Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the;Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measure to prevent fraudulent returns and this has increased processing times.

How To Check On Your State Tax Refund

Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID.; One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income, but do tax some income from dividends and investments.

Wheres My State Tax Refund Maryland

Visit the Comptrollers website to check the status of your Maryland tax refund. All you need to do is enter your SSN and your refund amount. Joint filers can check their status by using the first SSN on their return.

According to the state, it usually processes e-filed returns the same day that it receives them. That means you can expect your refund to arrive not too long after you file your taxes. On the other hand, paper returns typically take 30 days to process. For security reasons, it is not possible to verify any of your tax return information over the phone.

Recommended Reading: What Taxes Do You Pay In Texas

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Will The Irs Send Out Unemployment Tax Refunds This Fall Here’s What We Know

Millions of taxpayers remain in limbo without any updates or a timeline on refunds for 2020 unemployment benefits.

The IRS has sent 8.7 million unemployment compensation refunds so far.

Over summer, the IRS started making adjustments on 2020 tax returns and issuing refunds averaging around $1,600 to those who can claim a $10,200 unemployment tax break. The tax agency said adjustments would be made throughout the summer, but the last batch of refunds, which;went out to some 1.5 million taxpayers, was two months ago. No rounds of payments seem to have gone out in September, and now it’s fall.;

Here’s a recap of what those refunds are about. Since the;first $10,200 of 2020 jobless benefits; was made nontaxable income by the American Rescue Plan in March, taxpayers who filed their returns before the legislation and paid taxes on those benefits were due money back. And though;some have reported;online that their tax transcripts show pending deposit dates, others haven’t received any clues at all. Some are wondering how to get a live agent to ask with questions or if they should file an amended return. The IRS’;massive backlog of unprocessed returns;doesn’t help the matter.;

Recommended Reading: How Can I Pay Tax Online

When Will I Get My Tax Refund

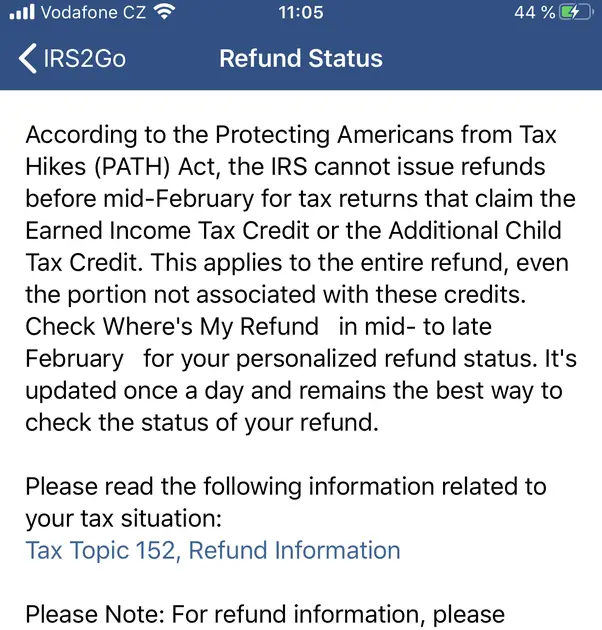

The Wheres My Refund?;tool lets you check the status of your refund through the IRS website or the IRS2Go mobile app. If you submit your tax return electronically, you can check the status of your refund within 24 hours. But;if you mail your tax return, youll need to wait at least four weeks before you can receive any information about your tax refund. Keep in mind that usually you can file your taxes in January.

In order to find out the status of your tax refund, youll need to provide your Social Security number , filing status and the exact dollar amount of your expected refund. If you accidentally enter the wrong SSN, it could trigger an IRS Error Code 9001. That may require further identity verification and delay your tax refund.

Most taxpayers receive their refunds within 21 days.;If you choose to have your refund deposited directly into your account, you may have to wait five days before you can gain access to it. If you request a refund check, you might have to wait a few weeks for it to arrive. The table below will give you an idea of how long youll wait, from the time you file, until you get your refund.

| Federal Tax Refund Schedule | |||

| Paper File, Check in Mail | |||

| Time from the day you file until you receive your refund | 1-3 weeks | 1 month | 2 months |

Note that these are just guidelines. Based on how you file, most filers can generally expect to receive a refund within these time frames.

| 2021 IRS Refund Schedule |

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Includes errors such as an incorrect Recovery Rebate Credit amount

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.;

- Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

- Needs further review in general

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return.

Don’t Miss: How Long Can You Wait To File Taxes

Income Tax Refund Information

You can check the status of your current year refund online, or by calling the automated line at 260-7701 or 1-800-218-8160. Be sure you have a copy of your return on hand to verify information. You can also e-mail us at to check on your refund. Remember to include your name, Social Security number and refund amount in your e-mail request.

If you’re expecting a tax refund and want it quickly, file electronically – instead of using a paper return.

If you choose direct deposit, we will transfer your refund to your bank account within a few days from the date your return is accepted and processed.

Electronic filers

We usually process electronically filed tax returns the same day that the return is transmitted to us.

If you filed electronically through a professional tax preparer and haven’t received your refund check our online system. If not there, call your preparer to make sure that your return was transmitted to us and on what date. If sufficient time has passed from that date, call our Refund line.

Paper filers

Paper returns take approximately 30 days to process. Keep in mind that acknowledgment of the receipt of your return takes place when your return has processed and appears in our computer system.

Typically, a refund can also be delayed when the return contains:

- Math errors.

- Missing entries in the required sections.

- An amount claimed for estimated taxes paid that doesn’t correspond with the amount we have on file.

Check cashing services

Splitting your Direct Deposit

District Of Columbia Refund Status Information

You can track whether you are in the process of your District of Columbia return on income taxes on the District of Columbia Department of Taxation and Revenue website.

Youll require to be aware.

The principal Social Security Number

Your exact sum of the refund

Check whether you are in the process of completing the status of District of Columbia income tax refund:

D.C. Income Tax Refund Status

On average, the District of Columbia Office of Tax and Revenue provides refunds in 6 weeks. Taxpayers can check their refund status online by going to OTRs portal online, MyTax.DC.gov.

On MyTax.DC.gov, The refund status is only available for returns filed in the past six months. If you require an additional information or have questions, taxpayers are advised to contact the OTRs e-Services Unit at 759-1946.

Recommended Reading: What Is The Federal Inheritance Tax

Wheres My State Tax Refund Oklahoma

In order to check the status of your state tax refund, visit;Oklahoma Tax Commission page and click on the Check on a Refund link. From there you can get to the Oklahoma Taxpayer Access Point. You will need to log in with the last seven digits of your SSN or ITIN, the amount of your refund and your;zip code.

If you e-filed, you can generally start to see a status four days after the;Oklahoma Tax Commission receives your return. Paper filings will take longer an you should wait about three weeks before you start checking the status of a refund. Once a refund has been processed, allow five business days for your bank to receive the refund. If you elect to get a debit card refund, allow five to seven business days for delivery.

Wheres My State Tax Refund New York

You can use this link to check the status of your New York tax refund. You will need;to enter the exact amount of your refund in whole dollars in order to log in. This amount can be found on the state tax return that you filed.

Dont forget that if you paid any local income taxes for living in New York City or Yonkers, those taxes are included in your state return.

Recommended Reading: Where Can I Get 1040 Tax Forms

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

Also Check: Is Past Year Tax Legit

Identity Verification & Validation Key

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. Fraud detection, along with verification that claims made on an individual income tax return are valid and the documentation is submitted with the returns, are part of the process of ensuring the return is correct and complete and that taxpayers receive the refund amount to which they are entitled. Please be aware that these measures, meant to ensure state tax dollars are going to the right person, could delay individual income tax refunds up to 60 days beyond the time frames of prior years.

To verify your identity, the Department may request the following:;

- Validation Key: the Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Visit the Identity Verification web page for more information.;

- Copy of Driver License or ID

- Copy of a document containing your name and address

- Copy of W-2 and/or 1099 claiming Colorado tax withholding

- Refund Amount

What Could Cause Delays On Your District Of Columbia Refund

If the department has to confirm the information provided on your return or ask for more information, the process may take longer.

Incorrect math in your tax return or any other adjustments.

You may have used more than one type of form to submit your returns.

The information you provided on your return was not included or was incomplete.

The protection against identity theft and tax refund fraud can cause extended processing times for individual tax returns and refunds. The processing time for certain tax returns may be extended at least 25 days.

Also Check: How To Get Money Back From Taxes

What Information Is Available

You can start checking on the status of your refund within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Wheres My Refund? will give you a personalized refund date after we process your return and approve your refund.

The tracker displays progress through three stages:

To use Wheres My Refund, you need to provide your Social Security number, filing status and the exact whole dollar amount of your refund.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit amount. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

Recommended Reading: How To Report Tax Evasion

How Long State Tax Refunds Take

Since refund schedules for most state tax refunds arent released by state departments of revenue, we cannot give an exact time frame. But it usually takes less time compared to federal tax refunds. While the IRS issues tax refunds in about three to four weeks, state tax income tax returns are processed much faster, therefore, tax refunds are issued at a sooner date.

If you file federal and state income tax returns at the same time, dont be surprised if your federal tax refund arrives much later.

All and all though, it comes down to how you filed your tax returns. Those who file electronically get their tax refunds whether it be state or federal much sooner than the ones who filed by mail. More information on that can be found on our front page.

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.;

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Don’t Miss: Does California Have An Inheritance Tax

What Does A ‘math Error’ Notice From The Irs Mean

Millions of Americans have received confusing “math-error notices” from the IRS this year — letters saying they owe more taxes. Once they get the notice, they have a 60-day window to respond before it goes to the agency’s collection unit.;

From the start of the year to August, the IRS sent more than 11 million of these notices. According to the Taxpayer Advocate Service, “Many math error notices are vague and do not adequately explain the urgency the situation demands.” Additionally, sometimes the notices “don’t even specify the exact error that was corrected, but rather provide a series of possible errors that may have been addressed by the IRS.”;

The majority of the errors this year are related to stimulus payments, according to the Wall Street Journal. They could also be related to a tax adjustment for a variety of issues detected by the IRS during processing. They can result in tax due, or a change in the amount of the refund — either more or less. If you disagree with the amount, you can try contacting the IRS to review your account with a representative.