How To Calculate Social Security Tax

Its fairly easy to calculate your Social Security tax. You multiply your earningsup to $147,000by your Social Security tax rate, depending on whether youre an employee or are self-employed.

For example, lets say Michael works for a company and earns a salary of $150,000 in 2022. The Social Security tax applies to the first $147,000 of his wages, so his tax liability is $9,114: his $147,000 income multiplied by 6.2% .

If hes working for himself and earns the same $150,000, hell owe the full Social Security tax on his first $147,000 of income. So his liability would be $18,228: $147,000 multiplied by 12.4% . However, his tax bill may be lowered if he qualifies for the self-employment tax deduction.

How To Determine If Social Security Benefits Are Taxable

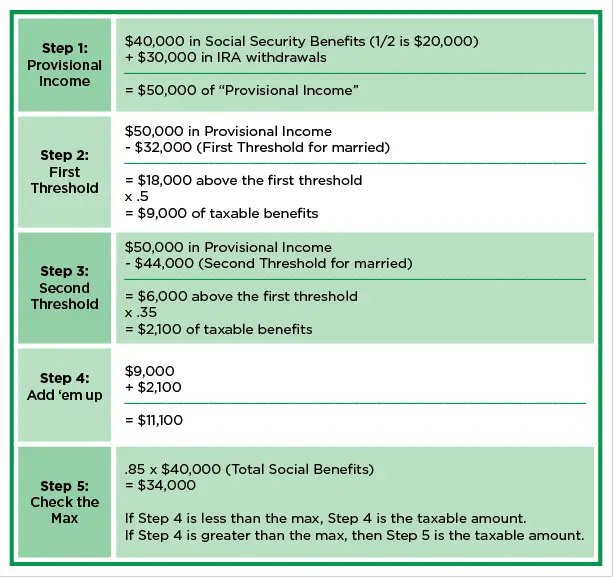

People whose only source of income is Social Security do not have to pay federal income taxes on their benefits. However, if they receive other sources of income, including tax-exempt interest income, they must add one-half of their annual Social Security benefits to their other income and then compare the result to a threshold set by the IRS. If the total is more than the IRS threshold, some of their Social Security benefits are taxable.

For 2022 the threshold amount is $25,000 for singles and $32,000 for married couples filing jointly. Married couples who live together but file separately have a threshold of $0 and must pay taxes on Social Security benefits regardless of other income earned.

The formula for calculating your combined income includes adding your adjusted gross income plus nontaxable interest plus half of your Social Security benefits. Your other income, which is included in AGI, can come from a part-time job or withdrawals from a 401 plan or traditional individual retirement account .

More specifically, Social Security benefits are taxed as follows:

- Up to 50% of Social Security benefits are taxed on income from $25,001 to $34,000 for individuals or $32,001 to $44,000 for married couples filing jointly.

- Up to 85% of benefits are taxable if the income level is more than $34,000 for individuals or $44,000 for couples.

| Taxable Social Security Income |

|---|

Five Groups Exempt From Social Security Taxes

Nearly every American worker as well as their employer is required to pay Social Security and Medicare taxes, including the self-employed. If you dont pay into the system when you work, then you cant collect the income benefits later in life. And for many older Americans who havent saved enough on their own for retirement, Social Security may be the only money they have to rely on.

However, there are certain groups of taxpayers for which Social Security taxes do not apply, including:

Recommended Reading: Can You File For Previous Years Taxes

When Will I Get My December Social Security Check

Here’s the for when you could get your Social Security check and/or SSI money:

- Payment for those who receive SSI.

- Social Security payment for those who receive both SSI and Social Security, or have received Social Security since before May 1997.

- 14: Social Security payment for those with birthdays falling between the first and 10th of any given month.

- 21: Social Security payment for those with birthdays falling between the 11th and 20th of any given month.

- 28: Social Security payment for those with birthdays falling between the 21st and 31st of any given month.

- January SSI payment. This check will have the COLA increase.

Note that was the final payment date for November.

Impact Of Taxes Medicare Premiums

While the COLA increase will be a welcome boost for Social Security’s roughly 70 million recipients, there are some implications to be aware of, Johnson noted.

The benefits hike could result in higher taxes for some recipients, for instance. Single taxpayers who receive more than $25,000 in retirement income need to pay taxes, while the threshold kicks in at $32,000 for married couples, according to the Social Security Administration.

The average Social Security benefit for 2023 will be below that amount, almost reaching $22,000 per single recipient next year. However, many seniors also have other sources of retirement income that could push them above the taxation threshold, especially after accounting for the 8.7% boost from their monthly benefit checks.

Of course, taxes are dependent on a number of variables, including the standard deduction, which is increasing in 2023 to reflect inflation, and every person’s tax situation will vary.

Another issue that seniors should be aware of is the impact of their higher Social Security benefits on Medicare premiums, Johnson said. This is mostly an issue that will impact higher-income seniors, since Medicare premiums work on a sliding scale based on income.

Also Check: How To Pay Taxes Throughout The Year

Who Pays Social Security Tax

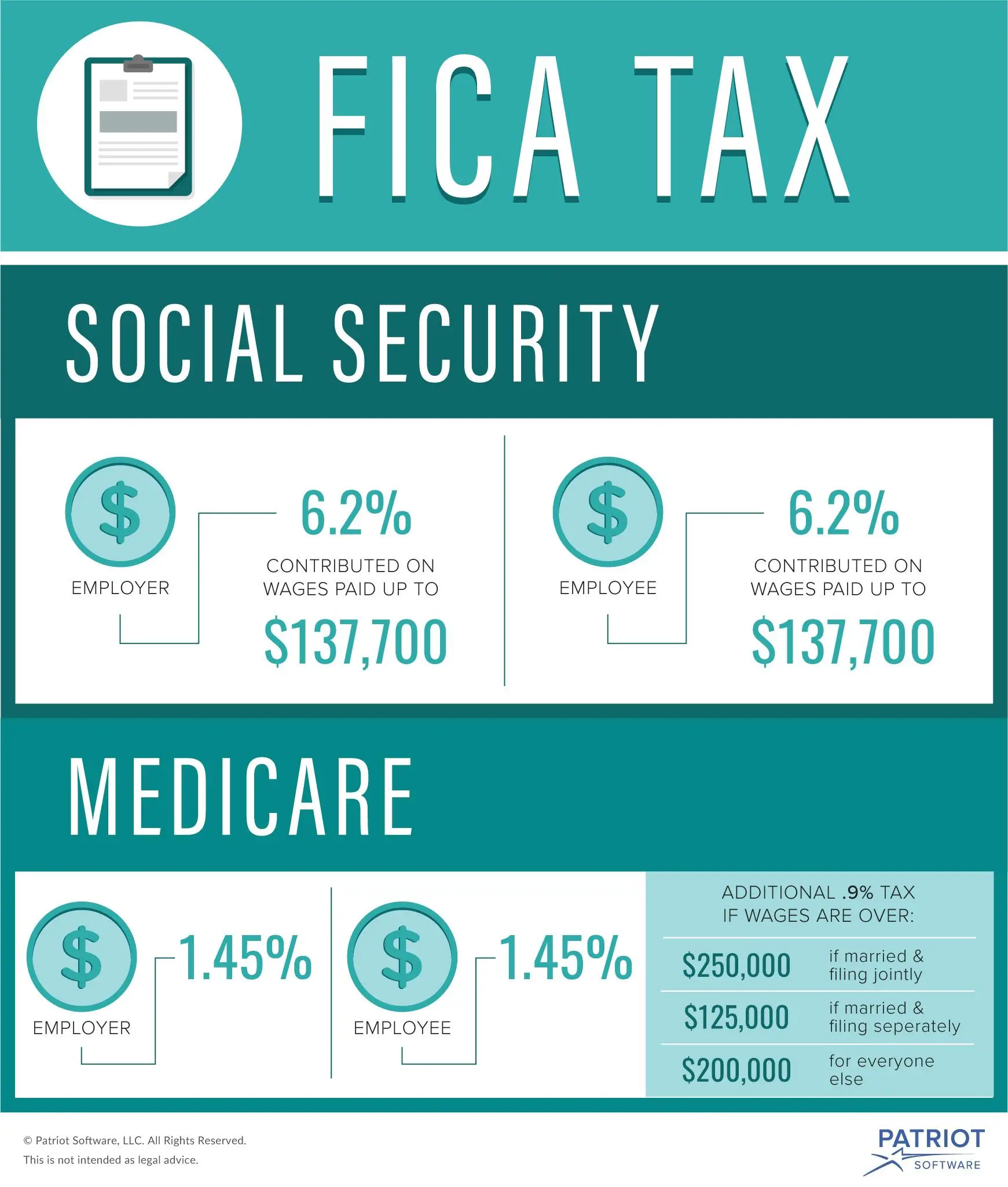

Nearly all employed individuals must pay Social Security tax on their work income. The employee pays one-half of the tax through payroll withholding and the employer pays the other half of the tax.

Under the current rate, employees must pay 6.2% of their total earnings up to the maximum wage base employers pay 6.2% of each employees earnings up to the maximum wage base. This amount equals the 12.4% that makes up the Social Security tax.

The 12.4% Social Security tax does not include the Medicare tax this amounts to an additional 2.9%, which is divided between the employee and employer.

While the Social Security tax is paid by almost all U.S. employees, there are some exceptions, which include members of some religious groups, temporary students, temporary student workers, nonresident aliens, foreign government employees, employees of state and local governments that already pay into a government pension plan, and individuals who are self-employed who earn less than $400 annually. Also, those under the age of 18 who work for a family business and those under the age of 21 who are employed as babysitters, housekeepers, or who perform domestic work are exempt from Social Security taxes.

Make Sure To Pay Your Estimated Taxes On Time To Avoid Penalties

A Tea Reader: Living Life One Cup at a Time

People who work for companies have estimated taxes withheld from their paychecks, but the self-employed, business owners, and those who live on investment income are required to proactively pay estimated taxes on a quarterly basis.

In the United States, income taxes are pay-as-you-go. If you dont keep up with payments, you could potentially end up with a large tax bill, in addition to penalties for late payment, when it comes time to file your return.

Recommended Reading: How To Calculate Your Tax Bracket

Don’t Miss: Are Uber Rides Tax Deductible

How Is Social Security Tax Calculated For Self

If an individual runs a small business and does not have any employees , then he or she is considered to be self-employed. If the self-employed individual earns more than $400 in a year, they are required to pay self-employment taxes.

Therefore, they must pay the self-employment tax, including Social Security and Medicare taxes. This works out to 15.3% of the self-employed persons total income .

Tip: Self-employment tax is calculated on Schedule SE, which is not the employers responsibility.

Why Do I Pay Social Security Tax

Workers pay Social Security taxes to support government programs in society. Social Security benefit payments issued by the government to retired individuals are funded using the aid of Social Security tax payments from current workers. When current workers retire, they will then become eligible to claim these government benefits in the future.

You May Like: How To Correct Taxes After Filing

Social Security Payments For December: When To Expect Your Check

Here’s when your December Social Security payment will arrive.

The Social Security Administration started disbursing December payments this week. We’ll explain below how the timing of Social Security payments work.

This month, you should also keep an eye out for a letter in the mail about your Social Security cost-of-living benefit increase for 2023. The letter will have details about your individual benefit rate increase for next year — or you can check your benefits online using your My Social Security account. In , you’ll get your first increased benefit amount.

Read more: Stimulus Checks: 18 States Are Sending Tax Rebates to Residents and Your Schedule for Social Security Disability Insurance

How Do You Calculate Social Security Tax

To calculate the Social Security tax, multiply the employees gross taxable wage by the Social Security tax rate. Pay frequency does not matter. You always calculate the tax the same way.

Say you pay an employee $1,000 in gross wages. Multiply the $1,000 by 6.2% to determine how much to withhold from the employees wages. Because you contribute the same amount, use the calculated amount to determine how much you contribute.

Social Security tax = $1,000 X 0.062 = $62

Withhold $62 from the employees wages and contribute $62 for the employer portion of the tax.

Once the employee earns $142,800 in 2021 , stop withholding and contributing Social Security tax on their wage. If the employees wages never reach the annual wage base, do not stop withholding and contributing the tax.

Don’t Miss: Where Do I Get Paperwork To File Taxes

Who Is Exempt From Paying Social Security

Members of certain religious groups may be exempt from Social Security taxes. To become exempt, they must waive their rights to benefits, including hospital insurance benefits. They must also be a member of a religious sect that is conscientiously opposed to receiving private death and retirement benefits and provides food, shelter, and medical care for its members.

Most foreign students, scholars, teachers, and researchers are exempt if they are non-immigrant and non-resident aliens. Foreign citizens who work in the U.S. for a foreign government , also do not need to pay. State and local government employees covered under a public retirement plan do not need to pay twice by paying into Social Security.

Self-employed workers who make less than $400 annually do not need to worry about paying Social Security taxes. High-income individuals are also exempt from paying the tax on any earnings over the $147,000 threshold in 2022 and $160,200 in 2023. This reduces their overall Social Security tax liability.

The current Social Security tax rate is a 6.2% tax on both the employee and employer, for a total of 12.4%. If you are self-employed and make more than $400, you must cover both the employee and employer portions.

Registering To File A Self

You will need to register with HMRC in order to file a self-assessment tax return. This must be done by 5 October for the following tax year.

You can do this online through the Gov.uk website, after which you will be sent a unique taxpayer reference through the post. Activation details for the governments Gateway platform will also be posted to you the Gateway is used for filing an online tax return.

This process can take up to three weeks, so its a good idea to start the registration process as early as possible.

Read Also: Does Coinbase Help With Taxes

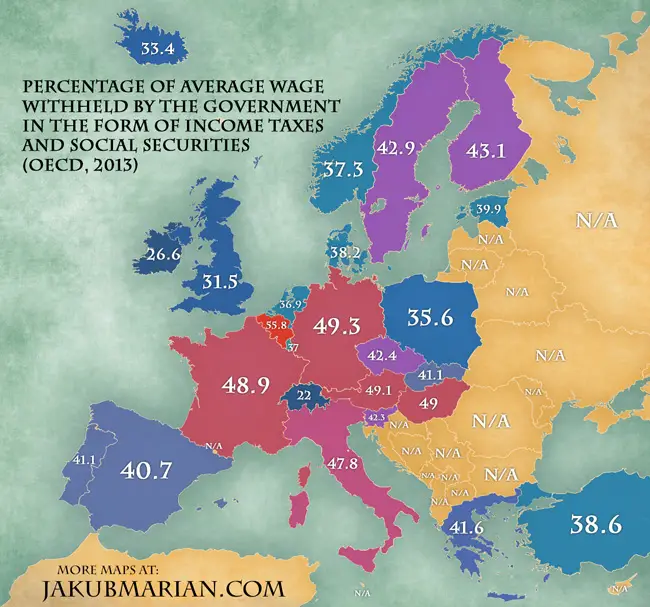

Definition Ofsocial Security Contributions

Social security contributions are compulsory payments paid to general government that confer entitlement to receive a future social benefit. They include: unemployment insurance benefits and supplements, accident, injury and sickness benefits, old-age, disability and survivors’ pensions, family allowances, reimbursements for medical and hospital expenses or provision of hospital or medical services. Contributions may be levied on both employees and employers. Such payments are usually earmarked to finance social benefits and are often paid to those institutions of general government that provide such benefits. This indicator relates to government as a whole and is measured in percentage both of GDP and of total taxation.

Social Security Tax Limits

The government bases the annual Social Security tax limits on changes in the National Wage Index , which tends to increase every year. The changes are intended to keep Social Security benefits on track with current inflation.

Any income you earn beyond the wage cap amount is not subject to a 6.2% Social Security payroll tax. For example, an employee who earns $165,000 in 2023 will pay $9,932 in Social Security taxes .

Keep in mind, however, that there is no wage base limit for Medicare tax. While the employee is only subject to Social Security tax on the first $160,200, they will have to pay 1.45% Medicare tax on the entire $165,000. Individuals who earn more than $200,000 are also subject to a 0.9% additional Medicare tax.

The combination of the increase in the Social Security tax limit and the additional Medicare tax for high-earners could result in lower take-home pay. Unfortunately, that means workers who earned over $200,000 in 2022 are at risk of owing more taxes in 2023.

Here is an example of how the Social Security limit works:

| Social Security Tax Limit Example |

|---|

| 2022 Income |

You May Like: How Much Do I Have To Pay In Taxes

Rep Frank Ryan Introduced The 314

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

A state lawmaker has come up with a revised version of a plan he first introduced three years ago that would not only eliminate school property taxes but would make it illegal for a Pennsylvania school district to impose one.

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

Of course, the plan calls for some tax shifting to generate the $16 billion needed to replace the lost property tax revenue for schools. It also includes new taxes on certain retirement income and food and clothing.

Rep. Frank Ryan, R-Lebanon County, on Thursday unveiled his a 314-page House Bill 13 that is the product of five years of work and pulls in the expertise of a bipartisan working group of property tax elimination advocates.

Everybody wants to get rid of property taxes as long as the other person is the one who is going to pay the replacement tax, Ryan said at a Capitol news conference flanked by members of his working group. It is clear that any solution will require sacrifice on the part of all Pennsylvanians.

His plan tries to spread that burden around. It would:

Ryan acknowledges applying the tax on retirement income makes the sales pitch for his plan a tough pill to swallow, but said he believes Pennsylvanians will face that eventuality anyway.

Read Also: Ssa Retirement Benefits Application Form

Get Your Expat Taxes Done On Time With H& R Blocks Expat Tax Services

No matter if youre early, on-time, or behind, weve got a tax solution for you whether you want to be in the drivers seat with our DIY online expat tax service designed for U.S. citizens abroad or prefer to let one of our experienced tax advisors take the wheel.

Ready to get the tax season over with? Start the process with virtual Expat Tax Preparation from H& R Block today!

Was this article helpful?

Don’t Miss: How Much Are Payroll Taxes In Massachusetts

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Reportable Social Security Benefits

Iowa does not tax Social Security benefits. While Social Security benefits are excluded from income when computing tax, some Social Security benefits are included as income in determining whether a taxpayer has sufficient income to file an Iowa return, and are included as income for purposes of computing the alternate tax on line 39. NOTE: This also affects you if you are single and use the Tax Reduction Worksheet. The reportable Social Security benefit is calculated using the worksheet below and entered on Step 4 of the IA 1040.

Donât Miss: How Do You Qualify For Medicare Benefits

You May Like: How Much Does 401k Get Taxed

I Am Having Issues Downloading The Income Tax Forms Online What Is The Issue

The most compatible browsers for this form are Internet Explorer or Mozilla Firefox. If you are using Google Chrome or Safari and see a blank/warning/error message, please view the form within your computers Download folder instead of online.

Please ensure you download and open the form from your computer folder using Acrobat, as you will encounter issues when viewing and filling it out within your internet browser.

Fillable forms are in PDF format and contain JavaScript coding, which does not operate properly in internet browsers.

For more forms technical help, see .

You May Like: How To Pay Sales Tax For Small Business

Why Do You Pay Social Security Tax

Workers have to pay the Social Security tax for the same reason we have to pay any sort of tax: to support government programs in our society. Social Security benefit payments are, in essence, money that we receive from the government. Since more than 60 million people are currently receiving benefits, thats a lot of money the government has to spend. To foot the bill, the government can do two things: create the money or collect it through taxes.

Printing enough money every month to pay all Social Security benefits is effectively impossible. Inflation would skyrocket to catastrophic levels in no time at all. Therefore, collecting the money through taxation is really the only option.

In broad strokes, the idea of the Social Security tax is a reasonable one. Even though you have to cough up part of your paycheck now, you will eventually get that money back when youre on the receiving end of the system. Things are a bit more complicated when we depart from the general assessment, but the overarching theory makes sense.

Read Also: When Should We Expect Tax Refund 2021