Total Tax Burden: 823%

Nevada relies heavily on revenue from high sales taxes on everything from groceries to clothes, sin taxes on alcohol and gambling, and taxes on casinos and hotels. This results in a state-imposed total tax burden of 8.23% of personal income for Nevadans, the second-highest on this list. However, it still ranks a very respectable 22 out of 50 when compared with all states.

That said, the high costs of living and housing put Nevada near the bottom when it comes to affordability. The state ranks 37th on the U.S. News & World Report Best States to Live In list.

Nevadas spending on education in 2019 was $9,344 per pupil, the fourth-lowest in the western region of the U.S. One year earlier, in 2018, the ASCE gave Nevada a grade of C for its infrastructure.

In addition to receiving an F grade from the Education Law Center in 2015, Nevada was also the worst state overall in terms of the fairness of its state school funding distribution. Nevadas healthcare spending in 2014 was $6,714 per capita, the lowest on this list and the fourth-lowest nationally.

How Are Property Taxes Calculated

Property tax is calculated using the value of the property in question. More specifically, the value is assessed based on the type of property, its structure, and the land that it sits on. For example, a vacant plot of land will have a much lower tax than its neighbor with a similar plot of land with a house and guest cottage. If the property has access to public services or has the potential for further development, higher taxes could be assessed.

Each state computes its property tax rate using its own unique formulas. However, they all share two common factors: the propertys assessed value and the percentage tax rate. Because of this, its easiest to look at the tax rate itself when comparing and contrasting property taxes between states.

For example, lets say person A in state A owns a home worth $1 million. They were assessed a property tax of $10,000 last year. Thats a property tax rate of 1 percent. Then, lets say person B in state B owns a condo worth $150,000. However, they were assessed a property tax of $10,000 last year as well, the same amount person A paid. Thats a whopping 7 percent property tax rate. Although person A and person B paid the same dollar amount, you can easily tell that person B has a much heavier tax burden by looking at the property tax rate.

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Also Check: How Much Taxes Deducted From Paycheck Mn

Ways To Minimize Your Property Tax Burden

There is no way to avoid paying property taxes. However, there are a few things that you can do to keep the assessed value of their property low, which will result in lower property taxes. These include:

- Confirming that the information listed on your annual tax assessments is correct.

- Try to avoid making home improvements that include significant structural changes like converting an attic into a bedroom. You should only consider such differences if the change will help generate additional rental income.

- Nicer-looking homes are more likely to get assessed a higher tax.

- Find out the property taxes for neighboring houses similar in size and features to yours and compare the assessed .

- Invite the local tax assessor to your house to conduct a walk-through of your home. Highlight things that may help reduce the perceived property value, such as popcorn ceilings, outdated appliances, or older windows and doors. Otherwise, an assessor will likely only look for things that add value to your house.

Property Taxes By State 2022

Most adults in the United States strive to own their own home. However, this ownership comes at a price. Not only will you have an auto loan or mortgage, insurance, and repair costs, but you also have to pay property taxes. Unfortunately, every state has property tax, but some states have very low property taxes.

Property taxes are a real estate ad-valorem tax levied by the jurisdiction in which the property is located and paid for by the property owner. Property taxes are paid to your state and contribute to the state’s revenue. This revenue is used for various purposes, including building schools, repairing roads, and building other critical infrastructure. Property taxes are paid on an annual basis, and the amount you pay varies by state.

The average American household spends about $2,375 on property taxes for their homes each year.

Read Also: Where To Find Paper Tax Forms

Who Sets Home Value

After looking at the example above, youre probably wondering who exactly determines why person A and person B in the example above paid what they did in property taxes last year. The entities that set home values in each state are tax assessors, and they are typically government agents who value your property every one to five years. They will look at other similar properties in your market and compare recent sales prices to determine your propertys value. Unique formulas are also involved, and as you might imagine, this involves a lot of complicated math.

These tax specialists look at numerous other factors unique to each state and properly calculate tax rates. It might be that Person Bs condo was located a short distance from a popular tourist attraction, or perhaps Person As home is valued at a higher value but local property taxes are considerably low for that area. You can expect your tax bill to go up if you add any value to your home, such as by adding a pool or building a second story. Most states offer an appeal process so that there is some recourse if you feel like your property value assessment is unfair or unreasonable.

Highest Property Taxes #: New Jersey

The median price of a home in New Jersey is $335,600, making it a costly place to live. Add in the nations highest property tax rate of 2.49 percent, and the average homeowner is paying more than $8,000 a year in property taxes. Ouch! And, New Jersey has consistently had this high property tax rate for the last 10 years. But, theres a flip side. In a separate 2021 WalletHub survey, New Jersey ranked as the #1 state in the nation for overall quality of life, earning top marks for safety, education and health.

Family Handyman, Getty Images

Read Also: When Is The Last Day I Can File My Taxes

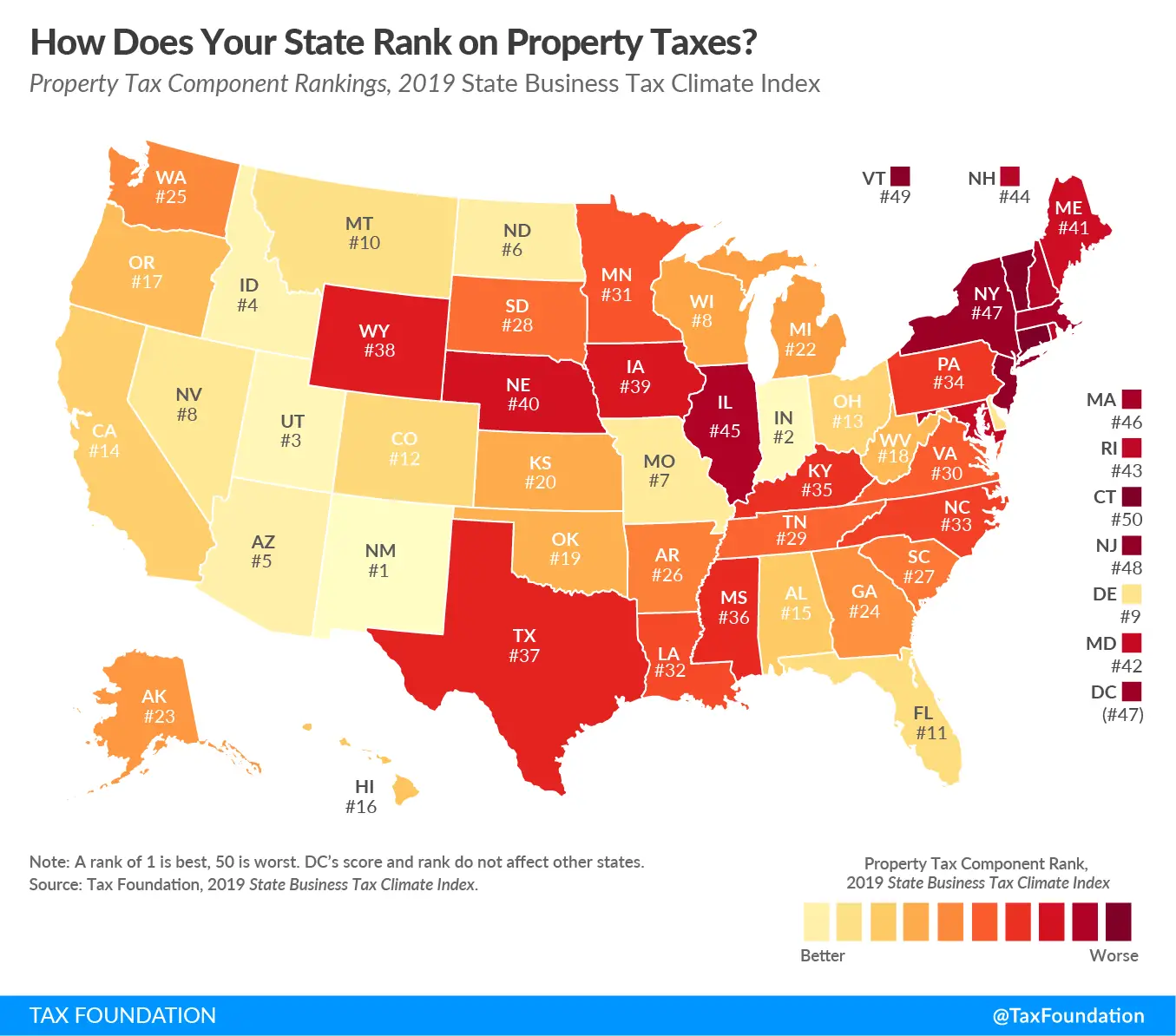

Which States Have The Highest Property Taxes

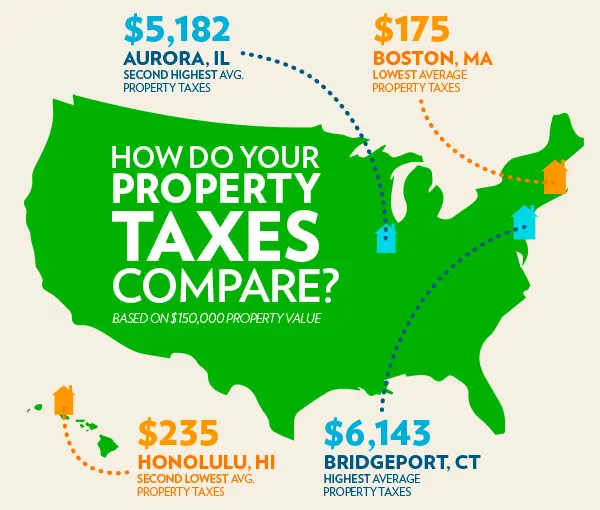

The state with the highest property tax rate in 2019 was New Jersey at 2.13%. Second and third place went to Illinois with a 1.97% tax rate and New Hampshire at 1.89%. Vermont, Connecticut, Texas and Nebraska also had property tax rates higher than most of the country.

Some states such as Texas and New Hampshire rely heavier on property taxes than other forms of taxation like state income tax, which is why they are ranked high. In other states like New Jersey and Illinois, higher property tax rates are matched by higher rates of other taxes.

Living in a state with higher property taxes can have its benefits. These taxes are generally allocated towards community resources such as schools, libraries and fire departments. Having well-funded community programs like these can take the sting out of paying higher property taxes.

How Do I Find Out How Much My Property Taxes Are

You will receive an annual property tax bill from your local tax agencyor an annual statement from your lender if you pay through escrowwith your total tax amount. If you want to estimate your taxes before then, you can look up your propertys assessed value and your local tax rate. Your annual bill will be your assessed value times your tax rate.

Dont Miss: How To Qualify For Farm Tax Exemption

You May Like: How Can I File My Past Years Taxes

No Matter Where You Live If You Own A Home You Will Have To Pay Property Taxes But The Amount You Have To Pay Varies Across The United States

Property taxes are used to fund essential government services like the fire and police departments, water systems and schools, among other things. So, no matter where you live, if you own a home you will have to pay property taxes.

However, property taxes are calculated differently depending on where you live with home values and rates being set at the local level. Both of these factors can drastically change how much you have to pay the tax collector.

Where Can I Live And Pay Less Taxes

Everybody wants a lower tax bill. One way to accomplish that might be to live in a state with no income tax. As of 2021, our research has found that seven statesAlaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyominglevy no state income tax.

Recommended Reading: What Does Payroll Tax Mean

Property Taxes By State

Depending on where you live, property taxes can be a small inconvenience or a major burden. The average American household spends $2,471 on property taxes for their homes each year, according to the U.S. Census Bureau, and residents of the 27 states with vehicle property taxes shell out another $445. Considering these figures and the massive amount of debt in America, it should come as no surprise that more than $14 billion in property taxes go unpaid each year, according to the National Tax Lien Association.

And though property taxes might appear to be a non-issue for the 36% of renter households, that couldnt be further from the truth. We all pay property taxes, whether directly or indirectly, as they impact the rent we pay as well as the finances of state and local governments.

But which states have the largest property tax load, and what should residents keep in mind when it comes to meeting and minimizing their tax obligations? In search of answers, we analyzed the 50 states and the District of Columbia in terms of real-estate and vehicle property taxes. We also asked a panel of property-tax experts for practical and political insight.

| $335,600 | $8,362 |

*$217,500 is the median home value in the U.S. as of 2019, the year of the most recent available data.

Take Advantage Of Tax

Retirement accounts like a 401 or IRA are great ways to defer taxes to a later date, while also growing your net worth. In 2022, you can contribute up to $20,500 in pre-tax income to your employer sponsored 401, and defer paying them until youre ready to start withdrawing the money in retirement. If youre employer doesnt offer a 401, its easy to open an IRA through a financial company like like Wealthfront or Fidelity.

Additionally, if you have a high deductible health plan , you can contribute to a Health Savings Account if your employer offers one. If they dont, you can contribute with post-tax money, and you will earn a tax write-off for your contribution.

Dont Miss: How Much Is Sales Tax On A Car In Nc

Don’t Miss: When Do Taxes Get Deposited 2021

What Are Property Taxes Based On

While your homes assessed value for property taxes may match its actual value, that wont always be the case. That gap can affect your tax amount. What youll pay in property taxes ranges depending on the state and county you live in as well as the overall value of your home. That includes both the land itself and the structures on it. So, vacant land will likely have lower real estate taxes due to a lower assessed value.

Assessment is based on a unit called a mill, equal to one-thousandth of a dollar. Assessors find annual property tax liability by multiplying three values:

- the state tax rate,

- the assessment ratio ,

- and the property value.

Some of these values fluctuate according to the market and state.

States do their property assessments at different frequencies, some annually and others every couple of years.

Take the first step toward buying a house.

Get approved to see what you qualify for.

Listing The Lowest Property Tax States

There are several reasons why this data could be of major significance to you.

Property taxes could be gobbling up a huge chunk of your income, leaving you with less for your home payment, bills, savings, and investments. The information could also help you know how to maneuver when property taxes are due.

Either way, read on to find out the states with the lowest property taxes in the US.

The ranking is based on property tax data shared by Roofstock in August 2022. The median household income figures are sourced from statistics aggregator World Population Review.

1. Hawaii

- Annual taxes paid on homes priced at typical value: $2,391

- Median annual household income: $83,173

According to Roofstock data, Hawaii has the lowest property taxes in the USA. Home insurance costs are also the lowest in the country.

However, it still has the highest typical home value of all the 10 states featured in this list, meaning that residents could still be slapped with a hefty tax bill.

Hawaii having the lowest property taxes is a surprise considering it perennially ranks among states with the highest cost of living, according to data shared by the Bureau of Economic Analysis .

2. Alabama

- Annual taxes paid on homes priced at typical value: $1,097

- Median annual household income: $50,800

Like Alabama, Louisiana is another state where residents enjoy both low property tax rates and home prices below the national average.

5. South Carolina

8. Nevada

Also Check: How To Report 1099 K Income On Tax Return

Lowest Property Tax #: Hawaii

Youll pay a pittance in property taxes in Hawaii if you can afford to live there, that is. Converse to its low tax rate of just 0.28 percent, the Aloha State has the countrys highest housing costs by a lot. The median home price here is $615,300, higher even than California, which is known for its astronomical housing prices. So youll pay $1,715 in property taxes a drop in the Pacific Ocean, in the grand scheme of things. Hawaii scores high in health care and, not surprisingly, natural environment. But its extremely high cost of living pulls its overall quality of life ranking down to the middle of the pack.

Family Handyman, Getty Images

Total Tax Burden: 737%

Like many states with no income tax, South Dakota rakes in revenue through other forms of taxation, including taxes on cigarettes and alcohol. The home of the Lakota Sioux and the Black Hills has one of the highest sales tax rates in the country and above-average property tax rates. South Dakotas position as home to several major companies in the credit card industry, in addition to higher property and sales tax rates, helps to keep the states residents free from income tax, according to reporting by The Atlantic.

South Dakotans pay just 7.37% of their personal income in taxes, according to WalletHub, ranking the state eighth in terms of the total tax burden. The state ranks 14th in affordability and 15th on the U.S. News& World Report Best States lists.

South Dakota spent $8,933 per capita on healthcare in 2014, the 14th highest in the nation. Although it spent more money on education, at $10,139 per pupil in 2019, it spent less than any other neighboring Midwestern state. Additionally, it received a grade of F for its school funding distribution.

South Dakota hasnt received an official letter grade from the ASCE, though much of its infrastructure is notably deteriorated, with 17% of bridges rated structurally deficient and 90 dams considered to have high hazard potential.

Don’t Miss: What Taxes Do You Pay In Florida

Which States Do Not Have Property Tax In 2022

Unfortunately, there are no states without a property tax. Property taxes remain a significant contributor to overall state income. Tax funds are used to operate and maintain essential government services like law enforcement, infrastructure, education, transportation, parks, water and sewer service improvements.

States without property tax refer to those states that have the lowest ratio rate of property tax. In other words, the tax is so small that its almost negligible and doesnt affect the investment return much.

The Top 10 States With the Lowest Property Tax Based on State Median Home Value Are:

1- Hawaii

Property Tax Rate: 0.35%

Hawaii has the lowest effective property tax rate among all states. Here, residents only pay 0.35% of their home value. On the other hand, Hawaii also has the highest median home values in the USA. The current rate is likely to stay there for 2022.

2- Alabama

Property Tax Rate: 0.40%

Another state among the most affordable states for homeowners is Alabama. It has the second-lowest property tax rate among all states.

3- Louisiana

Property Tax Rate: 0.52%

Louisiana has the third lowest property tax rate. The median home value in Louisiana is well below the national average which stands at just $178,000.

4- Wyoming

Property Tax Rate: 0.55%

The average home price is not the lowest in Wyoming compared to other states, which are $257,300. But with the fourth-lowest property tax rate and no state income tax makes it an ideal place to live in.

Why Are Taxes So Crucial

Some states in the U.S. are more tax-friendly for retirees when compared to others. The advantage of these states is determined by the rates of income tax, sales tax, and property tax that are charged by the state.

Tax data collected by personal finance site Kiplinger shows that the tax burden in one state can vary by almost thousands of dollars per year compared to another state. As such, it is beneficial to understand the tax benefits that some states provide for retirees.

Recommended Reading: How Much Money Can Be Gifted Tax Free