Can I Get A Copy Of My Original Tax Return

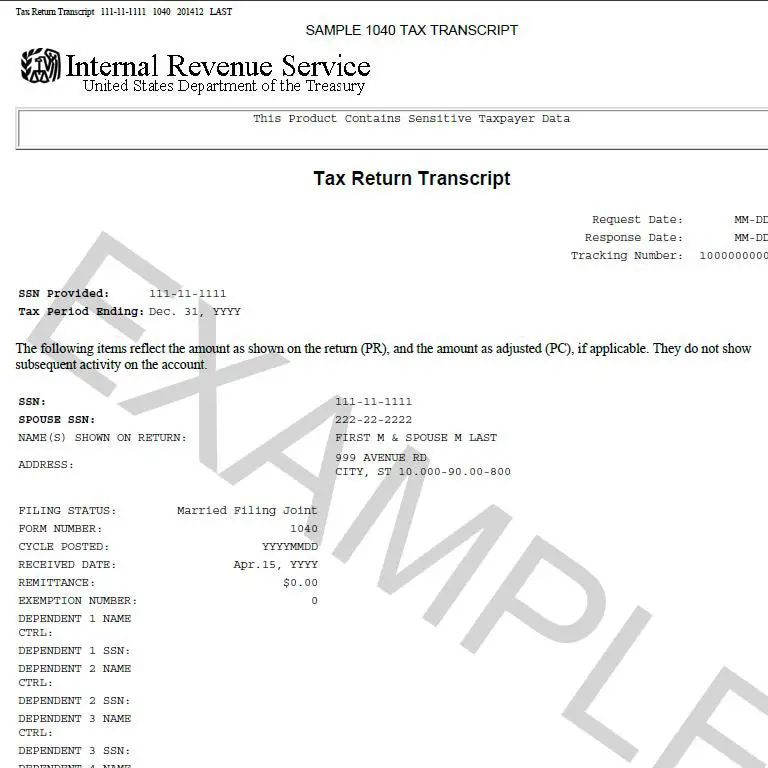

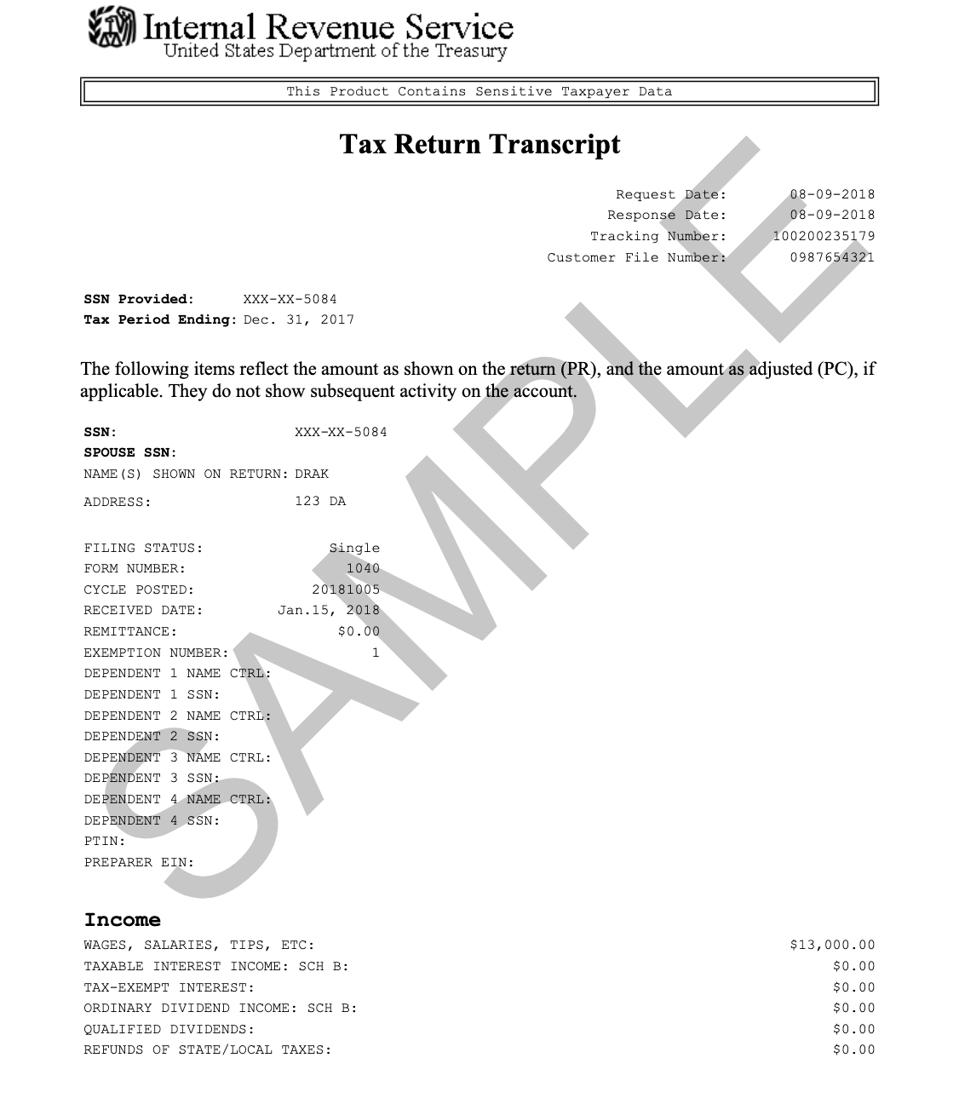

A tax transcript isnt a photocopy of the original return. Instead, a transcript displays a certain amount of information, processed and transcribed.

If you want to access a photocopy of your tax return, you will need to submit Form 4506, which can be found on the IRS website.

This will need to be mailed to the IRS, and there is an associated fee. Expect a processing time of up to 75 days.

Record Of Account Transcript

How Are Bonuses Taxed?

Financial planning and Investment advisory services offered through Diversified, LLC. Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Diversified, LLC are not affiliated companies.

Diversified, LLC does not provide tax advice and should not be relied upon for purposes of filing taxes, estimating tax liabilities or avoiding any tax or penalty imposed by law. The information provided by Diversified, LLC should not be a substitute for consulting a qualified tax advisor, accountant, or other professional concerning the application of tax law or an individual tax situation.

Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell securities in the United States or in any other jurisdiction.

How To Get State Tax Transcript

Visit the IRS website and download Form 4506-T, which is the Request for Transcript of Tax Return form. A tax transcript is a record of your tax return that displays most of the information on your filed tax return, including all supporting forms. You can request returns for up to three prior tax years.

Read Also: What Happens If I Forgot To File Taxes Last Year

Types Of Irs Transcripts

There are several types of IRS transcripts you can request,depending on your needs. These include the following:

- Tax return transcript: The most common type, this includes the line-by-line details from your annual original tax return. Keep in mind that this is a record of your original return if you needed to make an amended filing, the amendments will not be found on this transcript. You can get this for the current year and three previous years.

- Tax account transcript: If you need even more details, this may be the record that you want to request. This transcript includes adjusted gross income, various types of taxable income and the types of tax payments you have made. It does include amended filings. You can receive this for the current tax year and up to 10 years previous.

- Record of account transcript: This document includes all of the data from both of these transcripts into one document. You can receive records for the current year and three past years.

- Wages and income transcript: This document records only your income. It does not show the deductions that you took that reduced your taxable income. This is available for the current year and up to 10 previous years.

- Verification of non-filing letter: This is a verification that affirms that you did not need to file a return for a certain year because your income was too low. This is also available for the current year and up to 10 previous years.

stanleyblock

Image Credit:

What Is A Tax Transcript

What is a tax transcript, and how can you obtain one? IRS tax transcripts are summary documents of your tax return information, and theyre often used as proof of income when applying for loans. You may also use a tax transcript when determining the amount of estimated taxes that you might owe in the future. If youre completing financial aid documents, such as the FAFSA, you will likely need to request a tax transcript if you dont have a copy of your return already.

Recommended Reading: Where Do I Pay My Taxes

What Does An Irs Transcript Show

There are five types of tax transcripts you can request from the IRS:

Requesting A Transcript By Phone

Don’t Miss: Does Quickbooks Calculate Sales Tax

Requesting A Transcript For A Business

Also Check: Cook County Appeal Property Tax

Can I Get A Copy Of My Taxes Online

Order Online. The fastest way to get a Tax Return or Account transcript is through the Get Transcript tool available on IRS.gov. Although the IRS temporarily stopped the online viewing and printing of transcripts, Get Transcript still allows you to order your transcript online and receive it by mail.

Recommended Reading: How To Retrieve 1040 Tax Return

How To Complete Any Form Tax Return Transcript Online:

PDF editor permits you to help make changes to your Form Tax Return Transcript from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

IR-2021-226, November 16, 2021

WASHINGTON The Internal Revenue Service today announced that, effective Nov. 15, 2021, tax professionals are able to order up to 30 Transcript Delivery System transcripts per client through the Practitioner Priority Service® line. This is an increase from the previous 10 transcripts per client limit.

Through PPS, tax professionals can order a variety of transcripts. Practitioners can receive transcripts for up to five clients per call. Theres no change to the number of clients.

Other Rules And Quirks To The Request Process

There are some rules and quirks that could affect your transcription request process.

How you filed your return and whether you owe unpaid taxes on that return can affect how quickly you can get transcripts for the current year. Your current year transcripts most likely will not become available for two to four weeks after you e-file a return, and up to six weeks if you mail in a paper return.

You won’t be able to access your transcript if you owe taxes until you pay the balance due or otherwise arrange to pay it through a finalized agreement with the IRS.

Finally, if you’ve placed a with Experian because you are a victim of identity theft, you may have to lift that temporarily so that the IRS can verify your identity. You can put the freeze back in place after this is accomplished.

Also Check: Are Taxes Due By Midnight May 17

How Can You Get Your Tax Transcript

There are two main ways get your tax transcript from the IRS:

Paper Request Form Irs Form 4506t

ONLY the Tax Return Transcript can be obtained using the 4506T-EZ. If you require other IRS documents, as well, and you need or choose to use a paper request form, use the IRS Form 4506-T, instead, as all of the IRS documents may be ordered together on that one form.

NOTE: If any information does not match IRS records, the IRS will notify the tax filer that it was not able to provide the transcript.

Also Check: How Much Can You Earn Before You Owe Taxes

Q: What Is The Difference Between A Tax Return Transcript And An Tax Account Transcript

-

Tax Return Transcript – A tax return transcript shows most line items from your tax return as it was originally filed, including any accompanying forms and schedules. It does not reflect any changes you, your representative, or the IRS made after the return was filed. In many cases, a return transcript will meet the requirements of lending institutions such as those offering mortgages and for applying for student loans.

-

Tax Account Transcript – A tax account transcript shows any payments and any later adjustments either you or the IRS made after the tax return was filed. This transcript shows basic data, including marital status, type of return filed, adjusted gross income and taxable income.

How To Obtain Irs Tax Transcripts

Its easy to get your IRS tax transcript. You can obtain reports going back as far as three years. All transcripts are free, and you have several options for requesting a copy. The IRS2Go mobile app allows users to easily access their tax transcripts. If the IRS can verify your identity online, you can instantly access your transcripts through IRS2Go or the Get Transcript feature on IRS.com.

Unfortunately, you have to request a transcript by mail if you cant prove your identity online. You can request a tax transcript by mail using the IRS website and mobile app too. However, if youre not technically inclined, you can request a tax transcript the old fashioned way using an IRS form. You can use Form 4506-T to request your tax return transcript through the mail.

You can also use your phone to request your IRS tax transcripts. The IRS has a toll-free phone line that handles these requests, and you can call it at .

If you order your transcript online or via phone, it typically takes about 15 days to arrive. It can take up to 30 days to receive a transcript with a mailed request.

Also Check: How To Appeal Property Taxes Cook County

Don’t Miss: Are Donations To Churches Tax Deductible

How Much Does It Cost To Get A Tax Return Transcript

The IRS does not charge a fee for transcripts, which are available for the current tax year as well as the past three tax years. A tax return transcript shows most line items from your tax return as it was originally filed, including any accompanying forms and schedules.

How Can I Get A Tax Transcript

You can obtain a tax transcript from the IRS through various methods: online, over the phone, and through a mail request.

To request a tax transcript online, visit the IRS Get Transcript page and create an account if you dont already have one. To create an account you will need a photo ID. Obtaining your tax transcript online is the fastest way to get your transcript, and you can view, print, and download it directly from the portal. You will also be able to use other IRS online services when you have an online account. This service is only for individual use so a business can not log in to obtain your transcript on your behalf.

If you would rather request your transcript by phone, youll have to call 1-800-908-9946 to use the automated IRS phone system to request your transcript. In order to request a transcript by phone, you will need the mailing address from your most recent return.

You may also request a transcript by mail by visiting the IRS online transcript mail request. For this option, youll need your Social Security number or Individual Tax ID number, Date of Birth, and your mailing address. You can also print IRS form 4506-T or IRS form 4506-T-EZ and complete it and mail it to request a transcript. Both phone and mail options are generally processed within 10 days.

Read Also: How Are Annuity Death Benefits Taxed

Q3 How Long Must I Wait Before A Transcript Is Available For My Current Year Tax Return

If you filed your tax return electronically, IRS’s return processing takes from 2 to 4 weeks before a transcript becomes available. If you mailed your tax return, it takes about 6 weeks. If you didn’t pay all the tax you owe, your transcript may not be available until mid-May or a week after you pay the full amount owed. Refer to transcript availability for more information.

Once your transcript is available, you may use Get Transcript Online. You may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call . Please allow 5 to 10 calendar days for delivery. You may also submit Form 4506-T, Request for Transcript of Tax Return. The time frame for delivery is the same for all available tax years.

What Is An Irs Tax Transcript And How Do I Request One

OVERVIEW

Learn which situations may require an IRS tax transcript, along with how to request your tax transcript, and how to interpret it when it arrives.

Do you need information from a tax return you filed three years ago because you’re making a major purchase and the lender wants to see your tax history? Maybe you need to provide your adjusted gross income from the past three years to demonstrate your financial picture but can’t find your tax return paperwork.

If you find yourself in a similar situation, you don’t need to panic. You can simply find this information by downloading your IRS tax transcript online or requesting a copy in the mail. This form provides most of the information you submit on your Form 1040, and you can access it for free.

Don’t Miss: What Is Federal And State Tax