Why Your Taxes Keep Getting Higher

Property taxes are determined based on the value of your property and the tax rates set by local jurisdictions. Since Texas does not allow income tax, the property taxes are higher than in other states. With multiple inputs, there may be many reasons why your tax bill is high. We will address a few of them in this article.

Tradeoff For Lower Sales Tax & No State Income Tax

Texans have some of the highest property taxes in the U.S., but we have one of the lowest sales tax rates and no state income tax. For many, the increased property tax rates are a straightforward tradeoff for these benefits. Because we pay less in taxes elsewhere, the state and local governments and taxing units have to get funding somewhere. In many cases, that funding has come from property taxes.

How Can You Lower Down Your Taxes

There are multiple ways of lowering down your taxes.

Property taxes vary from state to state and county to county. You can move to a less expensive area that has low property taxes. Some states dont even charge state taxes and have property taxes lower than 1%. If you want to own a lot of property, then you can move to such states and remain in benefit.

A lot of states have homeowner or old age exemptions available. There are some tax relief policies for the disabled, underprivileged, old age, and agricultural purposes. Do check if you meet the eligibility criteria for it. These exemptions save you hundreds of dollars yearly.

Sometimes local governments have errors in the taxation process, and they can send you the wrong bills. So do check your tax cards that have all the details of your taxes. If you notice errors, then you can ask for a reevaluation. There are some storage sheds or greenhouses in your home. If you do not need them, and it is adding up extra charges in your tax, then get rid of such things immediately. But dont forget to notify your assessor so that they dont add it up in your taxes.

Recommended Reading: Can You Still File Taxes After Deadline

Failure To Seek Refund Of Documentary Transfer Tax Erroneously Paid

This one always raises eyebrows. Most sellers of commercial property assume that if the Recorder demands payment of the tax as a condition to recording the grant deed or other transfer document, the tax must be owed. Not necessarily so. We recently recovered $170,000 for a seller who had no idea that no tax was owed, but the Recorder, once we provided the legal basis, quickly refunded all taxes paid. The documentary transfer tax statutes are ancient and ambiguous, and counties have resisted every effort to clarify those statutes at the state level. Couple that with the fact that most sellers are only giving up a small portion of their gains , and you have the perfect setting for a painless tax.

These are just the more common examples of non-value ways to reduce taxes related to commercial real estate in California. Since each requires timely action on the part of taxpayers, many of these opportunities are lost simply because an owner is unaware that the procedure exists or despite knowing about it, fails to appreciate the consequences of procrastination. AVS can help get you off the dime contact us at 415-956-8090 or .

All you have to lose is your money.

About the Author

What Is The Iowa Income Tax Rate

Once current reforms have phased in, Iowa will be able to boast a 3.9 percent single-rate individual income tax, a 5.5 percent flat corporate income tax, and no inheritance tax or alternative minimum taxes. Improvements have been made to the state sales tax base and several tax credits have been reformed.

You May Like: Where Do I Report 1099 Q On My Tax Return

But First Lets Unravel Utahs Truth

This law sets up a system that allows taxing jurisdictions to receive only the amount of revenue they collected the year before, plus whatever taxes they got from new development in their jurisdiction.

Because of those constraints, when property values in a jurisdiction rise, tax rates automatically adjust downward to offset the additional revenue that the taxing entity would have collected from appreciation.

If a taxing jurisdiction wants to create additional revenue to pay for things like new public safety services or water infrastructure, officials in that jurisdiction would need to hold a truth-in-taxation hearing.

Those hearings put governing bodies in the political hot seat, forcing officials to explain to the public why they want to raise property tax rates. They usually attract an abundance of opposition, and that political blowback often prevents, or at least reduces, major tax increases.

About half the time, entities that seek a rate hike back off their initial proposals, according to John Valentine, chair of the Utah State Tax Commission.

Questions About Your Property Taxes

Property taxes are calculated using the assessed value of your property and multiplying it by the combined municipal and education tax rates for your property class.

Your municipality or local taxing authority determines their revenue requirements, sets municipal tax rates and policies, and collects these property taxes to pay for your municipal services.

You can search for your municipality and contact them for more information about your property taxes.

Don’t Miss: What Is Property Tax Used For

Has Anyone Tried To Fix This

Texas legislators have tried numerous ways to limit property tax growth.

Lawmakers have raised the states homestead exemption the portion of a homeowners home value exempt from taxation to $25,000.

State law also limits the taxable value of a home from rising more than 10% in a given year on an owners primary residence. In Travis County, the median market value of a home grew nearly 54%. But the median taxable value of a home in Travis County rose by about 11% after also accounting for the construction of new homes just coming onto tax rolls for the first time.

In 2019, lawmakers passed a pair of laws aimed at slowing growth. House Bill 3 was an $11.6 billion school finance bill that included $5.1 billion to lower school district taxes, $6.5 billion in new school spending and caps on school districts tax rates. Senate Bill 2 required many cities, counties and other taxing units to get voter approval if they want to raise the property tax revenue they collect from all property owners by 3.5% or more than the previous year.

According to a study by the Texas Taxpayers and Research Association, the bills worked sort of. The study says Texas taxpayers would have shelled out $6 billion more in property taxes than they did in 2021 if not for the two bills the result of falling tax rates.

But that doesnt mean everyones paying less in taxes. School tax rates dropped by 13% since the bills passed in 2019, but taxable property values rose by 23%, according to the study.

How Are Home Values Affecting Property Tax Bills

Taxing jurisdictions look at property tax revenue as a whole, not on a category-by-category basis.

Utahs housing market is booming, and the value of residential properties shot up exponentially more than commercial properties, many of which are seeing sluggish growth coming out of the COVID-19 pandemic.

Many businesses dont want to buy an office building right now because everybodys dealing remote work, Valentine said. So your value didnt increase very much, or even maybe went down.

Because home values grew so far and so fast, and commercial property values grew relatively slowly, homeowners are taking more of the tax burden to meet revenue needs for taxing jurisdictions.

Lets look to Salt Lake County as an example. In 2022, the median residential property value was $561,100, a whopping 28.7% higher than the year before.

This is unprecedented, really, Salt Lake County Assessor Chris Stavros said.

Commercial property values, meanwhile, climbed by 11.8%.

The difference in growth between both categories of property created a natural shift in taxation from commercial property owners to residential property owners.

Note, however, that appreciation only hurt homeowners whose property value grew by more than the median increase in a given jurisdiction.

If an individual propertys valuation went up less than the median increase to the taxing entities they paid to, Stavros said, then they probably saw a decrease or no increase.

Don’t Miss: How Long Does It Take To Get Your Taxes

How Can Home Tax Solutions Help

We offer some of the most competitive property tax loan terms in the state of Texas. These property tax loans allow homeowners to repay back property taxes, split the cost of their current home taxes into more manageable payments, and avoid the hefty fines and penalties from the state. We dont check individual credit scores to determine eligibility, but we will need a little bit of information about you to get started. Simply complete our online form. A team member in the office location closest to your home will be in touch soon to discuss your options.

Does Canada Have Property Tax

Canadian property tax ratesEvery municipality across Canada determines its own annual property tax rate. Typically, this number falls between the range of 0.5% to 2.5%. Note that the size of your property, what you paid for it, and your income play no role in how much you will pay in property taxes.

Read Also: Are There State Taxes In Florida

The Bc Assessment Website Shows Comparable Homes And Recent Sales In My Area Is That A Tool I Or My Real Estate Agent Can Use To Decide A Listing Price

While assessment values dont directly translate into a homes listing or selling price, Stewart recommends buyers and sellers check the B.C. Assessment website for information that can help in a decision to buy or sell.

As far as when youre looking at selling or buying and if you want to look at assessed values for your property type, for other recent sales and just for things that are just neighbouring, that have turned over, he said.

If you notice anything particular in there, that is great publicly accessible data that empowers you as a buyer or seller.

Why Your Property Tax Bill Is So High And How To Fix It

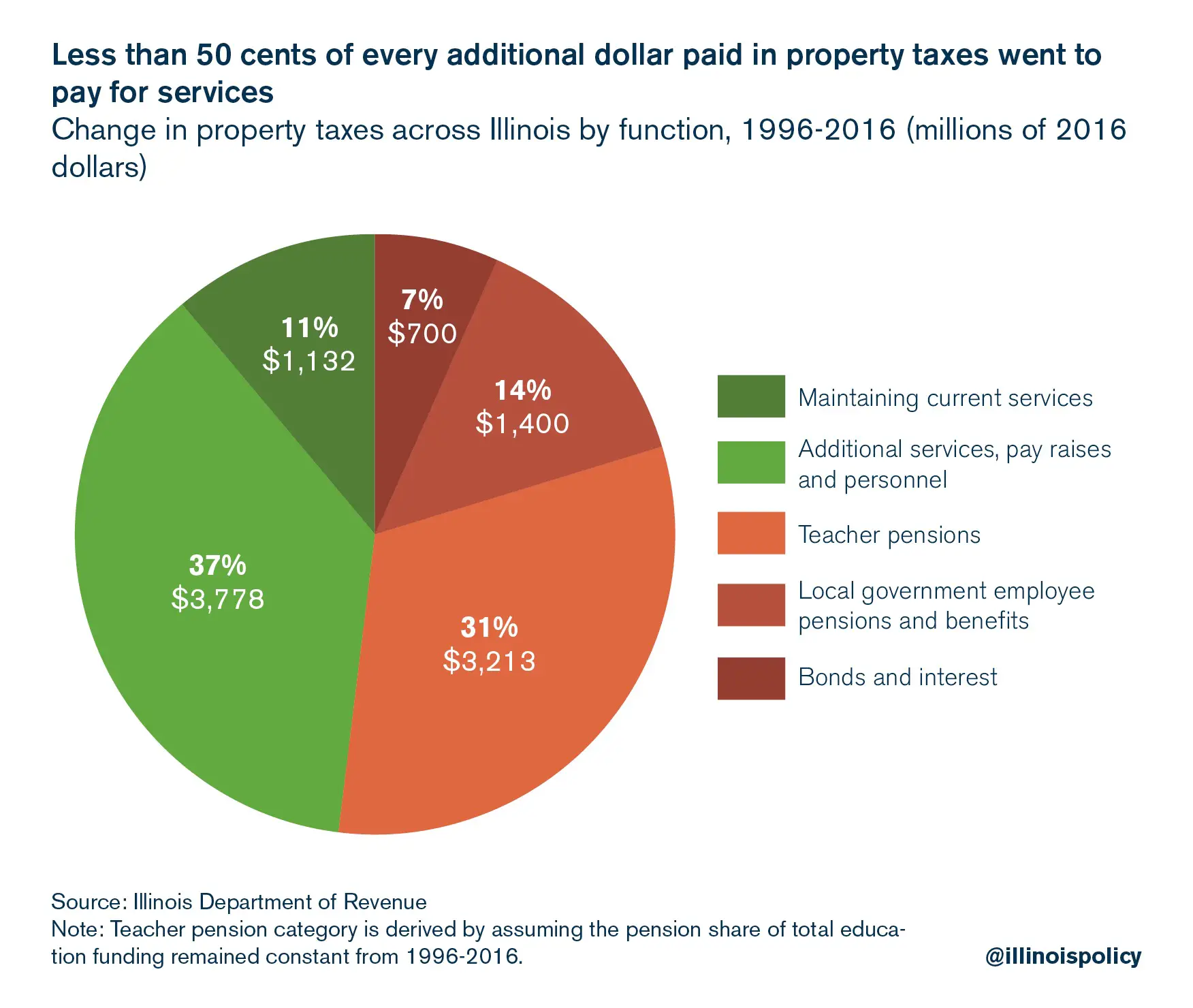

Less than 50 cents of every additional property tax dollar over the last 20 years went to pay for services that raise home values. Instead, the primary driver of the rise in property taxes was pension costs.

Vicki McCarthy purchased her home in northern Illinois Round Lake Beach in 2002, paying $195,000. She now pegs that homes value at around $180,000 and is staring at a property tax bill of nearly $8,000 a year.

Illinoisans such as McCarthy know all too well the pain of their property tax bill. Researcher after researcher pegs them as some of the highest in the country, if not the highest.

What Illinoisans may not know is that as recently as 1996, property tax bills in the Land of Lincoln were hovering around the national average. But a punishing 80 percent increase in residential property taxes since then, adjusted for inflation, has rocketed Illinois to the top of the table.

What happened in those 20-some intervening years? The truth holds the key to fixing the state. And politicians touting further tax increases and opposing sensible spending changes would prefer voters didnt know.

The answer, revealed in a new report from the Illinois Policy Institute, is a rapid rise in pension costs.

Across the state, home value appreciation is severely lagging the national average despite property taxes increasing at a frenetic pace.

So if the problem wasnt state money, how come property taxes exploded? The answer is found by following where that money went.

Don’t Miss: How To Claim Stock Losses On Taxes

What Are Property Taxes

Often considered the financial backbone of local government, property taxes are generally levied by your municipality, county government, and in some cases, your local public school system. When collected, they help pay for your community’s needs, such as emergency services, trash collection, and public libraries, to name a few.

Property taxes are what’s called an ad valorem tax, which is considered by some circles to be a regressive tax, which means it’s based on the assessed value of a property. How much you’ll pay in property taxes will depend on several factors and varies among municipalities. Furthermore, some municipalities may levy taxes on more than just real estate, opting to include other tangible personal property, such as vehicles or furniture.

Does An Increase In My Mpac Property Assessmentmean My Property Taxes Will Go Up

Not necessarily. When a province-wide assessment update occurs, the most important factor is not how much your assessed value has changed,but how your assessed value has changed relative to the average change for your property type in your municipality.

Explore the examples below to see how changes to property assessments can impact property taxes.

If your assessed value percentage increase is lower than the average for your property class, your taxes will likely decrease.

If your assessed value percentage increase is lower than the average for your property class, your taxes will likely decrease.

Previous assessment: $420,000Average increase of property class: 5%

Property taxes likely decrease.

If your assessed value percentage increase is higher than the average for your property class, your taxes will likely increase.

If your assessed value percentage increase is higher than the average for your property class, your taxes will likely increase.

Previous assessment: $420,000Average increase of property class: 5%

Property taxes likely increase.

*These examples assume that there are no changes in the budgetary requirements of your municipality or local taxing authority.

Don’t Miss: How To File Joint Taxes For The First Time

Home Improvements Increase Assessed Value

One of the most significant causes of property tax increases, which is also among the most controllable, is a rise in the value of a property due to home improvements. Adding a home office, a swimming pool or an addition to your home will undoubtedly increase its value at the time of the next assessment. Since assessments determine the value of the home, and property taxes are based on this value, a higher assessment means a higher tax bill.

Other improvements, including adding a garage or shed or improving fencing may also result in a higher assessed value. If a taxpayer objects to an increased assessment, he can file an appeal to request a lower assessment amount.

Why Is My Property Tax Higher Than My Neighbors

In the majority of cases, this will be due to the assessed value of your home being higher. Your home may have a higher value if you have a larger plot of land, if your home is larger, or if your home has desirable features. In some rare cases, however, you may live in a different jurisdiction from your neighbor.

Recommended Reading: Do You Have To Pay Taxes On Life Insurance Payout

How Do I Apply For A Homestead Exemption

For details on homestead tax exemptions, go directly to your county or local tax assessor’s website. Some states require you to fill out an application . Make sure you comply with your state’s application deadlines.

Also, be aware that some sites may be fraudulent and may request payment to fill out an application. Your county or local tax assessor will not require you to pay a fee to fill out an application for homestead tax exemption.

Practical Reasons Why Property Taxes Are So High In Your Neighborhood

Home buying is an expensive affair. If you are a homeowner, it means you also owe your local government property taxes. Property tax money is used to fund several public services you receive. You must contribute even if you dont directly benefit from some such services.Alas! Your woes don’t end there. The value of your home or the land on which it is built isn’t fixed, which means your property tax can’t be fixed either. While there are factors that can make your propertys value higher, Learn why and what you can do about it here, some things may be out of your control. Are you wondering why your annual property tax bill is especially high this year? Here are 7 major factors you should consider:

Read Also: Can I File Old Taxes Online

What If The County Rejects My Appeal

You still have options, but it will require jumping through more hoops. You can take your case to the Utah State Tax Commission, which has a few ways of seeing if your county got your valuation right.

Cases that make it to the tax commission also have a fairly good success rate. Most of the time, taxpayers get at least some change to their valuation, according to Valentine, the commission chair.

You can start with an informal hearing, where you tell your story, the county tells its story, and a judge decides. You could also waive this informal hearing and go straight to a formal hearing. Theres also the option of going to mediation, where a judge will help you and your county come to an agreement on what the valuation of your property should be.

If you cant reach an agreement through mediation, you can get a new judge and go through a formal hearing.

Still didnt get an outcome you like? You have another set of options.

You can take the record from your formal hearing and send it straight to the Utah Supreme Court to make a call, or you can file the case in district court.

Appeal The Assessed Value

There are two main ways to pay property taxes. Your mortgage lender can wrap your property tax payment in your monthly mortgage bill, then pay the tax on your behalf when its due. Or, you can pay the tax directly to your local government typically once a quarter.

In both cases, your local tax assessor should send you a statement that explains how they calculated your tax bill. You wont be able to appeal the tax rate, which is usually set at the county level, but you can appeal the assessed value of your home if you feel its incorrect.

Contact your local tax office. Ask how you can appeal your tax bill and request a copy of your propertys current assessment. Youll usually submit a form, but every city or county has a different system for filing an appeal.

Go over your homes assessment. Read through the document and look for areas in which you think mistakes were made, said Tendayi Kapfidze, Lending Trees chief economist. For example, if youre told your lot size is 10,000 square feet, and you can prove its only 8,000, you might be able to get the assessed value of your home lowered.

Order an appraisal. Tax assessors may rely on historical data to come up with your assessed value, Kapfidze said, but a private appraiser can provide a much more detailed examination of your home. Depending on what the appraiser says about the value of your home, you can use their findings to appeal how much money the government says you owe, he noted.

You May Like: How Much To File Taxes