Why Do I See Irs Treas 310 In My Bank Statement

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed in the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of electronic payment. You may also see TAX REF in the description field for a refund.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Tax Refund Frequently Asked Questions

Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. The Department of the Treasury’s Bureau of the Fiscal Service and the Internal Revenue Service both encourage direct deposit of IRS tax refunds. Direct Deposit combined with IRS e-file provides taxpayers with the fastest and safest way to receive refunds.

This resource page of frequently asked questions about IRS tax refunds provides financial institutions with useful information for reference while assisting customers during the tax filing season.

For other FAQs about Direct Deposit, .

Your Refund Has Been Delayed Lost Or Issued Incorrectly

If your return has been processed, there are a handful of reasons that your refund may not have arrived . If you opted for a paper check rather than direct deposit, its possible that your check got lost in the mail or stolen. If you were expecting your refund to show up in your bank account, its possible that the account information on your return was entered incorrectly.

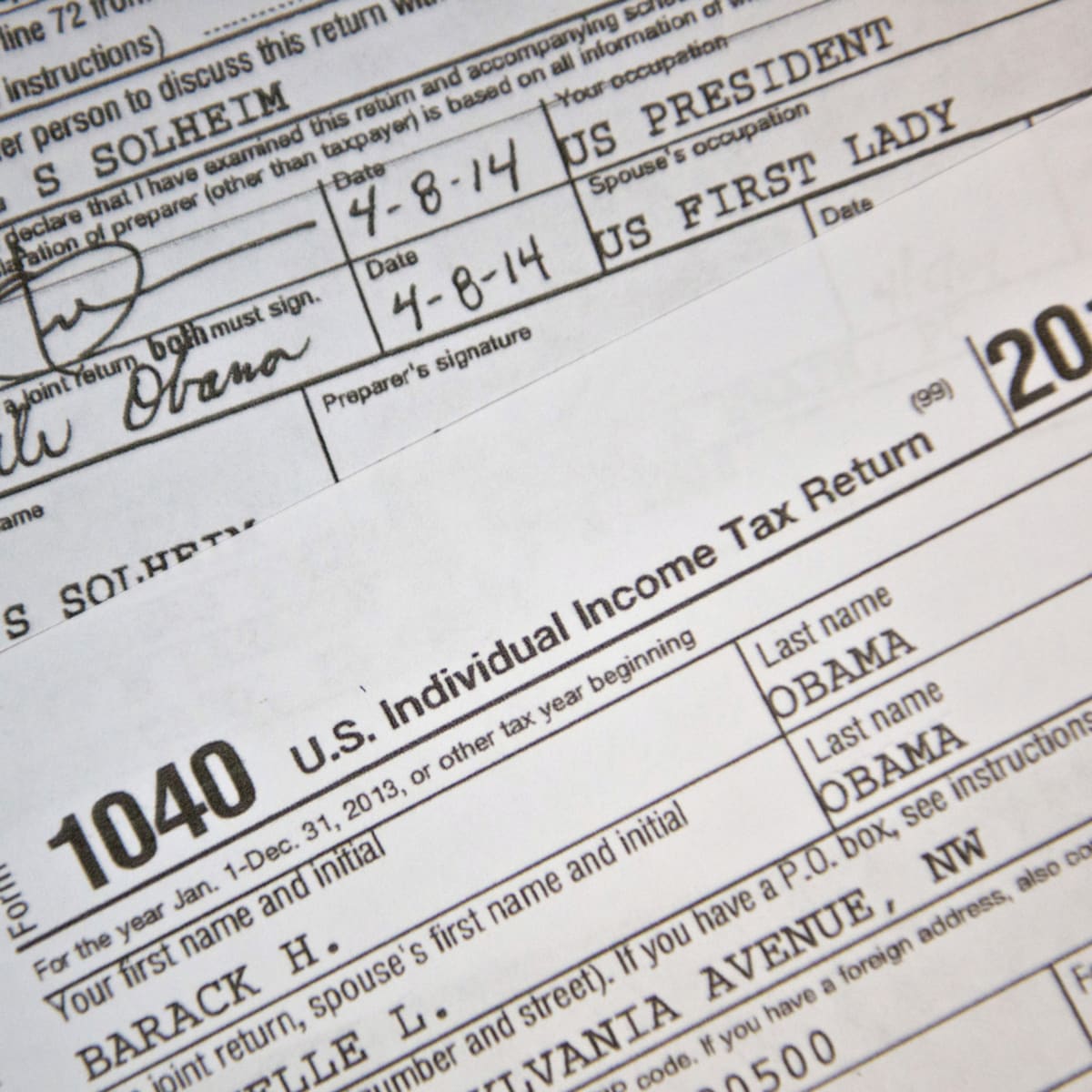

Another unfortunate possibility is tax return preparer fraud this is when the individual you hired to do your taxes altered your return after you approved and signed it to redirect funds to a different account than the one you selected. This situation may be tricky to track down, but often the IRS will alert you to inconsistencies on your return. You may also request a transcript of your tax account to make sure it matches the return you signed.

A final possibility is that the IRS is holding onto your refund, either related to your claim for the EITC or ACTC or to offset debts, such as outstanding taxes or child support.

Recommended Reading: Is Real Estate Tax The Same As Property Tax

Wait I Still Need Help

The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers rights. We can offer you help if your tax problem is causing a financial difficulty, youve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isnt working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you.

Visit www.taxpayeradvocate.irs.gov or call 1-877-777-4778.

Low Income Taxpayer Clinics are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you, see the LITC page on the TAS website or Publication 4134, Low Income Taxpayer Clinic List.

The Irs Suspects Identity Theft

If the IRS flags a tax return for having a possible chance of identity theft, the agency will hold your refund until your identity is verified. When that occurs, you’ll likely receive a 5071C letter that provides instructions for proving your identity. If your tax return is legitimate, don’t panic — an IRS letter doesn’t mean there is proof of identity theft, merely a suspicion.

Taxpayers can verify their identity on the IRS website, which currently requires creating an ID.me account, or by calling a dedicated phone number listed on the IRS letter. If those methods fail, you’ll need to schedule an in-person appointment at a local IRS office.

One method for avoiding identity-theft-related delays is to create an “Identity Protection PIN” or IP-PIN. This unique six-digit ID is known only to you and the IRS and prevents anyone else from filing a return in your name. The IP PIN will only last for one year — you’ll need to create a new one next tax season if you want the same level of identity protection. You’ll need an ID.me account to create an IP PIN online, although it is possible to acquire an IP PIN using IRS Form 15227 and a telephone interview or in-person appointment.

Don’t Miss: What Is The Last Day To File Taxes

Eitc/actc Tax Refunds Delayed Until Late February

Thats why, starting in the 2017 tax season, Congress gave the IRS more tools to question refunds. Specifically, Congress:

- Moved up the deadline for employers to send Forms W-2, which show taxpayers wages and the income tax withholding they paid, and Forms 1099 reporting payments made to independent contractors. The deadline is Jan. 31.

- Delayed refunds containing the earned income credit and/or the additional child tax credit . The IRS cant release these refunds before Feb. 15, but the IRS is saying to expect your refund by the first week of March.

Both new rules mean that, for the first time, the IRS will have the information and the time it needs to question more returns before issuing refunds. However, questioning and delaying refunds isnt a new concept for the IRS. In fact, several IRS compliance programs take or hold refunds for millions of taxpayers each year. Here are some of the reasons why your tax refund may be delayed:

Does Still Being Processed Mean Audit

If my refund on the IRS website says still processing does it mean I will be audited? There’s absolutely no reason to necessarily think that you’re under review or that an audit is pending, so please don’t worry. The “processing” message you see is perfectly normal. In fact, the messages and bars on the IRS.

Also Check: How Much Is Georgia State Tax

Reasons For A Late Tax Refund

Many things can hold up the processing and delivery of your tax refund. For example, it could be delayed if you filed your return too early or waited until the last minute. If you tried to file in January, for example, a last-minute change to the tax code could have triggered an error on your return that slowed down the processing. Similarly, waiting until the very last minute to get your return in can mean a longer wait for your refund if the IRS is backlogged with a larger-than-usual volume of returns.

Also, keep in mind that filing a paper return can slow things down. The fastest way to fileand to get your refundis to do it electronically online. Here are some of the most common causes of delay:

These States Are Still Sending Out Tax Rebates Find Out How To Claim Yours

California isn’t expected to finish mailing out “inflation relief checks” until January 2023.

You might not be getting a Christmas bonus this year, but many states are giving residents a bonus tax refund or stimulus check to help them cope with ongoing inflation. Some have finished sending out funds, but many others are still issuing payments.

Massachusetts only began returning $3 billion in surplus tax revenue in November. The payments, equal to about 14% of a individual’s 2021 state income tax liability, are expected to continue to be issued at least through about Dec 15.

South Carolina started issuing for up to $800 in October and will continue through the end of the year. The income tax rebates were approved by state lawmakers as part of this year’s $8.4 billion budget.

Your state could be sending out a rebate or stimulus check, too. See if you qualify and how much you could be owed. For more ontax credits, see if you qualify for additional stimulus or child tax credit money.

Recommended Reading: Are Medical Premiums Tax Deductible

Did You Get A Refund And The Amount Was Less Than You Expected Or When You Checked The Status Of Your Refund The Automated System Indicated The Irs Had Not Received Your Tax Return

You may want to request a transcript of your tax account to see what happened. The IRS may have changed an amount on your tax return during processing, but for some reason you didnt get a notice, or maybe your tax return wasnt received by the IRS. A transcript of your account will have information about the receipt and processing of your return

Reason #2 Irs Holding Your Refund

The IRS can hold your refund and request more information from you in several situations. This doesnt mean youre being audited but it can lead to one if you dont respond with all the information by the deadline.

Here are six of the most common situations when the IRS can hold your return:

You mailed in your return, and the IRS flagged a math error:

When taxpayers e-file their returns, the e-file process catches many return errors and rejects the returns at the time of filing. If you mail your return instead of e-filing it, the IRS is more likely to identify an error after the fact.

The IRS calls most of these errors math errors, but they arent limited to arithmetic mistakes. If your Social Security Number or your dependents information doesnt match IRS records, the IRS can change any related deductions or credits . The IRS can also change your return if you forget to include a corresponding schedule or form to support a deduction or credit.

If the IRS changes your return, youll get a letter asking you to correct the error within 60 days. If you dont provide enough explanation and information, the IRS change is final. At that point, you would have to amend your return and follow up with the IRS to get your refund.

The IRS suspects identity theft:

The IRS is challenging tax credit you claimed:

The IRS identified potential ACA health insurance issues:

You need to file an old return:

Also Check: How To Get Income Tax Return Copy

How Can I Check The Status Of My Refund

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your refund shown on line 34 of Form D-400, Individual Income Tax Return.

I Have Moved To Another Address Since I Filed My Return My Refund Check Could Have Been Returned To The Department As An Undeliverable Check What Do I Need To Do To Get My Check Forwarded To My New Address

In most cases, the US Postal Service does not forward refund checks. To update your address, please complete the Change of Address Form for Individuals, call the Department toll-free at 1-877-252-3052, or write to: North Carolina Department of Revenue, Attn: Customer Service, P.O. Box 1168, Raleigh, NC 27602-1168.

Don’t Miss: What Is The Penalty For Filing Your Taxes Late

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

Due to the late approval of the state budget, which included multiple tax law changes, the Department has experienced delays processing returns. If you filed your return electronically and received an acknowledgment, your return has been received but may not have started processing. Follow the guidance below based on your filing method:

Filed Electronically:

If its been more than six weeks since you received an acknowledgment email, please call 1-877-252-3052.

Filed Paper:

If its been more than 12 weeks since you mailed your original return, you can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “Duplicate” should be written at the top of the return that you are mailing. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

If You Did Not Qualify For The Atr

Under Indiana law, the $200 ATR eligibility requirements differ from the $125 ATR.

If you were not eligible for the $125 ATR, you would be eligible for the $200 ATR if you:

- receive Social Security benefits in 2022 and

- are not claimed as a dependent on someone elses tax return.

The General Assembly did not pass legislation proposing an affidavit to apply for the $200 ATR. No form is needed to receive this refund.

If you qualify for only the $200 ATR, you will not receive an additional taxpayer refund in 2022. Instead, you must file a 2022 Indiana resident tax return before Jan. 1, 2024, and claim the $200 ATR as a tax credit.

You must file a 2022 state tax return to claim the credit, even if you do not normally file a tax return due to your income.

Tax credits are not the same as tax deductions. Tax credits are applied dollar-for-dollar as an additional amount to your tax refund or used to reduce the amount of any tax you may owe. Eligible recipients will receive the $200 ATR in the form of a tax credit on their state income tax return.

Tax returns for 2022 will not be accepted until mid- to late-January 2023. You can find information on how to claim the $200 ATR as a credit on this page, in tax instruction booklets and on Form SC-40 by early 2023. In addition, many major tax software vendors are expected to include this information in their products.

Don’t Miss: What Form Do I Need To File My Taxes Late

How To Contact The Irs If You Haven’t Received Your Refund

Insider’s experts choose the best products and services to help make smart decisions with your money . In some cases, we receive a commission from our our partners, however, our opinions are our own. Terms apply to offers listed on this page.

- In most cases, you’ll get your tax refund within 21 days of e-filing, though it can take longer.

- Check the status of your return online, then call the IRS if there seems to be a problem.

- Be prepared to follow up, too, because the IRS isn’t necessarily keeping track of your case.

I am a money nerd. I love adding the finishing touches to my tax return and generating pages that neatly summarize my income for a year. Some years, that also comes with the good news that a tax refund is headed my way.

I wasn’t sure what to expect for 2018, the first filing year under the new rules of a major tax overhaul. My results were much better than expected, but my refund was months late. I had to hunt down the steps to follow if your refund doesn’t show up as planned.

In most cases, taxpayers can expect to get their refund within 21 days of filing. If it has been longer, follow these steps to track down your refund.

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax ReturnPDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

Read Also: Should I Efile My Taxes

How To Find The Current Status Of My Refund

The Wheres My Refund? tool lets you check the status of your refund through the IRS website or the IRS2Go mobile app. If you submit your tax return electronically, you can check the status of your refund within 24 hours. But if you mail your tax return, youll need to wait at least four weeks before you can receive any information about your tax refund. Keep in mind that usually, you can file your taxes in January.

In order to find out the status of your tax refund, youll need to provide your Social Security number , filing status and the exact dollar amount of your expected refund. If you accidentally enter the wrong SSN, it could trigger an IRS Error Code 9001. That may require further identity verification and delay your tax refund.

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

Recommended Reading: How To Pay Your Federal Taxes Online