How To Lower Your Property Taxes

If you are interested in lowering your property taxes, know that you are not the only one! Many Americans wish for lower property tax rates to help ease the costs associated with homeownership. Not surprisingly, there are a few ways you can achieve this goal. The following options exist to help lower your property taxes:

-

Check Eligibility For Property Tax Exemption

-

File For A Homestead Exemption

-

Raise Concerns With The Tax Assessor

What Are Property Taxes Used For

Now you may be thinking, if Im going to pay a lot of taxes as a property owner, I want to know where my tax dollars are going. Local governments predominantly use property tax dollars to fund public services. Although taxes can be expensive, you may find some reassurance knowing that your tax dollars are typically used to improve your local neighborhood, schools, parks, infrastructure, and amenities. These can help improve the attractiveness of your zip code, and thus help you bring in higher-paying tenants over time and improve your property value.

Here are some examples of where your property tax payments might go:

-

Building or improving public schools

-

Maintaining city parks and other green spaces

-

Help pay for museums, libraries, and other public amenities

-

Road construction and repair

-

Salaries and operational costs of emergency services

-

Local government services, administration, and infrastructure

Tax Rates Imposed In The Most Recent Year

Minimum Tax Rate. States with lower minimum rates score better. The minimum rates in effect in the most recent year range from zero percent to 2.10 percent .

Maximum Tax Rate. States with lower maximum rates score better. The maximum rates in effect in the most recent year range from 5.4 percent to 20.93 percent .

Taxable Wage Base. California, Florida, and Tennessee receive the best scores in this variable with a taxable wage base of $7,000in line with the federal taxable wage base. The state with the highest taxable bases and, thus, the worst score on this variable, is Washington .

Don’t Miss: How To Find Your Tax Return

Cigarette Tax Rates By Jurisdiction

The following table lists American state and territory tax rates :

| Excise tax per pack | State or territory |

|---|---|

| U.S. Virgin Islands |

The above table does not include the federal excise tax on cigarettes of $1.01 per pack, cigarette taxes levied by individual municipalities , or sales taxes levied in addition to the retail price and excise taxes.

What Is Property Tax

Property tax is a tax paid on property owned by an individual or other legal entity, such as a corporation. Most commonly, property tax is a real estate ad-valorem tax, which can be considered a regressive tax. It is calculated by a local government where the property is located and paid by the owner of the property. The tax is usually based on the value of the owned property, including land. However, many jurisdictions also tax tangible personal property, such as cars and boats.

The local governing body will use the assessed taxes to fund water and sewer improvements, and provide law enforcement, fire protection, education, road and highway construction, libraries, and other services that benefit the community. Deeds of reconveyance do not interact with property taxes.

Don’t Miss: Do You Have To Claim Social Security On Taxes

Texas Has No State Income Tax At All

In Texas, no state income tax really does mean no state income tax. Its not like New Hampshire where you pay tax on interest and dividends even though theres no tax on your earned income.

There are no income tax rates of any kind in Texas. You will probably have to pay sales taxes and property taxes, though.

States With The Lowest Overall Tax Burden

Low tax rates

getty

Depending on your income in 2021, you may be feeling the pain of paying your taxes. Perhaps, you hurt when you look at your paychecks and see all the state and federal taxes being withheld. Some of you may feel a bit more pain based on the state where you live, how you earn your income, and whether you own a home. The overall tax burden can vary widely from state to state.

While seven states boast of not having an income tax, this doesn’t mean you get to live tax-free. Those states have to fund their budgets somehow. If you were wondering, the seven states without an income tax are Nevada, Washington, South Dakota, Texas, Florida, Wyoming, and Alaska. Keep reading to find the five states with the lowest overall tax burden for their residents.

Income taxes are just one part of the overall tax burden of living in a state. Your tax burden at the state level can vary widely depending on your financial circumstances. Your tax burden is the proportion of your total personal income required to cover your state and local taxes. The most common types of state and local taxes are personal income taxes, sales taxes, and of course, property taxes.

State tax burdens aren’t uniform across the country. For example, while Nevada and Washington have no state income tax, they have the second and third highest sales and excise taxes and rank No. 33 and 30, respectively, for overall tax burden.

Corbis via Getty Images

4. Wyoming

Getty Images

3. Delaware

Getty Images

Recommended Reading: How Much Tax Return Do You Get

In Most States State And Local Tax Systems Worsen Inequality

Forty-five states have regressive tax systems that exacerbate income inequality. When tax systems rely on the lowest-income earners to pay the greatest proportion of their income in state and local taxes, gaps between the most affluent and the rest of us continue to grow.

The ITEP Tax Inequality Index measures the effects of each states tax system on income inequality by assessing the comparative impact a states tax system has on the post-tax incomes of taxpayers at different income levels. Essentially, it answers the following question: Are incomes more equal, or less equal, after state taxes than before taxes?

For example, consider this scenario: if taxpayers in the top 1 percent are left with a higher percentage of their pre-tax income to spend on their day-to-day living and to save for the future than low- and middle-income taxpayers, the tax system is regressive and receives a negative tax inequality index score. This indicates that the income inequality that existed before the levying of state and local taxes has been made worse by those taxes. On the other hand, states with slightly progressive tax structures have positive tax inequality indexes. This means that after taking state and local taxes into account incomes are no less equal than they were before taxes and tax systems in those states, at the very least, did not worsen income inequality.

FIGURE 2

NOTE: See Appendix B for detailed ITEP Tax Inequality Index and Methodology for more information.

FIGURE 3

What States Dont Have Property Taxes

A common question for new real estate investors is Are there states without property taxes? While every state has a minimum property tax, the reliance on these taxes for local projects and plans can be what drives investor interest. Property taxes are just one tax type in a combination of other state taxes, such as income tax or sales taxes. Some investors might purchase real estate in a part of the country with low-income taxes to minimize their taxpayer obligation overall

Property taxes are essential they are used to fund government services critical for the public good and welfare. Therefore, every state assesses property taxes in one shape or form. However, the good news is that some states have a much lower property tax rate than others, and investors can strategically explore property options with attractive property tax rates.

Read Also: What Is The Minimum Amount Of Income To File Taxes

Low Taxes Or Just Regressive Taxes

This report identifies the most regressive state and local tax systems and the policy choices that drive that unfairness. Many of the most upside-down tax systems have another trait in common: they are frequently hailed as low-tax states, often with an emphasis on their lack of an income tax. But this raises the question: low tax for whom?

No-income-tax states like Washington, Texas, and Florida do, in fact, have average to low taxes overall. However, they are far from low-tax for poor families. In fact, these states disproportionate reliance on sales and excise taxes make their taxes among the highest in the entire nation on low-income families.

FIGURE 10

Figure 10 shows the 10 states that tax poor families the most. Washington State, which does not have an income tax, is the highest-tax state in the country for poor people. In fact, when all state and local taxes are tallied, Washingtons poor families pay 17.8 percent of their income in state and local taxes. Compare that to neighboring Idaho and Oregon, where the poor pay 9.2 percent and 10.1 percent, respectively, of their incomes in state and local taxes far less than in Washington.

How Does Your State Rank

As weve already mentioned, Alaskas combined tax rate is the countrys lowest at just 1.23%. Well break down each area in subsequent sections, but Alaska has no state income tax and no statewide sales tax, though some counties in the state do charge sales taxes. The states gas tax rate is the lowest in the country, and its property tax rate is near the middle of the pack.

On the flip side, Californias combined rate of 8.61% is the nations highest, putting the Golden State more than a percentage point ahead of Minnesota. California has the highest median income tax rate, the 10th-highest state sales tax rate and the fifth-highest gas tax rate.

Heres a look at how every state performed in our full ranking:

Among the states with the lowest combined tax rates, half are in the West, and Florida is the only Southern state among those with the 10 lowest overall rates. Two of the three most populous states have among the five highest rates in the nation.

North Carolina and South Carolina have almost identical rates , and four states have both one of the 10 highest tax rates and 10 highest rates of poverty, though, notably, the District of Columbia is the only one of the bunch with a very high income tax rate. That could indicate that the burden of state-level taxes in some places is being borne by people who can little afford it.

You May Like: When Do Llc File Taxes

Alaska Wyoming Montana And Delaware Have Lowest Effective Tax Rates

Alaskans of all income levels enjoy the lowest effective tax rates in the nation. The effective tax rate in Alaska for low income individuals is 5,4%, the rate for middle-income individuals is 4.5% and that of high income individuals is a mere 3.83%. Wyoming came in second place nationwide, with a 7.68% effective tax rate for low income people, a 6.65% rate for mid-income and a 3.98% rate for wealthier families. Delaware also offers low effective tax rates across the board at only 5.43% low-income folks, 5.7% for middle-income people and 6.14% for high-income individuals. Montana also has relatively low effective tax rates, at 6.10% for low income people, 6.59% for middle-income and 6.42% for high-income families.

FTX, one of the largest crypto exchanges in the world, teeters on the edge of collapse as executives try to engineer a bailout. However, there is much more to the world of digital currencies than just currency. Blockchain technology presents a multitude of possibilities within asset management, including tokenization. Blockchain experts say its only a Read More

States With No State Sales Tax

What is a sales tax? The U.S. Department of the Treasury defines a sales tax as a tax levied on the sale of goods and services. The three different types of sales tax include the vendor tax, the consumer tax and the combination vendor-consumer tax. Only five U.S. states do not have a sales tax. These five states are:

Although Alaska doesnt have a statewide sales tax, the state does allow localities to impose a local sales tax on residents. While most states do charge a statewide sales tax, not all of these tax rates are particularly high. According to data from The Tax Foundation, states with low state sales tax rates include Colorado , Georgia , Hawaii , Louisiana , Missouri , Alabama , Wyoming , New York , North Carolina , Oklahoma and South Dakota .

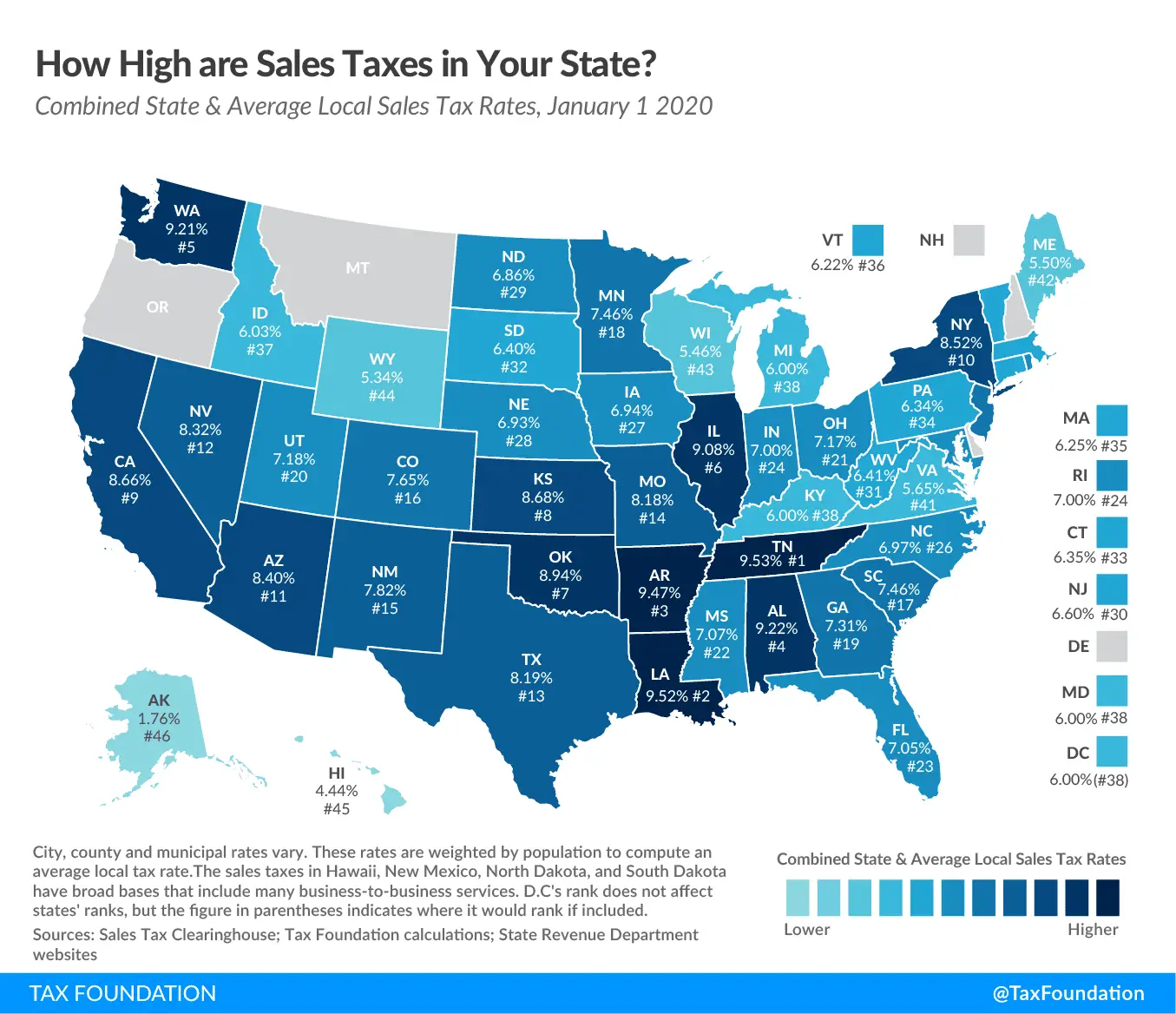

Of course, when considering sales tax, its important to keep in mind local sales tax rates as well. Combined with the state sales tax, these rates can quickly add up. According to data from The Tax Foundation, the five states with the highest average combined state and local sales tax rates are Tennessee and Arkansas , Louisiana , Washington , and Alabama . States with the lowest average combined rates are Alaska , Hawaii , Wyoming , Wisconsin , and Maine .

Recommended Reading: What Home Improvement Expenses Are Tax Deductible

Read Also: How To Figure Out 1099 Taxes

Calculating Costs And Benefits

The LIHTC is estimated to cost around $9.5 billion per year. It is by far the largest federal program encouraging the creation of affordable rental housing for low-income households. Supporters see it as an effective program that has substantially increased the affordable housing stock for more than 30 years. LIHTC addresses a major market failurethe lack of quality affordable housing in low-income communities. Efficiencies arise from harnessing private-sector business incentives to develop, manage, and maintain affordable housing for lower-income tenants.

Critics of the LIHTC argue that the federal subsidy per unit of new construction is higher than it needs to be because of the various intermediaries involved in its financingorganizers, syndicators, general partners, managers, and investorseach of whom are compensated for their efforts. As a result, a significant part of the federal tax subsidy does not go directly into the creation of new rental housing stock. Critics also identify the complexity of the statute and regulations as another potential shortcoming. Another downside is that some state housing finance authorities tend to approve LIHTC projects in ways that concentrate low-income communities where they have historically been segregated and where economic opportunities may be limited. Finally, while the LIHTC may help construct new affordable housing, maintaining that affordability is challenging once the required compliance periods are over.

How Are Property Taxes Calculated

Property tax is calculated using the value of the property in question. More specifically, the value is assessed based on the type of property, its structure, and the land that it sits on. For example, a vacant plot of land will have a much lower tax than its neighbor with a similar plot of land with a house and guest cottage. If the property has access to public services or has the potential for further development, higher taxes could be assessed.

Each state computes its property tax rate using its own unique formulas. However, they all share two common factors: the propertys assessed value and the percentage tax rate. Because of this, its easiest to look at the tax rate itself when comparing and contrasting property taxes between states.

For example, lets say person A in state A owns a home worth $1 million. They were assessed a property tax of $10,000 last year. Thats a property tax rate of 1 percent. Then, lets say person B in state B owns a condo worth $150,000. However, they were assessed a property tax of $10,000 last year as well, the same amount person A paid. Thats a whopping 7 percent property tax rate. Although person A and person B paid the same dollar amount, you can easily tell that person B has a much heavier tax burden by looking at the property tax rate.

Read Also: How Much Do I Owe In Property Taxes

File For A Homestead Exemption

The homestead exemption can be used on primary residences as a way to lower property taxes. The exemption essentially protects homeowners up to a certain amount or percentage of their annual property taxes. The exact exemption amount depends on your state. For example, in Colorado homeowners may be eligible to exempt up to $75,000 of their home.

Paychecks And Retirement Benefits Are Safe From State Taxes If You Live Here

by John Waggoner, AARP, Updated March 9, 2022

En español | Saving for retirement is important, but saving money in retirement is important, too. One possible way to save money is to move to a state with no income tax. For retirees, that can mean no state tax on Social Security benefits, pensions and other sources of retirement income.

Nine states Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming have no income taxes. New Hampshire, however, taxes interest and dividends, according to the Tax Foundation. It has passed legislation to begin phasing out that tax starting in 2024 and ending in 2027.

Read Also: Do You Pay Income Tax On Unemployment

State & Local Tax Breakdown

All effective tax rates shown below were calculated as a percentage of the mean third quintile U.S. income of $63,218 and based on the characteristics of the Median U.S. Household*.

|

State |

|---|

| 15.01% |

*Assumes Median U.S. Household has an income equal to $63,218 owns a home valued at $217,500 owns a car valued at $25,295 and spends annually an amount equal to the spending of a household earning the median U.S. income.

Check Eligibility For Property Tax Exemption

There are certain property tax exemptions available at the state and local level, depending on where you live. Thy are typically reserved for seniors, veterans, active-duty service members, and individuals with disabilities. If any of these apply to you, you can apply for an exemption with your county. Note that for some of these categories, there may be additional income requirements as well. In some situations, homeowners may be eligible for a complete exemption from property taxes.

Don’t Miss: What Tax Year Is The Third Stimulus Based On