What You Need To Fileand When

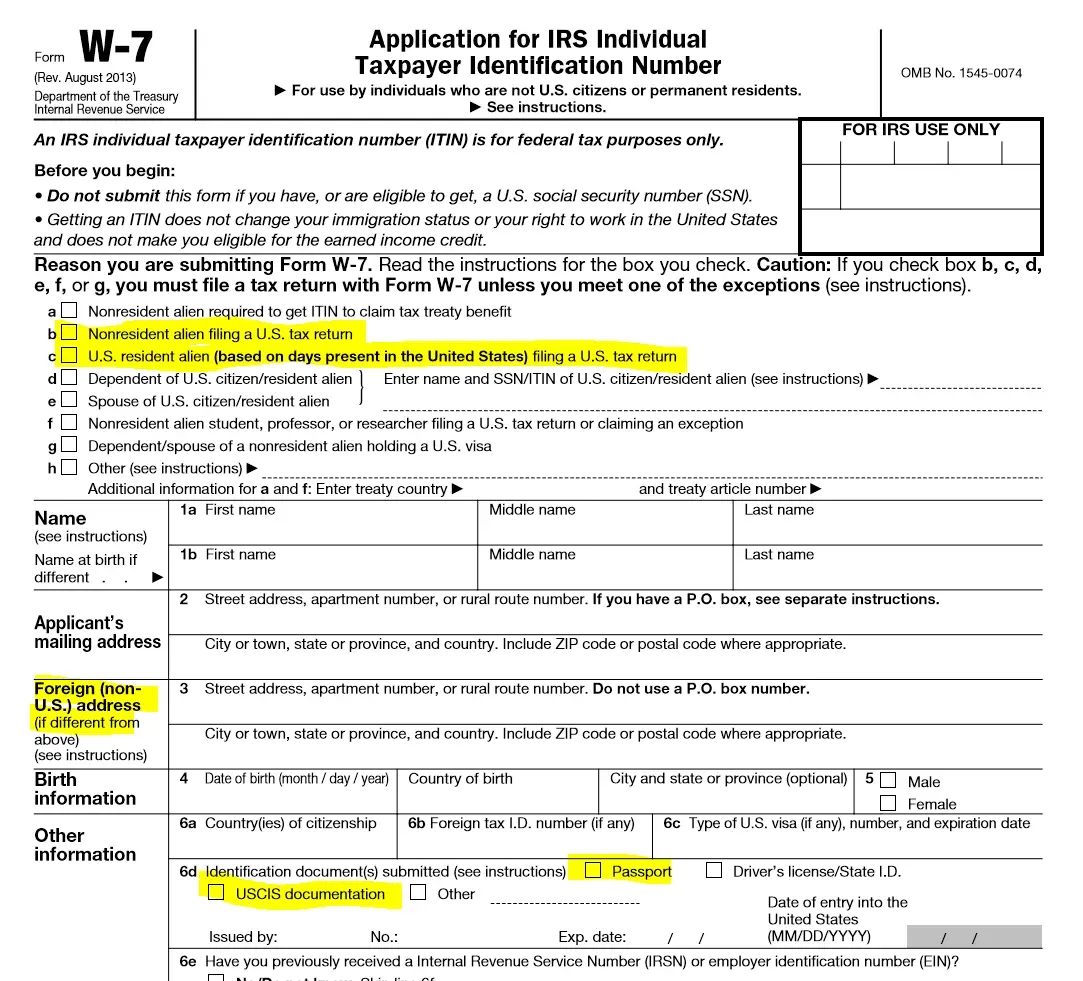

If you are a non-resident for tax purposes who received income in the U.S. during the last calendar year, you must file a tax return with the U.S. government. In addition to filing a federal tax return, you will likely need to file a return on the state level, as well.

Federal Tax Return

Federal taxes are those paid to the U.S. central government Internal Revenue Service . OIA pays for software licenses for our international population to use a special non-resident tax filing software for their federal returns only.

State Tax Return

In addition to a federal tax return, many will also have to file a State of Illinois income tax return. If you resided and/or worked in more than one U.S. state during the past calendar year, you may have to file tax returns in all of the states in which you resided or worked. You should check the state revenue website of the other state where you lived and worked to figure out your tax filing obligations. There will be a fee to use Sprintax to file a state tax return as the code provided by OIA only covers the federal return.

If You Are Getting A Refund

This is one of the great little secrets about the federal tax law. If you have a refund coming from the IRSas about three out of four taxpayers do every yearthen there is no penalty for failing to file your tax return by the deadline, even if you don’t ask for an extension. However, this might not be the case for state taxes.

That’s not to say there aren’t very good reasons for filing on time. Even if you have a refund coming, consider the following:

-

You can’t get your money back until you file, so you should file as soon as you can to get your money as soon as possible.

-

The statute of limitations for the IRS to audit your return won’t start until you actually file your return. So, the sooner you file, the sooner the clock starts ticking.

-

Some tax elections must be made by the due date, even if you have a refund coming. This applies to a very tiny percentage of taxpayers.

Paying With Your Bank Account

This is your best option because this way youll avoid any fees. Plus, the IRS will have your account information on file for refunds and awesome things like stimulus checks. People who pay directly from their bank account can count on the quickest processand the fastest refund if youre owed one.

When you file with direct deposit, you can see your refund in as soon as one week, compared to filing with a check in the mail, which can take up to eight weeks, a Chase representative told me. E-filing with direct deposit is easy, you just need to find your account and routing numbers.

Not sure where to find your account info? Its easy. Most major banks will have it in your online account. As Ive mentioned, I bank with Chase and was able to find my account and routing numbers in the banks app in a couple of taps while at my appointment with H& R Block.

Read Also: How To Pay Taxes On Etsy Sales

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

File An Extension Pay What You Can

Because not filing taxes garners the most severe penalties, the IRS suggests that taxpayers who can’t pay the total amount they expect they owe file their returns anyway or file an extension and pay whatever amount they can afford.

“Taxpayers who are thinking of missing the filing deadline because they can’t pay all of the taxes they owe should consider filing and paying what they can to lessen interest and penalties,” the agency advises.

Taxpayers should make an effort to figure out what they owe and pay what they can, CPAs advise. Eric Bronnenkant, tax head at Betterment, suggests that people use the previous year’s taxes as a starting point for how much they might owe.

“If your prior year is a good barometer for your current year, start with that as a way to come up with some sort of reasonable estimate,” Bronnenkant told CBS News recently. “Don’t let perfect be the enemy of good enough.”

Even if you missed the filing deadline, you can avoid future hefty penalties by filing as soon as possible.

“The thing is, per month. Whether you’re one day late or 30 days late, it’s per month,” said Davidoff. “So get that return done by May 15. And even if you can’t pay, you’ll at least have the return filed by that date.”

You May Like: How To Pay Taxes On Contract Work

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

What Are The Limitations To The Service

United Way is an equal opportunity provider and anyone in Washington State can access United Ways Free Tax Preparation services. However, some returns are too complex for our volunteers. For example, we cannot prepare returns for income earned in other states.

We have partnered with Express Credit Union to process returns with ITINs and will offer free ITIN applications and renewals through Express Credit Union.

Here are services we do NOT provide:

- State returns .

- If you have a 1099-B .

- If you sold your home or if it went into foreclosure.

- If you received rental income.

- If you are self-employed and had expenses above $25,000, had a net loss, or want to deduct the use of your home as a business expense.

- If you are a registered domestic partnership.

Also Check: How To Pay Your Federal Taxes Online

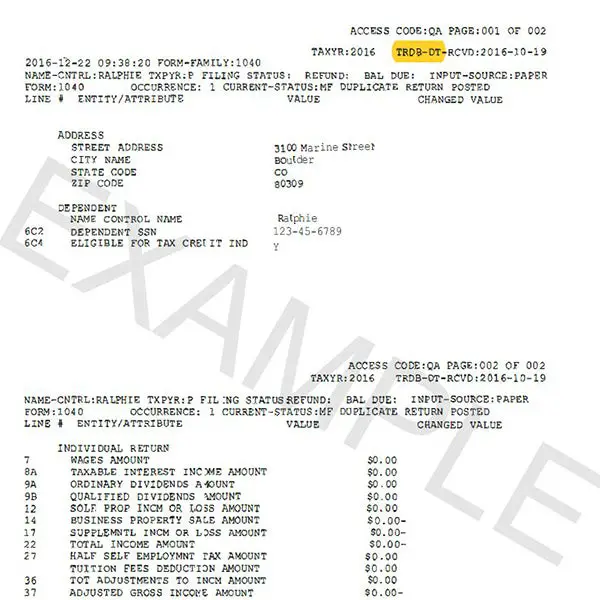

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Tax Filing 202: How To Set Up Idme For The Irs

After a year of delays, errors, staff shortages and all-around misery, the IRS wants to make it as easy as possible for taxpayers to manage their records and prepare their tax returns as filing season cranks up. One option is ID.me, a third-party service that has partnered with the IRS to provide identity verification for IRS applications.

Find: 10 Things That You Didnt Know Were Tax Deductions

As ID.me noted on its website, identity proofing services help the IRS ensure that millions of taxpayers and tax professionals can securely access the agency and its applications. Using the ID.me site, both taxpayers and tax professionals will be able to prove their identities by uploading government documents, taking video selfies and filling out personal information.

Once this is done, you can access the appropriate IRS application and use your ID.me account to log in across government websites and private sector partners wherever you see ID.mes green button. Most states use ID.me verification, CNET reported, but youll need to check with your state to see if its one of them.

If you want to sign up for an ID.me account, youll first need your Social Security number, drivers license or other government-issued ID , and a phone or computer with a camera.

Taxes 2022: Are Face Masks and Hand Sanitizer Deductible?

After that, youll have to go through a fairly lengthy series of steps. Here is the process, as laid out by CNET:

More From GOBankingRates

You May Like: When Are Extended Taxes Due

Will We See Simpler Solutions Ahead

U.S. Sen. Elizabeth Warren, D-Mass., took a shot in July on Twitter at Intuit for exiting the Free File program and said the “IRS can, and should, create its own free tax preparation and filing system.”

Back in early 2020, before the pandemic hit, the IRS said it was no longer promising not to enter the tax return software and e-file services marketplace. The pledge no longer exists for not creating a government-run system.

Then, it seemed there could be a flicker of hope.

The pandemic, though, hit the IRS hard. Shutdowns to stem the spread of COVID-19 in the spring of 2020 triggered delays in processing income tax returns and issuing refunds. The IRS also picked up extra work for rolling out Economic Impact Payments and later the advance Child Tax Credit to shore up the economy. It wasn’t pretty.

Going forward, it only makes sense for the IRS to work harder to give taxpayers even more access to no-cost software options for those willing to do their own tax returns. Getting Congress to really simplify the tax code wouldn’t hurt, either.

Follow Susan Tompor on Twittertompor.

If You Owe Taxes Youll Pay A Penalty And Interest

Keep in mind paying late comes with repercussions. For every month that you file late, youâll have to pay an additional 5 percent penalty on the total amount you owe. Itâs important to note that a month doesnât mean 30 days to the IRS â filing your return even one day late means you’ll still be hit with the full 5 percent penalty. On top of that, youâll also pay interest, which will only add to your fees. And if you file more than 60 days late, things become a bit more complex and costly â another reason to submit your return as soon as you can.

If you canât pay the full amount you owe when you file, paying what you can and looking into payment plans with the IRS is better than paying nothing.

Also Check: How Do I Report Tax Evasion

Intuit H& r Block And Americas Broken Tax Filing System

The Free File and Free File Fillable Forms systems can perhaps best be understood as a kind of peace treaty between the IRS and the private tax preparation industry, specifically Intuit and H& R Block.

For years, the government leaned on those two companies to provide free tax services to Americans in need. But the basic problem with relying on private sector companies that provide paid tax services to provide free ones is that they will always have an incentive to make the free service worse and to make the paid one more attractive. Thats been the story the past couple of decades.

In 2002, as part of a broader effort to improve government technology to take advantage of the internet, the Bush administration proposed that the IRS develop an easy, no-cost option for taxpayers to file their tax return online.

This, as ProPublicas Justin Elliott and Paul Kiel reported, led to a massive lobbying push from Intuit, including a coordinated letter from Republican members of Congress demanding that the IRS not compete with private companies, with an implicit threat of reduced IRS funding if it did try to offer free filing.

So the IRS, hamstrung by limited funding to start its own free filing program anyway, negotiated a deal with the tax preparers: The companies would offer low-income Americans free tax prep software, and in exchange, the IRS would promise not to set up a free filing program of its own.

This, perhaps unsurprisingly, led to backlash from the tax prep industry.

Does The Irs Ever Negotiate The Amount Owed

Under certain circumstances, the IRS is authorized to resolve a tax liability by accepting less than full payment. An “offer in compromise” is an agreement between a taxpayer and the IRS that settles the taxpayer’s tax debt. There are three circumstances under which the IRS is authorized to compromise:

When there is doubt that the tax is correct.

When there is doubt that you could ever pay the tax in full.

When the tax is correct and you could pay it, but payment would result in an exceptional circumstance, economic hardship, or be unfair and inequitable.

Form 656: Offer in Compromise Package should be completed to file an Offer in Compromise with the IRS. Included with the Form 656 package are Form 433-A, Collection Information Statement for Wage Earners & Self-Employed Individuals and Form 433-B, Collection Information Statement for Businesses.

-

You may need to complete the appropriate Form 433 and should be prepared to provide other documentation and explanations as they are requested.

-

Various options are available for accepted Offers in Compromise requests, such as a reduced total payment and scheduled monthly payments.

-

Defaulting on an accepted offer in compromise can result in the IRS filing suit against you and reinstatement of the original tax debt, plus interest and penalties.

Don’t Miss: Where Do I File My Federal Tax Return

Pay Your Balance Due Immediately

Of course, this is the IRS preferred payment method, even if its only a partial payment. And most taxpayers facing collection actions are probably dealing with some sort of financial hardship. So its the payment method that most of these taxpayers are least able to afford.

To make an immediate partial payment on your outstanding balance, you can go to the IRS websites payment page. From there, you can:

- Establish or log into an online IRS account

- Pay from a bank account via DirectPay

- Make a payment through the Electronic Federal Tax Payment System

- Make a payment by debit card, , or digital wallet.

- Using this payment method may incur processing fees, although low-income taxpayers may qualify for a reduced user fee

How Biden And The Irs Can Fix Tax Filing

The IRS desperately needs to put together an easier-to-use, simpler way for people to file their taxes and access benefits free of charge. Accomplishing that, of course, is easier said than done. The IRS has been underfunded for decades and does not have sufficient in-house technical expertise to build a free file system on its own.

But there are signs suggesting that the limitations keeping the IRS from enabling free filing are falling away.

First, the agency removed the ban limiting it from offering such a product in 2019. Then the Biden administration made increased funding to the agency one of its top domestic spending priorities, as well it should funding the IRS increases tax revenue and pays for itself several times over. While the provision fell out of the bipartisan infrastructure deal over Republican opposition, its set to be used as a pay-for in Democrats $3.5 trillion spending package.

That could provide the funding necessary for the IRS to make free filing a reality and Intuits withdrawal from the Free File program could provide some sense of urgency. The problems with Free File lead me to conclude that it is time for IRS to develop the technology that will allow individuals to access our tax system with minimal burden, Leslie Book, a professor of tax law at Villanova, told me, in a judgment that echoes many tax law experts Ive spoken with.

Also Check: When Does The Irs Start Accepting Tax Returns For 2021

Irs Free File Online Options

Do your taxes online for free with an IRS Free File provider.

If your adjusted gross income was $73,000 or less, review each providerâs offer to make sure you qualify. Some offers include a free state tax return.

Use the IRS Free File Lookup Tool to narrow your list of providers or the Browse All Offers page to see a full list of providers. After selecting one of the IRS Free File offers, you will leave the IRS.gov website.

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Recommended Reading: Who To Call For Tax Questions

Know The Pros And Cons Of Digital And Paper Tax Returns

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

mediaphotos / Getty Images

When you file your taxes, you have two options for submitting your return with the Internal Revenue Service : electronically or by mail.

Both methods of filing have their pros and cons. E-filing is safe, faster, and generally more convenient than paper filing. Filing by mail can be cheaper, though it takes the IRS longer to process refunds.

Learn more about choosing how to file your tax return.