Income Limits To Qualify For The Child Tax Credit

Income limits determine how much you will receive and if you even qualify, though there is no limit on the number of children you can receive tax credits for as long as youre eligible. This time around, you can receive the credit if you have no income.

Single filers earning less than $75,000 per year, heads of household earning less than $112,500 per year and married couples earning less than $150,000 a year will be eligible for the full amount.

The amount youll get will then phase out for higher incomes. Your child tax credit payments will phase out by $50 for every $1,000 of income over those threshold amounts, according to Joanna Powell, managing director and certified financial planner at CBIZ. In other words, your family could still receive some money above those income limits, but it wont be for the maximum payment.

IR-2021-59, March 17, 2021

WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days.

Documents You Need To File Tax Return

ITR-1 form , which is the form used by most salaried taxpayers, comes prefilled with majority of the information. to find out if you have filed your ITR using the correct form. Besides choosing the correct ITR filing form for yourself and thoroughly checking the pre-filled information, you need to keep in handy the documents and proofs associated with the task. Here we list down the nine documents you must collect before you start filing your ITR for FY 2020-21.

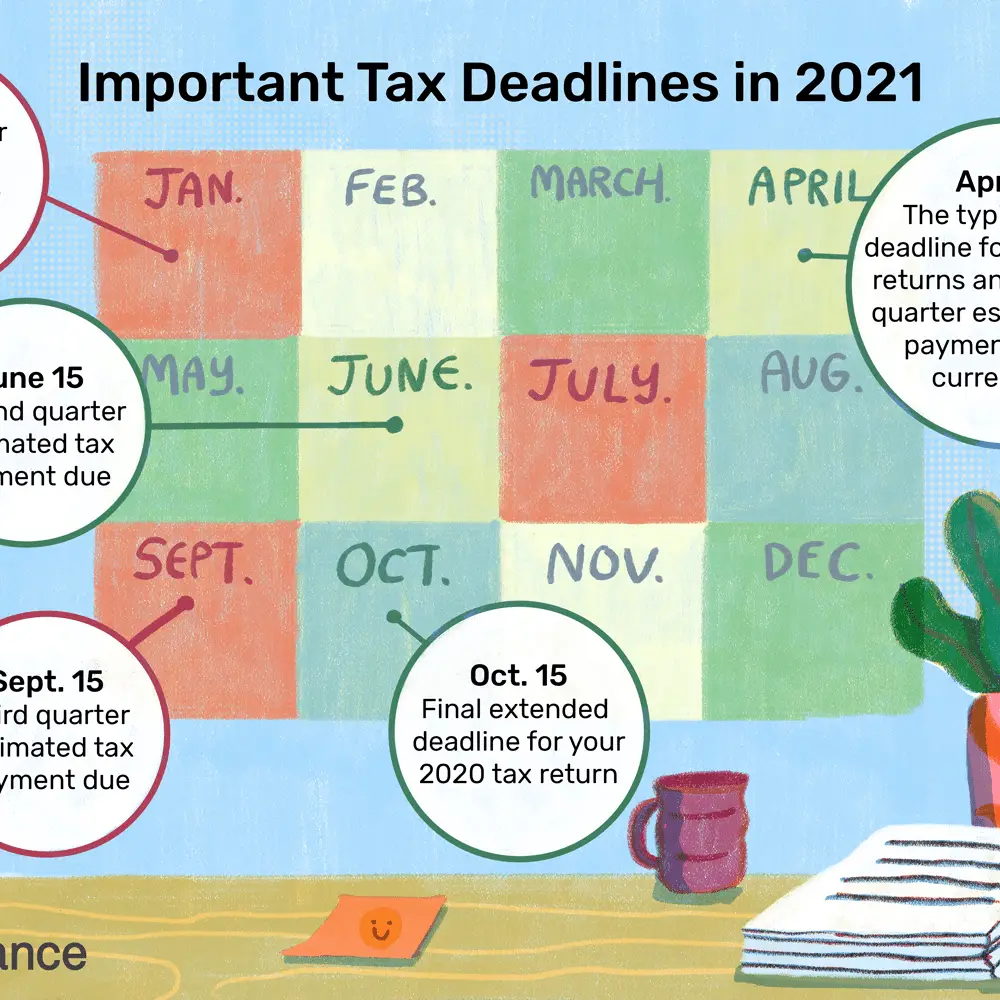

When Are Estimated Taxes Due In 2022

Those who pay estimated taxes have a slightly different filing schedule than everyone else. People who pay quarterly estimated taxes include the self-employed, as well as those who work similar entrepreneurial or independent contractor jobs. If your paycheck doesnt have income taxes taken out before the money gets to you, then this requirement applies to you.

Estimated taxes are due quarterly and must be submitted with Form 1040-ES. Heres when those payments are due:

- First-quarter payments: April 18, 2022

- Second-quarter payments: June 15, 2022

- Third-quarter payments: Sept. 15, 2022

- Fourth-quarter payments: Jan. 17, 2023

Note: Like Tax Day, quarterly tax payments are due on April 18 this year. But because Jan. 15, 2023, is a Sunday, and Monday, Jan. 16 is Martin Luther King Jr. Day , the deadline to pay estimated taxes on the self-employment income you earn in the fourth quarter of 2022 has been pushed to Jan. 17, 2023.

This is the standard schedule to follow, provided nothing interferes.

If youre an employee who earns tips, youre required to report all your monthly tip earnings to your employer by the 10th of the following month. Your employer is responsible for sending those numbers to the IRS, as well as for adjusting how much money comes out of your paycheck to satisfy your tip withholding.

Also Check: How Are Sole Proprietorships Taxed

In The Face Of The Coronavirus Pandemic The Internal Revenue Service Extended A Number Of Filing Deadlines For Taxes Whats The Current Position

Covid-19 has forced millions in the United States to file for unemployment, led to people losing their jobs or having their hours cut, forced individuals to find new work, and also led to taxpayers being eligible for new tax credits, all of which has meant that people may find that filing their taxes may be a bit, or a lot, more complicated than in previous years.

Unemployment Benefits With A Tax Break In 2022

Taxpayers got a surprise tax break on unemployment benefits received only in 2020, as part of a $1.9 trillion stimulus package signed into law in March 2021.

As part of the American Rescue Plan, many taxpayers were no longer required to pay taxes on up to $10,200 in unemployment benefits received in 2020. The exclusion was up to $10,200 of jobless benefits for each spouse for married couples filing jointly.

UNEMPLOYMENT INCOME TAXABLE:Don’t forget: Jobless benefits are taxable on 2021 tax returns

Contributing: Brett Molina and Elisabeth Buchwald, USA TODAY Susan Tompor, Detroit Free Press Russ Wiles, Arizona Republic Associated Press

Follow USA TODAY reporter Kelly Tyko on Twitter: @KellyTyko. For shopping news, tips and deals, join us on .

Read Also: How Do I Pay My New York State Taxes

Filing Deadline Extended To May 16same As For Kentucky Victims

As promised by the Internal Revenue Service , victims of recent tornados in parts of Illinois and Tennesse, like their neighbors in Kentucky, will have until May 16, 2022, to file individual and business tax returns and make tax-related payments. The IRS has offered this relief to taxpayers affected by storms, tornadoes, and flooding that took place beginning December 10 in parts of Illinois and Tennessee. Specifically, taxpayers and business owners in the Illinois counties of Bond, Cass, Coles, Effingham, Fayette, Jersey, Macoupin, Madison, Montgomery, Morgan, Moultrie, Pike, and Shelby and residents of Cheatham, Decatur, Dickson, Dyer, Gibson, Lake, Obion, Stewart, and Weakley counties in Tennessee are eligible for these extensions.

According to the IRS, the same relief will also be provided to any other areas designated by the Federal Emergency Management Agency in these and neighboring states. In addition, the IRS will work with any taxpayer who lives outside the disaster area but whose records necessary to meet a deadline occurring during the postponement period are located in the affected area. These taxpayerswho include relief workers affiliated with recognized organizationsneed to call the IRS at 866-562-5227. A list of eligible areas is always available on the IRS Disaster Relief page.

How To File An Extension

To file an extension, submit IRS Form 4868 electronically by the filing deadline on May 17. You can also do it for free using any of the Free File software offered by the major tax preparation companies. These often help you estimate your tax due so you can make a payment.

Another option is to print out the form and send it to the IRS address for your state by the deadline.

Even if you file an extension, you still need to pay what you owe by May 17. If you underestimate that amount, you could end up paying interest on what you dont pay.

Read Also: How Do I Find My Taxes

Will The Tax Deadline Be Extended Again In 2021

Due to the COVID-19 pandemic, the federal government extended this year’s federal income tax filing deadline from April 15, 2021, to May 17, 2021. In addition the IRS further extended the deadline for Texas, Oklahoma and Louisiana residents to June 15. These extensions are automatic and applies to filing and payments.

Will The Tax Filing Deadline Be Extended Again In 2021

The deadline for Americans to file their tax returns is Thursday, April 15. IRS

STATEN ISLAND, N.Y. — The Internal Revenue Service extended the deadline for Americans to file their tax returns in 2020 amidst the chaos of the coronavirus pandemic, which was in full swing last April.

The IRS moved the deadline from April 15 to July 15, giving filers an extra three months to have their taxes prepared and filed without punishment.

Although the COVID-19 pandemic has not vanished, the IRS said it will not be extending the tax filing deadline this year. Taxpayers are expected to file their taxes by the April 15 deadline or face penalties.

The 2021 tax filing season began on Feb. 12.

The agency is urging taxpayers to file electronically and opt for direct deposit to ensure refunds are processed as quickly as possible.

For those who need a filing extension, the standard process for requesting more time is still in place.

The IRS reminds individual taxpayers the easiest and fastest way to request a filing extension is to electronically file Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses must file Form 7004, according to the IRS.

The IRS said it anticipates nine out of 10 taxpayers will receive their refund within 21 days of electronic filing as long as there are no issues with their tax return.

You May Like: How Long Does It Take To Do Taxes In Person

Why Is The Tax Deadline Different In 2021

In the previous couple of years, the tax return deadline was extended to May 17. This was to allow the IRS to prioritize Covid-19 relief payments such as Stimulus Payments to businesses or individuals that were suffering as a result of the pandemic.Many peoples taxes were also affected by unemployment benefits, increased child tax credits and insurance changes. This made filing for tax a little more complex and meant that reclaims and credits needed to be made for missed stimulus payments.The extension here gave tax filers and the IRS a little more time to get everything in order before the deadline.However, as 2021 was the final year for stimulus payments, the deadline has been pulled back to the normal April date each year.

When The Deadline Is Different

Submit your online return by 30 December if you want HMRC to automatically collect tax you owe from your wages and pension. Find out if you are eligible to pay this way.

HMRC must receive a paper tax return by 31 January if youre a trustee of a registered pension scheme or a non-resident company. You cannot send a return online.

HMRC might also email or write to you giving you a different deadline.

You May Like: Why Do I Owe Money On My Taxes

Can I File An Extension

As in past years, you can request an extension if you need more time to prepare and file your 2021 return. Before the April 18, 2022, deadline, you must fill out and submit Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. At the time you file Form 4868, you must also pay the estimated income tax you owe to avoid penalties and interest, the IRS says.

Generally, taxpayers are granted an automatic six-month extension to file, or two months if theyre out of the country, in which case the extension also applies to payment of taxes owed.

To qualify for an extension, you must file Form 4868 before April 18, 2022. You will not be notified unless your request is denied.

Free File To Stay Open Until Nov 17 To Help Refund Filers Eligible For Stimulus Child Tax Credit Eitc

Starting this week, the Internal Revenue Service is sending letters to more than 9 million individuals and families who appear to qualify for a variety of key tax benefits but did not claim them by filing a 2021 federal income tax return. Many in this group may be eligible to claim some or all of the 2021 Recovery Rebate Credit, the Child Tax Credit, the Earned Income Tax Credit and other tax credits depending on their personal and family situation. The special reminder letters, which will be arriving in mailboxes over the next few weeks, are being sent to people who appear to qualify for the Child Tax Credit, Recovery Rebate Credit or Earned Income Tax Credit but haven’t yet filed a 2021 return to claim them. The letter, printed in both English and Spanish, provides a brief overview of each of these three credits.

These and other tax benefits were expanded under last year’s American Rescue Plan Act and other recent legislation. Even so, the only way to get the valuable benefits is to file a 2021 tax return.

Often, individuals and families can get these expanded tax benefits, even if they have little or no income from a job, business or other source. This means that many people who don’t normally need to file a tax return should do so this year, even if they haven’t been required to file in recent years.

Also Check: How To Calculate Your Taxes On Your Paycheck

How To Use Tfsa To Reduce Your Tax Burden

A survey from H& R Block Canada asked Canadians how they planned to use their refunds this year. Most of them stated they will use their benefits to pay bills, debt, and daily essentials. The benefits amount is to help Canadians with their expenses. But dont forget you also have to pay taxes. Planning your expenses and refraining from impulsive buying can help you save some amount for your taxes.

From the $8,646 cash benefit, if Anna could save $400 for her Tax-Free Savings Account , that could further relieve the tax burden. As Anna doesnt have much money to spare, she has a low-risk appetite. She can invest in a resilient stock like Enbridge , which pays a 7.23% dividend yield. A $400 investment can fetch her $29 in annual dividend income for a lifetime.

Enbridge is a safer bet because of its robust business model of pipeline toll that fetches regular cash flows. It increased its dividend per share at an average annual rate of 10% in the last 26 years. The company has the potential to grow the dividend at an average rate of 6% for the next 10 years, which can help you reduce your tax burden.

Fool contributor Puja Tayal has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Enbridge.

Dont Miss: Do I Have To Report Plasma Donations On Taxes

Which States Have Had Their Tax Filing Deadline Extended

While no national extension has been announced at the federal level, the IRS has identified various states and counties where the deadline was postponed because of a severe natural disaster.

After Kentucky was hit by a wave of tornadoes, the IRS announced that households and businesses in various counties would have until 16 May to submit their return.

For those who were victims of the of wildfires that began on December 30, 2021 in Colorado also have until 16 May to submit their return. The same goes for residents of Decatur and Dyer countries in Tennessee.

If you were a victim of severe storms, straight-line winds, and tornadoes in parts of Tennessee, you may have until May 16, 2022 to file various individual and business tax returns and make tax payments. See details of #IRS relief at

IRSnews

Recommended Reading: How To Claim Refinance On Taxes

No Extension To First Quarter Estimated Tax Payments

For individuals and businesses who need to make estimated tax payments for first quarter 2021 the IRS have decided not to extend the deadline. These amounts are due on Thursday 15 April. Check who must pay estimated tax.

The IRS has indicated that small business taxpayers could ask for relief from penalties if the cannot pay by April 15, that though of course leaves the decision on relief in the hands of the IRS.

How Do I Know That The Data Is Correct

This year, for the first time, you can view third-party data certificates submitted by third party data providers on your behalf. Simply log in to eFiling and following the steps below:

- Once successfully logged in, click on Third Party Data Certificate Search menu option displayed as part of the left menu option.

- Once you have selected the Third Party Data Certificate Search menu option, the Request Third Party Certificates screen will be displayed.

- On the Request Third Party Certificate form, select the Certificate Type and Tax Year.

- Click on the Certificate Type drop down list and select the appropriate certificate type.

- Click on the Tax Year drop down list and select the appropriate tax year.

- Once you have made the applicable selection, click on the Submit Query button displayed at the bottom of the page.

- The Certificate Type selected will be displayed and you will be able to click on to view your Certificate.

- Note the certificate cannot be used to submit to SARS.

If there is an error or the data is incomplete:

Also Check: Do You Pay Taxes On Bitcoin

Latest Cra Update: Is The Tax Deadline Extended Again In 2021

The Canada Revenue Agency moved the tax deadlines, filing and payments, for the 2019 taxes due to the COVID-19. Most individuals had until June 30, 2020 to file returns, while the tax payment extension was up to September 30, 2020.

Were on the second wave of coronavirus and a new tax season is at hand. However, the CRA hasnt announced an extension in 2021, similar to last year. Taxpayers have until the regular yearly deadline, or April 30, 2021, to file tax returns and pay taxes owed to the government for the 2020 income year.