States With No Income Tax: Should You Move To One

While everyone in the US pays a federal income tax, not everyone pays a state income tax. There are seven states in the US with no income tax whatsoever, plus two more that dont tax wages.

While people who live in these states dont pay income tax, they may pay higher taxes in other ways, like when they go shopping or stop at the gas station. This guide will explore whether or not people in income tax-free states save money overall, along with the pros and cons of moving to one of these states.

First, lets look at the nine states with few or no taxes on income.

Which States Tax Social Security And Retirement Accounts

Where you live when you retire can have a major effect on your long-term retirement plans. Managing taxes is an important part of retirement planning, so choosing a state with favorable tax treatments of your retirement account withdrawals and Social Security benefits is a good place to start.

Here are all the states that dont tax retirement account distributions whatsoever:

In addition to the above states, Alabama and Hawaii do not tax pension plan withdrawals. However, they do tax withdrawals made from 401s and traditional individual retirement accounts .

When it comes to Social Security, 38 states dont tax benefits in any way. The 12 states that do tax Social Security to some degree include:

Us State Income Tax Rates

The general approach to US state income tax rates is done in three different ways.

- Residents and those working in a specific state either do not pay any income tax at all

- They pay a flat rate of income tax, including on interest and dividends, and this income tax rate does not change based on the level of earnings

- Or, the state you live in imposes a progressive tax. This means that people with higher taxable incomes pay higher state income tax rates, and those with lower incomes pay less tax.

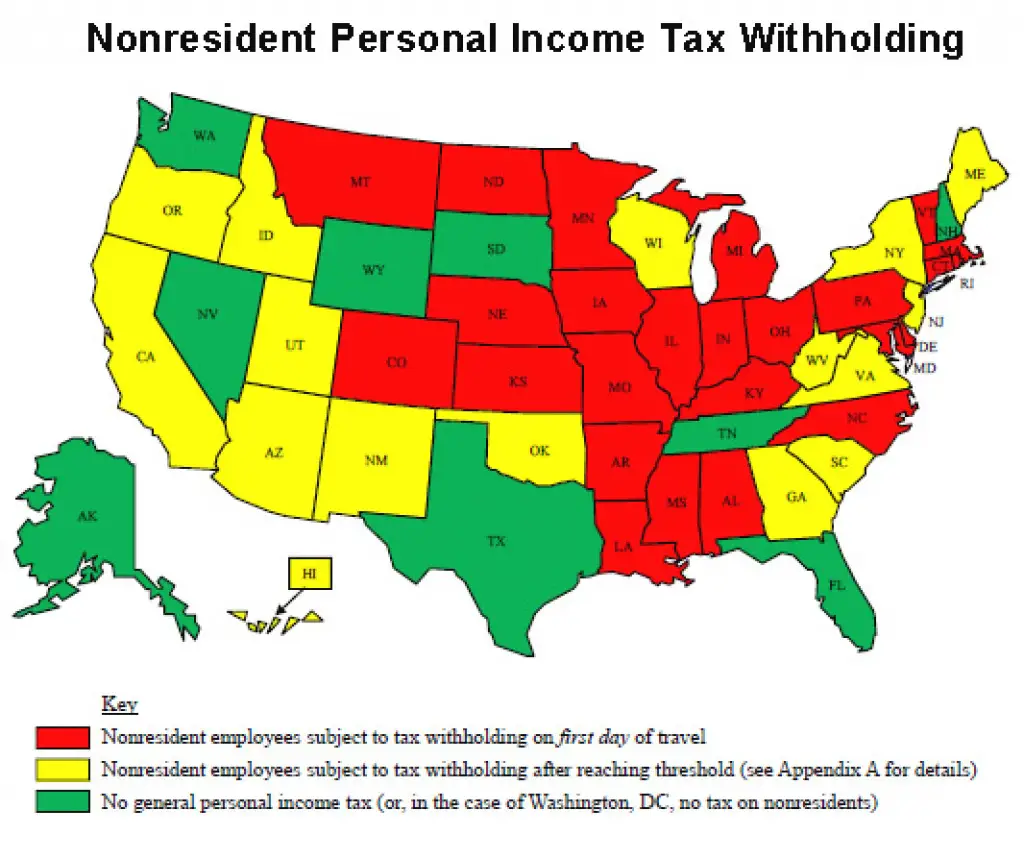

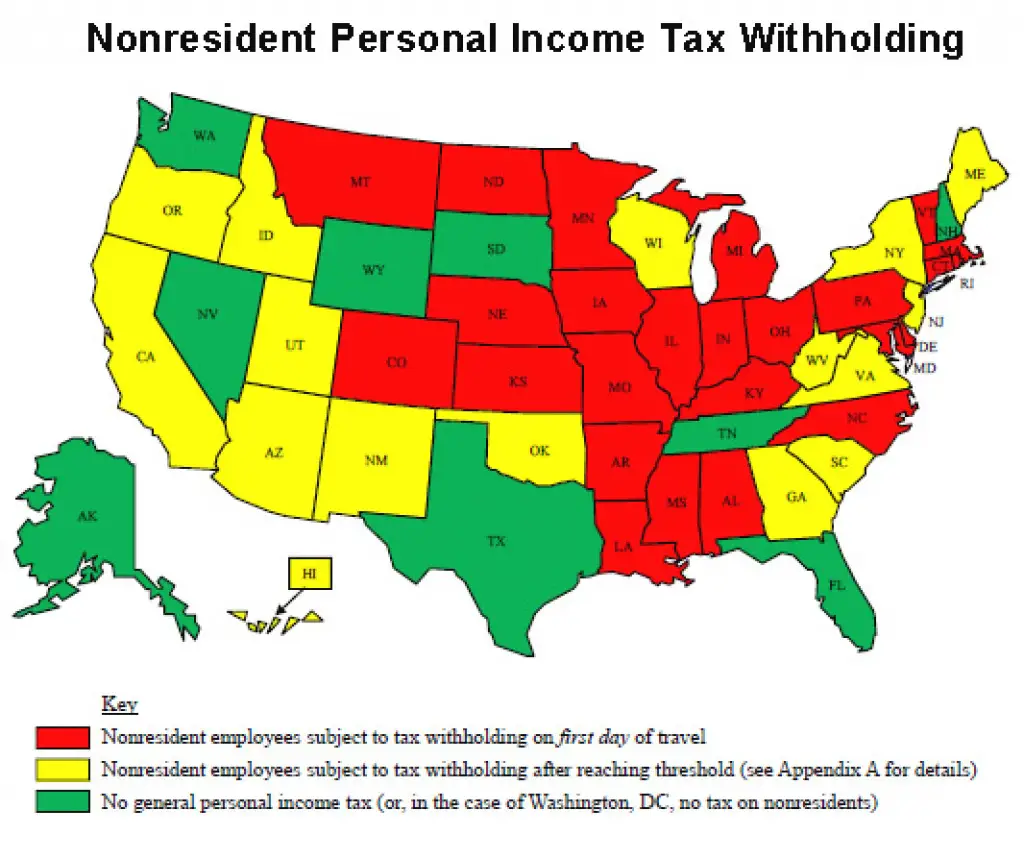

Most people live and work in the same state for the entire year. This is your state of residence and determines the rate of income tax you pay. You may have a job that requires travel to other states, but this does not typically affect the rate of tax you pay on your income, it is the state you live in that determines this.

However, if you lived in one state for part of the year and moved to another state, you may owe state income tax to two different states at two different rates. Similarly, if you work in one state and own income-generating property in another state, you may be liable to pay income tax in more than one state, which may require more than one tax return.

Recommended Reading: Do State And Federal Taxes For Free

Who Should Move To An Income Tax

As you read above, income tax-free states tend to have higher sales, gas, and property taxes and a reduced budget for public programs, like education. If any of the following are true for you, then you might benefit from living in one of these states. If the opposite is true, then you probably shouldnt move to one.

Unemployment Insurance Tax Base

The UI base subindex scores states on how they determine which businesses should pay the UI tax and how much, as well as other UI-related taxes for which businesses may also be liable.

The states that receive the best scores on this subindex are Oklahoma, Delaware, Vermont, New Mexico, and Ohio. In general, these states have relatively simple experience formulas, they exclude more factors from the charging method, and they enforce fewer surtaxes.

States that receive the worst scores are Virginia, Nevada, Idaho, Maine, and Georgia. In general, they have more complicated experience formulas, exclude fewer factors from the charging method, and have complicated their systems with add-ons and surtaxes. The three factors considered in this subindex are experience rating formulas , charging methods , and a host of smaller factors aggregated into one variable .

Experience Rating Formula. A businesss experience rating formula determines the rate the firm must paywhether it will lean toward the minimum rate or maximum rate of the particular rate schedule in effect in the state at that time.

Charging Methods and Benefits Excluded from Charging. A businesss experience rating will vary depending on which charging method the state government uses. When a former employee applies for unemployment benefits, the benefits paid to the employee must be charged to a previous employer. There are three basic charging methods:

Also Check: Can I Still Do My Taxes

Key Facts About Taxes

For a typical middle-class family, the difference between living in the highest-tax state in our rankings Illinois and the lowest Wyoming is nearly $10,000 a year. A breakdown of the state-by-state tax picture reveals:

- Illinois imposes the highest tax burden. A hypothetical middle-income family would pay $13,894 a year in state and local income, sales and property taxes.

- Wyoming collects the least. The same family with the same financial picture would spend just $3,279.

- Mississippi is in the middle of the pack. A typical family would pay $8,025 a year in state and local taxes.

Youre probably not going to pick up and move simply to avoid state and local taxes. There are simpler ways to cut your tax bill, like saving for retirement, calculating business expenses and taking advantage of education credits and deductions. But if youre pondering a relocation for professional or personal reasons, taking tax implications into consideration could help you choose your next move.

States With The Highest Personal Income Tax Rates

A comparison of 2020 tax rates compiled by the Tax Foundation ranks California as the top taxer with a 12.3% rate, unless you make more than $1 million. Then, you have to pay 13.3% as the top rate. The additional tax on income earned above $1 million is the state’s 1% mental health services tax.

The top 10 highest income tax states for 2021 are:

Each of these states has a personal income tax floor, deductions, exemptions, credits, and varying definitions of taxable income that determine what a citizen actually pays.

You May Like: How To Become Tax Exempt

Total Tax Burden: 697%

This popular snowbird state features warm temperatures and a large population of retirees. Sales and excise taxes in Florida are above the national average, but the total tax burden is just 6.97%the sixth-lowest in the country.

Florida ranks 31st in affordability due to its higher-than-average housing costs. Still, Florida came in at 10 on the U.S. News & World Report Best States to Live In list.

In 2019, Florida was one of the lowest states in terms of school system spending, at $9,645 per pupil. In 2021 the ASCE gave Florida a C grade for its infrastructure. Six years earlier, Florida received the same grade from the Education Law Center for the fairness of its state school funding distribution. In 2014, its healthcare spending per capita was $8,076, $31 more than the national average.

Should You Move To A State With No Income Tax

If youre trying to determine whether moving to a state with no income tax is financially worth it, start by taking a look at your most recent tax return. Calculate how much you paid in state income taxes and determine your individual income tax rate. Then, compare that total with what you would be paying in the state where you wish to move.

But those calculations should be the tip of the iceberg, according to Steber. Compare the property tax and sales tax rates of both locations, along with cost-of-living considerations, such as housing and food.

Familial and educational considerations might matter as well, which might not be immediately on your radar. Steber, for instance, ended up having to pay out-of-state tuition to his childrens colleges back in Alabama after the family moved across state lines to Florida.

I would tell you, if I had stayed in Alabama, I wouldnt pay out-of-state tuition, which wouldve offset the income tax that I wouldve had, he says.

Recommended Reading: How To Buy Property For Back Taxes

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

State Stimulus Payments 202: Is Your State Mailing Out A Check This Week

Numerous states are issuing tax rebates and stimulus payments in September.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Hawaiians should start seeing direct deposits of a one-time tax refund on Friday, according to Gov. David Ige. Close to $300 million is being returned to taxpayers, Ige told KHON. Those who earned less than $100,000 will get $300, while residents making more than $100,000 will receive $100.A qualifying family of four could receive $1,200.

The Aloha State isn’t the only one giving money back to taxpayers this month: In Illinois, residents will start receiving tax rebate checks worth up to $400 next week. And in Colorado, refund checks for $750 — or $1,500 for joint filers — have been trickling into mailboxes since August, thanks to the Taxpayer’s Bill of Rights Amendment, and should be done by the end of this month.

Which other states are issuing payments? How much can eligible taxpayers get? When will the money arrive? Read on to find out.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

Read Also: When Is Taxes Due This Year

Time Frame Measured By The Index

Starting with the 2006 edition, the Index has measured each states business tax climate as it stands at the beginning of the standard state fiscal year, July 1. Therefore, this edition is the 2021 Index and represents the tax climate of each state as of July 1, 2020, the first day of fiscal year 2021 for most states.

How Property Tax Rates Are Determined

The property tax rates of local jurisdictions arent uniform, but they do use similar formulas to calculate the rates. Each state has a number of tax districts that establish property tax rates based on their financial needs for the year, which generally include the necessary funding to support school districts and local government offices. From this amount, local governments subtract the funds they expect to receive from other sources to arrive at the budget deficiencywhich is the amount it needs to raise through property taxes. This budget deficiency is divided by the total assessed values for all homes within the jurisdiction to determine the appropriate rate of property tax to charge homeowners.

Read Also: When To Expect My Tax Refund 2021

All The States That Don’t Tax Retirement Income

States vary widely in the way they tax retirement income so location is an important consideration in financially planning for retirement. Some states dont levy income states on any sort of retirement income, while others tax IRA and 401 distributions, pension payouts and even social security payments like ordinary income. Income taxes are just part of the story, however, as some states with low or no income taxes have high property, sales and other taxes. Consider working with a financial advisor when you are planning for retirement to make sure you avoid any unnecessary taxes.

Retirement Income Tax Basics

Most retirement income can be subject to federal income taxes. That includes Social Security benefits, pension payments and distributions from IRA and 401 plans. Exceptions include distributions from Roth IRA and Roth 401 plans. Federal income taxes on Roth contributions are paid before the contributions are made. These contributions as well as any investment gains can be withdrawn free of federal income taxes after five years if you have reached age 59 1/2.

The situation is more complex when it comes to how states will tax your income. Many states have no income tax at all, so all retirement income, as well as other income, is state tax-free. Most states specifically exclude Social Security benefits from taxation. Some others also exempt retirement account distributions and pensions. Most have a mix of approaches to taxing retirement income.

Bottom Line

States With The Lowest Personal Income Tax Rates

Only eight states have no personal income tax:

In addition, New Hampshire limits its tax to interest and dividend income, not income from wages.

Among the states that tax income, Pennsylvania’s 3.07% flat tax ranks the Keystone State as the 10th lowest in the nation for 2021.

Low personal income tax rates can be misleading a lack of available tax deductions, for example, can raise the effective rate you pay. The Retirement Living Information Center states that figuring your total tax burden, including sales and property taxes, can give you a more accurate reading on affordability, especially if you’re on a fixed income. However, these states with the lowest taxes on income can be a good place to start looking for a more affordable location.

Don’t Miss: When Do I File Business Taxes

Why Do These States Have No Income Tax

As income tax is organised at the state level, it is as simple as states deciding that they do not want to impose it.

What this means is the state hikes taxes on products and other things people can buy to make up the shortfall. This can make these items more expensive and in some cases have unseen consequences. For example, Washington state has a tax of 49.4 cents per gallon on gasoline, one of the highest rates in the nation.

BREAKING: Florida Senate, on a 23-16 vote, just passed legislation ENDING Disneys tax privilege, self-governing power & special exemption status.

Tim Swain

Having no income tax comes with its problems. In 2015, Alaska saw one of its largest budget deficits in years. In 1980 the state had eliminated state income tax, as it was able to generate enough revenue through the extraction and commercialization of oil.

However, as many countries that depend on natural resources can attest, problems started when the price of oil began to fall. At the time of the crisis, the state saw a $4 billionbudget deficit with the Commissionaire of the Alaska Department of Revenue saying that for every $5 drop in oil prices, the state loses $120 million.

On the other side, the recent surge in oil price as a result of the war in Ukraine means Alaska can get a lot more money from the taxing of one commodity.

Is It Better To Live In A State With No Income Tax

At the end of the day, whether or not its better to live in a state with no income tax depends in part on your personal financial situation but there are other considerations as well. For example, quality of life and the lifestyle you choose to live are also important.

From a strictly financial standpoint, its important to remember that the amount you earn plays a large role in your tax situation. If youre a single taxpayer living in California and earning $1 million per year, for example, tax rates reach a whopping 13.3%. However, if you earn a low-to-moderate wage, tax rates are not that onerous, even in California. As with any financial question, theres no black-and-white answer to whether its preferential to live in a state with no income tax, as a number of personal factors come into play.

Read Also: Is 529 Plan Contribution Tax Deductible

Pro: Youll Have To Pay Only Federal Income Tax

The top federal income tax bracket for 2022 is 37%. If you find yourself in that bracket, youll already be forking over a significant amount of your income to the federal government. Adding state income tax on top of that, especially in a high-tax state like California, can push your total income tax bill to over 50%. Rates like that are enough to push some high earners away from high-tax states like California to no-tax states like Texas.

The Effect On Your Federal Tax Return

It used to be that you could claim a tax deduction for state income taxes you paid if you itemized on your federal return. The Tax Cuts and Jobs Act capped this deduction at $10,000 when it went into effect in 2018, and this $10,000 limit includes certain property taxes as well.

The property taxes you can deduct are the taxes you pay for property such as a boat or car charged annually.

Don’t Miss: When Do You Have To Pay Taxes On Crypto