How To Claim And Track Your Child Tax Credit

Heres what you need to know about claiming your credit. Eligible filers can claim the CTC on Form 1040, line 12a, or on Form 1040NR, line 49. To help you determine exactly how much of the credit you qualify for, you can use the Child Tax Credit and Credit for Other Dependents Worksheet provided by the Internal Revenue Service. If you need to file a return for a year before 2018, you can only claim the credit on Forms 1040, 1040A or 1040NR.

Eligible recipients who did not receive the right amount or nothing at all should verify their information on the IRS Child Tax Credit Update Portal. For cases where the portal shows that payment has already been disbursed but not received, a trace or inquiry to locate funds can be filed by mailing or faxing Form 3911 to the agency.

There could be a payment delay depending on the disbursement method. The IRS says that it can trace payments:

- 5 days after the deposit date and the bank says it hasnt received the payment

- 4 weeks after the payment is in the mail by check to a standard address

- 6 weeks after the payment is in the mail, and you have a forwarding address on file with the local post office

- 9 weeks after the payment is in the mail, and you have a foreign address

The agency updates its frequently asked questions page with information about Child Tax Credit payments and posts notifications about delays.

Some Tax Credits Are Changing For 2022 With The Irs

Tax deductions for the year 2022 will look different than they did for 2021 as the American Rescue Plan brings an end to many of its programs.

If you use TurboTax, it will remind you of which credits are being reverted or ending entirely for your tax return with the IRS.

According to My Twin Tiers, there are various credits ending or changing from the 2021 tax season to the 2022 tax season.

Will I Keep Getting The Expanded Credit Amounts And The Advance Payments Next Year

The American Rescue Plan enacted these historic changes to the Child Tax Credit for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit for years and years to come. President Biden proposes that in his Build Back Better agenda.

Also Check: How Do I Find Last Years Tax Return

Do I Qualify For The Child Tax Credit

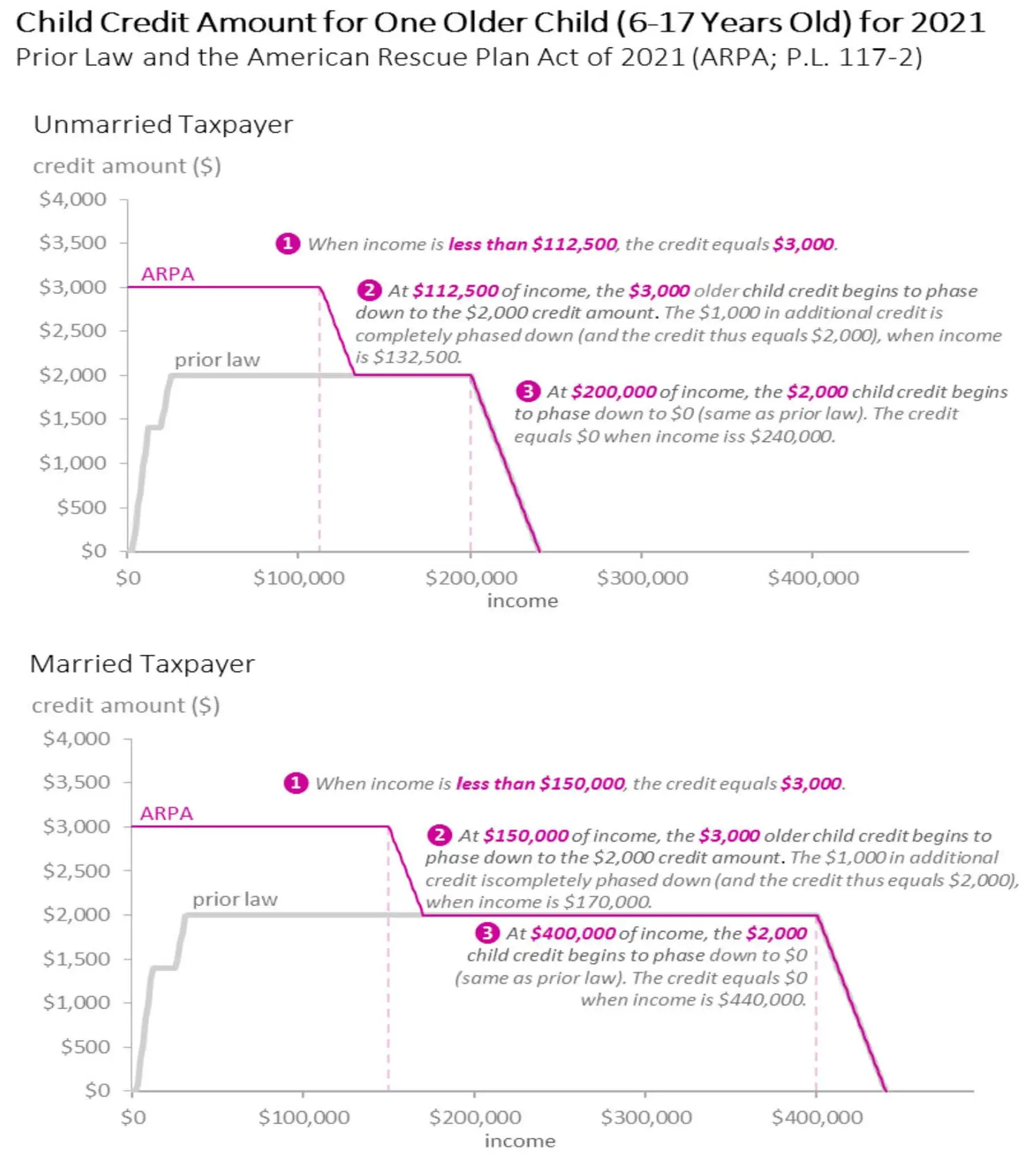

Nearly all families with kids qualify. Some income limitations apply. For example, only couples making less than $150,000 and single parents making less than $112,500 will qualify for the additional 2021 Child Tax Credit amounts. Families with high incomes may receive a smaller credit or may not qualify for any credit at all. For more detail on the phase-outs for higher income families, see How much will I receive in Child Tax Credit payments?

If you have any questions about your unique circumstances, visit irs.gov/childtaxcredit2021.

How Do I Trace A Missing Child Tax Credit

The IRS has a timeline for when you can even begin to track missing payments.

If youve been waiting since July 15 for a payment, you might be able to put a trace on it now.

You do have to wait a bit if youre anxious about an August payment, which just began rolling out by direct deposit on Aug. 13.

For example, the IRS says you cannot trace the money until youve waited:

- Five days since the deposit date and the bank says it hasnt received the payment.

- Four weeks since the payment was mailed by check to a standard address

- Six weeks since the payment was mailed, and you have a forwarding address on file with the local post office

- Nine weeks since the payment was mailed, and you have a foreign address

To start a payment trace, mail or fax a completed two-page Form 3911, Taxpayer Statement Regarding Refund.

Read Also: How To Find 2020 Tax Return

Recommended Reading: What Is The Tax Rate On Unemployment

Filed A Tax Return But Still Didn’t Receive Your Money Here’s What Else It Could Be

If you filed your taxes this year but still haven’t received your stimulus check or child tax credit money that you’re eligible for, there are some other things that could be holding it up.

- You don’t have a bank account set up.

- It was your first time filing.

- You have a mixed-status household.

- You haven’t updated your address with the IRS or USPS.

- You’re experiencing homelessness.

- You have limited or no internet access.

If none of these reasons apply to you, it may be time to file a payment trace with the IRS either by calling 800-919-9835 or mailing in Form 3911.

Child Tax Credit / Advance Child Tax Credit Payments 2021

Connecticuts New law enacted- May 2022:

Connecticut enacted a new Connecticut Child Tax Credit rebate for income eligible families for 2022. Families can apply starting on June 1, through July 31, 2022 to receive the rebate of up to $250 per child for a maximum of three children. Visit the Connecticut Department of Revenue Services at the website below for more details on the rebate and how to apply, if eligible.Applicants should visit portal.ct.gov/DRS and click the icon that says, 2022 CT Child Tax Rebate.

++++++++++

The following is primarily summarized from Publication 972: Child Tax Credit posted on the Internal Revenue Service website.

WHAT IS THE CHILD TAX CREDIT?The Child Tax Credit is a tax credit for single or married workers earning low or moderate incomes who have dependent children under age 17. Workers who qualify for the CTC and file a federal tax return can receive a credit of up to $2,000 per child. The amount of the credit will depend on the workers income. Workers whose earnings are too small to have paid taxes may also be eligible for the CTC.

WHO IS ELIGIBLE FOR THE CHILD TAX CREDIT?To be eligible for the CTC refund, a single or married worker must:

CLAIMING THE CHILD TAX CREDIT:

To claim the child tax credit, you must file Form 1040. You must provide the name and identification number on your tax return for each qualifying child.

TO FIND PROVIDERS IN CONNECTICUTS COMMUNITY RESOURCES DATABASE:

–

Don’t Miss: How Do Tax Returns Work

How The Child Tax Credit Works

The Child Tax Credit for the 2021 tax year differs from the credit allowed in 2020. The 2021 changes, mandated by the American Rescue Plan, are limited to just that single tax year. For 2022 taxes, the credit will revert to the rules in effect for 2020, with some inflation adjustments. Here’s a look at the credit rules and how they vary across years.

Irs: Families Now Receiving October Child Tax Credit Payments Still Time For Eligible Families To Sign Up For Advance Payments

IR-2021-201, October 15, 2021

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit payment for the month of October.

This fourth batch of advance monthly payments, totaling about $15 billion, is reaching about 36 million families today across the country. The majority of payments will be issued by direct deposit.

Under the American Rescue Plan, most eligible families received payments dated July 15, August 13 and September 15. Future payments are scheduled for November 15 and December 15. For these families, each payment is up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17. The vast majority will be issued by direct deposit.

Here are more details on those payments:

The IRS is currently sending letters to some Americans reminding them it is not too late for families who haven’t filed a 2020 income tax return including those who are not normally required to file because their incomes are too low to sign up for advance CTC payments. Most low-income families can get these monthly payments. The IRS urges families who normally aren’t required to file a tax return to visit IRS.gov for more information on how to file a return and receive their credit.

Read Also: When Do Taxes Need To Be Filed 2021

Receive Confirmation Of Your Completed Identity Verification Process

You will receive an email confirmation. You will be sent an email from the sender ID.me with the subject line You have completed your identity verification. The message will look like this:

The page will refresh and you will see this message.

You will be directed to the Child Tax Credit Update Portal. You can use this portal to check your eligibility for advance payments, get information about your monthly payment amounts, or to opt-out of advance payments.

Residents Of Puerto Rico

Because of the American Rescue Plan signed by President Biden in March 2021, bona fide residents of Puerto Rico are eligible to receive the same expanded Child Tax Credit as residents of the 50 States or the District of Columbia$3,600 per qualifying child under age 6 and $3,000 per qualifying child age 6 to 17. This change removed the previous requirement that a resident of Puerto Rico have at least three qualifying children to be eligible for the Child Tax Credit. Bona fide residents of Puerto Rico now need only one qualifying child to claim the Child Tax Credit.

Residents of Puerto Rico were not eligible to receive advance monthly payments of the Child Tax Credit in 2021. Instead, residents will be able to receive the full amount of Child Tax Credit they are eligible for by filing a 2021 U.S. federal income tax return during the 2022 tax filing season.

Read Also: How To Calculate Tax Bracket

How Do You Make Changes

The IRS has a Child Tax Credit Update Portal at IRS.gov. You can visit IRS.gov/childtaxcredit2021 for details.

Youd have until 11:59 p.m. Eastern Time Aug. 30 to make possible changes if you want those changes to be reflected in the next payment, which will be issued Sept. 15.

The advance payments, which currently apply to this year only, were scheduled for July 15, Aug. 13, Sept. 15, Oct. 15, Nov. 15 and Dec. 15.

As of mid-August, the IRS portal tool could help you figure out if youre enrolled to receive payments, put a stop to receiving any more advance monthly payments in 2021, and provide or update your bank account information for monthly payments.

In the near future, the IRS portal is expected to allow families to make changes to their address. Further down the road, the portal is expected to allow other changes, such as adding the birth or adoption of a child, making changes to your marital status and income and the ability to re-enroll for those monthly payments if you opted out.

ContactSusan Tompor via . Follow her on Twittertompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

Dont Miss: Penalty For Not Paying Taxes Quarterly

Estimate Payment Based On The Earned Income Credit

Example: The line 65 amount on Taxpayer A’s 2021 return is $300:

Taxpayer A would multiply $300 by 25% . If Taxpayer A is eligible, their earned income credit payment is $75.

Don’t Miss: What Happens If The Irs Rejects Your Tax Return

What Are Possible Reasons I Haven’t Gotten Any Child Tax Credit Payments

The 2021 advance monthly child tax credit payments started automatically in July. Even though child tax credit payments are scheduled to arrive on certain dates, you may not have gotten the money as expected for a few reasons. The IRS may not have an up-to-date mailing address or banking information for you. The mailed check may be held up by the US Postal Service or, if it was a recent payment, the direct deposit payment may still be being processed.

It’s also important to note that if you’ve been a victim of tax-related identity theft, you won’t receive child tax credit payments until those issues have been resolved with the IRS. If the issues aren’t cleared up this year, you’ll get the full amount when you file taxes in 2022. And keep in mind that even if you have unpaid state or federal debt, you should still receive child tax credit money if you’re eligible.

In September, roughly 700,000 families did not receive a payment due to an IRS technical error. Problems with missing payments were also reported in previous months among “mixed-status” families, where one parent is a US citizen and the other is an immigrant, though that issue should have been corrected for later payments.

How Will The Child Tax Credit Give Me More Help This Year

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families.

- It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6.

- For each child ages 6 to 16, its increased from $2,000 to $3,000.

- It also now makes 17-year-olds eligible for the $3,000 credit.

- Previously, low-income families did not get the same amount or any of the Child Tax Credit. Under the American Rescue Plan, all families in need will get the full amount.

- To get money to families sooner, the IRS began sending monthly payments this year, starting in July.

- It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

- Youll get the remainder of the credit when you file your taxes next year.

Don’t Miss: Who Can File Ez Tax Form

How Much Child Tax Credit Will I Get

If you meet the guidelines for child tax credit eligibility, you may qualify for the following:

- $3,600 for children ages 5 and under

- $3,000 for children ages 6 through 17

Your total advance Child Tax Credit payment amounts will equal half of the amount of your estimated 2021 Child Tax Credit. This amount is then divided into monthly advance payments to you. Your advance will be divided up into six monthly payments for July through December. So, if you were to get $7,200 in total child tax credits for two children in 2021, you’d get half of that in monthly payments of $600 per payment. The rest of the credit can be claimed on your taxes when you file your 2021 taxes in the spring of 2022.

When Is The Deadline For Claiming Stimulus Or Child Tax Credit Money

The deadline for claiming your money depends on if you’re required to file a tax return or not. You’re generally not required if you file single and earn less than $12,550 per year.

You have until Tuesday, Nov. 15, to complete a simplified tax return to claim your missing stimulus or child tax credit money if you’re not typically required to file taxes. That’s roughly one month away. To help, the IRS is keeping the free file site open until .

If you filed a tax extension earlier this year or haven’t filed yet, your deadline to submit your tax return if you’re required to file was . That was also the last day to file Form 1040 to avoid a late-filing penalty.

If you were affected by one of the recent natural disasters, such as Hurricane Ian, you have until Feb. 15, 2023, to file. If you live in an area covered by Federal Emergency Management Agency disaster declarations, like Kentucky or Missouri, you have until to file.

You could soon miss out on your stimulus and child tax credit money.

Read Also: What To Claim On Taxes

Which Dependents Are Eligible For The Child Tax Credit

Eligibility for the CTC hinges on a few factors. The child you claim as your dependent has to meet seven pieces of criteria from the IRS:

How To Determine Whether A Child Qualifies

Most children under the age of 18 are qualifying children for the 2021 Child Tax Credit. This means that a parent or guardian is eligible to claim them for purposes of the Child Tax Credit.

For your children to qualify you for a Child Tax Credit, they must:

The IRS has provided detailed information on other, less common factors that may impact whether a child is a qualifying child for the Child Tax Credit.

Don’t Miss: How Do I Report Tax Evasion