How To Submit A Paper Tax Return

The quickest way to submit a tax return is online, plus the deadline is longer as you have until 31 January to do it.

However, if you prefer to file a paper return, youll need to print out and fill in form SA100.

There is a guide on the gov.uk website on how to fill it out and supplementary pages which you may need for certain types of income. Dont forget to sign and date the form yourself. If you dont, it will be sent back to you.

HMRC must receive the completed tax return by midnight on 31 October, make sure you post it well before the final deadline.

If you live in the UK, send it to: Self Assessment, HM Revenue & Customs, BX9 1AS.

If you live outside the UK, send it to: HM Revenue & Customs, Benton Park View, Newcastle Upon Tyne, NE98 1ZZ, UK.

Find Out If Your State Is Sending Out A Stimulus Check Or Tax Rebate This Month

Residents of California have already started receiving up to $1,050 in inflation relief payments.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Earlier this month, California began mailing inflation relief checks of up to $1,050 to eligible taxpayers, and, by Halloween, an estimated 3.2 million Virginians should receive rebates of up to $500. They’re just two of the states issuing income tax refunds to help residents cope with a bumpy economy: Starting in early November, Massachusetts is returning nearly $3 billion in tax revenue, while South Carolina taxpayers will get refund checks of up to $800 later in the month.

Do you live in a state sending out a stimulus check? How much money could you get? Read on to find out.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US. Also, you have less than one month left to claim stimulus and child tax credit money.

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

You May Like: Why Does It Cost So Much To File Taxes

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

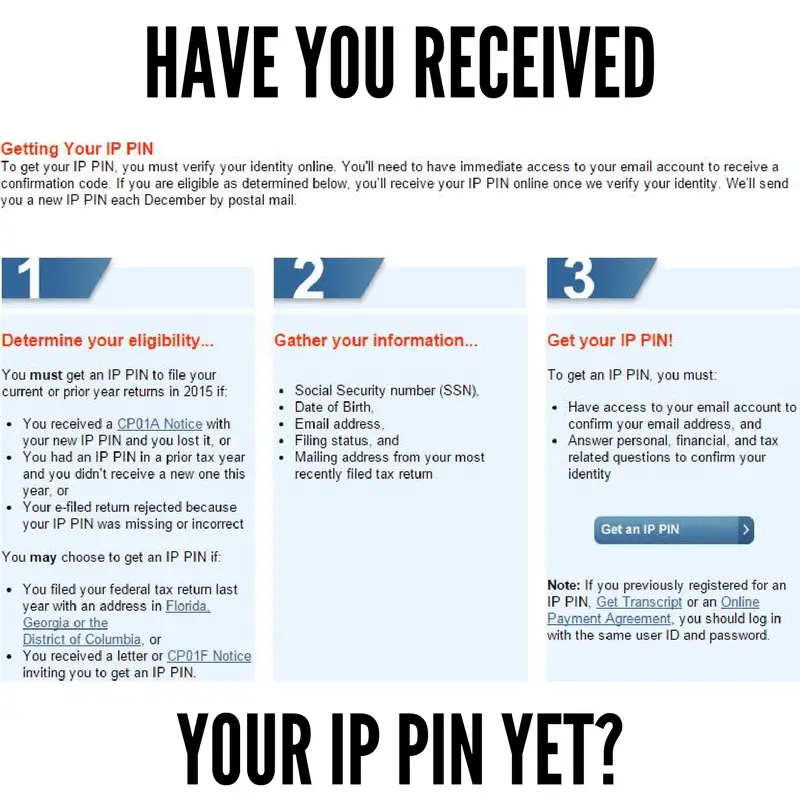

Electronic Filing Has Many Advantages Such As Speed Convenience And Security But There May Still Be Times When The Irs Requires You To Paper File A Tax Return

Another benefit of e-filing: You can get a tax refund sooner. The IRS says you can usually receive your refund within three weeks from the time they IRS receives your return if you have your refund directly deposited into your financial account. A paper return can take up to two months to process.

Whether you prefer the advantages of e-file or like the traditional route of filing a paper return, there are certain situations in which you may not have a choice. Lets look at five scenarios for when the IRS could require you to file a paper return.

Recommended Reading: Did They Extend The Tax Deadline

When Do I Need To Post My Tax Return By

You must submit your federal tax returns once a year. The deadline for this submission is known as tax day and it marks the end of the financial year.

The next Tax Day is in April 2023. Currently, Tax Day 2023 is scheduled for April 15th.

Typically, Tax Day is on April 15th, but if it falls on a Sunday or a holiday, it can be pushed back to April 18th.

When you are posting your tax returns, it is recommended that you put them in the mail at least two weeks before the deadline.

Federal Quarterly Estimated Tax Payments

Generally, the Internal Revenue Service requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply:

- you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and

- you expect federal withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your 2022 federal tax return, or

- 100% of the tax shown on your 2021 federal tax return .

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2022. Form 1040-ES includes an Estimated Tax Worksheet to help you calculate your federal estimated tax payments.

Also Check: How Much Do Cpas Charge For Taxes

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Keep Your Us Bank Account Open

You can choose to receive your tax refund either as a bank transfer, check or forward the amount to your 2021 return. However, every year countless nonresidents who file their tax documents from outside the US experience difficulties in accessing their tax refunds.

There are two common reasons for this.

- Firstly, the IRS does not transfer tax refunds into overseas bank accounts.

- Secondly, if you receive your refund as a check, you may find that banks in your home country will not cash them.

The solution?

You May Like: How To Find Tax Rate

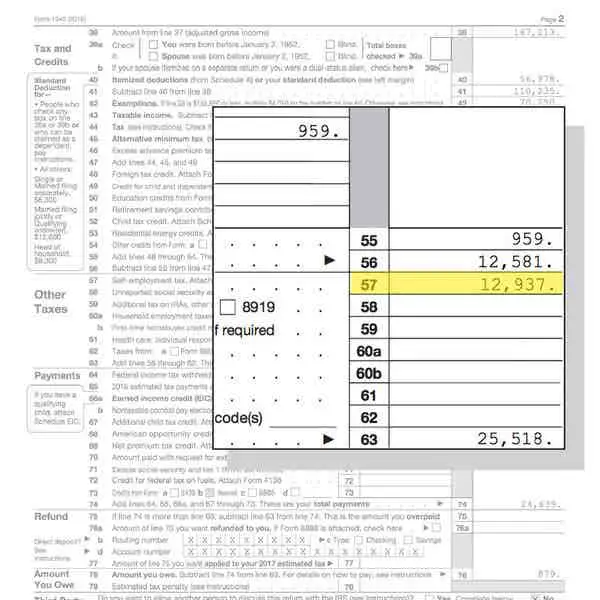

What Is An Irs 1040 Form

OVERVIEW

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return. IRS Form 1040 comes in a few variations. There have been a few recent changes to the federal form 1040. Well review the differences and show you how file 1040 form when it comes to tax time.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. Depending on the type of income you need to report, it may be necessary to attach additional forms, also known as schedules.

Heres a guide to all of the 1040 variations you may come across. to begin preparing your tax documents.

Will My Tax Return Data Be Kept Confidential

Yes. You’ve got no worries about data falling into the wrong hands or being misused because the IRS, the states and tax preparers are under the same rules of confidentiality for e-filed returns as they are for paper returns. They may not reveal or discuss any information contained in your return unless you authorize them to do so. Tax software developers also must operate under these rules, and they must protect customer confidentiality during the e-filing process. To ensure the integrity of your electronically filed tax return, always use only proven, high-quality e-filing software.

Don’t Miss: How Do Day Traders Pay Taxes

Mail As Early As Possible

Firstly, We recommend that you prepare and mail your tax documents as soon as possible. By preparing your tax documents today you can ensure that you receive your tax refund without delay.

As you will be mailing your documents to the IRS from outside America, delivery times may take longer than what you would expect if you were mailing from within the US. This is why its a good idea to file your documents as soon as possible to ensure they reach the tax office on time. Give yourself plenty of time to locate everything you will need in order to prepare your documents.

Choose The Right Income Tax Form

Your residency status largely determines which form you will need to file for your personal income tax return.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000.

If you lived in Maryland only part of the year, you must file Form 502.

If you are a nonresident, you must file Form 505 and Form 505NR.

If you are a nonresident and need to amend your return, you must file Form 505X.

If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents, you must file Form 515.

Special situations

If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan, using Form PV. Please refer to Payment Voucher Worksheet for estimated tax and extension payments instructions.

If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020. You should file Form PV only if you are making a payment with your extension request.

If you need to make certain changes to your original Maryland return that has already been filed and processed, you must file Form 502X for 2019 to amend your original tax return.

Recommended Reading: How Much Is California State Tax

Where To Mail Your Tax Return

If you are a U.S. citizen or resident from the United States, you lived in a foreign country during the Tax Year, you need to mail your return to the following address:

Department of the Treasury

Austin, TX 73301-0215

In case you are expecting a tax refund, you can request to have your refund directly deposited into a U.S. bank account or have the IRS send a check to the mailing address on your tax return.

If you are including an estimated tax payment with your mailed tax return, you should mail your estimated tax payments, along with Form 1040-ES, to the following address:

Internal Revenue Service

Charlotte, NC 28201-1303

Taxpayers with an Adjusted Gross Income within a specified tax period can electronically file their tax return for free using Free File. Taxpayers with an AGI greater than the specified threshold can either use the Free File Fillable Forms or e-file by purchasing commercial software. A limited number of companies provide software that can accommodate foreign addresses. Dont forget that all figures need to be provided in US dollars . Be aware of exchange rates between currencies.

Also Check: How Much Federal Income Tax Should Be Withheld

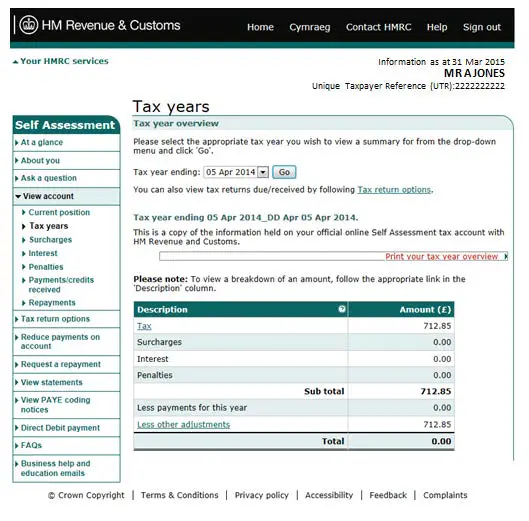

Who Must Send A Tax Return

About 12.2 million people submit a tax return each year, with the vast majority completing the process online rather than sending in a paper return. This year, 452,629 paper returns have been filed so far, according to HMRC.

Self-employed people, those with untaxed income , landlords with untaxed rental income, and parents who need to pay the high income child benefit charge are just some of the people who should file a tax return.

You dont usually need to send a return if your only income is from your wages or pension, or if youre newly self-employed but your earnings dont exceed £1,000.

The tax return that needs to be submitted currently relates to the 2021-22 tax year, which ran from 6 April 2021 to 5 April 2022.

If youre not sure whether you need to complete a tax return or not, use this free online self-assessment tool on gov.uk.

Read Also: How Do Taxes On Cryptocurrency Work

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What Is The Purpose Of A 1040 Form

Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income. One of the first steps is to calculate Adjusted Gross Income by first reporting your total income and then claiming any allowable adjustments, also known as above-the-line deductions. Your AGI is an important number since many credits and deduction limitations are affected by it.

On line 11 of the tax year 2021 Form 1040, you will report your AGI. You can reduce it further with either the standard deduction or the total of your itemized deductions reported on Schedule A. Itemized deductions include expenses such as:

If the total of your itemized deductions does not exceed the standard deduction for your filing status, then your taxable income will usually be lower if you claim the standard deduction. Beginning in 2018, exemption deductions are replaced with higher child tax credits and a new other-dependent tax credit.

TurboTax will do this calculation for you and recommend whether choosing the standard deduction or itemizing will give you the best results.

Read Also: Where Can I Get Oklahoma Tax Forms

Heres Where You Want To Send Your Forms If You Are Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000

- Florida, Louisiana, Mississippi, Texas: Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Internal Revenue Service, P.O. Box 802501, Cincinnati, OH 45280-2501

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7008

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7910

If youre filing a different 1040 income tax form, the IRSs website has a nifty breakdown of where each form has to go, most depending on whether or not a payment is enclosed.

This Is How Prepare Your Tax Return For Mailing

Your tax return is complete and ready to be mailed. Before sealing that envelope, take a few minutes to make certain that all information is complete and accurate. Avoid mistakes that may delay your refund or result in correspondence with the IRS. Here are just a few items to complete prior to mailing your tax return:

- Sign your return. Your federal tax return is not considered valid unless it is signed. If you are filing a joint return, your spouse must also sign.

- Provide a daytime active phone number. This may help speed the processing of your return if the IRS has questions about items on your return. If you are filing a joint return, you may provide daytime phone numbers for either you or your spouse.

- Assemble any schedules and forms behind your Form 1040/1040A in the order of the Attachment Sequence No. shown in the upper right-hand corner of the schedule or form. For supporting statements, arrange them in the same order as the schedules or forms they support and attach them last.

- If you owe tax, make your check or money order payable to the United States Treasury. Write your name, address, Social Security number, an active telephone number, and 2000 Form 1040 on your payment. Then complete Form 1040-V following the instructions on that form and enclose it in the envelope with your payment. Do not attach the payment to your return.

Recommended Reading: What Is The Mailing Address For Irs Tax Returns

Don’t Miss: How To File Taxes Without W2 Or Paystub

Where Do I Send My 1040ez Form

Whichever version of the 1040 form you use , your 1040 form has to be mailed to the IRS upon completion. However, the answer to this question depends on where you are located. You can check our list below to determine your appropriate IRS mailing address.

Whats your biggest 2022 HR challenge that youd like to resolve

Answer to see the results

Get Paper Unemployment Tax Forms

If you decide not to file electronically, you also have the option of filing your unemployment taxes using paper forms. You must use our original forms, and mail them back to us. We do not accept copies because our unemployment tax forms use unique ink that allows the information to be scanned into our computer system. Copy machines cannot reproduce the ink, so when someone submits a copy of the form, the information must be hand-keyed into the system.

If you file using a tax/wage form that is not an Agency original form, you may have to pay a penalty.

To request our paper forms:

Send an email to or call 855-TAX-WAGE

Read Also: Can I Get Tax Credit For Leasing Solar Panels