What Is Deferred Tax Liability

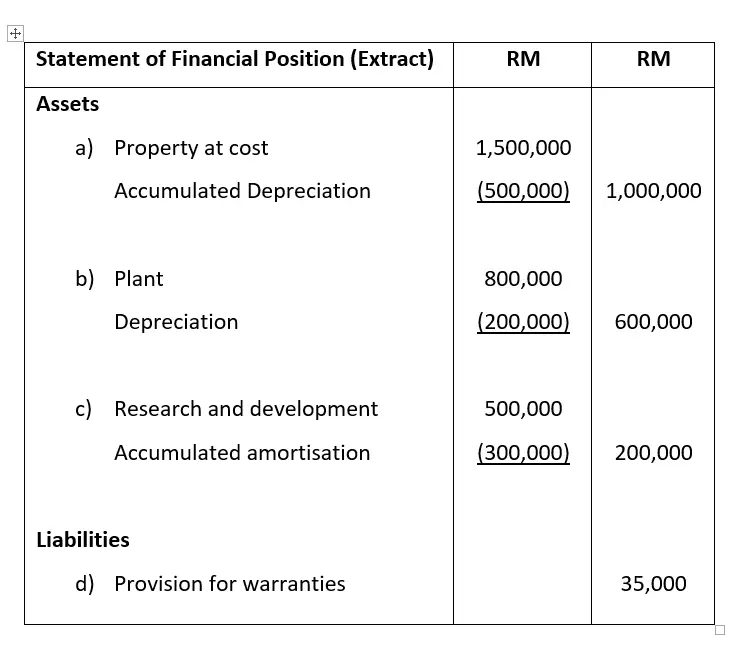

Deferred tax liability is created when a business delays making scheduled tax payments. This can occur for a number of reasons, but usually deferred tax liability is created because the pretax income reflected on the companys books at a given time is more than the actual taxable income that will be incurred. Many types of transactions can result in temporary differences between pretax book income and taxable income.

These special circumstances are always temporary. The situation tends to reverse itself, and the tax that was deferred will become due and payable.

Read On: Tax Tricks the Rich Dont Want You To Know

Tax Liability Formula And Calculation

The calculation of liability for a business or an individual involves the following steps:

The following formula is used to compute net taxable income:

Net Taxable Income = Gross Income Deductions Exemptions

The formula for calculating tax liability is given below:

For Individuals:

Tax Liability = Tax Credit

For Companies:

Tax Liability = Employee Taxes Tax Credit

Tax Liability For Capital Gains

If you sell any asset, including real estate or other investments, for a gain then youll owe taxes on that gain. For example, if you buy a house for $500,000 and sell it 10 years later for $1,000,000 then your capital gains tax liability basis will be the $500,000 you sold the house for that is above the $500,000 you paid for it.

When an asset is held for more than a year, the transaction becomes a long-term capital gain. Long-term capital gains are taxed at a lower rate than short-term capital gains would be. However, both short-term and long-term capital losses are treated the same way when it comes to tax liability. Losses can be applied against long-term gains that were incurred during the same tax period. They can also be carried forward, in some cases, to future years.

Read Also: How Do I Get Child Tax Credit

How Did The Tax Cuts And Jobs Act Of 2017 Impact My Taxes

As with any major tax reform, the Tax Cuts and Jobs Act of 2017 affected taxpayers in different ways depending on a number of factors, including income level, marital status, whether they had children, whether they owned a business, and more.

That said, chances are the TCJA lowered your taxes. On net, about 80 percent of taxpayers saw their taxes go down, 15 percent saw no material change in their taxes, and 5 percent saw their taxes go up.

To get a better sense of how the TCJA impacted you, we encourage you to explore our Tax Plan Calculator to model a scenario similar to your own and our interactive map to see the average tax change by income group and income range across the country. Both are linked below.

What Is Tax Liability

Tax liability is the payment owed by an individual, business, or other entity to a federal, state, or local tax authority.

Generally, you have a tax liability when you earn income or generate profits on selling an investment or other asset. It is possible to have no income tax liability if you don’t meet the income requirements to file taxes.

You May Like: How To File Taxes In The Military

Why Do I Need To Know My Tax Liability For My Business

Tax liability is like any other liability. You need to know how much you will owe for the year to ensure that you have the means to pay it. For example, if your rent payment is $1,000 a month, you know that you have a rent liability of $12,000 for the year, even though you expense the rent monthly.

Its important to calculate your tax liability for several reasons, but one of the main reasons is that it allows you to properly budget for the expense. Calculating your tax liability can also help you make more targeted business decisions or take a closer look at your expense deductions. Finally, knowing the tax liability for your business helps you have more accurate financial statements.

If you dont estimate your tax liability properly throughout the year, your liabilities will be understated on your financial statements, rendering them useless. Even if your tax liability is zero, you need to know.

What Are Income Tax Rates Like In My State

Individual income taxes are among the most significant sources of state tax revenue, accounting for 37 percent of all collections. Theyre also one of the most visible tax types to most individuals. Thats because taxpayers are actively responsible for filing their income taxes, in contrast to the indirect payment of sales and excise taxes.

Forty-three states levy individual income taxes. Forty-one tax wage and salary income, while two statesNew Hampshire and Tennesseeexclusively tax dividend and interest income. Seven states levy no income tax at all.

Recommended Reading: How To Pay Back Taxes To Irs

Taxation And Tax Liability

The tax liability for an individual or business is calculated based on current tax laws. This involves multiplying the tax base by the tax rate. Income that is subject to federal income tax includes earnings, gains on sales of a home or other asset, and other taxable events. This income may also be subject to state and local taxes.

The tax liability amount calculated above is reduced by items such as deductions, credits, and estimated tax payments made to reach total tax liability. If this is unpaid, charges, fees, and interest accrue over time.

Estimated Quarterly Tax Payments

Estimated quarterly tax payments can help to avoid a large, unexpected tax bill in the following year. Quarterly payments chip away at your estimated annual tax bill. When done right, many taxpayers have a lower tax bill or may even receive a refund for paying too much. This makes their income tax bill manageable.

Another advantage of estimated quarterly tax payments is that you avoid underpayment and penalties.

At the beginning of the year, if you estimate that your tax liability will be at least $1,000, you must make quarterly estimated tax payments. Self-employed individuals must also make quarterly payments.

Don’t Miss: When Is The Last Day To Do Your Taxes

What Are Sales Tax Rates Like In My State

Forty-five states and the District of Columbia collect statewide retail sales taxes, one of the more transparent ways to collect tax revenue: consumers can see their tax burden printed directly on their receipts.

In addition to state-level sales taxes consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could, in fact, have a very high combined state and local rate compared to other states.

The map below provides a population-weighted average of local sales taxes, to give a sense of the average local rate for each state.

How Does The Tax Foundations Tax

If youre familiar with our work, you may know that we produce estimates for how different U.S. federal tax policies could impact factors like GDP, wages, jobs, federal revenue, and the distribution of the tax system .

We produce these estimates using an in-house tool we call the Taxes and Growth dynamic model.

In economic jargon, the Tax Foundations tax model is considered a general equilibrium model and consists of three main parts: a tax simulator, a neoclassical production function, and an allocation or demand function. Together, these three components work together to produce revenue and economic estimates.

The Tax Foundation model can produce two types of estimates: comparative statics , and year-by-year estimates over the 10-year budget window.

Using the comparative statics framework, the model estimates the long-run impact of tax policy by comparing a baseline tax policy and economy to an economy with an alternate tax policy. It essentially tries to answer the question: what would todays economy look like if an alternative tax policy had always been in place?

In addition to long-run estimates, the Tax Foundation model can create estimates of federal revenues, GDP, wages, investment, capital stock, employment, consumption, and other measures of economic output for each year over a 10-year period.

Recommended Reading: How To Find Tax Lien Properties

The Definition Of Tax Liability

The definition of tax liability is the money you are obliged to pay as taxes to the government. If your income is low enough, you will not be taxed at all. And there are many Americans who don’t pay any taxes as many pay federal income tax or payroll tax through their work. There are also state and local taxes, excise taxes, and other taxes that generate income for very low-income people.

Contribute To A Retirement Fund

Contributing to a retirement fund does more than help you save for and grow your retirement nest eggif carefully planned, you can reduce your tax liability for years to come. You can contribute a specific amount per year to your IRA, which is tax-deferred. You contribute to a Roth IRA after you’ve paid taxes.

To lower your tax liability by contributing, you’ll only need to determine how much you plan to be taxed in retirement by projecting your income and withdrawals. If you’re in a higher tax bracket now than you will be in retirement, a traditional IRA can lower your total tax payments because:

- Taxes are deferred

- You’ll be in a lower bracket with less tax liability later

If you’re sure you’ll be in a higher tax bracket after you retire and begin taking withdrawals, a Roth IRA can lower your total tax payments because withdrawals are tax-free.

Read Also: Who Pays The Most Taxes In America

What Are Tax Liabilities

Tax liability is the amount of money a company or individual owes to the government in taxes on the local, state and federal level. Anytime an individual earns income, or a business makes a sale, they need to pay taxes on that amount. Individuals have different tax liabilities based on their income level, while businesses pay different amounts of taxes based on their type.

Employees fill out W-4s with their employers, who then withhold the requested amount of money for taxes and send it to the IRS. Employers send their employees W-2s once a year, which employees then use to file their taxes and ensure they don’t owe more or are due for a tax refund.

Businesses, however, make tax payments to the government throughout the year. Different businesses have varying tax liabilities based on several factors, like their type, amount of sales or income and tax bracket. Accountants calculate all of these factors and make estimated payments based on their figures.

Related:

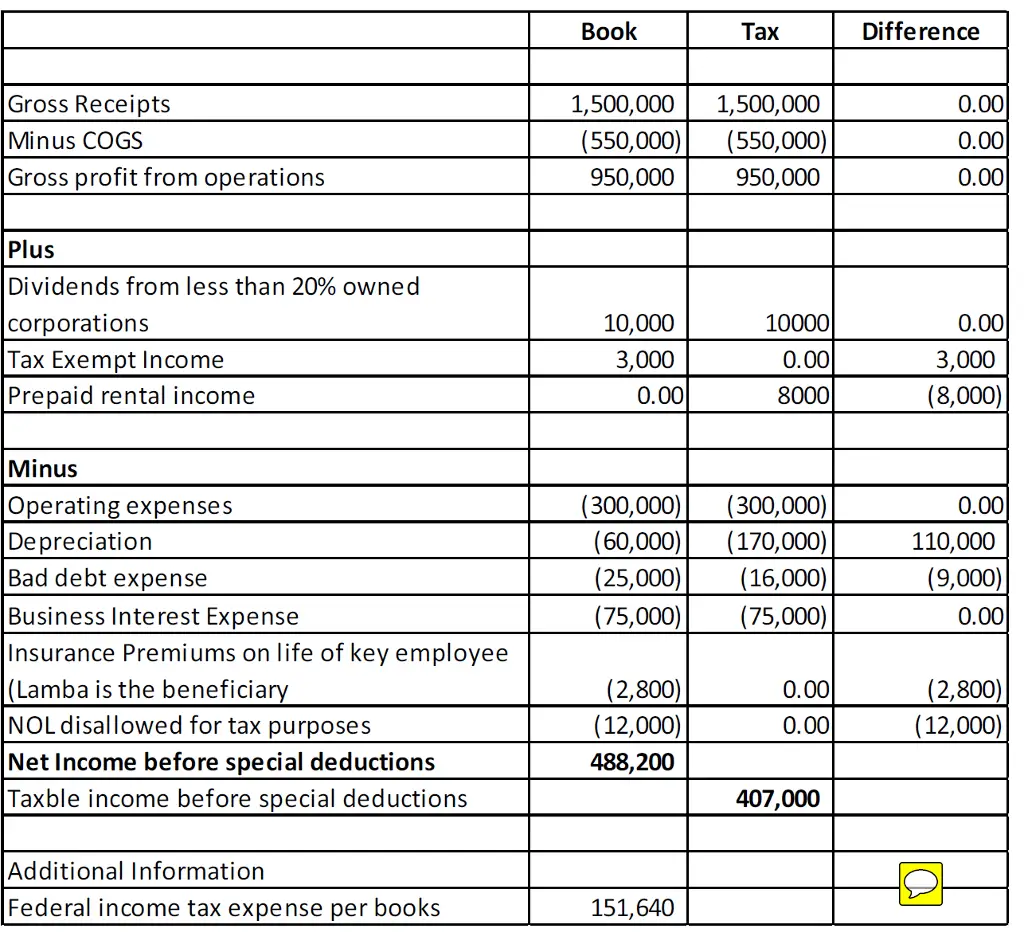

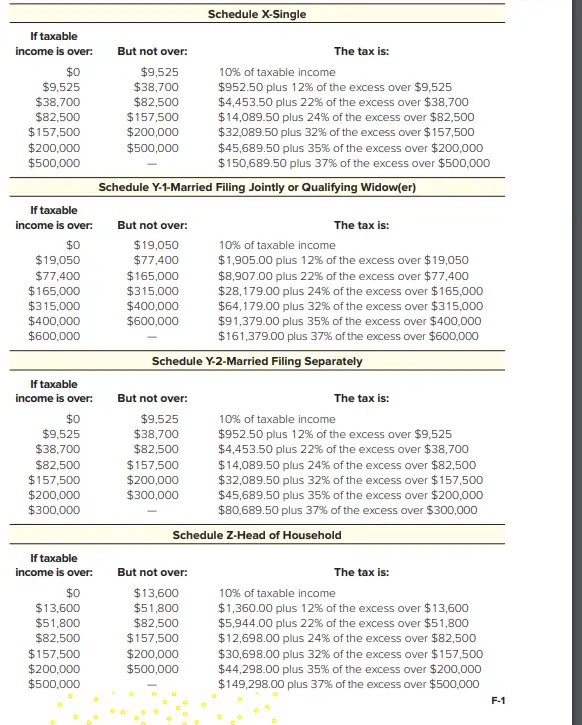

An Example Makes This Clearer

Letâs look at an example to see how a hypothetical flow-through entity would determine the amount of federal income tax it owes based on these tax tables. Suppose Wallyâs Widgets ends up with taxable income of $300,000 in 2018, and that Wally files a joint tax return with his wife, Wendy.

Wallyâs tax owed would be:

$28,765 + 24% of the amount over $168,400 .

The calculation: $28,765 + $31,584 = $60,349 total tax due for our friend Wally.

You May Like: How Do I Pay My State Taxes In Missouri

Types Of Tax Liability

Tax liability isnt limited to any income tax you might owe. Technically, the term covers all forms of taxes, such as capital gains and self-employment tax, as well as interest and penalties. Other contributing factors include:

- Interest that’s added to your total tax liability if you entered into an installment agreement with the IRS to pay a previous years taxes

- An early distribution from a retirement account that was subject to the 10% penalty

- Capital gains tax if you sell an asset for more than your basis in it. Your basis is the amount of your investment in the asset. Long-term gains are taxed at special capital gains rates: 0%, 15%, or 20%, depending on your income . It’s a short-term gain if you owned the asset for one year or less. It would be added to your tax liability as ordinary income and taxed according to your tax bracket.

Reduce Your Taxes With Credits And Deductions

You may be able to reduce the amount of tax your business pays by taking advantage of targeted tax breaks, including both tax credits and deductions.

For tax deductions, you can choose to either itemize your deductions or take one standard deduction .

If you donât have many deductions to claim, youâll probably want to claim the standard deduction.

If youâve got lots of deductions, youâll probably want to itemize. To claim every deduction you possibly can, check out The Big List of Small Business Tax Deductions.

To see what tax credits you might qualify for, check out The Big List of U.S. Small Business Tax Credits.

Recommended Reading: How To Deduct Taxes From Gross Pay

How To Calculate Tax Liability For Your Business

by |Updated Aug. 5, 2022 – First published on May 18, 2022

Image source: Getty Images

Tax liability is the amount of tax that you owe a particular tax authority. While the most common tax authority is the IRS, small businesses can also have a tax liability for other tax authorities including state and local jurisdictions.

How To Determine Your Tax Liability

As you calculate your taxes and complete your IRS Form 1040 for filing, all the various items that add to your tax liability are collected and documented. Once they are all added together, they are recorded on the very last page of your form 1040 on line No. 16. Thats how you come up with your gross tax liability.

Line 16 can be frightening, and the number might make you nervous when you first write it in. But dont worry about the amount quite yet it still has to be adjusted for withholding, estimated tax payments, tax credits and a few other items. This is your net or final tax liability.

More From GOBankingRates

You May Like: When Can I File My Taxes

Calculating Federal Income Tax Liability

First, find your gross taxable income for the tax year in question. This amount must include salaried wages, bonuses, tips, alimony payments, commissions, income from a hobby or side business, capital gains income, interest, retirement fund distributions, unemployment payments, and state and local tax refunds.

Some types of income are not taxed, including federal tax refunds, inheritances, gifts, welfare payments, child support payments, proceeds from life insurance policies, and tax-exempt bond interest.

Then, find your adjusted gross income by making common adjustments such as IRA contributions, alimony payments, student loan interest, moving expenses, tuition payments, and medical insurance premiums.

If you need help determining your federal income tax liability, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

How To Calculate Your Tax Liability

The most common tax liability for Americans is the tax on earned income. For federal taxes, you use the tax brackets and standard deductions issued by the Internal Revenue Service.

Standard deductions for 2022 are:

- $12,950 for single filers

| Over $647,850 | Over $539,900 |

Imagine you’re a single filer, earning $72,950 per year. After applying your standard deduction of $12,950, your reportable income is $60,000. You also have no other deductions or income. Because your adjusted gross income is between $41,775 and $89,075, you fall into the 22% tax bracket. Your tax liability is computed for each tax bracket up to the one you’re in. Here’s how it works:

- Your first $10,275 is taxed at 10%, so you owe $10,275 x 10% = $1,028

- The amount over $10,275 but under $41,775 is taxed at 12%, so you owe $31,500 x 12% = $3,780

- The amount over $41,775 but under $89,075 is taxed at 22%, so you owe $18,225 x 22% = $4,010

- You total up each amount you owe per bracket $1,028 + $3,780 + $4,010 = $8,818

- Your total tax liability is $8,818 plus backtaxes, if any

Read Also: How To Calculate Tax Bracket

How Is Tax Liability Calculated

Now, lets put all the pieces together. Taking each of the concepts outlined abovemarginal tax rates and brackets, refundable and nonrefundable credits, and standard and itemized deductionshere is an example of how a taxpayers overall liability might be calculated.

Nate is an engineer and earns $75,000. Emily teaches 7th grade and earns $50,000. The couple has two children, ages 7 and 9. In Scenario 1 they rent a townhouse and have no itemized deductions. In Scenario 2, they own their own home and pay $16,000 annually in mortgage interest. They pay a combined $10,000 in property taxes and state income taxes and contribute $2,000 to their church and various charities.

Lets compare their tax liability in the two scenarios: