Tennessee And New Hampshire Income Tax

Tennessee gradually reduced its “Hall tax” on interest and dividend income. The state’s 6% Hall tax rate was reduced by 1% increments each year until the tax was eliminated as of January 1, 2021. The Hall tax rate was just 1% in tax year 2020.

Alaska, Tennessee, and New Hampshire are the only states to ever take legislative steps to eliminate an existing income tax.

New Hampshire assesses a 5% tax on interest and dividend income beyond $2,400, as of 2021. Interest and dividend income aren’t taxed for married couples filing joint returns until that amount exceeds $4,800. An additional $1,200 exemption is available for certain taxpayers who are disabled, blind, or over the age of 65.

The tax on interest and dividends is currently being phased out over a five-year period, following the signing of a bill in 2018. New Hampshire will officially have no income tax by 2024.

The Effect On Your Federal Tax Return

It used to be that you could claim a tax deduction for state income taxes you paid if you itemized on your federal return, and you can still do that … sort of. The Tax Cuts and Jobs Act capped this deduction at $10,000 when it went into effect in 2018, and this $10,000 limit includes property taxes as well.

Those who don’t have to pay income tax might be able to deduct most or all of their property taxes on their federal returns.

If You Choose To Live In These States Every Penny You Earn Is Safe From State Income Tax But That Doesn’t Mean You Won’t Have To Pay Other State And Local Taxes

Everyone hates paying taxes. So why don’t we all live in one of the nine states without an income tax? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming don’t tax earned income at all. If you’re retired, that also means no state income tax on your Social Security benefits, withdrawals from your IRA or 401 plan, and payouts from your pension. That sounds pretty darn good to me!

But, of course, no state is perfect. The states without an income tax still have to pay for roads and schools, so residents still have to pay other taxes to keep the state running . And sometimes those other taxes can be on the high end. New Hampshire and Texas, for example, have some of the highest property taxes in the country. So, if you’re thinking of moving to a state without an income tax, continue reading to see some of the other taxes you’ll have to pay in those states. Maybe the state you’re in right now won’t look so bad.

Overall Rating for Taxes: Mixed Tax Picture

State Income Taxes: New Hampshire doesn’t tax earned income, but currently there’s a 5% tax on dividends and interest in excess of $2,400 for individuals . The tax on dividends and interest is being phased out, though. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026. The tax will then be repealed on January 1, 2027.

Sales Tax: New Hampshire has no state or local sales tax.

Inheritance and Estate Taxes: There is no inheritance tax or estate tax.

Also Check: Doordash On Taxes

How An Excise Tax Works

Excise taxes are primarily for businesses. Consumers may or may not see the cost of excise taxes directly. Many excise taxes are paid by merchants who then pass the tax on to consumers through higher prices. Merchants pay excise taxes to wholesalers and consider excise taxes in product pricing which increases the retail price overall. There are some excise taxes however that are paid directly by a consumer including property taxes and excise taxes on certain retirement account activities.

Federal, state, and local governments have the authority to institute excise taxes. While income tax is the primary revenue generator for federal and state governments, excise tax revenue also makes up a small portion of total revenue.

Excise taxes are primarily a business tax, separate from other taxes a business must pay, like income taxes. Businesses charging and receiving excise taxes are required to file Form 720 Federal Excise Tax Return on a quarterly basis and include quarterly payments. Business collectors of excise taxes must also maintain their obligations for passing on excise taxes to state and local governments as required. Merchants may be allowed deductions or credits on their annual income tax returns related to excise tax payments.

Living In A State With No Income Tax You Might Not Be Able To Claim The Full State And Local Tax Deduction

Another downside, taxpayers who live in states with no income tax might not be able to take advantage of one type of tax deduction.

Known as the state and local taxes deduction, the current code allows most taxpayers who opt to itemize their taxes instead of taking the standard deductions a maximum deduction of $10,000 from their federal taxes. That total is worth all of the property taxes they paid to state and local government agencies as well as their tally from either sales taxes or individual income taxes.

Since most people rack up more individual income taxes, that is the category they choose to deduct. Yet, without making some big purchases or holding a substantial real estate portfolio, it will likely be harder to hit the new $10,000 cap for individuals who live in a state with no income tax.

Read Also: Finding Your Ein Number

Only 12 States Actually Levy A Tax On Social Security Benefits

Social Security benefits are a vital source of income for many retired Americans. However, as with any income, the federal government is able to tax Social Security benefitshow much depends on the retiree’s income. Generally speaking, this is all that Social Security recipients in most parts of the United States will have to pay.

However, this isn’t always the case. While most states don’t tax Social Security, 12 states do. Here’s what to know.

Analysis Shows Population Growth In Lower Tax States

For many, the pandemic has altered their perceptions about where they want to live and where they can live. Millions of city-weary residents aching for more space have moved since the start of the pandemic.

Analysis of state tax burden rates and the change in population from 2019 to 2020 as estimated by the U.S. Census Bureau shows a negative correlation. The lower the state and local tax burden, the higher the population growth in 2020.

Four of the five states with an A grade in tax friendliness had population growth at or above the national average. The fifth state in the group with negative population growth was Alaska.

Of the states with an E grade, all three had population declines in 2020. Of the 9 states with a D grade, only one, New Hampshire, had population growth higher than the national average.

The included expert insights section on this page has advice on how to manage moving and taxes.

Read Also: Appeal Cook County Taxes

Tax Season Is Here: Check Out Select’s Top Tax Services

The IRS started accepting and processing tax returns on February 12, but if you haven’t yet filed yours you can still make the process as painless as possible by using one of Select’s best online tax software.

Taxes are traditionally due on April 15, but the IRS extended the federal income tax filing due date to May 17, 2021. You can check your state’s filing deadline here. Some states have changed their due dates to May 17 as well.

Select reviewed 12 tax filing software programs, evaluating them on a range of features, including cost, user experience, expert tax assistance and Better Business Bureau rating. Here is our roundup of the top tax software programs to ensure a fast process:

- Best overall tax software: TurboTax

Combined Sales And Income Tax Leaders

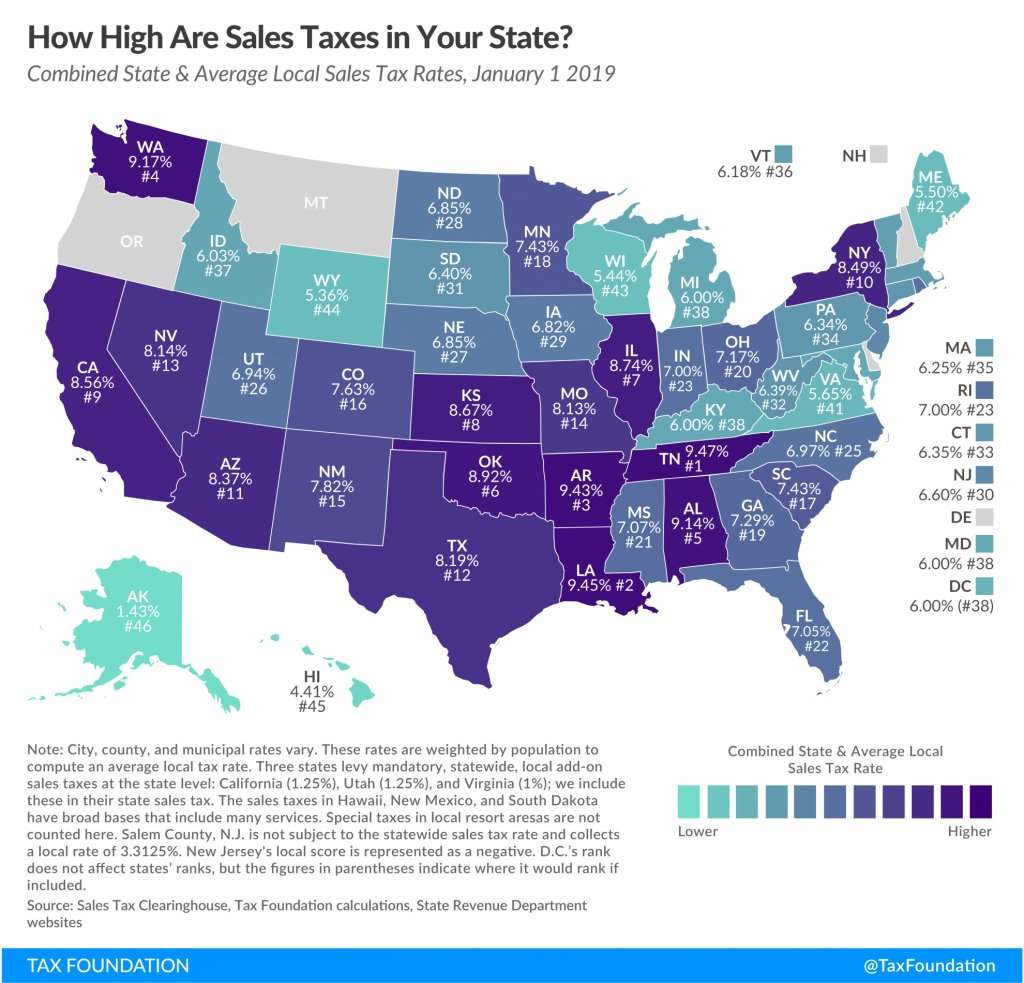

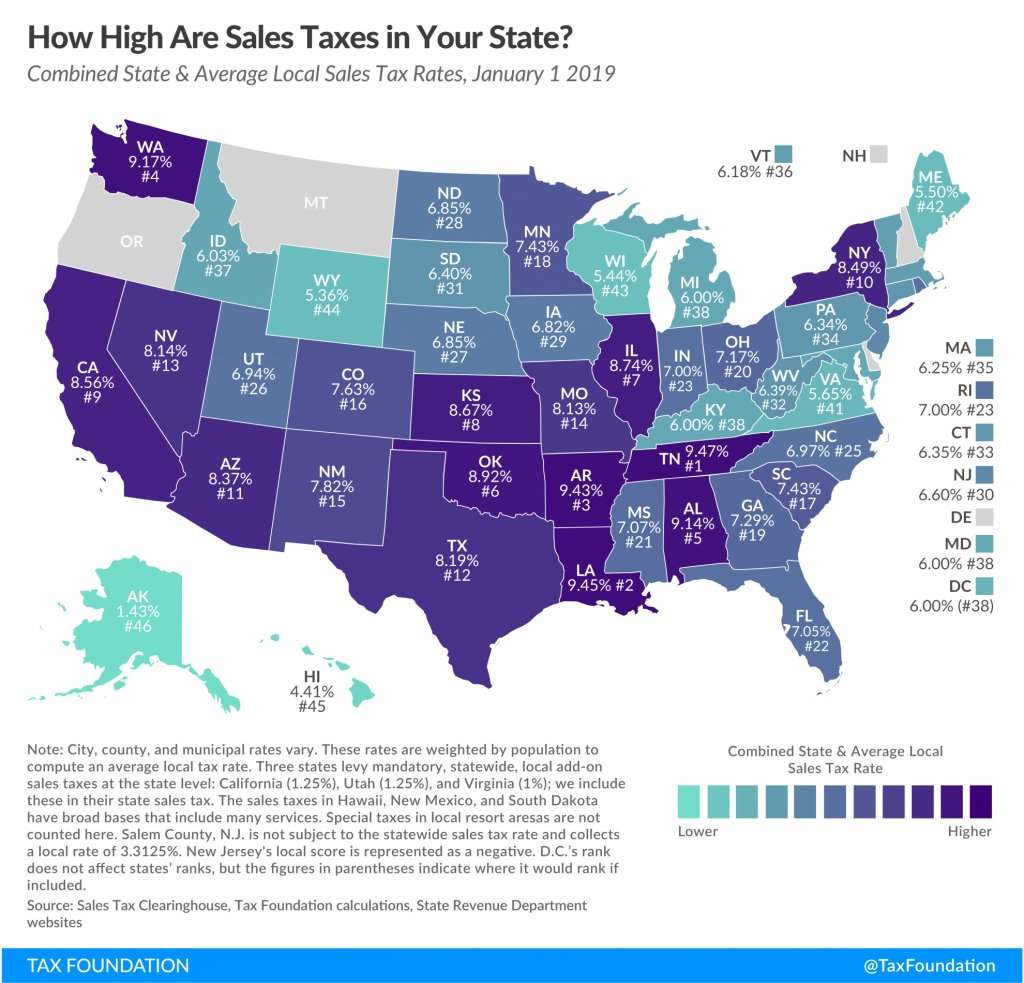

The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes, rather than report these expenses from the state revenue perspective used by the Census Bureau. Its 2019 State and Local Tax Burden Rankings study reported that Americans paid an average rate of 9.9% in state and local taxes.

According to the foundation, the top five states with the highest state and local tax combinations are:

- New York 12.7%

- Illinois 11.0%

- California and Wisconsin 11.0%

The same states have ranked as the top three consistently since 2005, according to the foundation.

Although taxes may not be the first thing you consider when deciding where to live, knowing the tax situations of the locations you’re considering for a move could help you save in the long-run, especially when retiring.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Read Also: Paying Taxes With Doordash

Florida Sales Tax Holiday

- Clothing, footwear and accessories, including face masks: $60 or less

- School supplies: $15 or less

- Computers and accessories: $1,000 or less per item

- Clothing and footwear: $100 or less

- Backpacks: The first $40 is tax-exempt

- School supplies: Not to exceed $50 per purchase

- Personal computers: Up to $1,500

- Computer software: Up to $350

- Graphing calculators: Up to $150

- Clothing and footwear: Less than $100

- Computers: $1,000 or less

- Computer-related items: Up to $500

- School supplies: Less than $30

Full list: www.tax.newmexico.gov

State Local And Foreign Income Taxes

State and local income taxes withheld from your wages during the year appear on your Form W-2, Wage and Tax Statement. You can elect to deduct state and local general sales taxes instead of state and local income taxes, but you can’t deduct both. If you elect to deduct state and local general sales taxes, you can use either your actual expenses or the optional sales tax tables. Refer to the Instructions for Schedule A PDF for more information and for the optional sales tax tables. You may also use the Sales Tax Deduction Calculator. The following amounts are also deductible:

- Any estimated taxes you paid to state or local governments during the year, and

- Any prior year’s state or local income tax you paid during the year.

Generally, you can take either a deduction or a tax credit for foreign income taxes imposed on you by a foreign country or a United States possession. For information regarding the foreign tax credit, refer to Topic No. 856 and Am I Eligible to Claim the Foreign Tax Credit?

As an employee, you can deduct mandatory contributions to state benefit funds that provide protection against loss of wages. Refer to Publication 17, Your Federal Income Tax for Individuals for the states that have such funds.

Recommended Reading: Do I Have To File Taxes For Doordash

How States With No Income Tax Generate Income

Now, before you decide to go rushing off and move to a state that does not levy an income tax, take a quick look at these statistics:

- Tennessee has yet to pass legislation that would require individuals to pay a state income tax, however Tennessee does require its citizens to pay taxes on dividend and interest income. In addition, Tennessee charges a higher state sales tax to compensate for the loss of revenue.

- Alaska has neither an individual state income tax nor a state sales tax. Rather, it charges a state corporate income tax instead. And local areas often charge a sales tax.

- Neither Nevada nor Texas has either a personal or corporate income tax provision. Instead, Nevada earns the majority of its revenue through the gaming industry and sales tax while Texas relies heavily on franchise taxes and property taxes.

- Like Tennessee, New Hampshire has instituted a tax on interest and dividends however there is no sales tax. Property taxes are also high.

- Wyoming has neither a personal income taxes nor corporate income taxes. Property taxes and sales taxes are also low.

- Florida utilizes proceeds from state sales tax and corporate income tax to offset lost revenue.

As you can see, states that do not require its citizens to pay state income taxes often still collect revenues from the citizenry, just through different means.

These means can be via sales tax, corporate income tax, property tax, tangible and intangible personal property tax and more.

Retirees Can Save A Lot Of Money In These States That Completely Exempt The Most Common Types Of Retirement Income 401s Iras And Pensions From Taxation

You’ve worked hard all your life, and now you’re retired . Unfortunately, there’s a pretty good chance that Uncle Sam is going to take a cut of your 401, traditional IRA or pension income. But what about your state? Will it take a bite out of your retirement income, too?

Most states tax at least a portion of retirement income . Your state might offer some tax breaks, but those breaks usually have limitations based on your age and/or income. A few states, however, completely exempt the most common types of retirement income401s, IRAs and pensionsfrom taxation. That’s a huge plus for retirees living in those states.

Here are 12 states where you don’t have to pay tax on any of your 401, IRA or pension income . If you liveor plan to livein one of these states, you can stretch your retirement savings quite a bit further.

1 of 12

Read Also: Doordash File Taxes

What Is An Excise Tax

An excise tax is a legislated tax on specific goods or services at purchase such as fuel, tobacco, and alcohol. Excise taxes are intranational taxes imposed within a government infrastructure rather than international taxes imposed across country borders. A federal excise tax is usually collected from motor fuel sales, airline tickets, tobacco, and other goods and services.

States Without Sales Tax

While almost every state in the U.S has a sales tax, five lucky states – Alaska, Delaware, Montana, New Hampshire and Oregon – don’t. But, why?

When you’re at the supermarket or the mall and you go to check out, there’s usually an additional price added on – the sales tax.

And while the sales tax comes in a variety of forms – from excise tax to value-added tax – most states in the U.S. add it to the base price of the goods. But, in five lucky states, residents are exempt from sales tax . But, what does it mean to be exempt from sales tax, and which states are sales-tax-free?

Read Also: Doordash 1099 Example

Paying Taxes Is A Part Of Life For Most Americans And While Everyone Is Subject To The Same Irs Tax Laws When They File Their Federal Tax Return Annually They Dont Necessarily Pay The Same State Income Taxes

Why? Where you live and work affects the state tax laws that apply to you. Some states dont have any income tax at all and you may be tempted to relocate to one thinking the move will reduce your overall tax obligation.

While the thought of living in a state where income taxes arent taken from your paycheck may be appealing to those who live in states where their income is taxed, theres usually a give and take. States may need to make up for a lack of income tax revenue in other ways. For example, some states have higher sales tax rates or rely on money from tourism to help fund budgets. Others have local taxes levied by municipalities or counties.

Before you consider a move to a state with no personal income tax, its important to know all the details and how they could impact you.

- Washington

- Wyoming

Keep in mind, just because you live in a state that doesnt have an income tax doesnt necessarily mean you wont file a state income tax return. If you live in one state and work in another, you may have to file an income tax return in the state where you earn your paycheck. Likewise, if you moved during the tax year and previously worked in a different state, youll likely need to file with that state. Its important to check each states tax laws to find out the details.

Does Living In A State With No Income Tax Save Americans Money

State governments use taxpayer dollars to fund road maintenance, law enforcement agencies and other public services. The funding for those services typically comes from three key areas: property taxes, sales taxes and income taxes.

States without a personal income tax might ask residents and visitors to pay more sales tax on groceries, clothes and other goods, as is the case in Washington. A 6.5 percent state sales tax combined with city and or municipal sales tax rates result in a sales tax of up to 9.29 percent. The Tax Foundation puts the states total tax burden at 9.8 percent, making it the 24th most affordable state, the least of any state with no income tax and behind other areas that do charge the levy, including Indiana, South Carolina, Utah and Missouri.

Pump prices in Washington are also among the highest in the country, in part because of a high gasoline tax. As of 2021, Washington charges 49.4 cents per gallon in gas taxes and fees, the third-highest in the country behind Pennsylvania and California, according to The Energy Information Administration.

Florida relies on sales taxes and has the 24th most affordable combined state and average local sales tax rate in the nation, while its property taxes are above the national average, according to the Tax Foundation. Tennessee has the highest average combined sales and local tax rates in the country, at 9.55 percent.

Recommended Reading: Pay Taxes On Plasma Donation