Check If You Need To File An Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass.

Find out if you need to file an Income Tax Return:

Non-resident individuals

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

What Is The Phone Number For The Irs

Phone support from the IRS is currently very limited. If you have questions about payments that affect the economy, call 8009199835. Where is my refund? Are you waiting for a refund? The IRS gives more than 9 out of 10 refunds in less than 21 days. 4 weeks after sending the paper declaration. Where is my refund? They invite you to contact us.

Also Check: Where To Get Tax Transcript

What If You Need Your Actual Tax Return

If your tax transcript wont meet your needs, you can still access your tax return in other ways. If you used TurboTax Online to prepare your taxes, you can access your tax return by signing in to your TurboTax account and navigating to the Your tax returns & documents section.

If you prepared your taxes in another way, you need to complete IRS Form 4506 and mail it to the IRS along with a $43 fee for sending you a copy of your tax return . These requests can take up to 75 days to process. So, youll want to make sure a tax transcript wont cut it before starting this process.

Remember, with TurboTax, well ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, weve got you covered. Feel confident doing your own taxes.

Dont Miss: Taxes For Doordash

Estimate Your Federal Tax Refund With The Last Pay Stub Of The Year

When workers receive their last pay stub of the tax year, they are likely wondering if they will receive a tax refund for the year and, if so, by how much. Most taxpayers know completing their income tax return is complex and challenging even with all the information they need, such as W-2 forms and receipts for other income and eligible deductions. However, even without this information, a taxpayer can make an educated guess as to whether they will receive a tax refund or not, including the amount, by using the information on their last pay stub.

Recommended Reading: Why Would My Taxes Be Rejected

Read Also: How To Pay Tax By Phone

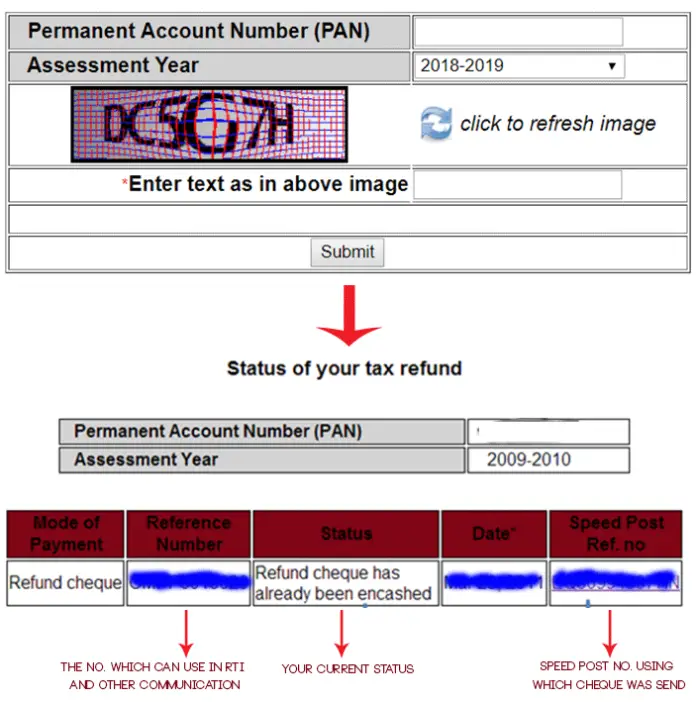

How To Check Income Tax Return Refund Status Online

ITR refund status: The due date for income tax return filing for AY 2022-23 is gone and those who filed their ITR for FY 2021-22 have either got their ITR refund or they are waiting for it. However, the due date for those taxpayers whose ITR requires to be audited is 31st October 2022. So, those whose ITR don’t require any audit are eligible for ITR refund and such taxpayers can check their ITR refund status online if they are yet to receive the excess tax amount they paid during the FY 2021-22.

How to check ITR refund status online with acknowledge number

Old is gold: Nikhil Kamath’s idea to smart investing

The income tax department in India offers taxpayers to check their ITR refund status after 10 days of ITR filing. So, those taxpayers who have filed their ITR more than 10 days ago and they are still awaiting their ITR refund can check one’s ITR refund status online by logging in at the income tax e-filing portal. Here is step by step guide on how to check ITR refund status online with acknowledgement number at income tax e-filing portal:

1] Login at the direct income tax e-filing portal link https://eportal.incometax.gov.in/iec/foservices/#/login

2] Login using User ID and Password

3] Go to ‘My Account’ and click at ‘Refund/Demand Status’

4] Go to the drop down menu, select ‘Income Tax Returns’ and click on the ‘Submit’ option

5] Click on your acknowledge number

How to check ITR refund status online by PAN number/card

2] Enter your PAN number

How Long Does It Take To Receive Itr Refunds

With the government switching to the online mode of payment, the procedure of receiving income tax refunds has been simpler. If you filed your income tax return on time and had it verified, the processing time for refunds of income taxes is typically 20 to 45 days.

The income Tax Department had even issued a statement where they said that the demands of less than Rs 100 will not be enforced but rather will be adjusted against future income tax refunds.

Income Tax refunds are granted by the government so that one gets back any extra income that they might have paid. The taxpayer may occasionally be required to pay more in taxes than they are legally required to. A person may request an income tax refund, for instance, if advanced tax or tax deducted at source is greater than the tax that is owed.

Also Check: When Is The Last Day I Can File My Taxes

Trump Claimed He Gave His Salary As President Away Each Year What Do His Tax Returns Say

Former President Trump announced each year of his presidency that he was giving away his salary. As a candidate in 2016, he told “60 Minutes” Lesley Stahl he’d just take $1 a year.

His tax returns don’t specify that he did so, but in three of the years of his presidency, Trump declared charitable gifts “by cash or check” that exceeded his $400,000 annual salary as president. One year, the last year of his presidency, does not.

In 2017, he noted $1,860,963 in charitable contributions by cash or check. That year, the White House announced Trump’s first salary donation, which was $78,333.32 for his first three months in office, would go to the National Park Service to help pay for maintenance of the nation’s battlefields.

One quarter’s salary went to a Small Business Administration program to help veterans. Another quarter’s pay went to fight the opioid crisis.

In 2018, Trump listed $500,150 in donations by cash or check, and in 2019, slightly more $504,700.

In 2020, the number that appears on that contributions line is 0.

However, forensic accountant Bruce Dubinsky says it’s not possible to decipher from the tax returns whether or not Trump actually donated his salary.

- https://www.cbsnews.com/live-updates/trumps-tax-returns-released-today-2022-12-30/#post-update-8138a503

Q12 How Do I Request A Transcript For An Older Tax Year When Its Not Available Online

Tax return and record of account transcripts are only available for the current tax year and three prior tax years when using Get Transcript Online. Note: There is a show all + expand button below the online tax account transcript type that may provide additional tax years you need. Otherwise, you must submit Form 4506-T to request a transcript for a tax year not available.

Tax return and tax account transcripts are also limited to the current and prior three tax years when using Get Transcript by Mail. However, you may be able to get older tax account transcripts by calling our automated phone transcript service at 800-908-9946. Otherwise, you must submit Form 4506-T.

Also Check: Amended Tax Return Online Free

You May Like: Is The Irs Extending The Tax Deadline For 2021

What Are Some Common Tax Forms Us Expats Need To Know About

Now that you know you have to file, you should get to know some of the common forms U.S. expats use to file their taxes.

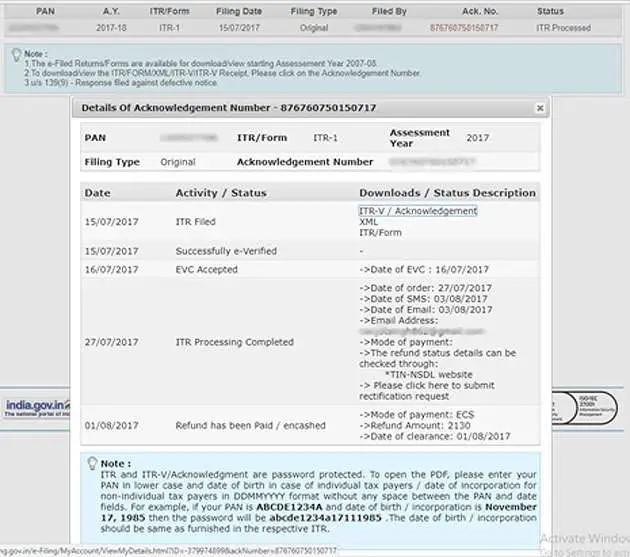

If You Are Using An E

- Log into your account on the portal

- From the dropdown menu, click on the View Filed Returns option

- You will see your current ITR files, as well as previously filed ITRs on the page, from which you must select the View details option for the ITR against which refund is expected.

- The refund status will be visible to you now.

Recommended Reading: Are Roth Ira Contributions Tax Deductible

Income Tax Refund Latest Updates

- CBDT issues refunds of over Rs 84,781 crore to more than 59.51 lakh taxpayers from 1st April, 2021 to 11th October, 2021. Income tax refunds of Rs. 22,214 crore have been issued in 57,83,032 cases & corporate tax refunds of Rs 62,567 crore have been issued in 1,67,718 cases, Income Tax India tweeted.

- This includes 29.23 lakh refunds of assessment year 2021-22 amounting to Rs 2,241.39 crore, as per details by Income Tax India.

Heres how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Heres an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

Dont Miss: Is Aarp Doing Taxes In 2021

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include “Surviving Spouse” and “Deceased” next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

Don’t Miss: How Do Roth Ira Contributions Affect Taxes

You Have Not Updated The Status Of My Refund In A While When Will I Receive It

Each return processes through multiple steps. We recommend you file electronically and include all documentation to ensure we can process your return/refund as quickly as possible. Please check back on the status daily. If we require additional information, we will contact you through U.S. Postal Service mail.

Checking Your Tax Refund Status Online

Step 1Wait

Wait at least three days after e-filing your tax return before checking a refund status. When you e-file your tax return to the IRS, it needs approximately three days to update your information on the website.

If you e-filed your tax return using TurboTax, you can check your e-file status online, to ensure it was accepted by the IRS. You’ll also receive an e-mail confirmation directly from the IRS.

However, if you mail a paper copy of your tax return, the IRS recommends that you wait three weeks before you begin checking your refund status. Most taxpayers who e-file will receive their tax refund sooner.

Step 2Obtain a copy of your tax return

Before you sit down to check your refund status, the IRS requires that you have some of the information from your tax return. If you printed a copy of your tax return, grab ityoull need the following information from it:

- The Social Security number that you entered at the top of your tax return

- The filing status you chose, which you can locate in the top portion of the first page to your tax form.

- The exact amount of your tax refund. You can find this at the end of your tax return.

Step 3Go to the “Wheres My Refund?” page on the IRS website

When you access the “Where’s My Refund?” tool, you will see three separate boxes to enter your filing status, refund amount and Social Security number. When you finish entering this information, click on the “Submit” button on the page to see the status of your refund.

Also Check: What Is The Age Limit For Child Tax Credit

What Tax Pros Will Be Looking For In Trump’s Returns

Trump’s finances are known to be complex, and the documents being released Friday only represent a portion of his business empire over a six-year period, so the financial picture will not be comprehensive.

CBS MoneyWatch asked two tax experts Bruce Dubinsky, a forensic accountant and founder of Dubinsky Consulting, and E. Martin Davidoff, founder and managing partner of Davidoff Tax Law some of the things they’d be looking for.

Among other things, the returns could reveal how much Trump continued to earn from the book and TV deals that helped make him a household name, and how much he donated to charity between 2015 and 2020.

The documents may also provide new insights into how his businesses took advantage of provisions in the tax code that benefit real estate developers.

Previously published excerpts of Trump’s returns, and testimony at the Trump Organization’s recent criminal trial, have focused on periods in which he reported large financial losses allowing him to pay little or nothing in federal income taxes some years.

How Long Does It Take To Receive An Amended Refund

You should receive your amended refund within six months from the date filed. If it has been more than five months since you filed your amended return, please call 1-877-252-3052 for assistance. Select the option for l Individual Income Tax then listen for the Refund option to speak with an agent. Please do not call 1-877-252-4052 as instructed in the main greeting. Interest will be paid on amended refunds at the applicable rate.

Don’t Miss: Do Non Profits Pay Property Taxes

New Mexico Imposes A Tax On The Net Income Of Every Resident And On The Net Income Of Every Nonresident Employed Or Engaged In Business In Into Or From This State Or Deriving Any Income From Any Property Or Employment Within This State

If you are a New Mexico resident, you must file if you meet any of the following conditions:

- You file a federal return

- You want to claim a refund of any New Mexico state income tax withheld from your pay, or

- You want to claim any New Mexico rebates or credits.

Nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement and have income from any New Mexico source whatsoever. You must file Form PIT-1 to report and pay personal income tax.

The rates vary depending upon your filing status and income. The top tax bracket is 4.9%

The Department offers taxpayers the ability to file their tax return online. Online filing provides a faster turnaround time than filing a paper return. For example, if you are due a refund, it could reach you within two weeks.

The Department allows taxpayers to check the status of their refunds online through the Taxpayer Access Point . The taxpayer must establish an online account to check the refund status.

Read Also: How Can I Make Payments For My Taxes