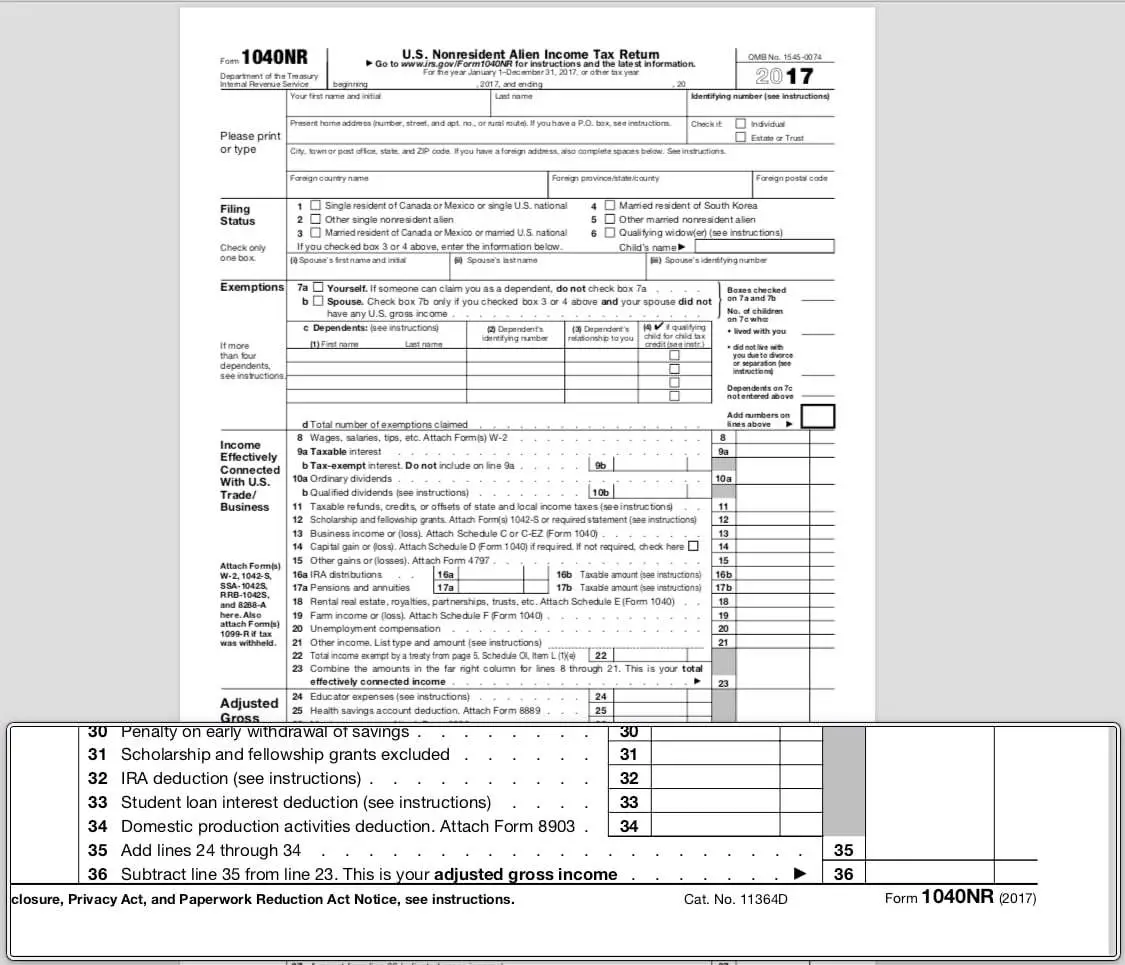

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax ReturnPDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

Also Check: Is The Tax Assessment The Value Of The Property

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Is The Payroll Tax Refund Taxable Income

While the ERTC is a valuable tool for businesses struggling to keep their workers during the pandemic, it is important to note that it is taxable income. This means that businesses will need to account for the credit when they file their taxes for the year. However, because the is refundable, businesses will receive a refund if the credit exceeds their tax liability.

Recommended Reading: What Paperwork Do I Need To File Taxes

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

What Is A Tax Transcript

A tax transcript is basically a printout summary of the major data on your tax return, including a particularly important one: adjusted gross income, or AGI.

The IRS doesnt charge for tax transcripts, and you can get one online immediately . Youll need to register online with the IRS before you can access the Get Transcript online tool.

In most cases, when you need tax return info you can use a tax transcript. Ask whoever needs your tax information whether a tax transcript will be OK or if a copy of the return is required.

Recommended Reading: How Does Business Tax Work

Copies Of Tax Returns

A copy of your tax return is exactly that a duplicate of the return you mailed or e-filed with the IRS. For a fee, the IRS can provide up to six years back, plus the current years tax return, if youve already filed yours. Youll need to fill out and mail Form 4506 to the IRS to request a copy of a tax return.

You might need a copy of your old tax return, rather than a tax transcript, if more-detailed information from prior tax returns is required or if older tax information is needed.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Read Also: What Is Child Tax Credit And How Does It Work

Wait I Still Need Help

The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers rights. We can offer you help if your tax problem is causing a financial difficulty, youve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isnt working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you.

Visit www.taxpayeradvocate.irs.gov or call 1-877-777-4778.

Low Income Taxpayer Clinics are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you, see the LITC page on the TAS website or Publication 4134, Low Income Taxpayer Clinic List.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Which Tax Return Did You Have From Last Year

I Have Moved To Another Address Since I Filed My Return My Refund Check Could Have Been Returned To The Department As An Undeliverable Check What Do I Need To Do To Get My Check Forwarded To My New Address

In most cases, the US Postal Service does not forward refund checks. To update your address, please complete the Change of Address Form for Individuals, call the Department toll-free at 1-877-252-3052, or write to: North Carolina Department of Revenue, Attn: Customer Service, P.O. Box 1168, Raleigh, NC 27602-1168.

Gather Relevant Business Records

You may need several types of business records to lodge your taxes, such as:

-

Receipts for purchases

-

Statements for any interest youve earned

-

Employee payroll records

-

Statements for any stock shares or trust disbursements.

The ATO currently requires businesses to keep records for 5 years from the date you lodge your tax return. Therefore, its extremely important to have a robust recordkeeping system in place.

Also Check: What Receipts Can I Claim On My Taxes