Requesting An Extension Of Time For Filing A Return

Revised Statute 47:103 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The five options for requesting an extension are as follows:

An extension does not allow an extension of time to pay the tax due. Payments received after the return due date will be charged interest and late payment penalty.

Where Do I Send My 1040ez Form

Whichever version of the 1040 form you use , your 1040 form has to be mailed to the IRS upon completion. However, the answer to this question depends on where you are located. You can check our list below to determine your appropriate IRS mailing address.

Whats your biggest 2022 HR challenge that youd like to resolve

Answer to see the results

Where Should I Mail My Tax Returns

There is no one address to mail your federal tax returns to.

Where the form needs to go will depend on exactly what return you are trying to file. Each type of form and tax return has its own mailing address and when you need to send it will depend on where in the country you live.

If you are filing but not making your tax payment then there will be a different address that you will need to use.

For example, if you are trying to file a Form 941 then you will need to use the following addresses:

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury |

|

P.O. Box 932100 Louisville, KY 40293-2100 |

You can find a full list of state by state addresses here on the IRSs website as well.

Don’t Miss: Can You File Taxes If You Did Not Work

Example For A Return Beginning With An Alpha Character:

To find Form SS-4, Application for Employer Identification Number, choose the alpha S.

Find forms that begin with Alphas:C, S, W

Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2022.

How Should I Contact The Irs For More Help

The IRS received 167 million calls this tax season, which is four times the number of calls in 2019. And based on the recent report, only 7 percent of calls reached a telephone agent for help. While you could try calling the IRS to check your status, the agencys live phone assistance is extremely limited right now because the IRS says its working hard to get through the backlog. You shouldnt file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if youre eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if its been 21 days or more since you filed your taxes online, or if the Wheres My Refund tool tells you to contact the IRS. You can call: 800-829-1040 or 800-829-8374 during regular business hours.

Recommended Reading: How To Find Your Employers Ein

You May Like: What Is The Deadline For Filing Taxes

Filing By Hand Vs Using Online Software

If you choose to file your taxes by hand, youll download and fill out relevant IRS forms and mail them to your local collection address. Tax forms are available for free at IRS.gov, and you may need to fill out more than 1 depending on your deductibles, employment situation and marital filing status.

To make a payment, you may mail a check to the IRS directly or you use a debit card, credit card or same-day wire transfer by using the IRS online payment system.

Filing your taxes by hand may take a little longer, but it can be a good option if you have a simple return. If you arent interested in learning more about tax process or have a complicated return, a tax prep software can help guide your way.

This is especially true if you own rental properties or make regular income through the stock market with investment taxes. Tax prep software can also walk you through the process if youre a business owner who needs to calculate capital gains taxes. Software can navigate the myriad of tax laws, deductibles and exemptions you need to detail.

Read Also: Florida Transfer Tax Refinance

When Do I Need To Post My Tax Return By

You must submit your federal tax returns once a year. The deadline for this submission is known as tax day and it marks the end of the financial year.

The next Tax Day is in April 2023. Currently, Tax Day 2023 is scheduled for April 15th.

Typically, Tax Day is on April 15th, but if it falls on a Sunday or a holiday, it can be pushed back to April 18th.

When you are posting your tax returns, it is recommended that you put them in the mail at least two weeks before the deadline.

Also Check: What Is The Easiest Online Tax Service To Use

Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

Read Also: Do You Charge Sales Tax On Services

Is Form 941 Required To Be Filed Electronically

The IRS requires that all businesses file Form 941 online through an approved e-file provider or on IRS-authorized paper forms.

How do I mail my federal tax return?

What do I send with my tax return?

n Attach a copy of Forms W-2, W-2G and 2439 to the front of Form 1040. Also attach Forms 1099-R if tax was withheld. n Use the coded envelope included with your tax package to mail your return.

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

You May Like: What If You Forgot To File Taxes Last Year

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

New Tax Rules For The Foreign Earned Income Exclusion During The Covid

As Coronavirus safety concerns and travel bans increased, some Americans living abroad decided to return to the US. Many had intended to stay abroad but cut their plans short because of the pandemic. Taking into account these unique circumstances, the IRS decided to adjust the requirements to qualify for the Foreign Earned Income Exclusion.

Under the revised rules, if you reasonably expected to meet the eligibility requirements of the FEIE during 2019 or 2020 but failed to do so because of the Coronavirus pandemic, you can still claim the tax exclusion. However, you must have left your country of residence within a specified date range. The date range is determined by when the period of adverse conditions began in different regions.

Therefore, you can still qualify for the FEIE if you left these regions after the dates below:

The period for this exception will end on July 15, 2020, unless the Treasury Department and IRS choose to extend it. This means that, if you left China between December 1, 2019 and July 15, 2020, you could still qualify as physically present or a bona fide residentso long as you expected to meet the requirements if not for the COVID-19 Emergency.

To determine the maximum available exclusion you can claim, youll need to prorate the FEIE amount based on the percentage of the year that you lived outside the US.

Heres how you would calculate the maximum FEIE exclusion for 2020 based on our example above:

Recommended Reading: How Does Doordash Do Taxes

Recommended Reading: Where Do I Find My Property Tax Statement

How Much Do You Have To Make To File Taxes

The IRS has several criteria for determining who must file a tax return. It depends on your filing status , the amount of federal income tax withheld from your earnings, and your gross income for the year. Even if your income is low enough to avoid filing, you may want to file to claim the earned income tax credit or other tax credits or to get a refund for the year.

You can use the interactive tax assistant on the IRS website, which takes you through a process of answering questions to help you figure out if you need to file a tax return

Prior Year Forms & Instructions

Make your estimated tax payment online through MassTaxConnect. Its fast, easy and secure.

- Form 1-ES, 2022 Estimated Income Tax Payment Vouchers, Instructions and Worksheets

- Form 2-ES, 2022 Estimated Tax Payment Vouchers, Instructions and Worksheets for Filers of Forms 2 or 2G

- Form UBI-ES, 2022 Non-Profit Entities Corporation Estimated Tax Payment Vouchers and Instructions

Income and Fiduciary Vouchers these estimated tax payment vouchers provide a means for paying any taxes due on income which is not subject to withholding. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year. Generally, you must make estimated tax payments if you expect to owe more than $400 in taxes on income not subject to withholding. Learn more.

Read Also: How Much To Do Taxes At H& r Block

What You Need To File

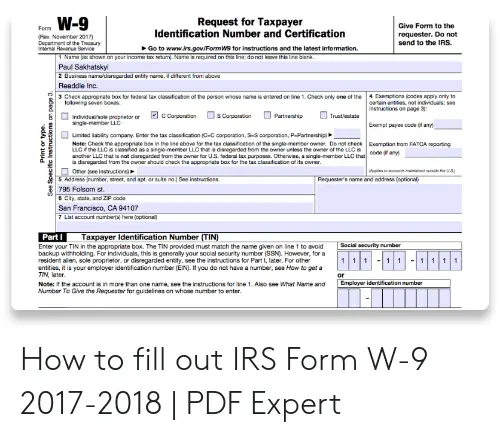

Taxpayer Identification Number

A taxpayer identification number is required on all of your tax-related documents.

Most taxpayer identification numbers are Social Security numbers.

If you are not eligible for a Social Security number, you must use an individual taxpayer identification number, or ITIN. ITINs are issued only for federal tax filing and reporting.

An ITIN does not:

- Qualify you for the Earned Income Tax Credit

Mailing Options & Services

These mailing services apply a postmark to your return. If your return is postmarked by the IRS deadline date, it is considered on time. With , you can pay for postage online and print a shipping label from your own computer. Generating a Click-N-Ship label with postage creates an electronic record for the label on that specific date, so it is important that you send your package on the shipping date you used to create the label. Your online Click-N-Ship account will save your shipping history for six months.

- 12 business day delivery

- Extra services available

You May Like: How Much Is Federal Income Tax

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Heres Where You Want To Send Your Forms If You Are Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000

- Florida, Louisiana, Mississippi, Texas: Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Internal Revenue Service, P.O. Box 802501, Cincinnati, OH 45280-2501

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7008

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7910

If youre filing a different 1040 income tax form, the IRSs website has a nifty breakdown of where each form has to go, most depending on whether or not a payment is enclosed.

Also Check: How Much Taxes Deducted From Paycheck Mi

Can You Send Overnight Mail To The Irs

When your tax return absolutely, positively has to get to the IRS, you might want to use a private delivery service. The IRS has authorized the following companies to handle delivery of tax returns: FedEx FedEx options accepted by the tax office include Priority Overnight, Standard Overnight and 2nd Day delivery.

Where Do I Enter Quarterly Taxes On Turbotax

Where do i enter my 4 estimated tax payments

What is the mailing address for IRS Form 941?

The general mailing address for IRS Form 941 is the Internal Revenue Service, P.O. Box 409101, Ogden, UT 84409, according to the Internal Revenue Service. For specific addresses, individuals mailing from most states east of the Mississippi River should send Form 941 to the Internal Revenue Service in Cincinnati, Ohio. Know More.

What is the address to mail a federal tax return?

The mailing address for the D-40 and D-40EZ individual income tax returns is Office of Tax and Revenue, PO Box 96169, Washington, DC 20090-6169. If mailing a refund or no payment return, mail to the Office of Tax and Revenue, PO Box 96145, Washington, DC 20090-6145.

Recommended Reading: Does Texas Have State Income Tax