I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.

Common Reasons That May Cause Delays

- We found a math error on your return or have to make another adjustment. If our adjustment causes a change to your refund amount, you will receive a notice.

- You used more than one form type to complete your return. The form type is identified in the top left corner of your return. We will return your State tax return for you to complete using the correct form type before we can process your return. View example of form types.

- Your return was missing information or incomplete. Sometimes returns are missing information such as signatures, ID numbers, bank account information, W-2s, or 1099s. We will contact you to request this information so we can process your return. Please respond quickly so we can continue processing your return.

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund.

Wheres My State Tax Refund Minnesota

Through the Wheres My Refund? System, you can check the status of your Minnesota tax refund. You will need to enter your SSN, your date of birth, your return type , the tax year and the refund amount shown on your return. Its important to be aware that if your tax return does not have your date of birth on it, you cannot check its status.

The refund system is updated overnight, Monday through Friday. If you call, the representatives will have the same information that is available to you in this system.

Read Also: How To Report Nonemployee Compensation On Tax Return

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return. We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.

Tax refund offsets – applying all or part of your refund toward eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim, and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to, you’ll need call the agency that made the claim.

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to a form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

Recommended Reading: What Is Income Tax In New York

Wheres My State Tax Refund North Dakota

North Dakotas Income Tax Refund Status page is the place to go to check on your tax refund. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. The refund status page also has information on how the state handles refunds.

The state advises not to call unless you check your refund status and it says to call.

Richmond Hill Georgia Sales Tax Rate

richmond hill Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Richmond Hill, Georgia?

The minimum combined 2022 sales tax rate for Richmond Hill, Georgia is . This is the total of state, county and city sales tax rates. The Georgia sales tax rate is currently %. The County sales tax rate is %. The Richmond Hill sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Georgia?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Georgia, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Richmond Hill?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Richmond Hill. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Read Also: How To Get Out Of Paying Back Taxes

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

Due to the late approval of the state budget, which included multiple tax law changes, the Department has experienced delays processing returns. If you filed your return electronically and received an acknowledgment, your return has been received but may not have started processing. Follow the guidance below based on your filing method:

Filed Electronically:

If its been more than six weeks since you received an acknowledgment email, please call 1-877-252-3052.

Filed Paper:

If its been more than 12 weeks since you mailed your original return, you can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “Duplicate” should be written at the top of the return that you are mailing. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

Claiming A Vermont Refund

To claim a refund of Vermont withholding or estimated tax payments, you must file a Form IN-111, Vermont Income Tax Return. You have up to three years from the due date of the return, including extensions, to file a claim for overpayment of tax due.

If the information on your return does not match the information available to the Department, your refund may be delayed. The Department may be waiting for information from your employer or the IRS for data verification. If we need additional information from you before issuing your refund, we will contact you in writing with instructions on how to respond either online through myVTax or in writing.

For tips on how to avoid the filing errors which commonly delay refunds, see Where’s My Vermont Income Tax Refund?

If you have an unclaimed refund from other tax years, find out how to claim it.

If you chose direct deposit for your refund, you may see your refund a few days after your status has been updated to Weve released your refund. Your financial institution may have additional processing times. If you chose to receive your refund by check, then it may take a few weeks to receive your refund by mail.

Also Check: How To Calculate Tax Return

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Wheres My State Tax Refund Maryland

Visit the Comptrollers website to check the status of your Maryland tax refund. All you need to do is enter your SSN and your refund amount. Joint filers can check their status by using the first SSN on their return.

According to the state, it usually processes e-filed returns the same day that it receives them. That means you can expect your refund to arrive not too long after you file your taxes. On the other hand, paper returns typically take 30 days to process. For security reasons, it is not possible to verify any of your tax return information over the phone.

Also Check: Which Tax Software Gives The Most Refund

Wheres My State Tax Refund Montana

Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page. From there you will need to enter your SSN and the amount of your refund.

The processing time for your tax return and refund will depend on when you file. The Montana Department of Revenue says that if you file your return in January, it may process your refund within a week. However, you may wait up to eight weeks if you file in April, which is generally when states receive the majority of returns.

Wheres My State Tax Refund Idaho

Learn more about your tax return by visiting the Idaho State Tax Commissions Refund Info page. From there you can click on Wheres My Refund? to enter your information and see the status of your refund.

Taxpayers who e-file can expect their refunds in about seven to eight weeks after they receive a confirmation for filing their states return. Those who file a paper return can expect refunds to take 10 to 11 weeks.

If you receive a notice saying that more information is necessary to process your return, you will need to send the information before you can get a refund. Once the state receives that additional information, you can expect it to take six weeks to finish processing your refund.

Don’t Miss: How To File An Extension Online For Taxes

I Still Dont Have My Refund What Should I Do Next

If you have waited the maximum number of weeks it should take to process a refund, we encourage you to check the status of your return or refund online one more time before contacting the Department.

Please note that our tax examiners do not have information about the status of your refund beyond what is available to you from our website. Although the Department is always available to answer your questions and concerns, calling us will not speed up the process. If you would still like to contact the Department, you may reach us at:

Phone: 828-2865 or .

Our staff is working hard to process your return. Our precautions may increase processing time, and we would like to ask for your patience as we strive to provide the protection you have come to expect and deserve.

We appreciate your patience and welcome your feedback to help us continue to improve our services.

If I Owe The Irs Or A State Agency Will I Receive My Nc Refund

In some cases debts owed to certain State, local, and county agencies will be collected from an individual income tax refund. If the agency files a claim with the Department for a debt of at least $50.00 and the refund is at least $50.00, the debt will be set off and paid from the refund. The Department will notify the debtor of the set-off and will refund any balance which may be due. The agency receiving the amount set-off will also notify the debtor and give the debtor an opportunity to contest the debt. If an individual has an outstanding federal income tax liability of at least $50.00, the Internal Revenue Service may claim the individual’s North Carolina income tax refund. For more information, see G.S. §105-241.7 and Chapter 105A of the North Carolina General Statutes.

Don’t Miss: When Is The Last Day To Pay Taxes 2021

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Wheres My State Tax Refund California

Track your state tax refund by visiting the Wheres My Refund? page of the California Franchise Tax Board. You will need to enter the exact amount of your refund in order to check its status.

According to the state, refunds generally take up to two weeks to process if you e-file. If you file a paper return, your refund could take up to four weeks. Businesses can expect processing times of up to five months.

Contact the Franchise Tax Board if you have not heard anything within one month of filing an electronic return . Businesses should reach out if they havent heard anything within six months of filing.

Amended returns for both individuals and businesses can take up to four months for processing.

Recommended Reading: How To Find Tax Sale Properties

Property Tax Billing Notices

Tax billing notices are mailed to property addresses unless otherwise advised. If you would like these notices mailed to a different address, please complete and submit a Mailing Address Change Form. This will only change your mailing address with the City of Barrie. You must also provide mailing address changes to MPAC.

Property taxes are billed by the City of Barrie twice per year: the interim bill and the final bill, with two payment installments due for each billing. If Tax Arrears appears on your tax bill it means that at the time of billing there will be an outstanding balance on the account. All payments must be received by the City by the due date* to avoid late payment charges of 1.25% per month .

Property taxes are calculated based on the assessment value of your property, which is determined by the Municipal Property Assessment Corporation . If you have any concerns about your assessed value or classification, please refer to aboutmyproperty.ca.

Wheres My State Tax Refund Wisconsin

Wisconsins Department of Revenue has an online tool, called Refund 123, that allows you to see the status of your tax refund. To use the tool, enter your SSN, the tax year and the amount of your return in whole dollars.

Refunds for taxpayers who filed electronically are typically issued within three weeks. Paper returns will take longer to process. The states fraud and error safeguards may also delay the processing of your return for up to 12 weeks.

Read Also: How Much Do I Owe In Property Taxes

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

How To Check On Your State Tax Refund

Any state tax refund you have coming can come at a variety of times, depending on what state you filed in. Most of the time, state returns are processed faster than federal returns. Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID. One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

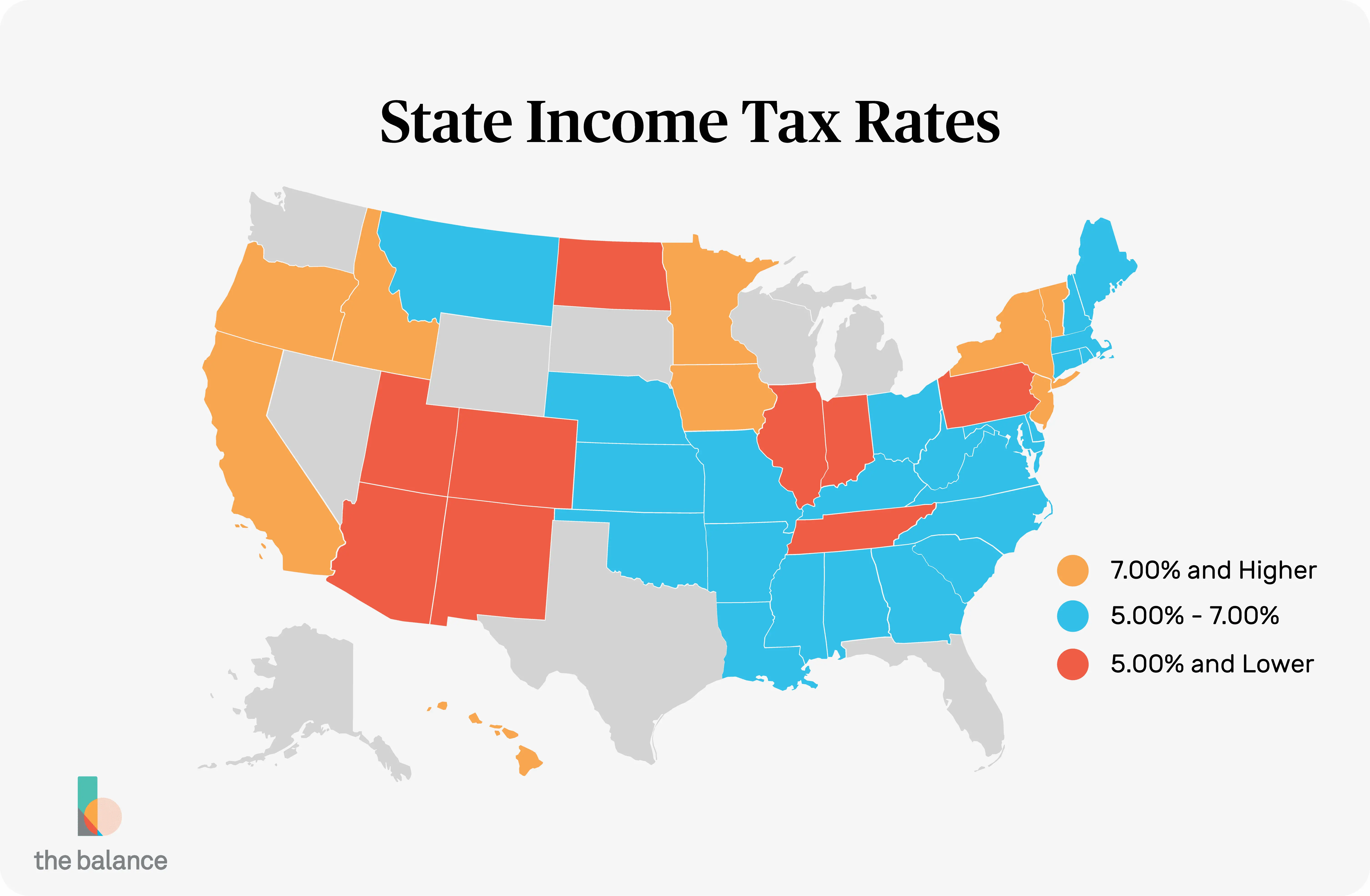

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income. Tennessee has phased out tax on income from dividends and investments and New Hampshire has proposed legislation to do the same.

Read Also: How To File Lyft Taxes Without 1099