Only One Person Can Claim The Same Qualifying Child

If a child meets the rules to be a qualifying child for more than one person, only one person can use that child to claim the EITC. Also, if the child qualifies for both a parent and a non-parent, the non-parent can only get the credit if he or she has a higher AGI than either of the child’s parents. After applying the tie-breaker rules, the person who does not claim the qualifying child may claim the EITC without a qualifying child, as long as all other requirements are met.

Kids And The Earned Income Tax Credit

If you claim one or more children as part of your earned income credit, each must pass certain tests to qualify:

-

The child can be your son, daughter, adopted child, stepchild, foster child or grandchild. The child also can be your brother, sister, half-brother or half-sister, stepbrother or stepsister or any of their children .

-

The child must be under 19 at the end of the year and younger than you or your spouse if you’re filing jointly, OR the child must be under 24 if he or she was a full-time student. There’s no age limit for kids who are permanently and totally disabled.

-

The child must have lived with you or your spouse in the United States for more than half the year.

Do I File A Tax Return If I Didn’t Work But Have A Dependent Child

The earned income tax credit reduces the amount of income tax that low and moderate wage earners have to pay. If you qualify for the credit, you get to deduct the credit from the amount of taxes youd otherwise owe. Families with children and without children who fall into certain income brackets can qualify for the tax credit. For some people, the earned income tax credit may be large enough that they wont owe taxes for the year.

Also Check: How Much Does H& r Block Charge To Do Taxes

Earned Income For Military Members

If youâre a member of the U.S. Armed Forces, you can choose whether or not you want to include nontaxable pay as earned income for the EITC. Examples of nontaxable pay from the armed forces are combat pay, the basic allowance for housing , and the basic allowance for subsistence . You can find the amount of your nontaxable combat pay in box 12 of your W-2 it has code Q.

When opting not to include nontaxable pay, you must exclude all of it. You cannot include some types and exclude others. However, if youâre married, you can also choose for just one spouse to include nontaxable pay as earned income while the other doesnât include it.

Members of the military who are on extended active duty outside of the U.S. are still considered to live in the U.S. for tax purposes.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Where Is My Tax Refund Ga

Earned Income Tax Credit Qualifications Explained

Should you choose to claim a child, or multiple children, as part of your earned income credit, note that certain requirements also apply. For example:

- The child must be a daughter, son, stepchild, adopted child, foster child or grandchild. They can also be your brother, sister, half-brother, half-sister, stepbrother, stepsister or related to you as a niece or nephew.

- The child must be under age 19 at the end of the year, or under 24 if he or she was engaged as a full-time student. Age limits do not apply to children who are permanently disabled.

- The child claimed must have lived with you or your spouse for more than half the year within the United States of America.

- Each child must have a social security number, which you must cite along with their birthdate

If you do not have children, but still meet the income requirements for your filing status, you may be able to obtain an EIC or EIT as well. In order to qualify, you must:

- Have resided more than half the year inside the United States of America

- Cannot be claimed by anyone as a dependent or qualifying child on their tax return

- Be between the ages of 25 65 at the end of the year

Combat Pay Normally Exempt From Tax Not Included In Agi

Under a special rule, those who receive combat pay can choose to count it as taxable income for figuring the amount of EITC. This may or may not increase the amount of the EITC. Normally, combat pay is exempt from tax. The IRS encourages those receiving combat pay to figure their taxes both ways to make sure they get the most benefit. There are also special rules for those with certain types of disability income and members of the clergy.

To learn more, go to IRS.gov/eitc for the Who Qualifies section or use the EITC Assistant.

Don’t Miss: 1040paytax.com Official Site

What Is The Earned Income Tax Credit

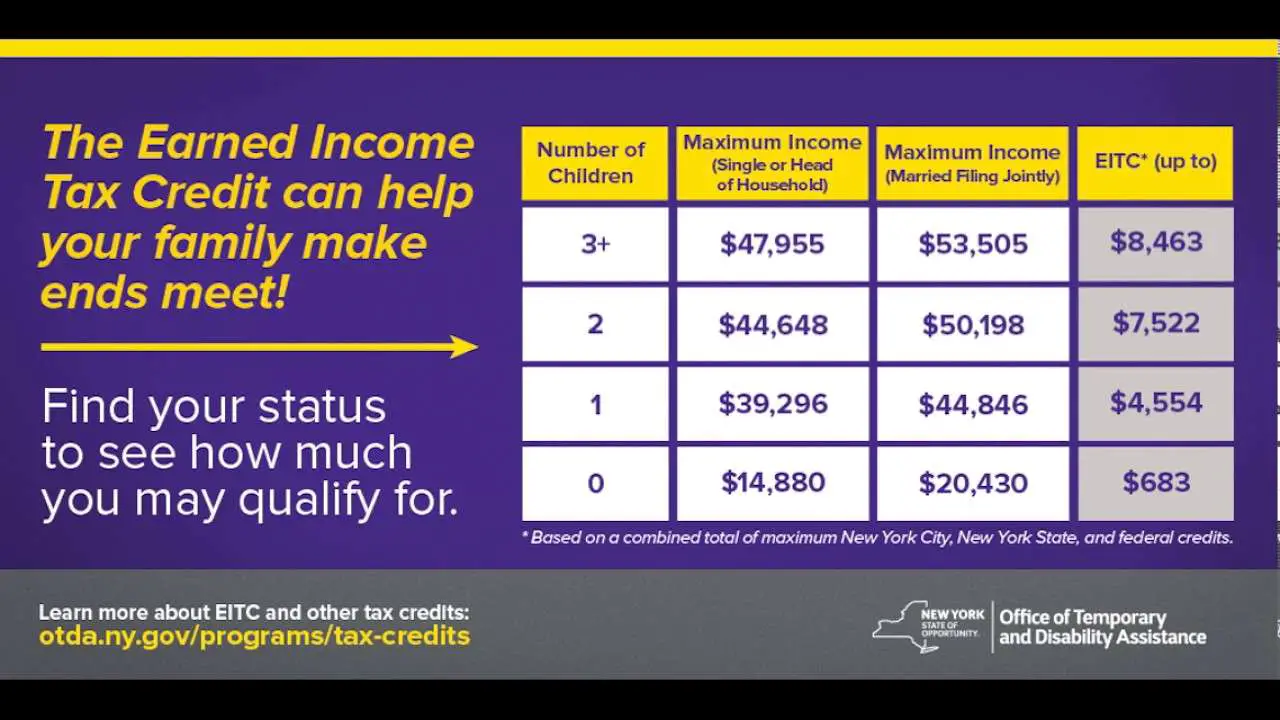

The Earned Income Tax Credit, or the EITC or EIC, is a refundable tax credit for low- and moderate-income workers. In 2021, the earned income credit ranges from $1,502 to $6,728 depending on tax-filing status, income and number of children. People without kids can qualify.

If you fall within the guidelines for the credit, be sure to claim it on your return when you do your taxes And if you didnt claim the earned income credit when you filed your taxes in the last three years but you think you qualified for it, the IRS encourages you to let it know so you can get that money back.

The $1.9 trillion American Rescue Plan Act changed some of the rules around the EITC. These changes are noted below.

Taxpayers Have New Option To Claim The 2020 Earned Income Tax Credit

In 2020, millions of Americans lost their jobs, were furloughed or worked fewer hours due to the Covid-19 pandemic outbreak. According to the National Conference of State Legislatures, unemployment rates increased in 2020 to 14.7% for April, compared to the previous year, where unemployment was only 3.6%.

Since the EITC is based on earned income, a taxpayer who only has income from unemployment will not qualify. To provide relief to those who have experienced a drop or elimination of earned income, Congress passed the Taxpayer Certainty and Disaster Tax Relief Act of 2020 in December. This Act allows taxpayers to report earnings from either 2019 or 2020 whichever year that provides the highest tax credit.

You May Like: How To Buy Tax Liens In California

Earned Income Tax Credit

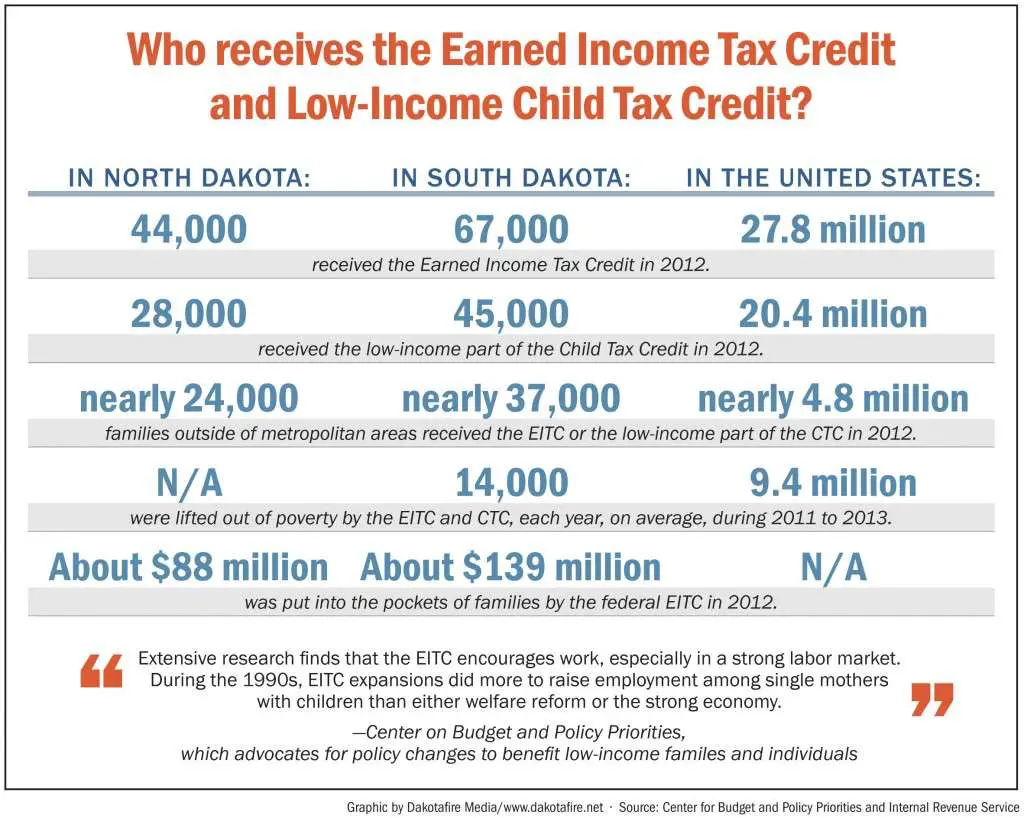

The United States federal earned income tax credit or earned income credit is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient’s income and number of children. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.

EITC phases in slowly, has a medium-length plateau, and phases out more slowly than it was phased in. Since the credit phases out at 21% or 16% , it is always preferable to have one more dollar of actual salary or wages considering the EITC alone. If the EITC is combined with multiple other means-tested programs such as Medicaid or Temporary Assistance for Needy Families, it is possible that the approaches or exceeds 100% in rare circumstances depending on the state of residence conversely, under certain circumstances, net income can rise faster than the increase in wages because the EITC phases in.

The earned income tax credit has been part of political debates in the United States over whether raising the minimum wage or increasing EITC is a better idea. In a random survey of 568 members of the American Economic Association in 2011, roughly 60% of economists agreed or agreed with provisos that the earned income tax credit program should be expanded.

Storefront Tax Prep Racs Prep And Account Fees Third

RALs are short term loans on the security of an expected tax refund, and RACs are temporary accounts specifically to wait to receive tax refunds, which are then paid by a check or debit card from the bank less fees. The combination of Earned Income Credit, RALs, and RACs has created a major market for the storefront tax preparation industry. A 2002 Brookings Institution study of Cleveland taxpayers found that 47 percent of filers claiming EIC purchased RALs, as compared to 10 percent of those not claiming EIC. The tax preparation industry responded that at least one-half of RAL customers included in the IRS data actually received RACs instead.

Advertisement phrases such as “Rapid Refund” have been deemed deceptive and illegal, since these financial products do not speed remittances beyond the routine automation of tax return processing, and do not make it clear that these are loan applications. Beginning with 2011 tax season, the IRS announced that they would no longer provide preparers and financial institutions with the âdebt indicatorâ that assisted banks in determining whether RAL applications were approved. Beginning with the 2013 tax season, major banks are no longer offering RALs but only RACs.

You May Like: How Does H And R Block Charge

Who Qualifies For Advance Payments

To qualify for advance payments of the Child Tax Credit, you must have:

- Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or

- Given us your information in 2020 to receive the Economic Impact Payment with the Non-Filers: Enter Payment Info Here tool or

- Given us your information in 2021 with the Non-Filer: Submit Your Information tool and

- Lived in a main home in the United States for more than half the year or filed a joint return with a spouse who has a main home in the United States for more than half the year and

- A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number and

- Made less than certain income limits.

Social Security Numbers Required For Everyone

The IRS reminds taxpayers to be sure they have a valid SSN for themselves, their spouse if filing a joint return, and each qualifying child before they file their return. For most people, the due date of the return is April 15, 2020. Most taxpayers can extend the due date for their 2019 tax return to October 15, 2020, by filing an automatic extension request with the IRS by the April 15 deadline. There are special rules for those in the military or for those out of the country.

Also Check: How Can I Make Payments For My Taxes

Who Is Eligible For The Dc Eitc

- Those District taxpayers who are allowed the Earned Income Tax Credit in filing their federal individual income tax return and did not claim the District Low Income Tax Credit.

- District taxpayers who do not qualify for the Earned Income Tax Credit for federal tax purposes can claim the credit on their District return if the taxpayer is:

Update Your Information For The Advance Child Tax Credit

Or you can use the Child Tax Credit Update Portal to:

- Confirm if youre enrolled to receive payments

- Un-enroll from the Child Tax Credit program to stop payments

- Provide or update your bank account information

To manage payments with the Child Tax Credit Update Portal, you may use an existing IRS username. Or, if youre a new user, create an account with ID.me.

Learn all about the child tax credit at childtaxcredit.gov.

Read Also: What Does Locality Mean On Taxes

What Is A Qualifying Child

For the purposes of the EITC, your “child” does not have to be your biological child. Rather, they must live with you in the U.S. for more than half the year, and have one of the following qualifying relationships with you:

- Son or daughter

- Sibling

- A descendant of any of the above

Your qualifying child must also be younger than you are and under the age of 19 at the end of the tax year24 if they are a full-time student. A child who is permanently and totally disabled can be any age.

How Much Is The Earned Income Tax Credit For 2019 And 2020

To determine how much earned income tax credit you qualify for, you can consult the IRS website, which offers a simple to use guide. EIC or EITC ranges from $529 up to $6,557 for tax year 2019, and from $538 to $6,660 for tax year 2020. As a general rule of thumb, the less money you earn, the larger the earned income credit youll receive.

When calculating earned income, be sure to include wages from your job, salary, tips, and other taxable forms of payment that you receive. Your adjusted gross income is your earned income minus select deductions. Both must fall below the maximums outlined in the IRS chart in order for you to qualify for the EIC or EITC.

Recommended Reading: Buying Tax Liens California

What Is The Eitc

The EITC is a refundable tax credit. Refundable tax credits are known as refundable because if you qualify for the credit and the amount of the credit is larger than your tax liability, you will get a refund for the difference. In contrast a non-refundable credit can only reduce tax liability to zero and cannot generate a refund.

The EITC acts as a wage subsidy for certain workers. Originally enacted in 1975 by the Ford administration, it was expanded in 1990, 1993, 2001 and 2009. This year, with the American Rescue Plan, the EITC was temporarily expanded .

The EITC has been the subject of political debates for nearly half a century. One of the main talking points is whether its a better idea to increase the EITC or raise the minimum wage. This is because the two welfare ideas have similar goals in raising working people out of poverty.

The EITC provides benefits to working people with earned income, not to non-working people. This makes it a form of a negative income tax, where earners below a certain threshold receive money from the government rather than pay money from their income.

Since the EITC goes to workers, it is not considered a handout by many, although it could be considered a form of welfare. Some proponents argue that raising the minimum wage is a more efficient way to help the poor than adjusting the EITC, while others believe the EITC is more effective than raising the minimum wage.

Child And Dependent Care Credit

If you paid a care provider to care for a child or other dependent while you worked or actively looked for work, you might qualify for the Child and Dependent Care Credit.

The credit is worth a percentage of your allowable care expenses. You can use up to $3,000 of expenses for one dependent or $6,000 of the costs of care of two or more dependents. The percentage ranges from 20% to 35% of your expenses, depending on your income. The higher your income, the lower your percentage. However, there is no upper limit on income for claiming the credit.

To qualify, you must have paid someone to care for:

- A child under age 13 at the end of the tax year whom you claim as a dependent on your return

- Your spouse, if they are unable to take care of themselves and lived with you for at least half the year

- Another person claimed as a dependent on your return, if that person cant take care of themselves and lived with you for at least half the year

These are just a few tax deductions and credits available to individuals and families in 2019. If you might qualify for one or more of these tax breaks, take time to research the rules or talk to a tax professional. Claiming them can significantly lower your tax bill or even result in a generous refund.

You May Like: Tax Lien Investing California

Valid Social Security Number

To qualify for the EITC, everyone you claim on your taxes must have a valid Social Security number . To be valid, the SSN must be:

- Valid for employment

- Issued before the due date of the tax return you plan to claim

For the EITC, we accept a Social Security number on a Social Security card that has the words, “Valid for work with DHS authorization,” on it.

For the EITC, we dont accept:

- Individual taxpayer identification numbers

- Adoption taxpayer identification numbers

- Social Security numbers on Social Security cards that have the words, “Not Valid for Employment,” on them

For more information about the Social Security number rules for the EITC, see Rule 2 in Publication 596, Earned Income Credit.