Pay Taxes By Check Or Money Order

Unfortunately, there is no singular IRS payment processing hub. Instead, you must mail your check or money order to the IRS Center that handles your particular type of tax payment, based on where you live. Sending your payment to the proper address helps ensure it will be processed correctly and on-time.

To mail a tax payment, make your check or money order payable to United States Treasury. Be sure to include your name, address, phone number, taxpayer ID number , the tax period, and the related tax form or notice number on your form of payment.

NOTE: Do not mail cash to the IRS.

Best Way To Pay Taxes: 7 Ways You Can Send Payments To The Irs

posted on January 9, 2020by Gary M. Kaplan, C.P.A., P.A.| Comments Off on Best Way to Pay Taxes: 7 Ways You Can Send Payments to the IRS

If you owe the IRS money, theres no doubt youre feeling stressed and overwhelmed.

Theres no need to panic if you have an IOU with the IRS as long as you know how to handle the debt in a way that works for them, and for you.

Check out this handy guide that will explore the best way to pay taxes so you can send payments like a boss.

Check Money Order Or Cashiers Check

How it works: Have one made out to the U.S. Treasury and mail it to the IRS. Make sure it includes your name, address, daytime phone number, Social Security number or employer identification number, the tax year it should be applied to and related tax form or notice number.

Cost: Stamps and/or mail delivery tracking, plus a possible fee to get a money order or cashiers check.

Pros:

-

You dont need a bank account to get a money order.

-

You may not need a bank account to get a cashiers check.

-

Money orders and cashiers checks cant bounce.

-

Money orders and cashiers checks are trackable, so you can verify receipt.

Cons:

-

You have to go to the bank or another provider to get a money order or cashiers check.

-

Money orders have a $1,000 limit.

-

You must mail the check, money order or cashiers check.

-

Payment may take days or weeks to get there and post.

-

Regular checks can bounce if theres not enough money in the account or you dont have enough overdraft protection.

» MORE:See more differences between cashiers checks and money orders

Don’t Miss: Can You File Llc Taxes Online

Stimulus Checks : How To Track Payments And Claim Money

If you are an American and paid your taxes earlier this year. It could take months to get back your refund.

However, due to the inconvenience, the IRS inaugurated a tool for all taxpayers who want to track their payments.

The Internal Revenue Service mentioned they processed around 143 million tax returns in the current year. As a taxpayer, you have a high possibility of receiving your money after the established date.

How To Check Your Tax Refunds

As you are already aware, the federal government of the United States, with the help of the Internal Revenue Service, initiates tax refunds to all eligible Americans who file income tax returns.

Apart from that, the federal government also announced some relief during the pandemic in the years 2020 and 2021. All of these reliefs are supposed to be processed by the Internal Revenue Service.

All Americans are well aware of its tax refunds and returns. That is why the Internal Revenue Service launched two portals for all Americans to check their tax refunds.

Recommended Reading: What Percentage Of My Income Goes To Taxes

From Your Bank Account Using Eftpsgov

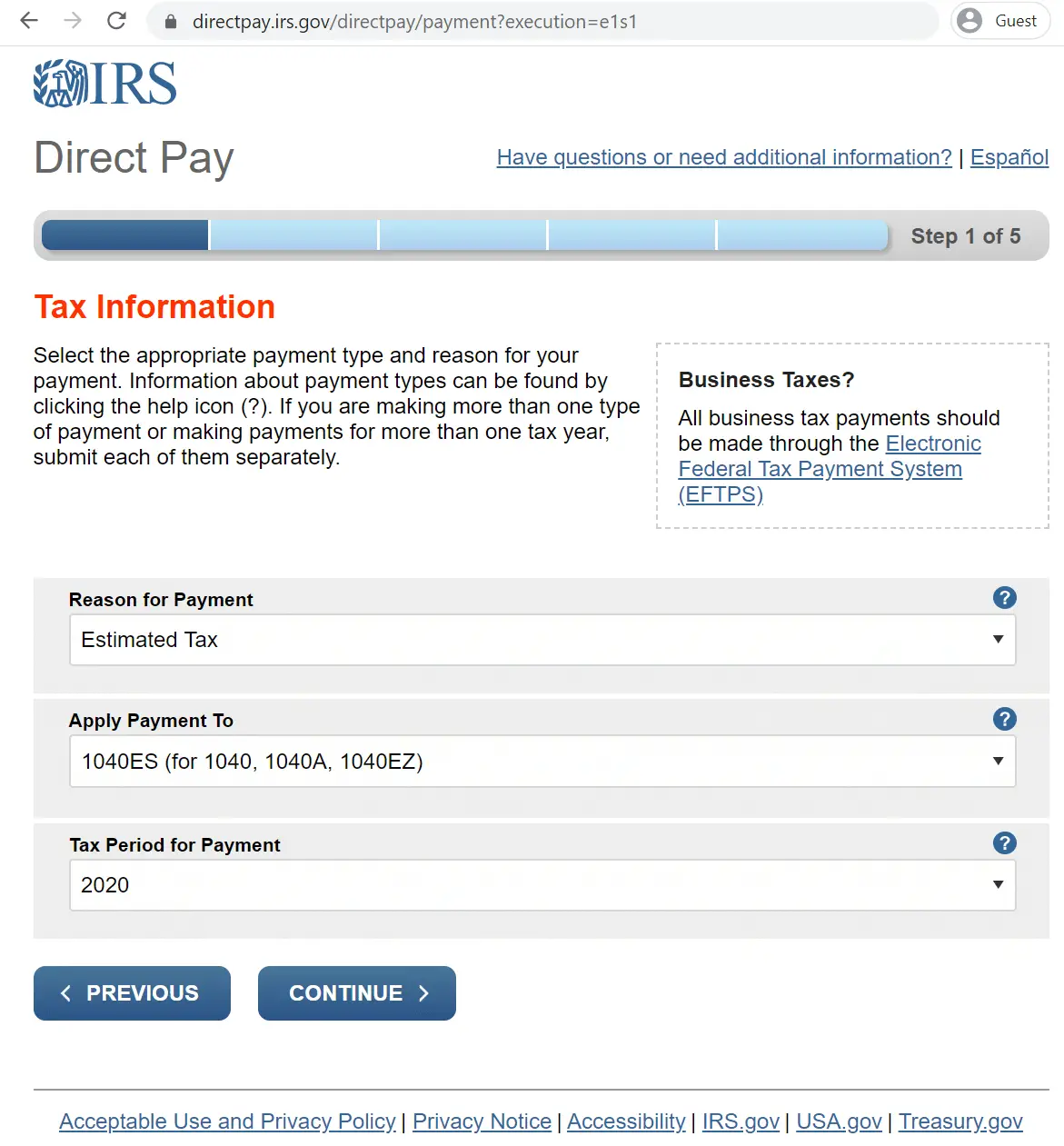

You can schedule payments up to 365 days in advance for any tax due to the IRS when you register with the Electronic Federal Tax Payment System . As with Direct Pay, you can cancel or change payments up to two business days before the transmittal date.

EFTPS is a good choice if:

- You want to schedule all of your estimated tax payments at the same time

- Your payments are particularly large

- Payments are related to your business

The Treasury Department operates EFTPS. It doesn’t charge any processing fees. It can handle any type of federal tax payment, including:

- 1040 balance due payments

- Corporate taxes

You must enroll with EFTPS, but the site saves your account information. You don’t have to keep re-entering it each time you want to make a payment. You’ll receive an email with a confirmation number for each transaction. EFTPS saves your payment history for up to 16 months.

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

Recommended Reading: Do You Have To Report Roth Ira On Taxes

Still Living Paycheck To Paycheck

Some top economists have called for more direct aid to Americans. More than 150 economists, including former Obama administration economist Jason Furman, signed a letter last year that argued for recurring direct stimulus payments, lasting until the economy recovers.

Although the economy is improving, millions of people continue to suffer from reduced income and have not been able to tap government aid programs, Nasif said. Only 4 in 10 jobless workers actually received unemployment aid, according to a from economist Eliza Forsythe.

Many people never applied for unemployment benefits because they didnt think they were eligible, while others may have given up due to long waits and other issues.

Youll see reports about how the economy is starting to grow, but there are a lot of Americans living paycheck to paycheck, and for a lot of them the government relief programs havent been able to help, said Greg Nasif, political director of Humanity Forward.

Recommended Reading: When Are The Next Stimulus Checks Going Out

How To Figure Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year’s federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

Read Also: Can You Still File Your Taxes

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, well send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

You May Like: 4 Stimulus Check For Social Security

Pay Your Fees In Person

For those concerned about fraud or lost payments, this is the best way to pay taxes. Youll need to find out where your local IRS office is, and you should make an appointment in advance to avoid waiting in line.

If you dont want to stand around your local IRS office, try an IRS retail partner. These are participating stores that will allow you to transmit the payment from their location.

You can find IRS partners online, but keep in mind that this method may take several days to process. You can also pay cash at both of these locations, just be sure to get a receipt showing the date, amount, and a confirmation number.

You May Like: Who Can File Ez Tax Form

Stimulus Check Irs Phone Number: Where To Call

The IRS Economic Impact Payment phone number is 800-919-9835. You can call to speak with a live representative about your stimulus check.

Be prepared to sit on hold, though. If the automated responses cant answer your questions and youd like to talk to a live operator, you may join a long waiting list. Some people say they havent even been able to get through.

Thats why the IRS recommends using its dedicated stimulus check portal for fast assistance. It also reminds those who are eligible for a stimulus check but arent required to file a tax return to use the Non-Filers tool to register for their payment.

Looking for more information about stimulus checks? Check out our stimulus check FAQ page for answers to common payment questions.

Read Also: How To Change Your Bank Account For Stimulus Check

What Is The Earned Income Tax Credit

The American Rescue Plan of 2021 also boosted the Earned Income Tax Credit, which has been available for decades and is aimed at helping low-income workers. Prior to the legislation, childless workers between 25 to 64 could only get up to $538, but the pandemic law boosted that to $1,502.

The law also increased the amount that can be claimed by working families with children, increasing it to as high as $6,728 for parents with three children.

Most people can claim the EITC if they earn under $21,430 for single taxpayers or $27,380 for married people filing jointly.

Read Also: How To Claim College Student On Taxes

Use A Secure Method To Mail Your Return

Always use a secure method, such as certified mail return receipt requested, when you’re sending returns and other documents to the IRS. This will provide confirmation that the IRS has actually received your documents or payment.

In addition to addressing it correctly and using sufficient postage, be sure the envelope is postmarked no later than the date your return is due. The date of the registration is the postmark date if you use registered mail. The date stamped on the receipt is the postmark date if you use certified mail.

Make sure the return is sent out no later than the date due if you use an IRS-approved private carrier.

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

Read Also: Are Financial Advisor Fees Tax Deductible

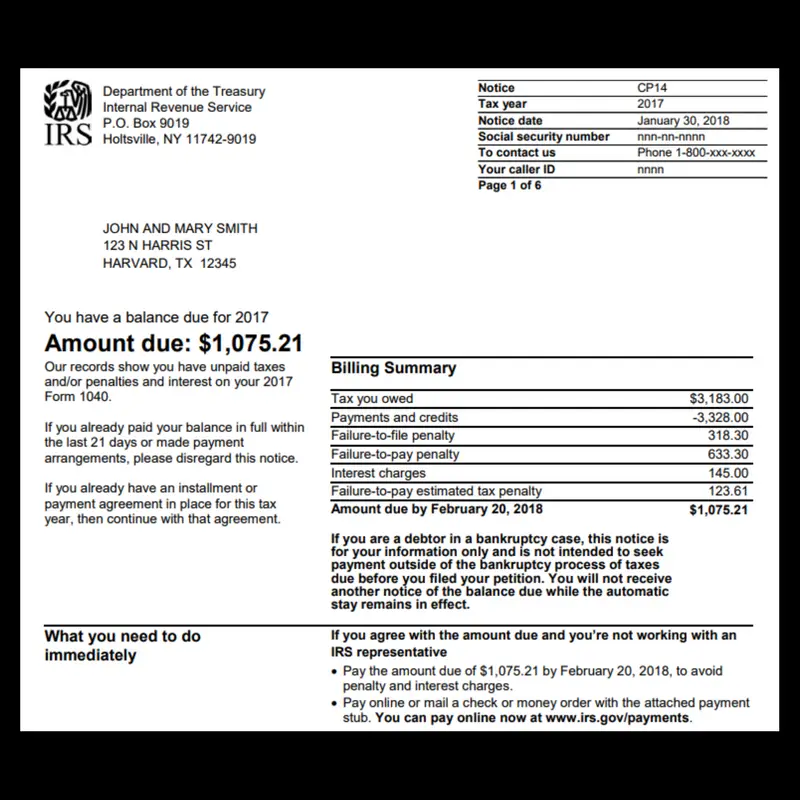

Payment Voucher Form 1040

This form shows payment due to the IRS. We recommend that you use one of the electronic payment options listed on the IRS website: . If you are unable to pay electronically, you should mail a paper check to the address provided to you in the Final Instructions file we give to all clients . You can also locate that address in the IRS instructions in the upper part of the voucher form.

- If you live abroad but use a U.S. mailing address on your tax return then address on the payment voucher may be different from the payment address that tax preparer provided on your final instructions. We recommend to use the address shown on the instructions. If you send payment to the IRS center for non-expat tax returns it will be applied to your account eventually but processing time will take longer.

- Write the primary taxpayer name, Social Security, filing year and the main tax Form number on the check. The Main tax form number is prominent on the first page of your tax return .

- Always send the check along with payment voucher to prevent incorrect allocation of payment to another year or – even worse – to another taxpayer account.

- Make payment as soon as you get the voucher to avoid penalties and interest accumulation.

Automatic Extension Of Time To File

Taxpayers who need more time to prepare and file their federal tax return can apply for an extension of time to file until Oct. 15. To get an extension, taxpayers must estimate their tax liability on the extension form and pay any amount due.

Individual taxpayers have several easy ways to file Form 4868PDF by the July 15 deadline. Tax software providers have an electronic version available. In addition, all taxpayers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension.

You May Like: Can I File Taxes Separately From My Husband

The Deadline To Claim The $3200 Stimulus Payments: How To Apply

The deadline to claim stimulus checks and the 2021 child tax credit is 15 November 2022. The IRS has sent letters to those who have yet to file a tax return and, thus, have left their benefits unclaimed.

For those who have not yet filed a 2021 tax return, one must be submitted to the IRS by the deadline in order to receive the payments, which could total more than $3,200.

The American Rescue Plan, passed by Democrats in March 2021, included a stimulus check worth $1,400 and funds to boost the value of the child tax credit.

In 2021, the value of the child tax credit increased from $2,000 per child to $3,600 per child under six and $3,000 for those between six and seventeen. There are no income minimums, unlike the $2,000 credit, meaning those who may not have submitted a return should do so as soon as possible. For more information, one can look to the IRS and a website dedicated to helping parents and guardians navigate the child tax credit.

Claiming certain #IRS credits may result in a refund, even if youre not otherwise required to file a tax return. Use #IRSFreeFile by Nov. 17, 2022 to prepare and your 2021 tax return electronically for free!

How Do I Claim These Benefits

The IRS is urging people who believe they are eligible for the tax credits but havent filed a tax return to go ahead and file a return with the tax agency, even if they havent yet received a letter from the IRS.

The IRS reminds people that theres no penalty for a refund claimed on a tax return filed after the regular April 2022 tax deadline, the IRS said.

There are a few ways people can claim the benefits:

- File a return with Free File before November 17, 2022. Free File is available to people who earn less than $73,000.

- File a simplified 2021 tax return through GetCTC before November 15, 2022.

The IRS said it urges people to file their tax form electronically and to choose direct deposit in order to get their tax credits as soon as possible.

Recommended Reading: When Will Nc Stimulus Checks Arrive 2021

Don’t Miss: What Forms Are Needed To File Taxes

How To Make An Irs Payment: 10 Ways To Pay Your Taxes

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Writing a check was the only way to pay the IRS back in the day. Now there are a ton of options.

Heres an overview of some common ways to make an IRS payment, what they’ll cost you, and the pros and cons of each IRS payment method.

Audit Found Tax Agency Didnt Send Payments To 41 Million Eligible Households But Was Still 98% Accurate In Delivering The Pandemic Aid

Listen to article

WASHINGTONThe Internal Revenue Service sent $1.1 billion in advanced child tax credit payments during 2021 to people who shouldnt have gotten them, and failed to send $3.7 billion to eligible households, according to an inspector generals audit released on Tuesday.

The audit found 1.5 million taxpayers received the payments in error, and the IRS didnt send payments to 4.1 million eligible households. Still, the agency was 98% accurate in sending more than 175 million child tax credit payments, made as part of the governments response to the economic challenges of the coronavirus pandemic, the report by the Treasury Inspector General for Tax Administration said.

Continue reading your article witha WSJ membership

Read Also: How To File State Taxes Only