Penalties For Not Paying Your Taxes

Even if you file an extension to submit your tax return, you must pay any estimated tax you owe by April 15, 2022. If you do not pay your taxes, you will be charged a penalty and owe interest on any unpaid balance.

The penalty for failing to pay your taxes by the due date is 0.5 percent of your unpaid tax for each month or part of a month that your return is late. This penalty is capped at 25 percent of late unpaid taxes. If you file your return on time and request to pay by an installment agreement, the penalty drops to 0.25 percent for each month or part of a month of the installment agreement.

Youre also charged interest on the unpaid balance, which compounds daily. The rate is set each quarter and is based on the federal short-term rate, plus an additional 3 percent.

If you owe taxes and dont file your return on time, youll be charged a penalty for failing to file. This is usually 5 percent of the tax owed for each month or part of a month your return is late. This penalty is also capped at 25 percent.

More Info For Explore Filing Options For Massachusetts Personal Income Tax Returns

Payment Agreements

If you cant make your tax payment in full, pay as much as you can with your tax return. After you are billed for the balance, you can set up a payment plan online through MassTaxConnect or by calling 887-6367.

To set up a payment plan with MassTaxConnect, you need to:

If you owe $5001 or greater, a payment agreement cannot be set up with MassTaxConnect. You would need to set up a payment agreement by calling Collections at 887-6400.

If You Are An American Who Works Or Lives Abroad Full

You could get a tax break for income earned outside the United States if you made $107,600 in 2020. Thats $108,700 for 2019.

A third way not to pay double taxes is to use the Foreign Tax Credit. Some people who have paid or collected taxes in a different country may be able to lower their US tax for US citizens living abroad burden below the FEIEs limits if they do this.

This rule is bad because it only applies to certain types of income, and each country has its own set of problems with it.

Recommended Reading: What Is The Best Tax Software To Do It Yourself

What If I Only Receive Social Security Benefits

In most cases, if you only receive Social Security benefits you wouldn’t have any taxable income and wouldn’t need to file a tax return.

One catch with Social Security benefits is if you are married but file a separate tax return from your spouse who you lived with during the year. Then you will always have to include at least some of your Social Security benefits in your taxable income to see if it is greater than your standard deduction. If your taxable income is greater than you standard deduction, you would need to file a return.

Income Taxes For Adults And Minors

The IRS effectively classifies tax filers into three different age categories: minors, adults, and 65+ . However, in terms of earned income, the requirements for adults and minors are similar.

Using the standard deductions in 2022 as an example, adults and minors need to start filing income taxes if their income is over $12,950 for a single filer. For seniors age 65 or older, the minimum income is $14,700. If adults file jointly, then they need to earn income in excess of $25,900.

You May Like: Where Can I Find My Tax Liability

Why Do You Need To Make Quarterly Payments

We know what you might be thinking. Why not just pay your taxes once a year, when you file your return? However, the IRS doesnt look too kindly on those who dont make enough tax payments throughout the year. It may be tempting to simply save all your tax payments for the year and throw them into a high-yield savings account. After all, Uncle Sam will still get paid in the end. In the meantime, maybe youll be able to make a few extra bucks in interest payments.

Unfortunately for you, the IRS frowns upon this practice. You can be charged interest and other penalties if you dont make at least quarterly payments. Do not wait until tax season to pay what you owe.

About Filing Your Tax Return

If you have income below the standard deduction threshold for 2022, which is $12,950 for single filers and $25,900 for married couples filing jointly, you may not be required to file a return. However, you may want to file anyway because you may be able to take advantage of several features and benefits in the tax system which could reduce the amount you owe, or in many cases, especially for people with low incomes, increase the amount you could receive in a refund. Some key factors to make sure you look out for include:

Recommended Reading: Where Can I Get Taxes Done For Free

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of whatâs due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Recommended Reading: What Are New Market Tax Credits

The Work Of Government

But wait. Many of those activities seem like the mission of governments charity, taxes, healthcare, education And Ill readily concede that point. Other governments find other ways to fund this without giving tax deductions.

For instance in the US if I want to donate $53 post-tax to a charity, I donate $92 and deduct the $92, netting $38 back, and the charity doesnt pay State VAT, netting $100 worth of goods. In the UK I donate $53 and the government matches with another $47 via the National Lottery something-or-other, and again the charity gets $100.

In the US I spend on a Health Service Plan to pay my insurance gap, and its tax deductible. The UK, NHS just pays all my medical bills and done.

The US is starting to swing that way too. Our first swing at Individual Retirement Endowments, we made contributions tax deductible and retirement-age payouts taxable . Now, US retirement , the contributions are taxable and then, withdrawals are tax-free

Recommended Reading: How To File Taxes With An Itin Number

Income Tax Personal Allowance

The Standard Personal Allowance is £12,570 . This means youre able to earn or receive up to £12,570 in the 2022-23 tax year and not pay any tax.

This is called your Personal Allowance. If you earn or receive less than this, youre a non-taxpayer.

Your Personal Allowance might be higher than this if you qualify to claim

Your Personal Allowance may be lower than this in certain circumstances for example, if youre a high earner and your adjusted net income is over £100,000.

How Tax Brackets Work

How much tax you must pay begins with your total or gross income from all sources. You can then claim any deductions to which youre entitled. These subtract from your gross income to arrive at your taxable income.

The federal government uses a progressive tax system, which means that the higher your taxable income, the higher your effective tax rate will be. These rates are determined by tax brackets.

For example, youre in the 24% tax bracket for tax year 2020 if you were single and your taxable income was between $85,525 and $163,300. But only the portion of your income above $85,525 will be charged at that 24% rate. The IRS adjusts these taxable income amounts annually for inflation. These taxable income thresholds increase to $86,375 and $164,925 for the 24% tax bracket in tax year 2021, the return youll file in 2022.

Dont Miss: Www.1040paytax.com

Also Check: Can I File My State Taxes Online For Free

Why You Should File Even If You Cant Deduct

The IRS places limits on the amount of child tax credit you can claim.

This stops people from playing the system. A prominent example of this is the home office deduction. In the past, many taxpayers were tempted to claim enormous deductions on their home offices. The IRS declared it absurd that you would claim a home office deduction so large that it would cause your business to lose money.

Whats interesting, though, is even if you earned nothing during the last tax year, its worth filing taxes still because then you can claim the leftover deduction in future tax years.

This means that even if you are not eligible to claim a credit or a deduction now, you can still claim it in future years when you do have income. It would be best if you started filing taxes now, though, rather than waiting until you are legally obligated to file a return.

The Case For A Simple Return

In 1985, President Ronald Reagan promised a return-free tax system in which half of all Americans would never fill out a tax return again. Under the framework, taxpayers with simple returns would automatically receive a refund or a letter detailing any tax owed. Taxpayers with more complicated returns would use the system in place today.

In 2006, President Barack Obamas chief economist, Austan Goolsbee, suggested a simple return, in which taxpayers would receive already completed tax forms for their review or correction. Goolsbee estimated his system would save taxpayers more than US$2 billion a year in tax preparation fees.

Though never implemented, the two proposals illustrate what we all know: No one enjoys filling out tax forms.

So why do we have to?

As an expert on the U.S. tax system, I see Americas costly and time-consuming tax reporting system as a consequence of its relationship with the commercial tax preparation industry, which lobbies Congress to maintain the status quo.

Don’t Miss: How Much Is Car Tax

What Taxes Can I Pay With Webfile

- Oil and Gas Well Servicing

Taxpayers who paid $500,000 or more for a specific tax in the preceding state fiscal year are required to pay using TEXNET.

Paying by credit card will incur a non-refundable processing fee:

| Amount Paid |

|---|

| 2.25% of the amount plus a $0.25 processing fee |

Payment Deadlines

- TEXNET ACH Debit payment of $100,000 or less, must be scheduled by 10:00 a.m. on the due date. Payments above $100,000 must be initiated in the TEXNET system by 8:00 p.m. the business day before the due date.

- and loss of timely filing and/or prepayment discounts.

- If you are required to pay electronically, there is an additional 5% penalty for failure to do so.

Read Also: How To Pay Ny State Taxes

Can I Offset My Taxes 2022

The Treasury Offset Program isn’t suspended, but the IRS will wait until after May 1, 2022, before it offsets tax refunds for student loan debt owed to the Department of Education. … This means the Department of Education will not start taking tax refunds until May 2, 2022 unless Biden extends the freeze once more.

Don’t Miss: Will The Irs Extend The Tax Deadline For 2021

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

You do not have to report certain non-taxable amounts as income, including:

- elementary, secondary and post-secondary school scholarships

Internet And Program Use

The IRS does allow a partial deduction for expenses required for the business operations that might be used for personal activities. A primary example of this is the internet.

As most streamers broadcast from home, generally the internet is also used for non-streaming activities. For this reason, only a portion of the internet bill would be deductible. In this case, the content creator must estimate the percentage that the internet is used for streaming or personal purposes.

The percent used for streaming is deductible. This is the case with all the equipment or bills that may be present.

Recommended Reading: How Do I Change My Tax Withholding On Unemployment

Don’t Miss: How Are S Corporations Taxed

Get Our Top Investigations

Heres what happened when we went looking.

Our first stop was Google. We searched for irs free file taxes.

And we thought we found what we were looking for: Ads from TurboTax and others directing us to free products.

The first link looked promising. It contained the word free five times! We clicked and were relieved to see that filing for free was guaranteed.

We started the process by creating the profile of a TaskRabbit house cleaner who took in $29,000. We entered extensive personal information. TurboTax asked us to click through more than a dozen questions and prompts about our finances.

After all of that, only then did we get the bad news: TurboTax revealed this wasnt going to be free at all. Turns out the house cleaner didnt qualify because he is a independent contractor. The charge? $119.99.

Then we tried with a second scenario. We went back to TurboTax.com and clicked on FREE Guaranteed. This time, we went through the process as a Walgreens cashier without health insurance, entering personal information and giving the company lots of sensitive data.

Again, TurboTax told us we had to pay this time because theres an extra form if you dont have insurance. The charge? $59.99.

But wait. Are the house cleaner and the cashier not allowed to prepare and file their taxes for free because of their particular tax situations? No! According to the agreement between the IRS and the companies, anyone who makes less than $66,000 can prepare and file their taxes for free.

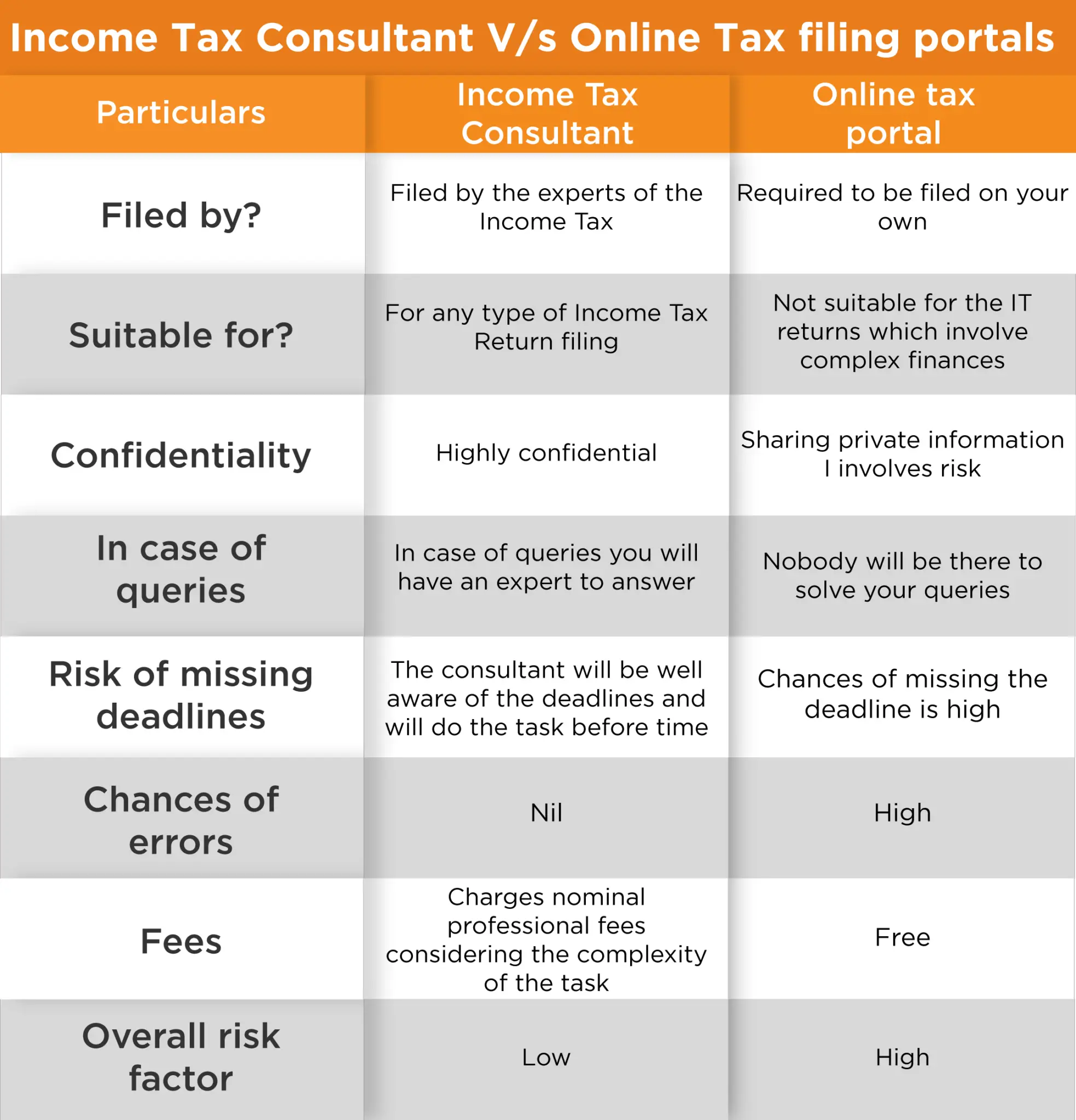

B Hire And Work With A Tax Preparer

While it’s never been easier to do your own taxes using software, as your financial life gets more complex you might wonder if you’re missing something and should get someone to prepare and help file your taxes. If you have a business or a healthy side gig, or you just want help understanding all of the forms, you might seek out a professional’s guidance.

If you don’t want to meet in person with a tax preparer, theres a way to file taxes without leaving the house. A secure portal lets you share documents electronically with a tax preparer. Typically, the preparer will email you a link to the portal, youll set up a password and then you can upload pictures or PDFs of your tax documents.

» Find a local tax preparer for free:See who’s available to help with your taxes in your area

Read Also: How To Calculate Your Tax Return

Requirements To File If You’re A Dependent

People who are claimed as an adult or child dependent have to file a tax return in some situations. The trigger for filing is largely based on the amount of earned or unearned income the person had during the tax year.

Unearned income is taxable interest, ordinary dividends, and capital gains distributions essentially investment income. It also includes unemployment compensation, taxable Social Security benefits, pensions, annuities, and unearned income distributions from a trust.

Earned income is salaries, wages, tips, professional fees, and taxable scholarship and fellowship grants. Unearned income and earned income combined equals gross income.

Unmarried dependents are required to file a tax return if any of the following were true for 2021:

- Unearned income exceeded $1,100

- Gross income exceeded the greater of $1,100 or earned income plus $350

- Unearned income exceeded $1,100

- Earned income exceeded $12,550

- Gross income was at least $5 and spouse files a separate return with itemized deductions

- Gross income exceeded the greater of $1,100 or earned income plus $350

Quick tip: Taxpayers who claim a child who was under age 19 at the end of 2021 or a child who was a full-time student under age 24 can opt to include their dependent’s income on their return rather than having the child file their own return. If certain conditions are met, such as the child’s only income was from interest and dividends, including capital gain distributions, use Form 8814.

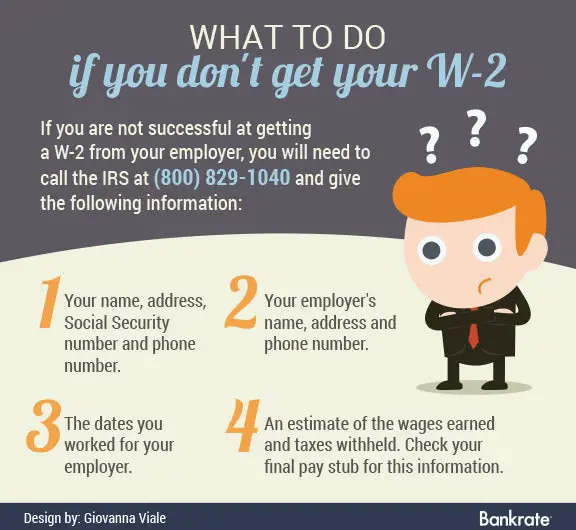

Run Your Numbers Before

With just your final paycheck from last year and a few additional details, you can gain insight into what kind of tax refund or balance due to expect come filing season. It pays to take the time for preparation now so there are no unpleasant surprises later! However, please note that you should never use your 2022 final paycheck to prepare your return. Youll need the actual W-2 from your employer in order to file a complete and accurate return.

To be prepared for tax season, compile all necessary records of your income, credits and deductions to estimate what you owe. Leverage the power of a reliable tax preparation software or use an everyday calculator with those numbers in hand to better understand your financial situation.

Recommended Reading: How Much Is Inheritance Tax In Nj