Common Reasons That May Cause Delays

- We found a math error on your return or have to make another adjustment. If our adjustment causes a change to your refund amount, you will receive a notice.

- You used more than one form type to complete your return. The form type is identified in the top left corner of your return. We will return your State tax return for you to complete using the correct form type before we can process your return. View example of form types.

- Your return was missing information or incomplete. Sometimes returns are missing information such as signatures, ID numbers, bank account information, W-2s, or 1099s. We will contact you to request this information so we can process your return. Please respond quickly so we can continue processing your return.

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund.

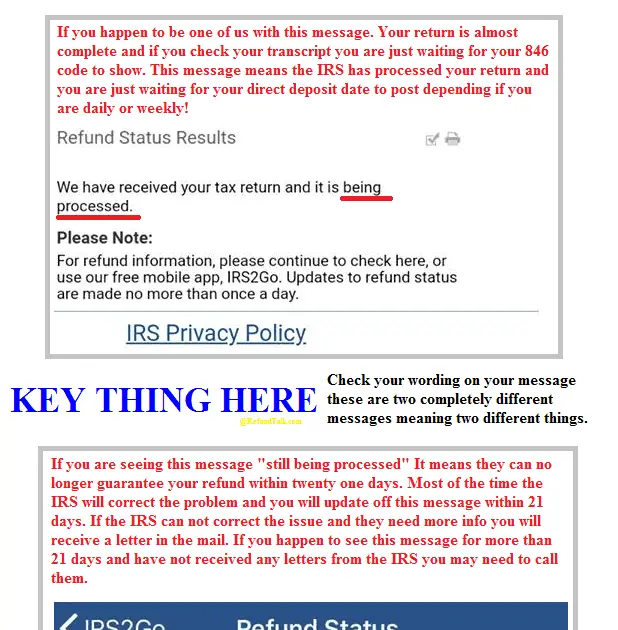

What Does Your Tax Return Is Still Being Processed A Refund Date Will Be Provided When Available Exactly Mean

Mine was approved on 2/22. Talked to IRS on 4/26. The person said I need to wait 45 from when I filed. Told her it had been over 60 days. She said no it hadnt. Told her to count and then I heard 1,2,3,4,5…. then she said Oh yea, it has been more than 45 days. After being put on hold several times was told that I should check back in a month or so. I guess the government is the every bit of inefficient they are always accused of being.

What Are The Reasons My Tax Refund Processing Is Delayed

Here are the most common reasons why your tax refund processing are delayed:

- Due to IRS backlog

- Your tax return includes errors

- Your tax return Is incomplete

- Your tax return needs further review

- Due to suspicions of identity theft or fraud

- Your tax return includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit

- Your tax return consists of a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

You May Like: Do Retirees Pay Income Tax

What Happens Once Irs Has Received My Return

As soon as you file your tax return using the IRS free tax return filing using the website, the tax return is received by the IRS.

They start processing the return, and refunds are issued right after processing. It can take around 21 days for refunds to appear in your bank statement. However, the procedure can be longer if you have filed a paper return.

Once you have filed a paper tax return and mailed it to the IRS, it will take some days to reach the IRS. In the case of paper returns, the refund processing is completed by IRS within 6 to 8 weeks after receiving the return. After processing, it will require 21 days or more for a refund to be shown in your bank account.

Its the standard procedure that every tax return has to go through. Around 9 out of every ten returns filed with the IRS receive the tax return within 21 days.

Can I Call The Irs To Get Answers

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited.

The IRS is directing taxpayers to the Let Us Help You page on its website and to get in-person help at Taxpayer Assistance Centers around the country. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to. You can call 800-829-1040 or 800-829-8374 during regular business hours. If you have not received a refund yet, you shouldn’t file a second tax return.

Read Also: How To Get Maximum Tax Deductions

How Long Your Tax Return Is Still Being Processed

We issue most refunds in less than 21 calendar days. It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Several Possible Explanations For Why You Have Not Yet Gotten Your Tax Refund

When a tax refund is delayed, it can cause concern for the person filing the return since they may need the money to cover a large expense. By this point in the process, the vast majority of Americans should have already gotten their tax returns. However, there are instances when a few cases cause a tax return to be delayed. Even if a filer is certain that they have done everything correctly, there are still several typical causes that could cause your tax return to be delayed. Lets have a quick conversation about these factors so that I can give you an overview.

You May Like: What Is Tax In Nevada

Why Is My Tax Refund Still Being Processed After 21 Days 2022

A tax refund could be delayed because it needs a correction or is incomplete, needs further review or is suspected of identity fraud, includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit or includes an injured spouse allocation form which may take up to 14 weeks for the IRS to …

Why Your Tax Refund Can Be Delayed

If you have not received your tax refund, its because the IRS is still processing your request or there may be a particular reason why its taking longer.

Here are some of the common reasons why your tax return may be delayed:

- Your tax return was incomplete

- You have missing information in your return

- The IRS intends to do an additional review of your file

- The IRS is assessing potential security issues

Other reasons may be that you have a claim for an earned income tax credit or additional child tax credit that must be processed.

Also, if you have filed Form 8379 , you can expect longer processing delays that can go up to 14 weeks.

Recommended Reading: How Much Taxes You Pay On Stocks

How To Check The Status Of A Tax Refund

You can track the status of a tax refund by using the IRS online Wheres My Refund portal. The online tool is updated once a dayusually overnight. Refund information is available 24 hours after e-filing or four weeks after filing paper returns. The IRS tool will tell you whether your tax return has been received, whether your tax refund has been approved, and whether it has been sent to you.

To access the IRS online portal, you will need your individual taxpayer identification number, social security number, your filing status, and the exact tax refund amount.

How Long Should It Take

On Wednesday, after the release of the National Taxpayer Advocate report, the IRS took issue with the backlog inventory numbers in report, stating that the numbers are “neither the most accurate nor most recent figures.”

“Newer numbers through June 10 demonstrate that the IRS is ahead of tax return processing compared to a year ago,” the IRS said, stating that the agency continues to make substantial progress.

The IRS said 19.13 million paper returns amended and original returns awaited processing as of June 10. That’s down slightly from 19.88 million paper returns in the pipeline at the same time a year ago.

Of the total, however, IRS numbers indicated that 11.2 million individual paper returns awaited processing as of June 10, up from 9.6 million similar returns at the same time last year.

The tax deadline was extended until May 17 during the 2021 season and April 18 last year.

Efforts have been helped, the IRS said, by hiring more workers, adding new contractor support, shifting existing staff, providing mandatory employee overtime and developing efficiency improvements.

Only one number matters to taxpayers, of course, and it is the one that shows up in their bank account for their tax refund. And tax refunds are not arriving quick enough for many who filed paper returns.

In general, the IRS issues refunds within a few weeks to a month. Paper returns take longer than electronically filed returns, even if there are no mistakes or issues.

Also Check: How Much Are Annuities Taxed

Is The Irs Still Backlogged

The IRS Is Still Processing Returns Filed During the 2021 Filing Season. Despite these challenges, the IRS has made significant progress in reducing the size of the backlogged inventory however, millions of returns have yet to be processed, meaning millions of taxpayers are still awaiting their refunds.

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates

When it comes to tax season I receive a lot of reader questions, many tinged with a hint of desperation, around why IRS tax refunds are taking so long to be processed and what can be done to get their money sooner rather than later.

This was no different in the latest tax season where a number of folks have commented on the extended delays they are seeing with the processing of their tax returns and payment of long overdue refunds. Despite PATH limitations now having lifted, many filers are still stuck in IRS refund processing limbo.

In fact the IRS had already announced that there will likely be longer than usual tax refund payment delaysdue to processing/validation of past year and amended returns, staffing/budget constraints and the ongoing payment and reconciliation of past stimulus payments and tax credits .

Those who filed paper based or amended returns, will likely face even longer delays in getting any refunds and will likely see the Return Processing Has Been Delayed Beyond The Normal Timeframe WMR message for extended periods and ongoing notices from the IRS around additional 60 day review periods.

For returns that require special handling or manual processing the IRS has said that due to staffing shortages it is taking up to 120 days to complete processing and notify taxpayers of adjustments or adjudications.

Covered in this Article:

Read Also: How Do I File My City Taxes

The Irs Has A Backlog Of Millions Of Unprocessed Tax Returns If One Of Them Is Yours And You’re Owed A Tax Refund You Want To Know When The Irs Will Send You Your Money

Getty Images

Service may be part of the IRS’s official name, but the tax agency has been lacking in this area, especially over the past couple of years. It’s not all the IRS’s fault. Credit the perfect storm of the COVID-19 pandemic, lots of stimulus-related tax law changes passed by Congress for the IRS to administer, years of budget cuts, and a shrunken workforce. All of these, plus other factors, has helped lead to the IRS’s backlog of millions of unprocessed returns and delayed tax refund payments.

The good news is that the IRS has made progress on its processing of returns, in part because it went on a hiring spree and shifted current personnel from other areas to assist with the backlog. Agency statistics from 2021 and 2022 demonstrate the forward movement made by the IRS. As of June 25, 2021, there were 16.7 million 2019 and 2020 1040 forms that still required manual processing. As of this summer, the IRS finished processing all individual returns it received in 2021 that had no errors, including 2020 e-filed and paper forms.

Can You Call The Irs To Check Your Refund Status

Yes, in some cases, it may be advisable to call the IRS.

The IRS recommends that taxpayers only called them when:

- Its been more than 21 days since they have electronically filed their return

- Its been more than 6 weeks since they have filed their paper tax return

- A message appears on the Wheres My Refund? tool asking the taxpayer to call the IRS

To call the IRS, you can reach them at 1-800-829-1040.

If you do not meet the above conditions, you may not get any value in calling the IRS as their customer service representative will not have any further information to offer you.

Also, be prepared to stay online for a long time before someone answers your call.

As a result, make sure you call when you have a few hours of free time ahead of you.

Recommended Reading: When Will I Get My Tax Refund

Irs Mobile App Irs2go

The Internal Revenue Service offers taxpayers a mobile platform to help with tax refund details. The app is designed in two languages: English and Spanish. IRS2GO app will display the status:

However, you need to enter some details for verification: social security number, filing status, and expected amount. Once the refunds are approved, the IRS department will send a date when you can receive the funds. The mobile app and Wheres My Refund app are regularly updated.

Why Is My Refund Still Processing After 3 Months

Your refund may be delayed if you made math errors or if you forgot to sign your return or include your Social Security number. It may also be delayed if your dependents’ information doesn’t match IRS records, or if you left out a corresponding schedule or form to support a deduction or credit, says Pickering.

Recommended Reading: Can You Turn In Taxes Late

How To Pay Bills While You Wait For Your Tax Refund

Because tax refunds can be delayed for a number of reasons, the IRS cautions taxpayers not to rely on receiving their tax refund within three weeks in order to cover expenses or make an important purchase.

Here are some ideas for getting by while you wait for your refund check.

Why Your Tax Refund Might Be Delayed

Even if you submit your returns electronically and request direct deposit, the IRS still takes additional time to process certain tax returns. The most common reasons for a delay include mistakes, incomplete returns, fraud or identity theft, or further review. Also, processing a return could be delayed by about 14 weeks if it includes Form 8379 . The IRS will contact you by mail if more details are required to process your returns.

This year, the IRS expects that taxpayers will have to wait longer than normal for refunds. It might take longer than 21 days to process refunds because the COVID-19 pandemic has made it difficult to process the paper returns.

Read Also: Do I Have To Pay Taxes On Inherited Money

Irs Moved The Goalposts

As noted, despite the usual turnaround time for tax refunds being 21 days, the IRS confirmed that it could take up to four months to receive the money you are owed, thanks in part to the large backlog.

“Tax returns are opened and processed in the order received. As the return is processed, whether it was filed electronically or on paper, it may be delayed because it has a mistake including errors concerning the Recovery Rebate Credit, missing information, or suspected identity theft or fraud,” said the IRS.

“If we can fix it without contacting you, we will. If we need more information or need you to verify that it was you who sent the tax return, we will write you a letter. The resolution of these issues could take 90 to 120 days depending on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return.”

If I Owe The Irs Or A State Agency Will I Receive My Nc Refund

In some cases debts owed to certain State, local, and county agencies will be collected from an individual income tax refund. If the agency files a claim with the Department for a debt of at least $50.00 and the refund is at least $50.00, the debt will be set off and paid from the refund. The Department will notify the debtor of the set-off and will refund any balance which may be due. The agency receiving the amount set-off will also notify the debtor and give the debtor an opportunity to contest the debt. If an individual has an outstanding federal income tax liability of at least $50.00, the Internal Revenue Service may claim the individual’s North Carolina income tax refund. For more information, see G.S. §105-241.7 and Chapter 105A of the North Carolina General Statutes.

You May Like: Can I File My Nys Taxes For Free