Gift And Inheritance Tax Ingeorgia

During the calendar year the following is exemptedfrom calculation of tax obligations:

- Propertyreceived as a gift or inheritance by the heirs of;I;and;II;sucession;

- Giftsworth up to 1,000 GEL, with the exception of gifts from the employer to theemployee;

- Giftsand inheritance in the amount of up to GEL 150,000 received by the heirs ofthe;3rd;and;4th;succession.

Relief From Personalincome Tax In Georgia

Georgian legislation exempts the followingcategories of people from income tax:

- individualswith an annual income of 3,000 GEL ;

- women;whohave received the status of Single mothers;

- veteransof;World;War;II;

- warveterans for the territorial integrity of Georgia;

- women;whoreceived the title of Mother of Georgia;

- persons;whohave;adopted;children.

In addition,;income tax is not withhelduntil January 1, 2023 from persons engaged in agriculture, namely:

- on profitreceived from the primary supply of agricultural products of Georgian origin,if the total annual revenue from this activity does not exceed 200,000 GEL;

- on wagesreceived by employees of the above-mentioned enterprises, if the annual incomefrom this activity does not exceed 200,000 GEL.

Also, persons with three or more childrenpermanently residing in highland settlements are exempted from taxobligations.;For persons;with two children, the tax obligation isreduced by half.;Georgian legislation also provides for a number of taxbenefits for persons with disabilities and limited capacities.

What Tool Can A Buyer Use To Calculate Their Tavt

The Department of Revenue offers a Georgia sales tax calculator that allows residents to calculate their Title Ad Valorem Tax on a vehicle. To use this tool, you will need your car’s identification number. If you don’t have the VIN, you will be directed to another tool that will allow you to input other information such as the purchase date, base price, and purchase price to receive a TAVT estimate.

You May Like: How To Buy Tax Lien Properties In California

Taxable And Exempt Shipping Charges

Georgia sales tax generally applies to delivery, freight, transportation, shipping, and handling charges for taxable sales, whether separately stated or included. Delivery charges for exempt sales are generally exempt.

There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. Specific questions on shipping in Georgia and sales tax should be taken directly to a tax professional familiar with Georgia tax laws.

For additional information, see Georgia Department of Revenue guidelines.

Georgia Income Tax Calculator

| $2,700.00 | $3,000.00 |

The standard deduction, which Georgia has, is a deduction that is available by default to all taxpayers who do not instead choose to file an itemized deduction.Essentially, it translates to $4,600.00 per year of tax-free income for single Georgia taxpayers, and $6,000.00 for those filing jointly.

The Personal Exemption, which is supported by the Georgia income tax, is an additional deduction you can take if you are primarily responsible for your own living expenses. Likewise, you can take an additional dependent exemption for each qualifying dependent , who you financially support.

The Federal income tax also has a standard deduction, personal exemptions, and dependant deductions, though they are different amounts than Georgia’s and may have different rules.

Head over to the Federal income tax brackets page to learn about the Federal Income Tax, which applies in all states nationwide.

You May Like: How To Appeal Property Taxes Cook County

How Much Will It Cost Me To Register My Car In Georgia

There is a flat rate fee of $20 for all vehicle registrations. Additionally, there is an $18 title fee for new titles issued by the state of Georgia. It will cost $8 for a replacement title. Additionally, if you submit the title application form in person or via expedited mail service, an extra $10 must be included.

Getting Your Georgia Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of Georgia, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your Georgia tax refund, you can visit the Georgia Income Tax Refund page.

Recommended Reading: Where To Find Real Estate Taxes Paid

Gains From Stock Option Exercises

| Residency status | |

| N/A | N/A |

Generally, any compensation or in-kind benefit of an individual received as a result of an employment is considered as employment income. The value of in-kind benefits in the majority of cases is determined as the market value of the benefit less any amount paid by the employee.

Live In The House For At Least Two Years

The two years dont need to be consecutive. Meaning, you can live in the house for a year, relocate for a job for a year, and move back for another year, which will total two years living in the property. If you sell a house that you didnt live in for at least two years, the gains can be taxable. Selling in less than a year is especially expensive because you could be subject to the short-term capital gains tax, which is higher than long-term capital gains tax.

Read Also: Do You Have To Claim Social Security On Taxes

Georgia Income Tax Rate 2020

Georgia state income tax rate table for the 2020 – 2021 filing season has six income tax brackets with GAtax rates of 1%, 2%, 3%, 4%, 5% and 5.5% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

The top Georgia tax rate has decreased from 5.75% to 5.5% while the tax brackets are unchanged from last year. Georgia income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2020 through December 31, 2020.

Outlook for the 2021 Georgia income tax rate is for the top tax rate to decrease further or change to a 5.375% flat rate. Georgia House Bill 918 passed into law in 2018 notes the reduction of the top rate towards the current 5.5%. House Bill 949 was presented in early 2020 which discussed the move to a flat tax coupled with a larger standard deduction.

Please reference the Georgia tax forms and instructions booklet published by the Georgia Department of Revenue to determine if you owe state income tax or are due a state income tax refund. Georgia income tax forms are generally published at the end of each calendar year, which will include any last minute 2020 – 2021 legislative changes to the GA tax rate or tax brackets. The Georgia income tax rate tables and tax brackets shown on this web page are for illustration purposes only.

State Of Georgia Sales Tax For Businesses

There is specific terminology surrounding whether, as a business, you need to collect Georgia sales tax. This is called Sales Tax Nexus. It basically means, does your business have a significant presence in the state. Any of the following criteria are considered by the state of Georgia as qualifying a seller to have sales tax nexus:

- An office or place of business in Georgia

- An employee that works within the state of Georgia

- Independent contractors or representatives that work for you in Georgia

- Goods that are housed in a warehouse in Georgia

- Delivery of merchandise in Georgia that is typically done via the businesses own fleet of vehicles

- Ownership of real or personal property

- Economic nexus

To learn exactly what the Georgia Department of Revenue determines to be sales tax nexus in Georgia, head over to their website and see what businesses this applies to and what you are expected to collect from your customers.

Sales Tax in Georgia by County

The table below lists the 159 Georgia counties that charge sales tax within the state. Georgias sales tax is based on the base rate plus the county rate and any other special exceptions, so the rates below are indicative of the total Georgia sales tax you will pay or have to collect from your customers.

| Georgia Sales Tax Rates by County | Total Georgia Sales Tax Rate | Georgia State Sales Tax Rate |

|---|---|---|

| Appling County Sales Tax |

Varieties Of Taxable Income Ingeorgia

In addition to obligations incurred by a personin relation to income from salary, the following types of income in Georgia arealso taxed:

- dividends;

- incomefrom supplies of scrap and waste of ferrous and / or non-ferrous metals;

- freetransfer of property worth more than 1,000 GEL;

- incomereceived by an individual from the provision of various services.

It should be noted that depending on the typeof income received, tax rates may vary.

Do You Need A Georgia Sales Tax Permit

If you are planning on doing significant business in Georgia, then the state views your business as sales tax nexus, which means you must apply for a Georgia sales tax permit, as TaxJar explains. Do this early as you are considering what GA sales tax your business will have to pay. Keep in mind your business may qualify as a nexus even if you run an e-commerce store and people from Georgia buy your products.

References

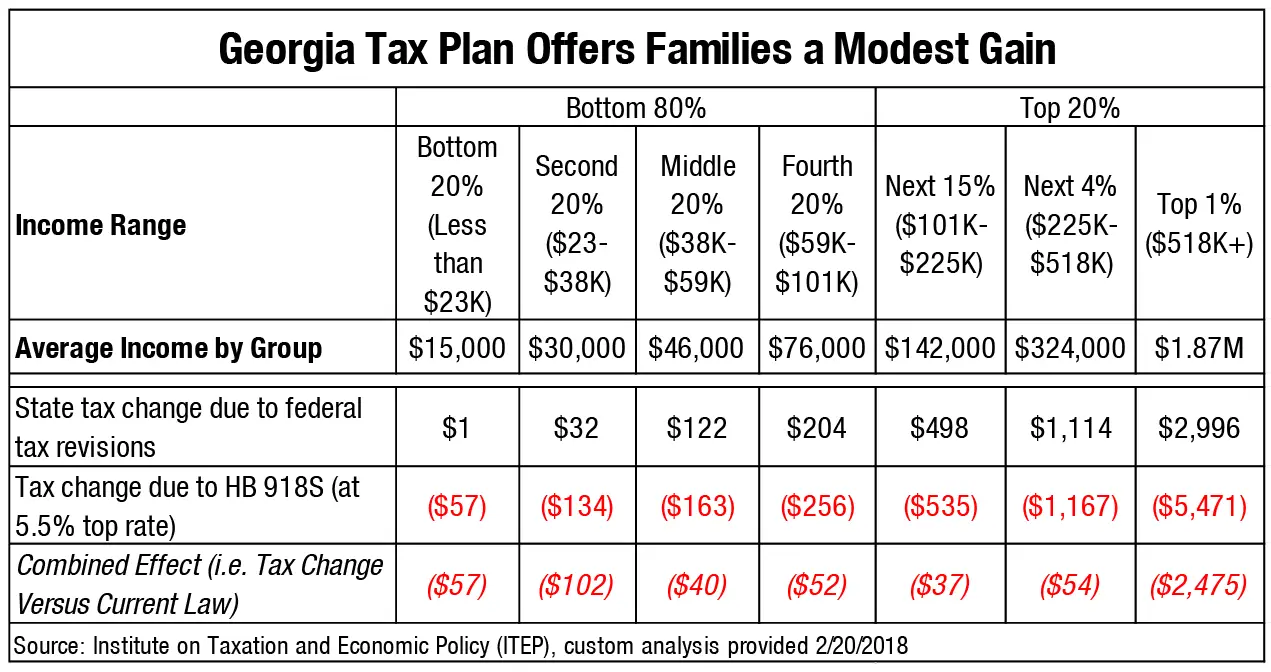

Sharp Revenue Losses Middle

Members of the Georgia General Assembly are considering legislation, HB 949 , to change the structure of the states income tax in ways that would negatively affect hundreds of thousands of families across the state while threatening to upend the state budget by reducing revenue collections by $383 million per year when fully implemented. For the most part, Georgia taxpayers with annual incomes below $108,000 per year would not benefitand may experience tax increasesas a result of the flat income tax structure created under the legislation. Overall, 88 percent of the $458 million in net tax cuts would go solely to filers earning over $108,000 per year. This fiscal impact is partially offset by $75 million in net tax increases that would be shared by 538,000 low- and middle-income households.

Overall, 88 percent of the $458 million in net tax cuts would go solely to filers earning over $108,000 per year. This fiscal impact is partially offset by $75 million in net tax increases that would be shared by 538,000 low- and middle-income households.

How To Register For A Sales Tax Number In Georgia

Quick Reference

Most businesses starting in Georgia selling a product or offering certain services will need to register for a;sales tax number. This is commonly referred to as a sellers permit, sales tax permit, sales & use tax number, or sales tax registration.

Check out the rest of this guide to determine who needs a sales tax number, what products and services are taxable, how to register for a permit, and reporting requirements.

How Much Sales Tax Is Charged

The sales tax rate that is charged varies depending on the address of the business if the purchase is made or shipped from a business located in the state. If the seller is based out of the state, the sales tax rate is based on the buyers address.

In addition to the statewide tax, there are additional sales taxes that may be added by cities and municipalities. To find the sales tax for your location, see the;sales tax rate table;from the Georgia Department of Revenue.

In Georgia, sales tax should be added to the cost of shipping retail products.

Georgia Tax Brackets 2020

Looking at the tax rate and tax brackets shown in the tables above for Georgia, we can see that Georgia collects individual income taxes differently for Single versus filing statuses, for example. We can also see the progressive nature of Georgia state income tax rates from the lowest GA tax rate bracket of 1% to the highest GA tax rate bracket of 5.5%.

For single taxpayers living and working in the state of Georgia:

- Tax rate of 1% on the first $750 of taxable income.

- Tax rate of 2% on taxable income between $751 and $2,250.

- Tax rate of 3% on taxable income between $2,251 and $3,750.

- Tax rate of 4% on taxable income between $3,751 and $5,250.

- Tax rate of 5% on taxable income between $5,251 and $7,000.

- Tax rate of 5.5% on taxable income over $7,000.

For married taxpayers living and working in the state of Georgia:

- Tax rate of 1% on the first $1,000 of taxable income.

- Tax rate of 2% on taxable income between $1,001 and $3,000.

- Tax rate of 3% on taxable income between $3,001 and $5,000.

- Tax rate of 4% on taxable income between $5,001 and $7,000.

- Tax rate of 5% on taxable income between $7,001 and $10,000.

- Tax rate of 5.5% on taxable income over $10,000.

How Do I Become Tax Exempt In Georgia

The exemptions are codified in Chapter 8 of Title 48 of the Official Code of Georgia.Nontaxable Sales

What Is The Percentage Of The State General Sales Tax Rate In Georgia

According to CarsDirect, Georgia has a state general sales tax rate of 4%. However, this retail sales tax does not apply to cars that are bought in Georgia. Instead, the state enforces an auto sales tax known as the Ad Valorem Tax for vehicle purchases. The exception to this is if you buy a vehicle outside of the state, in which case you would be required to pay the state sales tax of 4%.

How To Register For A Georgia Seller’s Permit

You can register for a Georgia sales and use tax number online through the Georgia Tax Center . To apply, youll need to provide the GTC with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

- Products to be sold

Georgia Sales Tax Nexus In Georgia

If you have nexus in Georgia, then you are required to collect sales tax on applicable sales, and file and remit that tax to the state. Nexus is simply defined as a significant connection to a state. Specifically in Georgia, the following activities give rise to economic nexus:

- Maintains a retail sales location, office, warehouse, distribution center, or other place of business within the state

- Posesses tangible personal property for retail sale, use, consumption, distribution, or storage

- Solicits business via an employee or other representative

- Has Georgia-based affiliates who earn commission by referring sales, sometimes known as a click-through nexus

Amazon sellers should note that there are Fulfillment by Amazon warehouses in the state of Georgia, and that storing goods for sale through FBA in Georgia warehouses gives rise to nexus and therefore sales tax resposibilities.

Please refer to the state of Georgia for a complete and up-to-date list.

How To Get A Georgia Sales Tax Certificate Of Exemption

A business can purchase items to resell without paying state sales tax. The tax liability is passed from the distributor to the retailer, who will then charge sales tax to the end-user of the item.

Wholesalers and distributors will require a sales tax number and a Georgia;Sales Tax Certificate of Exemption; to document the items being purchased are for resale.

Can I Buy A Car In Another State And Register It In Georgia

Titles and license plates for vehicles titled in another state or country can be obtained at your County Tag Office with the following information: Current out-of-state registration from the appropriate out-of-state agency. Must be: Issued in the applicant name or properly assigned to the applicant.

Is Fabrication Labor Taxable In Georgia

According to an article, Repair and installation labor for tangible personal property is exempt from sales tax; however, it must be separately stated from the material charges on an invoice. If fabrication labor is being provided, the entire charge is taxable regardless if the labor charges are listed separately.

Keep The Receipts For Your Home Improvements

The cost basis of your home not only includes what you paid to purchase it but all of the improvements youve made over the years. When your cost basis is higher, your exposure to the capital gains tax is lower. Renovations, new windows, new roofs, landscaping, fences, new driveways, air conditioning installs theyre all examples of things that can cut your capital gains tax.

Selling With A 1031 Exchange

Since we buy houses with our own money, we are able to close when it works best for you. If you want to sell your investment property, but need to work with a buyer that can close in a very specific time frame, just fill out the form below and lets chat.

We work with investors all of the time who are 1031 Exchanging their properties so that they can avoid paying capital gains taxes in Georgia. We can close on the exact date that works for you.

Dont mess with MLS buyers who rely on financing that can fall through at the last minute, making you lose the opportunity to do a 1031 exchange and deferring your capital gains.

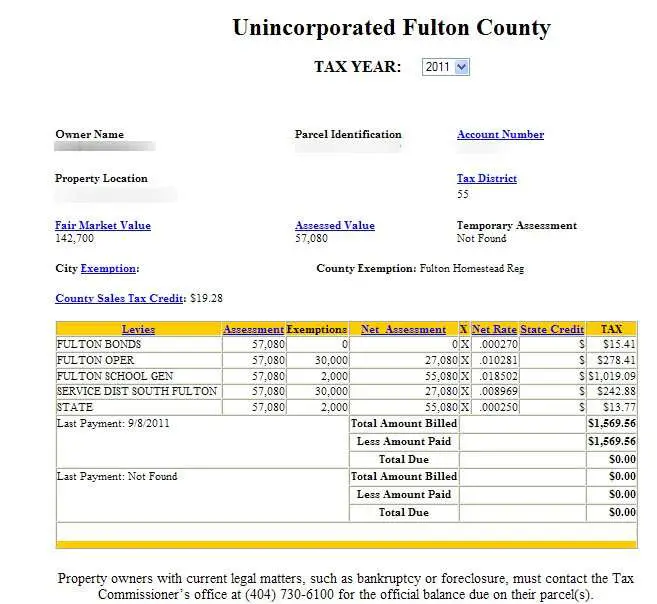

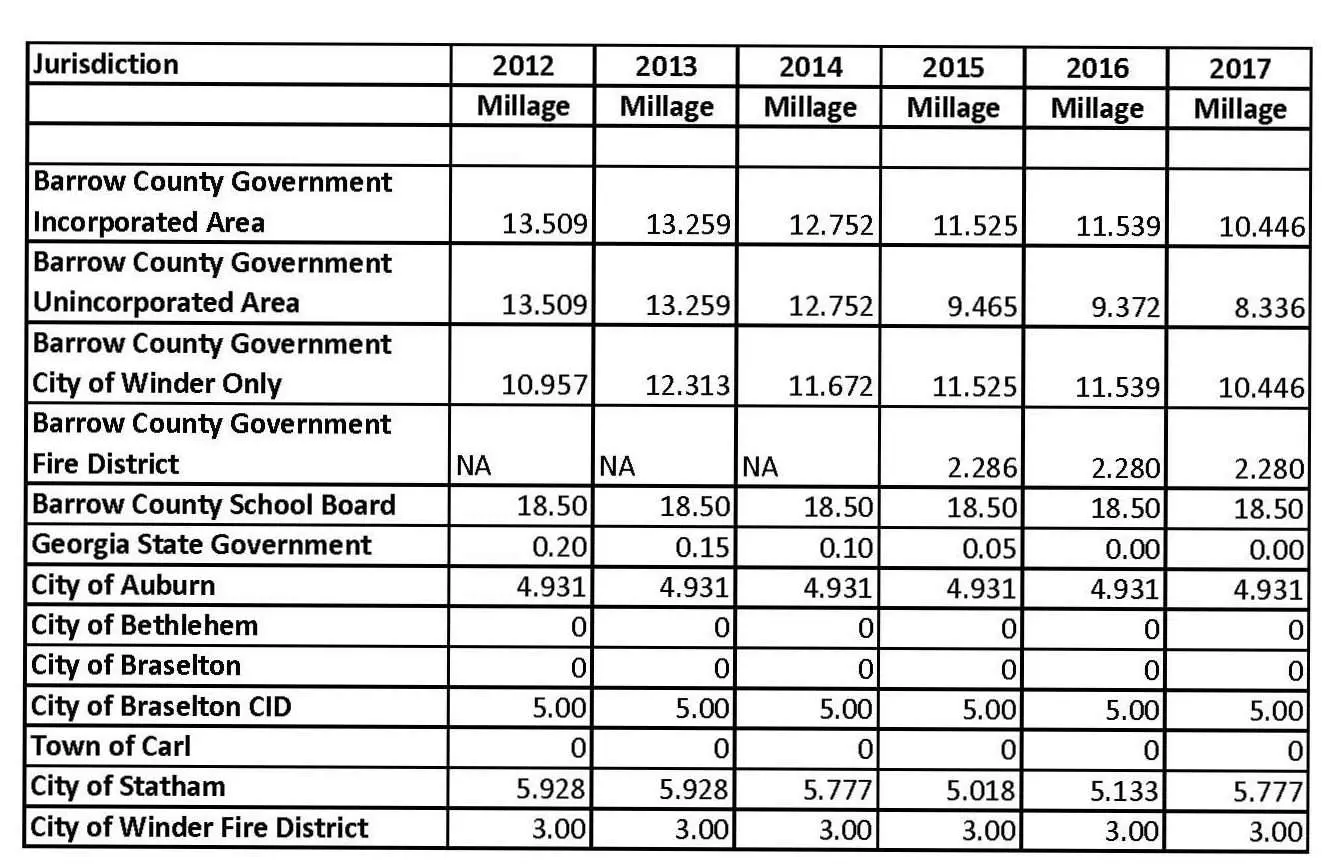

Find The Current Georgia Sales Tax Rate

The Georgia Department of Revenue keeps a list of sales taxes, including current rates and upcoming rate changes by county, that your business can consult at any time. For example, the general sales tax rate for Fulton County in Atlanta is 8.9 percent in 2021. If you are selling a retail good in the city, this is the sales tax that will be imposed and should be added to the price of all goods.

Note that this is one case where the sales tax outside of Atlanta is actually different even though it is still in Fulton County. While the overall sales tax rate for the state is 4 percent, most counties charge between 6 and 8 percent.