Can You Really Get Solar Panels Installed For Free

Heres the deal: Theres no free lunch . Free solar collectors are not really free you will pay for the electricity they produce, usually under a 20- to 25-year solar lease or electricity purchase agreement .

Are solar panels a ripoff?

Solar energy is a time-tested, clean and affordable source of electricity for your home. Recent improvements in the production of photovoltaic panels used to convert free, inexhaustible solar energy from the sun have made home solar energy a viable option for many consumers, which is NOT a SCAM.

A Solar Lease Is Just One More Financial Tool That Is Complex Enough That You Cant Quite See What The Real Cost Of It Is

A lease contract is not easily transferable if you decide to sell the house. According to one large solar leasing company: If you sell your home before the end of the lease, you can transfer the lease to the new owners if they qualify with excellent credit, or you can prepay the lease and add it to your home asking price.Qualifying means a 700 or higher FICO score.

History Of The Federal Solar Tax Credit

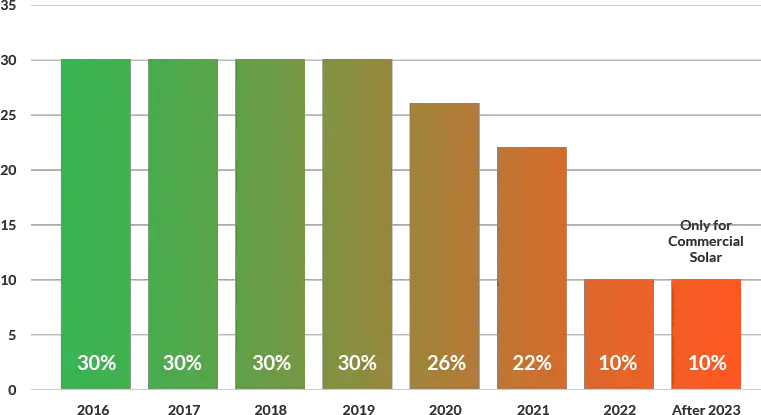

The solar tax credit was originally created through the Energy Policy Act, which was signed way back in 2005. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

You May Like: Doordash Payable Account

Selling Your House Is More Difficult

A solar PPA can make the process of selling your home longer and more complex. This is because you can’t just pass over that agreement when selling your house without including the solar company in the decision-making process. Thus, potential buyers may not make an offer on your home if they are unhappy with the terms and conditions set by the solar installer.

How Do Solar Installers Make Money

Understanding how solar companies make money

- Installation. The first way to make money is to install solar panels.

- Investors. Another way to make money is to offer your investors a fixed percentage revenue stream.

- Tax credits.

- Non-existent maintenance costs.

How do solar installation companies make money?

Solar rental providers make money by selling electricity, usually at a lower rate than what you pay for utilities. Although companies like SolarCity once dominated the solar leasing market, countless other players have since entered the space and started competing with each other.

Is solar installation business profitable?

In short, the solar business is profitable if you know how to move around the business. The start-up capital needed to start this business depends on the size of your business. However, with N300,000 N500,000 you can start a solar business. We wish you all the best.

Recommended Reading: Doordash Tax Calculator

Filing Requirements For The Solar Tax Credit

To claim the credit, you must file IRS Form 5695 as part of your tax return. You’ll calculate the credit on Part I of the form, and then enter the result on your 1040.

- If in 2021 you end up with a bigger credit than you have income tax due a $3,000 credit on a $2,500 tax bill, for instanceyou can’t use the credit to get money back from the IRS. Instead, you can carry the credit over to tax year 2022.

- If you failed to claim the credit in a previous year, you can file an amended return.

Currently, the residential solar tax credit is set to expire at the end of 2023. If you’re thinking about adding solar energy to your home, now might be the right time to act.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Increase your tax knowledge and understanding all while doing your taxes.

Faq: Are Free Solar Panels Really Free

Can I really get solar panels for free?

In short, no, you can not get solar panels for free. What is possible however, is installing solar with a $0-down financing option, whether through a solar lease, PPA or solar loan.

How can I get solar panels for zero money down?

Solar leases, PPAs and loans all offer viable options of investing in solar without upfront costs. The best financing option for you will vary depending on your budget, credit score and eligibility for local incentives.

Are no-cost solar programs really no cost?

No, there is no such thing as a no-cost solar program. These types of programs are really solar leases or power purchase agreements. In these types of agreements, a company installs solar panels on your roof for no money upfront but charges you to use the power they produce each month.

Karsten Neumeisteris a writer and renewable energy specialist with a background in writing and the humanities. Before joining EcoWatch, Karsten worked in the energy sector of New Orleans, focusing on renewable energy policy and technology. A lover of music and the outdoors, Karsten might be found rock climbing, canoeing or writing songs when away from the workplace.

Also Check: Does Doordash Withhold Taxes

How To Finance Your Solar Panels: Cash Loan Lease And More

Rooftop solar panels can come with quite the hefty price tag. Fortunately, there are more than a few options to make it more affordable.

Whether you’re looking to save money, avoid paying so much to your utility or keep some carbon out of the atmosphere, homeowners are generating their own energy with rooftop solar. By some estimates, 13.4% of homes will have solar panels installed by 2030.

While prices are dropping steadily , rooftop solar costs thousands of dollars, sometimes tens of thousands. Most people don’t have that kind of cash laying around, but there are plenty of options for paying for solar.

“Financing has always been an issue,” said Roger Horowitz, director of co-ops at Solar United Neighbors, a nonprofit and advocacy group helping people adopt solar in 11 states. Being able to finance solar is often dependent on having a bunch of cash, good credit and owning a home.

This article aims to hit some of the highlights of solar financing, but it should not be taken as financial advice. For that you’ll have to find someone more qualified to determine whether going solar makes financial sense for you and how to best pull it off.

No Worries About Installation And Maintenance

Most solar panel lease providers offer free installation and maintenance as part of their commitment to making lives easier for solar consumers. After all, not everyone has the right competencies for installing and maintaining a solar system.

Some companies also provide warranties for their products while continuously monitoring their solar gathering and generating performance.

Installing your purchased solar panels yourself can be a worthwhile DIY project. Unfortunately, setting up these gigantic slabs of mirror-like devices on the roof is fraught with dangers and risks. That is why most experts recommend expert installation.

Sadly, solar panel installation can cost families thousands of dollars. You can expect to spend $6,000 on a 2,000-watt solar panel array or $9,225 for a 3-kW system installation. Large families who need at least 8 kW of solar power can spend up to $24,500 on labor alone.

Repairs are also costly. People spend $195 to $1,225 to repair their solar systems. The good news is most solar panel manufacturers provide a 25-year solar performance warranty, a 5-year solar panel workmanship guarantee, and a 10-year solar panel manufacturerâs assurance.

Installation, maintenance, and repairs are not the only things people must consider when buying solar panels. The cost of ensuring the upkeep of the solar system is also a factor worth thinking about.

Also Check: Www.1040paytax.com

Can You Claim The Solar Tax Credit On An Investment Property That You Own And Rent Out

Yes, you can claim the tax credit on an investment property that you own and rent.

However, it cant technically be claimed under the residential solar tax credit. There are actually two federal solar tax credits: one for homeowners and one for business owners, and in this case, your property would qualify under the business tax credit.

They have slight differences in their step-down schedules and are under different tax code sections, but currently, they are both worth 26% of the cost.

Leasing Your Solar Panels With A Fixed Monthly Lease

If taking on some debt is also not in the cards for you, renting is your last option. You can rent a solar system on your roof for 20 years through a typical fixed monthly lease, or through a PPA. Both options are likely to have an escalator rate, or a percentage by which the initial rate will increase every year.

This escalator rate can range from 0%-4% per year. Six years ago, leasing was the solar industry standard, and allowed many homeowners to go solar while saving a few bucks a month on utility costs. However, this model is going out of style. The drawback of leasing is that every month your lease payment is exactly the same. Since solar production varies seasonally, this means that some months youll pay more than you would have if you simply stayed with your utility.

So, when you go shopping for solar, make sure you look at your financing options. Companies offering leases will tout the low initial monthly payments. Make sure you know what the payments are going to look like down the road and ask how many years you will be locked into this plan.

Read Also: Does Doordash Take Taxes Out

When And For How Long Can I Claim The Solar Tax Credit

If youre eligible for the ITC, but you dont owe any taxes during the given calendar year, the IRS will not refund you with a check for claiming the credit. The 26 percent ITC is not refundable. However, according to Section 48 of the Internal Revenue Code, the ITC can be carried back one year and forward 20 years. Therefore, if you had a tax liability last year, but dont have any this year, you can still claim the credit. Likewise, if you had no tax liability last year or this year, you can use the credit any time you have liability over the next 20 years.

Federal Solar Tax Credit

First, NY state property owners can lower their installation costs through the federal solar tax credit. With this program, you can deduct 26% of your installation costs from your federal taxes. Notably, the average solar customer can save over $8,000 with this investment tax credit . In addition, Congress has recently passed an extension for these savings. Originally, the credit was supposed to decrease to 22% starting in 2021. Under the extension, you can access 26% savings as long as your solar project is 5% complete by December 31, 2022. Typically, you need to own your solar system in order to qualify for this incentive. Therefore, be sure to ask your solar provider about your financing options as you start the installation process. Definitely, the federal solar tax credit is a great way for New York residents increase their solar savings.

Don’t Miss: Efstatus Taxact Online

Are Solar Batteries Covered By The Solar Investment Tax Credit

The Internal Revenue Service specifies that battery installations for which all energy that is used to charge the battery can be effectively assured to come from the Solar Energy System are eligible for the full solar tax credit.

In other words, yes, solar batteries like the Tesla Powerwall and the LG Chem are eligible for the solar tax credit if they are charged by solar energy more than 75% of the time.

This means that if you install a battery with a new solar system, you will save 26% on the total combined cost.

Ready To Start Your Commercial Solar Project

As you can see, if youre buying a solar energy system, timing is everything.

We know investing in solar energy is an important financial decision for your business, and our team is here to help guide you through the process.

Fill out the contact form below or call 844.732.7652 during business hours, and one of our solar energy advisors will talk to you about your ITC eligibility.

You May Like: Doordash Dasher Taxes

Leasing A Solar Energy System

In general, leasing a solar energy system is best for those homeowners who don’t have a tax liability and who are less likely to sell the house during the lease term. We say this because the best solar incentives are available as tax credits, and when it comes to selling a home with leased panels attached, transferring a lease to a new home buyer can be tricky. Let’s take a closer look.

More On Renewable Portfolio Standards

Learning from Germany’s expensive FiTs, the U.S. preferred a market-based solution to promote the adoption of renewable technologies.

RPS requirements created demand for large solar investments, most predominantly in California and the Southwest U.S., an area rich with potential. The federal ITC provided an incentive mechanism to lower these costs.

RPS programs rely on the most cost-effective renewable resource through bidding processes and are not handed out on a first come, first served basis like FiTs in Europe.

RPS policies combine requirements to seek sources of renewable energy while also relying on market mechanisms to select projects. Competitive auctions and long-term contracting and financing make RPS a more equitable distribution of subsidies based on economic competitiveness.

In contrast, FiTs serve as blunter instruments such that they do not place value on market-based solutions. Instead, FiTs compensate renewable resources at an administratively-set rate, which often falls out of sync with the market. In the U.S., FiTs aren’t a great fit. Sorry, I had to say it.

However, other federal incentives have helped to drive growth in the U.S. as well. Namely:

- the 30% federal investment tax credit discussed above

- Temporary Cash Grants offered by Section 1603

- Loan Guarantees made under Section 1705

- MACRS depreciation and special bonus depreciation allowance

- Net Energy Metering policies

- State-level incentives like PACE loans

- Solar Renewable Energy Credits

You May Like: Tax Write Offs For Doordash

Energy Storage And The Federal Solar Tax Credit

The primary requirement is that you own your home solar system. When homeowners add a home battery, it must be charged at your home by an on-site renewable energy system like solar . This is necessary for the home battery to be considered renewable, and for its cost to be eligible for the tax credit.

So, for your battery cost to be included in the tax credit, you must show that its only charged by renewable energy. To earn the tax credit for your battery cost, Sunruns solar guides can easily help you document how your home battery is charged solar.

What Happens When Its Over

At year 20 if you owned your solar system, your system would have up to another 15 to 20 years worth of income generating potential. When you lease a solar system, at year 20, youll have to give your solar system back to the leasing company or youll have to buy it from them at fair market value if you want to keep it or continue making lease payments.

Don’t Miss: How To Calculate Mileage For Doordash

Leasing Solar Panels Or Power Purchase Agreement

As weve covered, in solar leases or PPAs, a solar company installs a solar panel system on your home you then pay a monthly rate for the solar power those panels produce. The solar company you lease through will retain ownership of the panels, thereby cashing in on the solar tax credit.

Solar leases and PPAs are close to interchangeable, but for one key difference: In a solar lease, you make fixed monthly payments to use the solar energy system, whereas in a PPA, you purchase the electricity produced by the panels. Leases are more common through national solar companies like Sunrun and SunPower.

Savings are estimated for a medium-sized home with monthly energy costs of $150 per month.

Who Builds Solar Panels For Tesla

It still only has a manufacturer of 340-watt solar panels, Hanwha Solar.

Does Tesla solar pay for itself?

Tesla solar roof: How much could you save Tesla says the roof will pay off over time. Tiles are estimated to collect energy for 30 years, which means that in practice they can be cheaper than conventional roofs in the long run. That would reduce total costs to $ 4,121, according to Tesla.

Are Tesla solar panels made by Tesla?

No, Tesla is not a manufacturer of its own solar cells. As mentioned above, until recently, Tesla collaborated with the international electronic giant Panasonic to create Teslas solar collectors. The partnership was based on the use of highly regarded Panasonic HIT cells to create Teslas solar panels.

Don’t Miss: How Much Is Taxes For Doordash

What Do You Need To Do To Claim The Federal Tax Credit

Lets look at the steps you need to follow if youre filing your own taxes. First, we recommend that you use online tax filing to use the correct forms and not make any mistakes.

To claim the tax credit, youll need to file Form 5695 with your tax return. This is the form designed for residential energy tax credits.

First Steps Toward Saving Money With Solar Panels

Once you decide that you want to explore saving energy and money with solar panels, consult with the professionals. Seek out a reputable solar panel company that will take the time to answer your questions. Talk to your tax professional to fully understand your tax advantages. And, finally, connect with a reputable roofing company who can provide solid advice and quality work.

Contact Westfall Roofing today for a consultation on your existing roof or a new one.

Don’t Miss: 1099 Nec Doordash