How Can I Contact The Irs

You can call the IRS using their toll-free line at 1-800-829-1040.

However, be prepared to stay on the line for a long time before your call is answered.

Also, according to the Taxpayer Advocate, it appears that only 1 in 9 calls are answered by the IRS.

This means that 8 out of 9 callers will not even get through to the IRS.

Reasons You Havent Received Your Tax Refund

Delays in tax refund could trigger anxiety as the filer might need the money to meet a significant expense. Most Americans would have received their tax returns already by this time around. However, sometimes, a tax return gets delayed by a few cases although a filer affirms to do everything right, there are still some common reasons that could delay your tax return. Lets discuss these reasons briefly to present you with an overview.

How Will I Know If I Am Being Audited

In most cases, a Notice of Audit and Examination Scheduled will be issued. This notice is to inform you that you are being audited by the IRS, and will contain details about the particular items on your return that need review. It will also mention the records you are required to produce for review.

Also Check: How To Figure Federal Income Tax On Paycheck

Checking Your Refund Status

Anxious to get your tax refund? You can find out the status of your federal tax refund by pushing the Refund Status button. To find out whether your refund is on its way, youll need to enter your Social Security number, your tax filing status and your anticipated refund amount.

The IRS says that it sends out most tax refunds in less than 21 days. If youve e-filed your tax return, you can check your refund status within 24 hours. If youve filed a paper tax return, however, you may not find out where your refund is for about four weeks.

Keep in mind that theres more than one way to check the status of your tax refund. The IRS offers a Wheres My Refund tool online. If you havent received your refund 21 days after filing electronically or more than six weeks after filing a paper return, you may need to contact the IRS by phone.

You May Like: Buying Tax Liens California

Avoid Tax Refund Delays In 6 Simple Ways

After preparing your tax return and discovering you will get a refund, you might start planning how to spend or save it. But mistakes on your 1040 can keep you waiting for that refund. When your return is right to start with, the chances that youll get your refund quickly go way up. Likewise, the chances that youll get a letter from the IRS go way down and thats always good news, says IRS spokesperson Eric Smith.

We evaluated and mentioned the common mistakes that can slow the processing of your tax return and get your refund. You must avoid these six errors to get your refund faster. However, according to AARP, you can avoid the delays by following six simple ways.

You May Like: What States Allow Tax Deductions For 529 Contributions

Your Tax Return Is Still Being Processed Takeaways

So there you have it folks!

According to the IRS, most tax refunds are issued within 21 calendar days from the moment you have filed your electronic tax return.

If you have not received your tax refund within this timeline, there may be a reason why theres a delay.

There may be a variety of reasons for the IRS delay but the common ones are:

- Your tax return included errors

- Your tax return is incomplete

- Your return has been flagged for identity theft or fraud

- Your return includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit your return will be delayed.

If your refund is delayed is does not automatically mean that youre being selected for an audit.

Should the IRS need more information from you to process your return, they will contact you by mail. Now that you know the your tax return is still being processed meaning, the common causes for the delay, how you can check the status of your return, and how you can expedite your tax return processing, good luck with your income tax refund!

You May Also Like Related to Your Tax Return Is Being Processed

Form 8379

How Long Will My Refund Say Processing

As one would expect, IRS employees are stretched thin working through the manual processing of these returns, Collins said Wednesday. So if a taxpayers return is pulled for manual processing, there will be delays. Typically, the IRS sends most refunds within 21 days or less of taxpayers filing their return.

Dont Miss: Www.1040paytax.com

Read Also: Can I File Taxes If I Receive Ssi

Reasons For A Late Tax Refund

Many things can hold up the processing and delivery of your tax refund. For example, it could be delayed if you filed your return too early or waited until the last minute. If you tried to file in January, for example, a last-minute change to the tax code could have triggered an error on your return that slowed down the processing. Similarly, waiting until the very last minute to get your return in can mean a longer wait for your refund if the IRS is clogged up with a larger than usual volume of returns.

Also, keep in mind that filing a paper return can slow things down. The fastest way to fileand to get your refundis to do it electronically online.

Beyond those possibilities, here are some of the most common causes of delay.

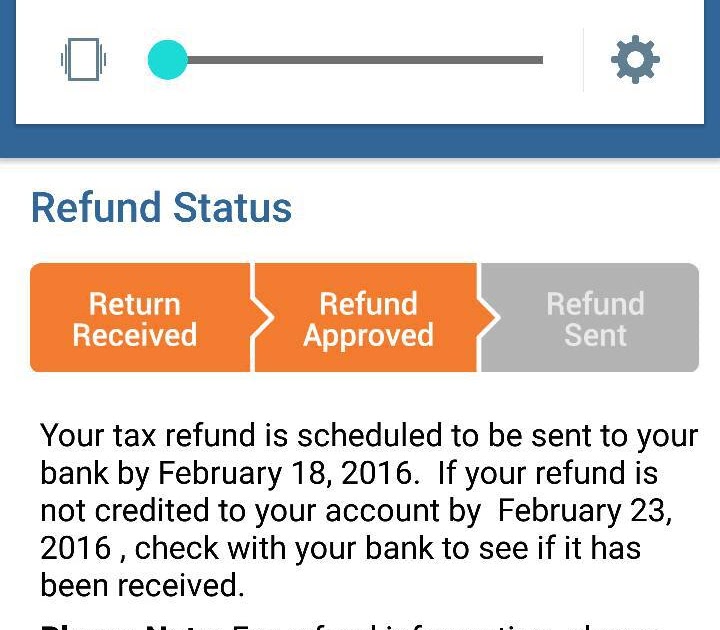

What Do These Irs Tax Refund Statuses Mean

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if youre owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

Recommended Reading: Mcl 206.707

Don’t Miss: How Much Am I Making After Taxes

Returns That Require Review

Most straightforward tax returns are being processed in 21 days or less, but some will take longer, even during normal times. Mailed paper tax returns, for example, will take much longer as they are among the multitude of mail pieces still being opened and processed. The IRS estimates that it can six to eight weeks to receive a tax refund when you submit your tax return by mail rather than electronically.

If your returns requires a review, that will cause a further delay. You may have your return reviewed for determining recovery rebate credit amounts for the first two stimulus payments, figuring earned income tax credits, and figuring additional child tax credits.

Other reasons your tax return is still being processed and your refund is delayed include:

- The return itself is incomplete. You may be missing a number or a signature, for example.

- Your return contains errors.

- You are a victim of identity theft or fraud that has affected your tax return.

- You included Form 8379, for an injured spouse allocation, which can delay processing for up to 14 weeks.

- Your return needs further review for other reasons as flagged by an IRS representative.

How Long Is The Irs Taking To Process Refunds In 2021

We issue most refunds in less than 21 calendar days. It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Read Also: How To Find Tax Delinquent Properties In Your Area

Tax Return Still Being Processed After 3 Months

There are many reasons your tax refund could have been delayed. Perhaps your numbers and your employers numbers did not match, or you accidentally skipped a line or an entire form, or maybe you claimed a credit that the IRS takes longer to check. However, this year, the most likely reason your tax refund is delayed is that you filed a paper return. There was an additional backlog of tax returns created by the COVID-19 pandemic.

While IRS workers have been back at work for a while, there is always a chance this is still impacting your return. Of course, the reasons for a delayed tax refund before the covid-19 crisis may still apply. If it has been three months since you filed your tax return, and you receive a message that your tax return is still being processed, you need to call at IRSs hotline that provides relevant information.

Why Does My Tax Refund Say Still Processing

If you’ve checked the Wheres My Refund? tool at IRS.gov, you may have seen one of three status messages: Return Accepted, Refund Approved, or Refund Sent. Some people are seeing a notification that says the refund is still processing, and that they will be given more information as soon as possible.

There may be several reasons for your refund is held up in processing. Paper returns tend to take longer to be received and processed by the IRS, though some people who e-filed are reporting that they’ve waited more than 21 days for their tax refund. An error in your tax preparation may also be causing a delay.

Read Also: How To Pay State Income Tax

Return Delayed Heres What To Do

If youve been waiting on your tax refund and you feel in the dark, your first response might be to call the IRS directly. However, this is rarely recommended.

Youre likely to find yourself on the line a long time before you reach a real person, and then theyll just direct you to use Wheres My Refund? Save time, and blood pressure, and avoid calling the IRS unless directed to.

The Wheres My Refund? tool is the best choice for checking the status of your refund. You can use this within 24 hours of e-filing your tax return, or within 4 weeks of mailing a paper return.

Wheres My Refund? will require your Social Security number or ITIN, your filing status, and the exact refund amount.

Wheres My Refund? updates daily, typically overnight, to provide you with the latest information regarding your tax return.

Alternatively, the IRS offers a mobile IRS2Go app. This works similarly to Wheres My Refund?, allowing you to check the status of your return daily.

How Can I Expedite My Tax Refund Processing

The fastest and most effective way of getting your tax refund is to file your income tax electronically.

If you want to make sure you expedite the processing of your request, use the e-filing services to submit your income tax return electronically and provide the IRS with your direct deposit information so you get paid faster.

Don’t Miss: Can You Pay Irs Taxes Online

Why Is My Amended Tax Return Taking So Long

Amended Return taking FOREVER Intuit

- Amended Return taking FOREVER. Its happening because the IRS is currently not processing any tax returns that are filed by mail, which includes all amended returns, because of the Covid-19 pandemic. When they start to process them again they will have reduced staff and a big backlog, so it will be a long time before your fiances amended return is processed, or even shows up on Wheres My Amended Return.

Youre A Victim Of Tax Fraud

One type of tax fraud involves someone using your personal information to file a fraudulent tax return and claim a refund in your name. For the 2019 tax-filing season, the IRS identified more than 58,000 fraudulent refund claims, with close to 14,000 of them tied to identity theft. If you think youre a victim of tax-related identity theft, you can contact the IRS and the Federal Trade Commission to report it.

Recommended Reading: How To Tax Return Online

Irs Tax Refunds Delayed: Why Are Refunds Taking So Long

There are a variety of reasons, including the IRS backlog, but it could be down to an error in your tax return

- New Stimulus Bill 2022.When are new payments coming?

It is tax season in the United States and that means that many people in the country are not far away from receiving a tax refund, with three in four Americans receiving a tax refund from the IRS each year.

However, it is thought that there could be a similar situation to what roughly 30 million taxpayers experienced last year, as they had a delay with regard to receiving their tax refund.

The IRS began to process tax returns on January 24, 2022, and officials from the Treasury Department have already warned that there will be challenges along the way, thanks in part to the backlog of returns from last year.

In fact, on December 31, 2021, the IRS still had six million unprocessed individual tax returns, and while its worth noting that the backlog was as high as 30 million in May 2021, the six million figure is still higher than the usual figure of one million for this time of year.

When Will I Get My Paper Check If My Direct Deposit Is Delayed Or Rejected

At times people will change their bank accounts after their return is filed or provide incorrect account numbers. In these instances the IRS will issue a paper check when they cannot send by direct deposit.

This will delay your refund, but the actually IRS processing time for a paper check is only 2 extra days more than direct deposit.

Usually paper checks are mailed on Fridays and you usually get within 1 week the following Friday or sooner. The US Postal usually dont deliver refund checks until Saturday morning to prevent someone watching your mail and stealing the check.

Recommended Reading: How To Pay Taxes On Etsy Sales

Whats The Difference Between Being Processed And Still Processing

Processed means exactly what it is being processed if it switches to still being processed is completely different. They found something that didnt add up. A mistake or further review for a variety of reasons. You should get a letter but it would be best to call them because it could take.

Irs Refund Schedule Chart

Here is a chart of when you can expect your tax refund for when the return was accepted . This is an estimate based on past years trends, but based on past information, does seem accurate for about 90% of taxpayers. Also, as always, you can use the link after the calendar to get your specific refund status.

When can you file your 2021 tax return? Anytime between January 24 and April 18, 2022.

Now, when to expect my tax refund based on when its accepted!

|

2022 IRS Tax Refund Calendar |

|---|

|

Date Accepted |

If, for some reason, you didnt receive your return in the time specified above, give or take a few days, you can always use the IRSs tool called Get Refund Status. Since the link requires personal information, here is the non-html version: https://sa2.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp.

Once you enter all your information, it will tell you what is going on with your refund. Remember, if you input the wrong SSN, it could cause an IRS Error Code 9001, and might make your return be held for Identity Verification.

Also, many people are concerned because they received a Reference Code when checking WMR. Here is a complete list of IRS Reference Codes. Just match up the code with the one in the list, and see what the problem could be. As always, if you are concerned, you can .

Dont Miss: How Much Do You Have To Earn To Pay Tax

Recommended Reading: Can You File Taxes If You Did Not Work

Your Income Doesnt Match Your Irs Records

W-2s and 1099s are the forms that show your real Income and assets. The officials also send a copy to the IRS when you get these forms. If your provided information doesnt match with the IRS records, the IRS withholds your payment until you submit a clear stance on it, or the IRS sends it back for resolution.

If your tax is higher than what is written in the information, the IRS will deduct it and send an amount less than you anticipated. Thats why make sure you are not hiding any income source while filling in information.

Are 2021 Tax Refunds Delayed

Taxpayers face unprecedented delays getting their refunds, IRS watchdog says. The Internal Revenue Service is facing an even bigger backlog for this tax season than it did a year ago, with delays creating unprecedented financial difficulties for taxpayers, according to a report released Wednesday.

Also Check: Do You Pay Taxes On Plasma Donations

You Claimed Certain Tax Credits

Tax credits reduce your tax liability on a dollar-for-dollar basis. Certain tax creditsincluding the Earned Income Credit and the Additional Child Tax Creditoften draw scrutiny from the IRS due to taxpayers claiming these credits fraudulently. If you claimed either credit, that could be the reason your refund hasnt arrived yet.

Is Where My Refund Deposit Date Accurate

Only the IRS and/or your state can provide you with an exact date for your deposits. If you are seeing that date on the IRS’s Where’s My Refund site that is the most accurate date and when you should receive your deposit. … You can use the IRS Where’s My Refund site for the latest status on your federal tax refund.

Also Check: How To Get Personal Tax Identification Number