California Issues More Golden State Stimulus Checks Including 1st By Mail

California on Tuesday distributed the third round of Golden State Stimulus II checks, including the first batch that will be delivered by mail to eligible residents.

Approximately 705,000 payments were issued, with an estimated total value of $480 million, according to the California Franchise Tax Board.

The number includes 375,000 paper checks that were sent out in the first batch of mailings, as well as approximately 330,000 payments that were disbursed by direct deposit.

Checks can take up to three weeks to arrive once mailed, while direct deposits typically show up within a few business days, the Franchise Tax Board says.

People can also check Californias Wait Times dashboard, which has more details on refund processing time frames.

Payments by direct deposit are expected to continue through at least October, while checks will be periodically mailed through the beginning of next year, according to the tax boards website. Delays can be expected depending on when someone turned in their 2020 tax return and the date it was processed.

To date, more than 3.3 million Golden State Stimulus II payments valuing over $2.3 billion have been distributed to Californians who reported earnings of up to $75,000 on their 2020 tax return.

Some people who received the first Golden State Stimulus check earlier this year may also qualify for another payment of $500, however.

Wheres My State Tax Refund California

Track your state tax refund by visiting the Wheres My Refund? page of the California Franchise Tax Board. You will need to enter the exact amount of your refund in order to check its status.

According to the state, refunds generally take up two weeks to process if you e-file. If you file a paper return, your refund could take up to four weeks. Businesses can expect processing times of up to five months.

Contact the Franchise Tax Board if you have not heard anything within one month of filing an electronic return . Businesses should reach out if they havent heard anything within six months of filing.

Amended returns for both individuals and businesses can take up to four months for processing.

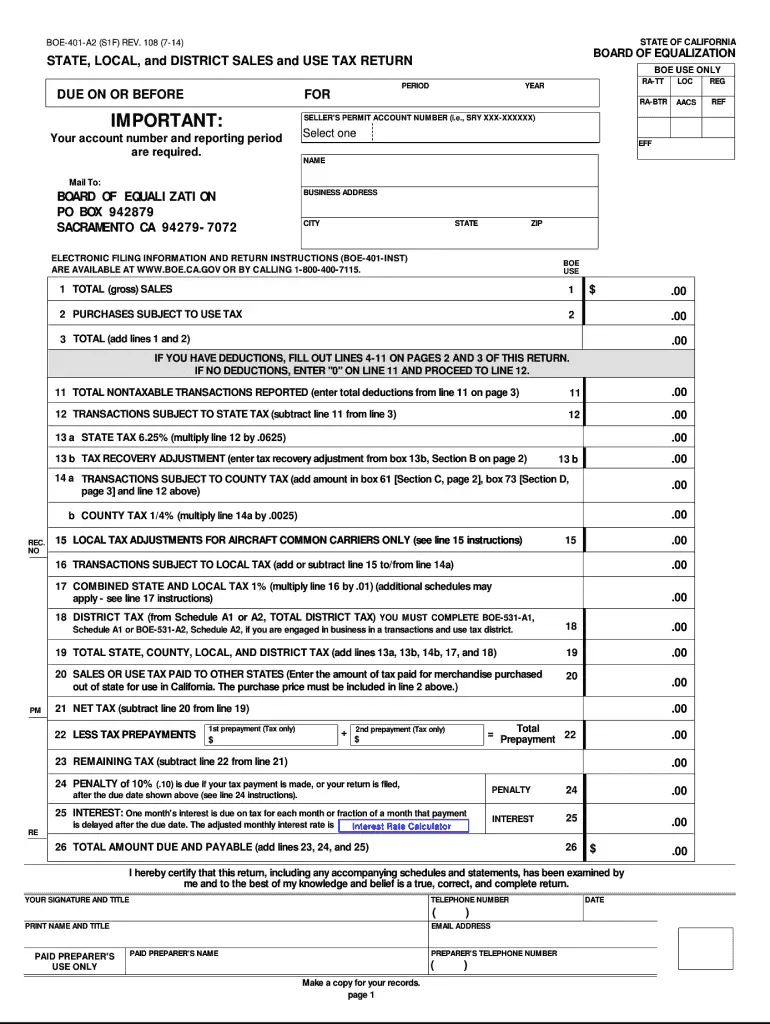

How To Collect Sales Tax In California

If you have an in-state location in California, you are required to collect both state and district sales taxes. District sales taxes vary between 0.10% and 1.00%, and in some cases more than one district tax will apply to any given location.If you have a single location, in-state buyers who are buying from outside your district will only be charged the state sales tax .If you have multiple locations, you must also collect district sales taxes from any buyer who resides in a district in which you have nexus .

Also Check: Where Is My Federal Tax Refund Ga

Wheres My State Tax Refund Ohio

The Department of Taxation for Ohio provides an online form to check your refund status. To see the status, you will need to enter your SSN, date of birth and the type of tax return. You also need to specify if it is an amended return.

According to the Department of Taxation, taxpayers who request a direct deposit may get their refund within 15 days. However, paper returns will take significantly longer. You can expect processing time for a paper return to take eight to 10 weeks. If you are expecting a refund and it doesnt arrive within these time frames, you should use the check status form to make sure there arent any issues.

How To File Your California State Tax Return

You have multiple options for tax preparation, filing and paying your California state income tax.

- E-file and pay for free with CalFile through the Franchise Tax Boards website. Youll need to create an account.

- File for free through an online tax-filing service like ®. But if your filing status is married filing separately, you wont be able to use Credit Karma Tax® to prepare your California state tax return.

- E-file through a fee-based tax-filing service.

- through the FTB website. You can complete and mail these forms to the Franchise Tax Board, PO Box 942840, Sacramento, CA 94240-0001, if no balance is due or youre owed a refund. If youre filing with a payment, mail it to PO Box 942867, Sacramento, CA 94267-0001.

Read Also: How Much Does H& r Block Charge To Do Taxes

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

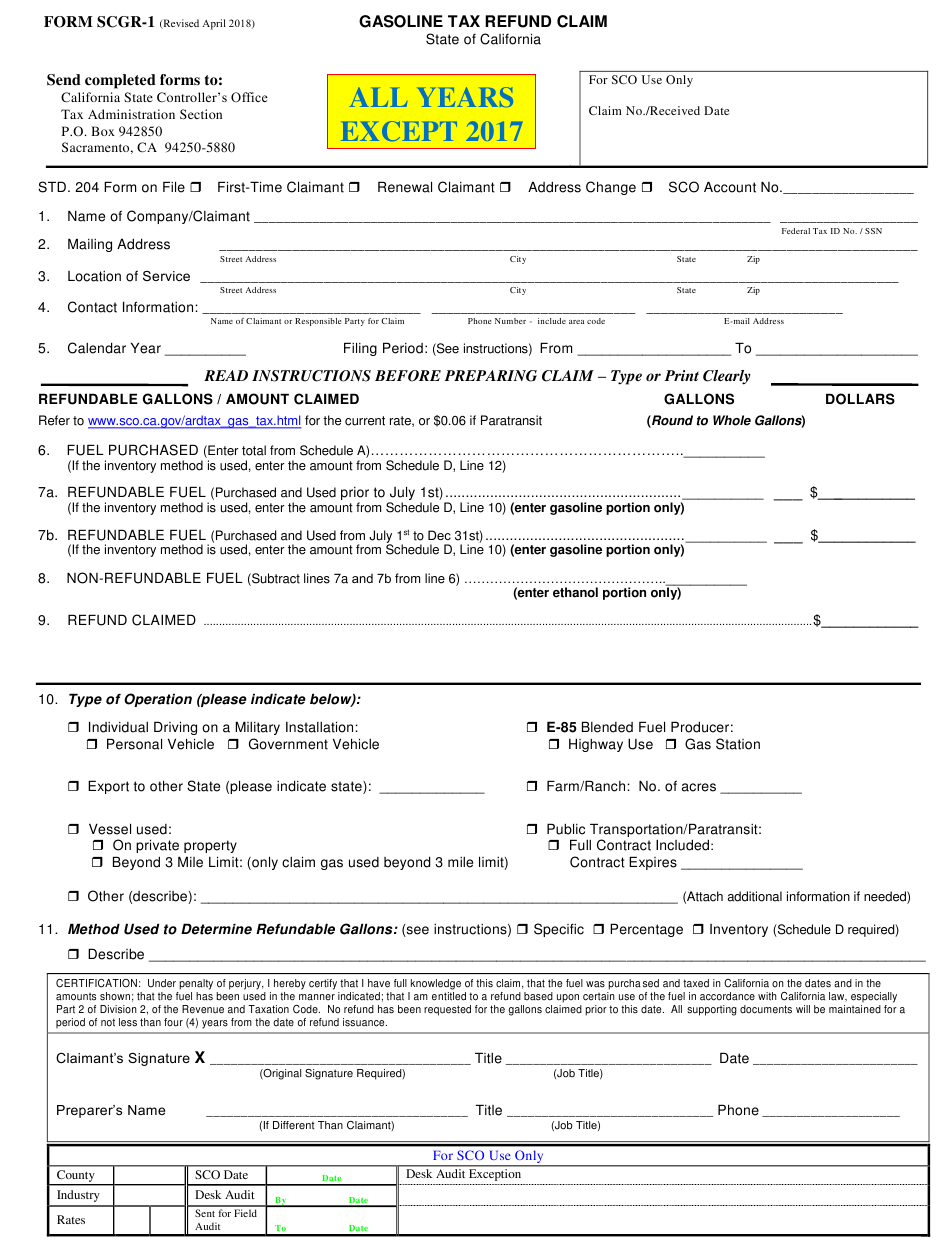

Statutes Of Limitations For Filing Refund Claims

Filing a timely claim for refund is critical in achieving a successful outcome. Even if you are legally due a refund, you may forfeit your entitlement if you wait too long to act. Although state and federal guidelines differ, here are some general rules of what you can expect:

Federal Income Tax Returns: Refund claims must be filed no later than three years from the date the return was filed, or within two years from the date the tax was paid, whichever is later.

In order to bring suit on a federal income tax refund claim, one of the following must have taken place:

Additionally, a suit based upon a refund claim has to be filed with the courts within two years from the date the IRS mails by registered or certified mail, a Notice of Disallowance of the claim.

California Income Tax Returns: Taxpayers have up to four years after the original due date of an income tax return to file a claim for refund or one year from the date of an overpayment, whichever is later.

California Quarterly Sales and Use Tax Returns: California refund claims must be filed within

- three years and one month following the close of the quarterly period for which the overpayment was made or,

- with respect to determinations, within six months from the date the determination becomes final or

- within six months from the date of overpayment, whichever period expires later.

Don’t Miss: Www Aztaxes Net

Wheres My State Tax Refund Maryland

Visit the Comptrollers website to check the status of your Maryland tax refund. All you need to do is enter your SSN and your refund amount. Joint filers can check their status by using the first SSN on their return.

According to the state, it usually processes e-filed returns the same day that it receives them. That means you can expect your refund to arrive not too long after you file your taxes. On the other hand, paper returns typically take 30 days to process. For security reasons, it is not possible to verify any of your tax return information over the phone.

Filing Your California Sales Tax Returns Online

California supports electronic filing of sales tax returns, which is often much faster than filing via mail.

California allows businesses to make sales tax payments electronically via the internet.

You can process your required sales tax filings and payments online using the official BOE Online Filing website, which can be found here

Don’t Miss: Efstatus Taxact Com Return

Wheres My State Tax Refund Colorado

Taxpayers can check the status of their tax refund by visiting the Colorado Department of Revenues Revenue Online page. You do not need to log in. Click on Wheres My Refund/Rebate? from the Quick Links section. Then you will need to enter your SSN and the amount of your refund.

Colorado has increased its fraud prevention measures in recent years and and warns that it may need take up to 60 days to process returns. Returns will take longest as the April filing deadline approaches. This is when the state receives the largest volume of returns. The state also recommends filing electronically to improve processing time.

What Is A Ups/fedex Accepted Physical Address For The California Franchise Tax Board

I need to file my California tax returns but am living abroad.I was told that I can only use FedEx/UPS to send my tax returns, but the California Franchise Tax Board only has a PO box address where ever I look .

Does anyone have an actual physical address EDIT: incliding a street and number that has worked for them for filing a return .

Thanks!

This address worked for me using UPS )

FRANCHISE TAX BOARD

From the FTB website:

Private Carrier Services do not deliver to USPS post office boxes.

For private carrier or overnight delivery service, use the address format below.

EMPLOYEE NAME OR PROGRAM AREA MS XXXX FRANCHISE TAX BOARD SACRAMENTO, CA 95827-1500

I’m not sure what you should use for the first line.

- Thanks… i just edited my question: UPS requires a street address which is missing in all the addresses I found onlineAug 27 ’17 at 18:12

- FTB is likely the only organization using that zip code. It’s fine, really.Aug 27 ’17 at 18:14

- 1If the FedEx or other form requires a street address field to be filled, put “N/A” or “No street address”.

I googled “California Franchise Tax Board mailing address”. The first link is a page from the CFTB entitled “Mailing Addresses for Tax Returns and Payments”.

At the bottom of that page it says:

Private Carrier Services do not deliver to USPS post office boxes. For private carrier or overnight delivery service, use the address format below.

Employee Name or Program Area MS XXXX Franchise Tax Board

Don’t Miss: How To File Missouri State Taxes For Free

How To Check On Your State Tax Refund

Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID. One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income, but do tax some income from dividends and investments.

How Do I Fill Out A California Tax Return

Complete your federal income tax return before you begin your California Form 540. Use information from your federal income tax return to complete your Form 540. California Form 540 Instructions.

How long do you have to live in California to be considered a resident for tax purposes?

You will be presumed to be a California resident for any taxable year in which you spend more than nine months in this state . Although you may have connections with another state, if your stay in California is for other than a temporary or transitory purpose, you are a California resident .

You May Like: Www Michigan Gov Collectionseservice

Will California Grant Me Innocent Spouse Relief

It depends. Innocent Spouse relief is a highly factual situation. It is really difficult for me to give you a yes or no answer on this one. What I will tell you is much like everything with California, it is a little bit more difficult to deal with California and to get determinations versus on a federal level.

When it comes to innocent spouse relief, you really have to jump through a few hoops with California in order for them to make that determination.

If a husband and wife or registered domestic partnership owe a tax/fee to the CDTFA, both parties are individually and jointly liable for the amount due when the account is registered as a co-ownership or a partnership.

However, California law recognizes that it is not always reasonable or equitable to hold a spouse accountable for the liability when certain conditions exist. Innocent Spouse claims usually occur when spouses divorce, separate, or no longer live with one another.

Generally, the requesting spouse claims that he or she was not involved with the business when the liability was generated. The burden of proof for this claim rests with the requesting spouse.

Many of our innocent spouse cases in California will end up in appeals or with some hearing officers. The important thing getting all of your facts straight at the beginning of your innocent spouse application.

Wheres My State Tax Refund Michigan

Checking your refund status is possible through the Michigan Department of Treasury. Just visit the Wheres My Refund? page. Michigan requires you to enter slightly different information than most other states. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income.

Michigan says to allow four weeks after your return is accepted to check for information. This assumes you filed electronically. If you filed a paper return, allow six to eight weeks before checking.

Read Also: How To Look Up Employer Tax Id Number

Some States Will Require An Amended Return To Get The Tax Break

In several states, some additional legwork may be required to get the unemployment tax break at the state level. “Now states are saying you’re going to need to formally amend your individual state return if you want to take advantage of the exclusion that we retroactively adopted,” Grzes says.

West Virginia, New Mexico, and Louisiana are among the states that have agreed to follow the federal unemployment tax break, but they are requiring eligible residents to file amended returns to get it. Other states, like Massachusetts, are allowing residents to take the unemployment tax break without having to file an amended return.

“Every state is different,” Grzes says. “That’s one of the challenges.” To find out how your state plans to tax unemployment benefits, visit its tax agency’s website for details.

Wheres My State Tax Refund Montana

Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page. From there you will need to enter your SSN and the amount of your refund.

The processing time for your tax return and refund will depend on when you file. The Montana Department of Revenue says that if you file your return in January, it may process your refund within a week. However, you may wait up to eight weeks if you file in April, which is generally when states receive the majority of returns.

Also Check: Do You Have To Report Roth Ira On Taxes

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

Sales And Use Tax And Special Taxes And Fees

California Department of Tax and Fee AdministrationPO Box 942879

- TDD service from TDD phones: 1-800-735-2929

- TDD service from voice phones: 1-800-735-2922

- Faxback: Call the Information Center: 1-800-400-7115

- Sellers permit number verification: 1-888-225-5263

Representatives are available to assist you Monday through Friday, except State holidays, from 8 a.m. to 5 p.m.

Read Also: Can You Change Your Taxes After Filing

California State Tax Credits

Available California tax credits include the following:

- Child adoption costs: 50% of qualified costs for a qualified adoption in the year an adoption is begun.

- College access tax credit: 50% of contributions to the College Access Tax Credit Fund, Californias Cal Grants financial aid program.

- Earned income tax credit: Similar to the federal earned income tax credit, Californias credit is intended for lower-income working people. If your income qualifies you, the amount of the credit depends on your income and the number of qualifying children you have.

Pennsylvania Direct Tax Filing

Pennsylvania offers myPATH, but your return must be pretty basic to use it. You’re not eligible if you’re intending to claim a resident tax credit or if your income derives from farming.

Although they’re not run by individual states, two websites also offer free state returns if you meet certain lower income requirements. United Way offers MyFreeTaxes.com for state returns, as does .

Don’t Miss: How To Buy Tax Forfeited Land

What Advice Can You Give Me About Setting Up A Payment Plan With The State Of California

The first thing that I would tell you about setting up a payment plan for delinquent tax liability is California is going to be much more aggressive in the payment of that liability than the IRS will be. California is pretty cash-strapped, so the thresholds for the seriousness of a certain liability are a lot lower than they are at the IRS level.

For example, if you owe $20,000 to the IRS, to them, it is not that huge of a deal. The IRS has hundreds of thousands of people who owe them $20,000. In California, a $20,000 liability would get you into what is called the complex account recovery unit.

California takes smaller liabilities much more seriously than the feds do. They are a lot quicker to assess them, too. As well, they are a lot quicker to take collections actions and they are a lot more aggressive in those collections actions.

One of the problems in dealing with the State of California is that everything with the IRS is usually pretty formulaic and it is regulated by the internal revenue manual. In California, the franchise tax board is the administrative agency that governs income tax.

The CDTFA has a collections manual, but it is nowhere near as in-depth or as detailed as the IRS manual. Because of the lack of detail, there is a lot more discretion that is given to the frontline collection agents and the managers.

The payment plan timelines that they are requesting are going to be a lot shorter and they are not going to be as flexible with their deadlines.