Complete Your Paperwork Properly

As you probably know, handling government paperwork can be a bit of a hassle. There can be lots of picky information that you need to include, details that you need to look up, and so on. However, it is important that you give this process the respect it deserves. Make sure you input all the correct information that you gathered during your research stage in order to

What Is A Property Tax Assessment Appeal Letter

Now that you know what a property tax assessment is, it is time to define what a property tax assessment appeal letter is. A property tax assessment appeal letter is a letter you send if you believe that your property assessment for tax purposes has not been done correctly. Your appeal should be done in writing, and you should also have copies kept so that your case wont be ignored or contested.

If you are a property owner, you may have come across this problem numerous times, but maybe you did not know how to appeal or did not know that your tax bill has increased. Knowing how to calculate property tax is vital if you want to overcome this problem. Assessors make mistakes unknowingly, leading to over-taxation of your property.

The first step you should take in the appealing process is sending a Knowing the format of a property assessment tax appeal letter is important when you have a case to present. We have provided a sample below to give you an idea of what a property tax assessment appeal letter looks like in the tax assessors office.

Property Tax Exemptions For Older Adults

In many states, home and property owners above a certain age can receive a property tax exemption. The specific details regarding the cutoff age and other eligibility requirements, such as Social Security status, may also play a part. Furthermore, there may be some additional requirements or other criteria. This kind of exemption could be a lifesaver for many older adults because 4.9 million Americans ages 65 and older were living in poverty as recently as 2019.

Also Check: Can I Get Stimulus Without Filing Taxes

What Happens After Sending The Letter

After you send the letter, youll usually get a response back to confirm it was received. Sometimes the communication you get will assign you a case number or appeal number other times it may even include a scheduled date and time for a hearing. The amount of time youll get to put your case together varies by state. Some states, like California, have so many hearings that your own date could be as far out as a year. For other states it could be as little as 30-45 days.

Ways To Assess Property Value

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owners property. The assessed value estimates the reasonable for your home. It is based upon prevailing local real estate market conditions.

The assessor will review all relevant information surrounding your property to estimate its overall value. To give you the most accurate assessment, the assessor must look at what comparable properties are selling for under the current market conditions, how much the replacement costs for the property would be, the maintenance costs for the property owner, any improvements that were completed, any income you are making from the property, and how much interest would be charged to purchase or construct a property comparable to yours.

The assessor can estimate the market value of the property by using three different methods, and they have the option of choosing a single one or any combination of the three.

Recommended Reading: Can You Track Your Tax Return

What If I Cant Pay My Property Taxes

After April 30th, property taxes are considered delinquent and subject to 1% interest per month. If your taxes are still delinquent on June 1st, you are subject to a 3% penalty. Interest continues to accrue until the taxes are paid in full. If you pay the first half of your taxes by April 30th, but fail to pay the second half by October 31st, the unpaid portion is subject to 1% interest per month. Any taxes still owing on December 1st are subject to an additional 8% penalty.

For example, if you pay your 2009 property taxes on December 31, 2009, the amount due includes 8% interest and an 11% penalty.

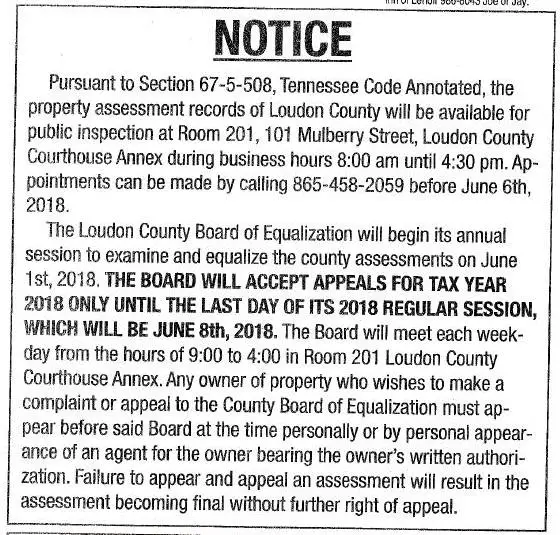

When Do You Send The Property Tax Appeal Letter

Typically, property owners have 30-45 days from the time they receive their valuation notice to send a property tax appeal letter. Thats a relatively small windowwhich means you wont have time to confirm your belief that the assessed value is too high before notifying the jurisdiction you intend to appeal. So if you do feel youve been assessed unfairly, send the letter to buy the time you need to research the matter properly. If it so happens that you discover the stated value is correct, you can always withdraw your appeal.

Recommended Reading: How To Transfer Money From India To Usa Without Tax

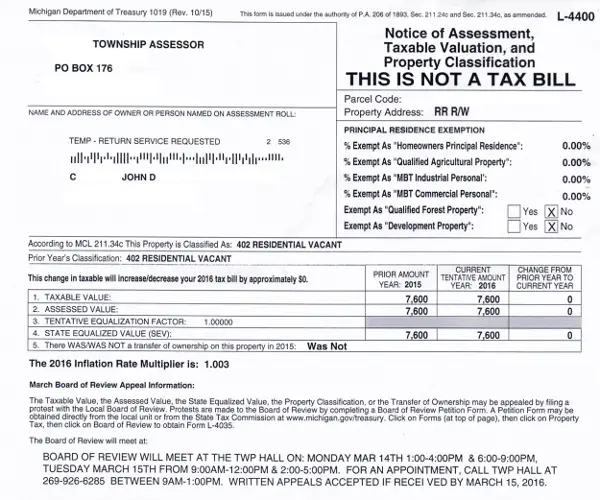

Check Your Property Tax Assessors Website

Property tax appeal procedures vary from jurisdiction to jurisdiction. As soon as you receive your proposed property tax notification, check your municipal or county tax assessors website to learn what you need to do next. The website should be clearly marked on your notification letter.

When you visit the site, note:

- Protest and appeal deadlines

- Phone numbers to call for pre-appeal consultations

- Locations, open hours, and dates for in-person hearings

- Acceptable forms of documentation and evidence supporting your claim

Many jurisdictions also include review and appeal instructions on proposed property tax notifications directly. These notifications are often sent late in the year before new rates go into effect. Your proposed property tax notification will include an appeal deadline, which can be as little as 30 to 45 days after you receive the notification but may be longer

Who Is On The Board Of Property Tax Appeals

BoPTA members are private citizens appointed by the Multnomah County Board of County Commissioners. They are not professional appraisers, but have training, experience and knowledge in property valuation.

BoPTA members are not part of the Assessor’s Office and they play no role in setting any of the values on your property.

BoPTA may be thought of as a panel which decides the value of your property based on the evidence you present.

Read Also: How Much Taxes Do The Top 10 Percent Pay

What Is The Homestead Exemption

The homestead exemption is a way to minimize property taxes for homeowners. It is also a legal provision offered in most states that helps shield a home from some following the death of a homeowner’s spouse or the declaration of bankruptcy. The homestead tax exemption can provide surviving spouses with ongoing property tax relief, which is done on a graduated scale so that homes with lower assessed values benefit the most.

The homestead exemption is helpful since it is designed to provide both physical shelter and financial protection, which can block the forced sale of a primary residence. However, the homestead exemption does not prevent or stop a bank foreclosure if the homeowner defaults on their mortgage. Foreclosure occurs when a bank takes possession of a home due to a failure to make timely mortgage payments.

When Will My Hearing Be Scheduled

Hearings start in mid-February and run until April 15. Hearings take place in 10 minute increments from 9 am-2 pm, Monday-Thursday at the Multnomah Building .

-

Notices of hearing will be mailed 5-10 days in advance of the scheduled time. You may also call or chat our Customer Service office to find out your scheduled hearing time.

-

Hearing times cannot be rescheduled. If, after your hearing is scheduled, you find you cannot attend, you may send a qualified representative. To designate a representative, fill out and submit the.

-

If you are in need of special assistance, please call or chat our office and we will be able to help you.

Recommended Reading: Do I Pay Taxes On Stimulus Check

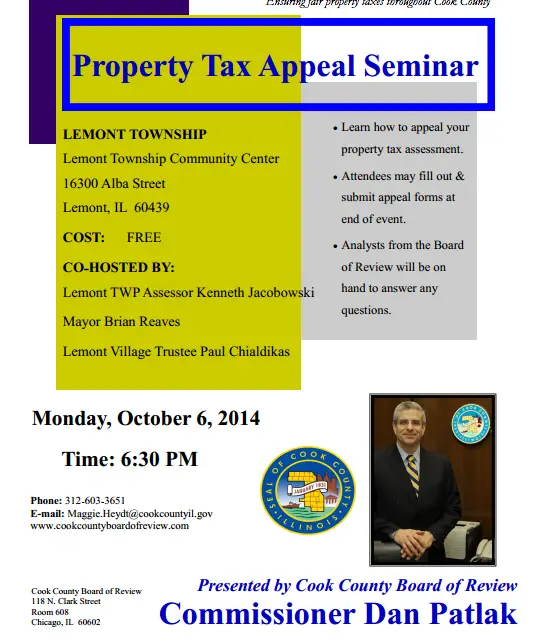

How Hard Is It To File An Appeal

Kevin DeTurris, a Fairfax County attorney with the firm Blankingship and Keith, said that most home value appeals can be easily handled by the homeowner and that using attorneys is usually only needed for large commercial properties. By the same token, a successful appeal typically saves the homeowner just a few hundred dollars, so its not worth the cost of obtaining a full appraisal.

An exception applies to homeowners who have recently refinanced their home to take advantage of low interest rates. If the refinance involved a professional appraisal, and that appraisal says the home is worth less than what the government estimates, the appraisal can be used as evidence in an appeal.

DeTurris advises finding recent sales of homes of similar size and quality to yours in the nearby area. If a house down the street sold for less than the estimate, youve got good grounds for an appeal. Even if a home sold for the same or more than your current home, if it was larger, had more bedrooms or bathrooms or other amenities than your home does, that can still be used to argue for a lower appraisal. The best way to do this is to search through your local tax database online, then fill out a form to begin the appeal process.

Appeals can also be made for errors in property description for example if an assessment says your home has four bedrooms when it only has three.

What Is A Tax Assessment

In order to calculate how much a property owner must pay in property taxes, the assessed value of the property in question must first be determined. Depending on where you live, that value could be determined by having a tax assessor physically visit the property to determine its value, though that’s not always the case. Some jurisdictions assess properties based on their , while other locations multiply the market value by an assessed rate to find the final assessed value.

Along with any exceptions, which we will address below, the assessed value of a property is dependent on the local property tax rate, as well. A property tax rate, also known as a mill rate, is multiplied by the final assessed value of the property in order to come to the property tax bill.

How often these assessments take place also depends on where you live. In many locations, such as Arizona, California, and West Virginia, tax assessments occur every year. However, in many other states, the frequency with which tax assessments take place can be as long as 10 years, or entirely at the discretion of the municipality. You should make sure you know when your assessments will take place in order to properly seek certain exemptions. Ideally, property tax assessments should take place on an annual basis so you’re only paying the amount that is typically determined at the local level.

Also Check: How To File Taxes With No Income

Prepare A Strong Case

If you do decide to appeal your property tax assessment, youll need to prepare a presentation and plead your case. If you are not equipped to do this then you will likely need to hire an experienced consultant to present on your behalf or to assist you. Fees, travel costs, and preparation cost will increase the cost of an appeal, so you will want to be confident your case is credible. Even so, depending on the complexity and size of the case, a board may defer the decision-making authority to a court of law. Focusing your resources on the more egregious assessments should be your strategy.

To assist you with these decisions, property tax software like TotalPropertyTax can help identify assessment reduction opportunities. It also provides easy access to rich data, allowing you to review and protest valuation differences, and simplifies the appeal process by including appeal forms in the software.

How To Appeal The Property Tax Assessment On Your Home

You can reduce your property tax by appealing the value applied to your home by an assessor. The assessed value is what is used to determine how much tax you owe. One way to lower property tax is to prove that your property is worth less than its valuation. You can do your initial research online or by calling your real estate agent. Heres how to appeal the property tax bill, step by step:

You can start by researching what to do to complete the process. Researching can be more time-consuming than the actual appealing process. Ensure that you build a strong case after doing your research. The appealing process varies slightly from state to state. In some states, you will have up to 45 days to build a case, and in others, you have up to a year.

Transaction privilege tax will help you build a strong case in a shorter time as it helps with data entry and any information needed to back your case.

Therefore, you should call your local tax assessors office to get information on the appealing process in your area. Normally, the state is required by law to send you the valuation letter. If you dont receive the notice, you should file a property tax return form.

The first step is to send your property tax assessment appeal letter to the tax assessors office within 45 days of receiving the valuation letter.

Don’t Miss: How To Get Property Tax Exemption

Do I Need To Hire Someone To File An Appeal

You do not need to hire anyone to file an appeal for you. Filing an appeal is free and can be done online in as little as 20 minutes.

You may have received a notice in the mail from a property tax firm saying they can file an appeal on your behalf. These notices do not come from our office and are sent by firms which charge you a fee based on their estimates of how much they think they can save you in property taxes. These estimates may or not be accurate.

Check For Errors In The Municipality Assessment

You wouldnt be trying to appeal your property value assessment if you werent convinced that there was at least one error that will eventually force you to pay higher property tax levels. Therefore, compile each of the errors that you notice and formally list them. This way, you can easily reference this information later on when it comes time to formally appeal your property value assessment with your local municipality.

Also Check: Do You Pay Taxes On Inherited Money

Who Is Eligible For A Homestead Exemption

Eligibility for the homestead exemption varies by state. Typically, you will be eligible if your income is low, you are a senior, you have a disability, or you are a veteran. Exemptions can be combined if you fall into more than one category. There may also be a limit on the value of a home that can qualify for an exemption. Check with your local tax assessor.

Why Would You Appeal Your Property Taxes

There are several reasons why you may want to appeal your property taxes. Examples are:

Your Propertys Assessed Value Is Wrong

If your property was valued more than comparable homes in your area, consider filing an appeal. For example, if a three-bedroom home was valued at $200,00 and your three-bedroom home was also valued at $350,000, there may have been an error. Its also worth noting that your propertys tax-appraised value doesnt have to be the same as its market value.

Your Assessment Contains an Error

A professional appraiser will establish your propertys worth by taking into account its renovations, construction, etc. However, if you find that one of those considerations is wrong, it would be a good idea to challenge the assessment. Suppose you own a two-bedroom home, but the tax assessment says that it has three this can significantly increase the calculation, so its best to file an appeal.

Recommended Reading: Are Charity Donations Tax Deductible

Property Tax Appeals: When How & Why To Submit

Taxes are still one of the certainties in life , but the same cant be said for the amount of taxes paid. Thanks to the property tax appeal process, valuation amounts are never set in stoneas long as you take full advantage of your right to challenge an unfair assessment.

The appeal process kicks off with a simple property tax assessment appeal letter. Below is what you need to know about why you might need an appeal, completing and submitting these letters, how to ensure you dont make the mistake of missing important appeal deadlines, and a sample property tax appeal letter you can use as a reference.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Which States Are Tax Free