How Do I Find My Adjusted Gross Income Without A W

If you want to find out your adjusted gross income but you have not received the W-2 form, do not worry. You can use other means such as your last paystub to calculate your adjusted gross income as well.

It is not much different from calculating AGI with the help of a W-2 form.

- You can find your annual income from the paystub. Add your other sources of income into it.

- Now add up all of your deductions like you did in the above steps.

- Subtract deductions from the annual income. This value will be your adjusted gross income.

How Do I Get My Original Agi If I Cannot Locate My Last Year’s Return

To retrieve your original AGI from your previous year’s tax return you may do one of the following:

- Use the IRS Get Transcript Online tool to immediately view your Prior Year AGI. You must pass the IRS Secure Access identity verification process. Select the Tax Return Transcript option and use only the “Adjusted Gross Income” line entry.

- Contact the IRS toll free at 1-800-829-1040

- Complete Form 4506-T Transcript of Electronic Filing at no cost

- Complete Form 4506 Copy of Income tax Return

Where Is The Agi On My Tax Return

To find the value of adjusted gross income by using your tax return, you will have to look in the upper left-hand corner of your income tax return. There you will see the name of your tax form which could be any form including: 1040, 1040-SR.

In the United States, form 1040 is used for federal income tax returns. This form has various versions. You can determine the value of your adjusted gross income from different lines on various forms.

- For the tax year 2020, check the line 8b on the form 1040.

- For the tax year 2020, check the line 8b on form 1040-SR.

Recommended Reading: How Much Does H And R Block Charge To Do Your Taxes

What Is Annual Gross Income

For an individual, annual gross income equals the amount of money that you earned in a year before taxes. If you’re a business, your annual gross income would be your company’s revenue, less any business expenses.

Because it’s your gross income that reflects how much money you made during the year, it becomes an important figure in determining whether you will be required to file a tax return. According to the Internal Revenue Service , if you’re a U.S. citizen, whether or not you must file a federal income tax return depends on your gross income, your filing status, your age, and whether you are a dependent.1 For additional details on who is required to file a tax return, visit the IRS website at www.irs.gov.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Calculating Your Adjusted Gross Income

If you use software to prepare your tax return, it will calculate your AGI once you input your numbers. If you calculate it yourself, you’ll begin by tallying your reported income for the year. That might include job income, as reported to the IRS by your employer on a W-2 form, plus any income, such as dividends and miscellaneous income, reported on 1099 forms.

Next, you add any taxable income from other sources, such as profit on the sale of a property, unemployment compensation, pensions, Social Security payments, or anything else that hasn’t already been reported to the IRS. Many of these income items are also listed on IRS Schedule 1.

The next step is to subtract the applicable adjustments to income listed above from your reported income. The resulting figure is your adjusted gross income.

To determine your taxable income, subtract either the standard deduction or your total itemized deductions from your AGI. In most cases, you can choose whichever gives you the most benefit. For example, the standard deduction for 2020 tax returns for married couples filing jointly is $24,800 , so couples whose itemized deductions exceed that amount would generally opt to itemize, while others would simply take the standard deduction.

The IRS provides a list of itemized deductions and the requirements for claiming them on its website.

If The Internal Revenue Service Changed My Adjusted Gross Income And/or Exemptions On My Federal Return Am I Required To File An Amended Michigan Return

Yes. If a change on your federal return affects the AGI and/or exemptions reported on your Michigan return, you must file an amended Michigan return within 16 weeks of the change. Include a copy of your amended federal return with all applicable schedules and supporting documents.Submit payment of any tax and interest due.

Examples of supporting documents include but are not limited to:

-

The Michigan Amended Return Explanation of Changes for tax years 2017 and forward

-

Michigan Schedules and Forms

-

Copy of original or corrected W-2, 1099, and/or U.S. Schedule K-1

- Copy of other state return

You May Like: How To File Missouri State Taxes For Free

Federal Adjusted Gross Income Starting Point For Nc Return

The starting point for determining North Carolina taxable income is federal adjusted gross income. Therefore, a taxpayer must determine federal adjusted gross income before beginning the North Carolina return. If the taxpayer is not filing a federal income tax return, the taxpayer must complete a schedule showing the computation of federal adjusted gross income and deductions. The taxpayer must attach the schedule to the North Carolina income tax return.

Special Instructions To Validate Your 2020 Electronic Tax Return

If your 2019 tax return has not yet been processed, enter $0 for your prior year adjusted gross income .

If you used the Non-Filers: Enter Payment Info Here tool in 2020 to register for an Economic Impact Payment in 2020, enter $1 as your prior year AGI. For more information, see Claiming the Recovery Rebate Credit if you arent required to file a tax return.

When self-preparing your taxes and filing electronically, you must sign and validate your electronic tax return by entering your prior-year Adjusted Gross Income or your prior-year Self-Select PIN.

Generally, tax software automatically enters the information for returning customers. If you are using a software product for the first time, you may have to enter the information yourself.

Also Check: How Can I Make Payments For My Taxes

I Cant Find My Tax Return

If you cant find your tax return, you can use the IRSs Get Transcript website.

You can request it online, for which youll need a whole series of personal information from your latest tax return including social security number, date of birth, filing status and mailing address, plus an email account to which you have access your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan and a mobile phone account in your name.

Alternatively you can request it by mail, for which youll only need your Social Security Number or Individual Tax Identification Number, your date of birth and the mailing address from your latest tax return.

The transcript should arrive within five to 10 calendar days.

- More aboutâ¦:

How Can I Find My Agi If I Dont Have My Prior Year Return

If you do not have last years tax return, you can get a copy of your transcript from the IRS. Start by visiting their site here. From there, you have two options:

- Use the Get Transcript Online tool to view your AGI.

- Use Get Transcript by Mail, or call 800-908-9946 to request a Return Transcript. Allow 5 to 10 days for delivery.

If you didnt file your taxes last year and you need to, use TaxSlayer to file a prior year return. The information you provide will be entered into the forms, and the calculations will be done for you.

Don’t Miss: How To Buy Tax Liens In California

Above The Line Deductions That You Will Have To Subtract Include:

- Alimony

- Contributions to a Health Savings Account

- Contributions to retirement accounts

- Moving expenses

- Half of the self-employment taxes that you paid

The greater the value ofyour deductions, the lower the taxes you will have. So, make sure you write in the correct value of deductions while calculating your adjusted gross income.

What Is Adjusted Gross Income

Adjusted Gross Income is simply your total gross income minus specific deductions. Additionally, your Adjusted Gross Income is the starting point for calculating your taxes and determining your eligibility for certain tax credits and deductions that you can use to help you lower your overall tax bill.

Dont Miss: What Is Tax Liabilities On W2

Read Also: Michigan.gov/collectionseservice

Lets Understand It Better With An Example

Suppose your final income is $100,000. Now calculate your specific expenses from the last year. Lets suppose those expenses are:

- Your student loan interest is $300

- Educator expenses are $700

- Your contributions to the retirement accounts are $10,000

- And your contributions to the health savings account are $5,000

Your total deductions will be $16,000. Now subtract deductions from your annual income , the value $84,000 will be your adjusted gross income.

How To Find Your Adjusted Gross Income To E

OVERVIEW

Your adjusted gross income is an important number come tax time, especially if you’re planning to e-file. Not only does it impact the tax breaks youre eligible foryour AGI is now also a kind of identification.

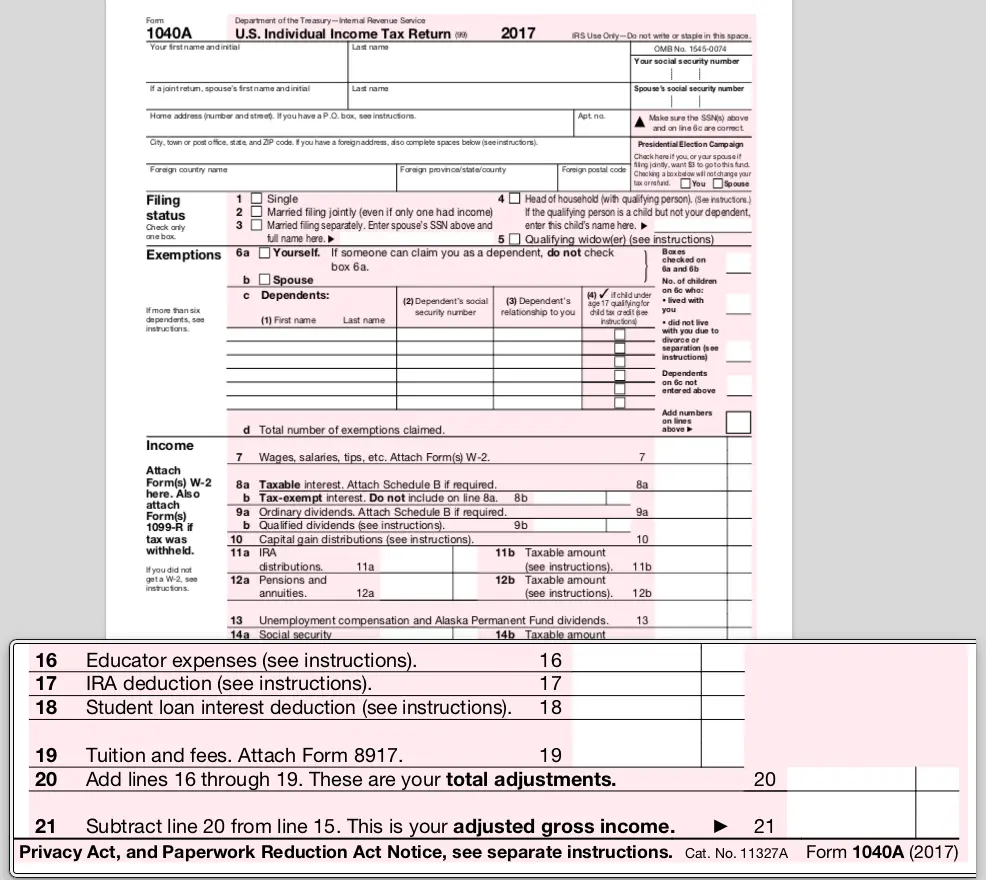

For tax years beginning 2018, the 1040A and EZ forms are no longer available. They have been replaced with new 1040 and 1040-SR forms. For those who are filing prior year returns, you can continue to use form 1040A or EZ for tax years through 2017.

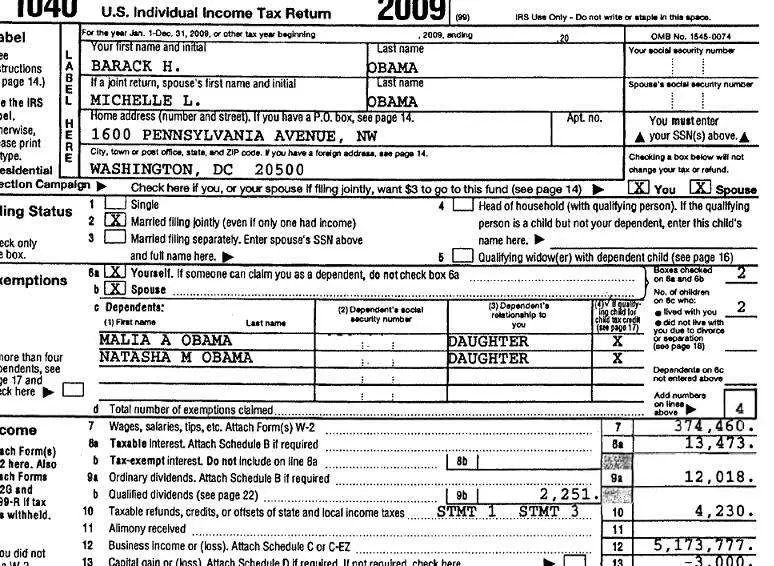

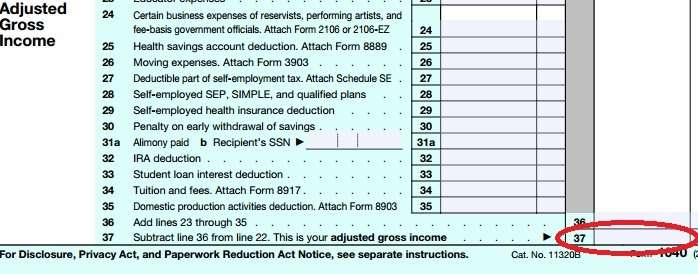

If you plan to e-file your tax return, you may need to first find the amount of AGI from last year’s return in order for the IRS to verify your identity. You can find your AGI on the form you used to file your last year’s return.

You May Like: Tsc-ind Ct

Where To Find The Prior Year Agi For Your Tax Return

- See More in: Tax Education

Adjusted Gross Income is a central calculation on any tax return, determining how much income tax you owe. The IRS uses prior year AGI as a sort of security check if youre filing your tax return electronically, the agency wont accept your return unless you enter this number correctly. The agency uses this number along with other details to verify your identity, but if youre like most people, you may not know where to find it.

Taxpayers, in a lot of cases, dont even know what an AGI is. Dont worry if youre in this boat, youre not alone, and this guide is designed to help. It defines prior year AGI and shows you exactly where to find it.

How Do I Calculate Agi

There is no rocket science involved in the AGI calculation. The simple steps involved in calculating your AGI from the information given on W-2 are:

Also Check: How Much H And R Block Charge For Taxes

How To Calculate Agi From W

- Pin

Do you want to claim your deductions and credits that are available on your tax return? To claim credits you first need to know your Adjusted Gross Income .

Want to figure out what AGI is and how can you calculate it? Then keep reading to find out!

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSUREFOR MORE INFO. Which means if you click on any of the links, Ill receive a small commission.

What Is Adjusted Gross Income Definition

Adjusted gross income, or AGI, is your total gross income minus certain tax deductions and other adjustments. Gross income includes such types of earnings as wages, dividends, alimony, government benefits, retirement distributions, capital gains and income from any other source. Adjusted gross income is calculated by subtracting such deductions and adjustments as alimony paid, retirement plan contributions, student loan interest and health insurance premiums.

Read Also: How Can I Make Payments For My Taxes

What Is Your Adjusted Gross Income

Adjusted gross income is the number you get after you subtract your adjustments to income from your gross income. The IRS limits some of your personal deductions based on a percentage of your AGI.

Thats why its so important. Your AGI levels can also reduce your personal deductions and exemptions. Many states also base their state income taxes on your federal AGI. The AGI calculation is at the bottom of Form 1040 in line 37.

What Is Agi

Adjusted gross income is the total or gross income a taxpayer earns minus eligible deductions or adjustments to income, which the IRS allows you to take against this income. These adjustments ensure that you arrive at your actual income before the IRS subtracts the tax deductions and exemptions that provide your taxable income.

Without the AGI, you might have to pay taxes on your gross income, that is, every cent you earn! We all know how scary that thought is. AGI is calculated when individual U.S. taxpayers and households use the IRS form 1040 to calculate and file their yearly taxes.

You May Like: How To Buy Tax Lien Properties In California

What Is A W

A W-2 form tells the amount of annual income you will receive along with the value of taxes deducted from the annual income. Your employer will send you as well as the Internal Revenue Service a W-2 after the end of the tax year .

A W-2 will give you a statement of your generated income and taxes withheld. This form is only for employers and not for those who are self-employed. Self-employed persons will have to use a different form .

You will receive your income-related information from the W-2 while the IRS will receive your wage and tax statement. That is why the information on a W-2 form must be accurate. Having a W-2 will help you get your tax returns back efficiently.

The Irs Uses Magi To Determine Ira Eligibility And More

The Balance / Bailey Mariner

Your modified adjusted gross income determines whether you are allowed to claim certain benefits on your taxes. These include whether you can deduct contributions to an individual retirement account . It also impacts what you can put in a Roth IRA each tax year.

Certain education-related tax benefits and income tax credits are based on MAGI. Under the Affordable Care Act, your household MAGI also impacts whether you can get income-based Medicaid or subsidized health insurance through the Marketplace.

In 2021, the American Rescue Plan allowed more households to access subsidized health insurance through the Marketplace. In tax years 2021 and 2022, you may be eligible for new tax credits that lower the cost of your Marketplace health insurance, even if your MAGI was too high to qualify in previous years. You will still need to file taxes at the end of the year to prove that your income was not too high for the tax credit.

The first thing to know is that your total income, modified adjusted gross income, and adjusted gross income are not the same things. Though they use most of the same base numbers, each is calculated in a slightly different way.

For tax-planning purposes, you will need to learn the differences and when to use each one.

Also Check: How Much Does H& r Block Charge For Doing Taxes

How To Calculate Modified Adjusted Gross Income

Written by: PeopleKeep TeamSeptember 22, 2020 at 2:52 PM

The Affordable Care Act offers premium tax credits to help eligible individuals and families purchase individual health insurance coverage through the Health Insurance Marketplace.

With the changes made through the American Rescue Plan, no American will ever pay more than 8.5% of their household income for health coverage. The tax credits will cover the rest. The household income figure here is your modified adjusted gross income .

Your MAGI is a measure used by the IRS to determine if you are eligible to use certain deductions, credits , or retirement plans. The percentage of income you must pay for individual health insurance depends on how close you are to the federal poverty line based on modified adjusted gross income, not adjusted gross income . People whose modified gross income is less than 400% of the FPL are eligible for a premium tax credit Here’s a quick overview of how to calculate your modified adjusted gross income.

Note: Premium tax credits work with the qualified small employer health reimbursement arrangement , but you must report your HRA allowance amount to avoid tax penalties. They do not work with an individual coverage HRA . If your employer offers you an ICHRA allowance that allows you to purchase a plan that meets affordability criteria on the ACA marketplace or your state exchange, you lose your premium tax creditseven if you opt out of the ICHRA.