More About Sale Taxes

Tax rates vary widely by jurisdiction and range from less than 1% to over 10%. Tax is collected by the seller at the time of sale. A sales tax is imposed at the retail level. In cases where items are sold at retail more than once, such as used cars, the sales tax can be charged on the same item indefinitely. To determine the tax rate you should identify the total amount of tax you must charge. If, for example, a state has a two percent tax rate, a given county two percent and a city one percent, the total tax rate applicable is five percent: 2 + 2 + 1 = 5.

You Purchase A Item For 110 Dollars And Pay 6 % In Tax How Much Is Tax And The Final Retail Price Including Tax

- Firstly, if the tax is expressed in percent, divide the tax rate by 100. You can do this by simply moving the decimal point two spaces to the left. In this example, we do 6/100 = 0.06

- Now, find the tax value by multiplying tax rate by the item value:tax = 110 × 0.06

- Finally, add tax to the before tax price to get the final price including tax:The final price including tax = 110 + 6.6 = 116.6

Objectives Of Central Sales Tax Act

The Central Sales Tax Act was formulated with the goal to make tax collection simpler and streamlined. The main objectives of CST Act are highlighted here.

- Provide provision for levying, collection and distribution of taxes collected from sale of goods through interstate trade.

- Frame principles to determine when sale and purchase of goods occurs.

- Classify certain goods as being of special importance for trade and commerce.

- Be the competent authority to settle interstate trade disputes.

Recommended Reading: How Can I Make Payments For My Taxes

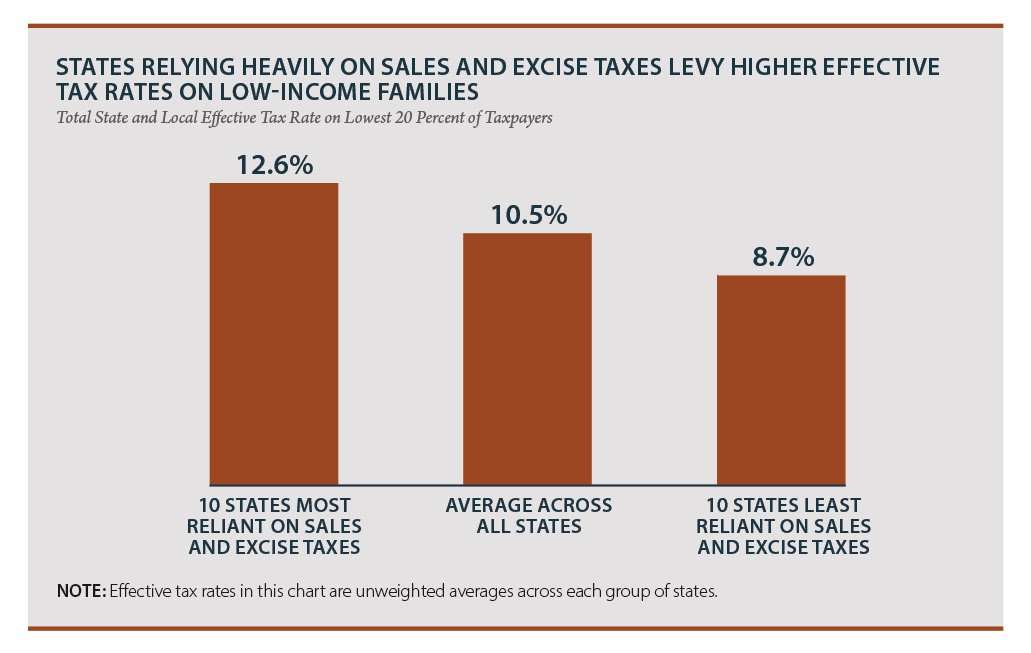

How Do General Sales Tax Rates Differ Across States

Among states which have sales taxes, Colorado has the lowest rate . All other states have a rate of at least 4.0%. Five states have rates equal or above 7.0%. California is the state which has the highest tax rate .

Alaska, Delaware, New Hampshire, Montana and Oregon do not have state general sales taxes. Of these, Montana and Alaska allow localities to charge local sales taxes.

The five states with the highest average combined sales tax rates are Louisiana , Tennessee , Arkansas , Alabama , and Washington .

The five states with the lowest average combined rates are Alaska , Hawaii , Wyoming , Wisconsin , and Maine .

Central Sales Tax Act 1956

The Central Sales Tax Act governs the taxation laws in the country, extending to the entire country and contains the rules and regulations related to sales tax. This Act allows the Central Government to collect sales tax on various products. The Central Sales Tax is payable in the state where the particular goods are sold.

You May Like: How To Get Tax Preparer License

Combined State And Local Sales Tax Rates

Five states do not have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Of these, Alaska allows localities to charge local sales taxes.

The five states with the highest average combined state and local sales tax rates are Tennessee , Louisiana , Arkansas , Washington , and Alabama . The five states with the lowest average combined rates are Alaska , Hawaii , Wyoming , Wisconsin , and Maine .

You Buy A Item On Ebay For 100 Dollars And Pay 75 % In Tax What Is The Tax On It And What Is The Total Price

- Firstly, divide the tax rate by 100: 7.5/100 = 0.075 . Note: to easily divide by 100, just move the decimal point two spaces to the left.

- Now, find the tax value by multiplying tax rate by the before tax price: tax = 100 × 0.075tax = 7.5

- Add tax to the before tax price to get the final price:The final price including tax = 100 + 7.5 = 107.5

Recommended Reading: Efstatus.taxact 2014

Is What You Are Selling Taxable

Most âtangibleâ property in the U.S. is taxable. This includes items you can touch and feel like furniture, coffee cups and books. Since sales tax is governed at the state level, some states have decided not to tax necessities like groceries, clothing or textbooks. Check with your stateâs taxing authority to find out if the products you sell are taxable.

In most cases, services are not taxable, though some states have changed that in recent years. If you are a service provider, such as a graphic designer or plumber, double check with your state to ensure that you arenât required to collect sales tax.

Sales Tax Bases: The Other Half Of The Equation

This report ranks states based on tax rates and does not account for differences in tax bases . States can vary greatly in this regard. For instance, most states exempt groceries from the sales tax, others tax groceries at a limited rate, and still others tax groceries at the same rate as all other products. Some states exempt clothing or tax it at a reduced rate.

Tax experts generally recommend that sales taxes apply to all final retail sales of goods and services but not intermediate business-to-business transactions in the production chain. These recommendations would result in a tax system that is not only broad-based but also right-sized, applying once and only once to each product the market produces. Despite agreement in theory, the application of most state sales taxes is far from this ideal.

Hawaii has the broadest sales tax in the United States, but it taxes many products multiple times and, by one estimate, ultimately taxes 105 percent of the states personal income. This base is far wider than the national median, where the sales tax applies to 34.25 percent of personal income.

Read Also: Turbo Tax 1099q

How Place Of Supply Affects Gst/hst Rates

The rate of tax to charge depends on the place of supply. This is where you make your sale, lease, or other supply.

A zero-rated supply has a 0% GST/HST rate throughout all of Canada. For example, basic groceries are taxable at the rate of zero in every province and territory.

The rate for other taxable supplies depends on the province or territory. The current rates are:

- 5% in Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon

- 13% in Ontario

- 15% in New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island

See previous rates (from January 1, 2008 to September 30, 2016

GST/HST rates from January 1, 2008 to September 30, 2016| Province | |

|---|---|

| Alberta | |

| 5% | 5% |

For example, your store in Vancouver, B.C. delivers a mattress to your customer in Toronto, Ontario. You charge 13% HST on the sale because the place of supply is Ontario.

For detailed place-of-supply rules, see GST/HST rates and place-of-supply rules. Some supplies of products or services are GST/HST exempt.

To find out if your supply is taxable or exempt, see Type of supply.

If you supply a product or service to someone outside Canada, see GST/HST Imports and Exports.

Enforcement Of Tax On Remote Sales

In the United States, every state with a sales tax law has a use tax component in that law applying to purchases from out-of-state mail order, catalog and e-commerce vendors, a category also known as “remote sales”. As e-commerce sales have grown in recent years, noncompliance with use tax has had a growing impact on state revenues. The Congressional Budget Office estimated that uncollected use taxes on remote sales in 2003 could be as high as $20.4 billion. Uncollected use tax on remote sales was projected to run as high as $54.8 billion for 2011.

Enforcement of the tax on remote sales, however, is difficult. Unless the vendor has a physical location, or nexus, within a state, the vendor cannot be required to collect tax for that state. This limitation was defined as part of the Dormant Commerce Clause by the Supreme Court in the 1967 decision on National Bellas Hess v. Illinois. An attempt to require a Delaware e-commerce vendor to collect North Dakota tax was overturned by the court in the 1992 decision on Quill Corp. v. North Dakota. A number of observers and commentators have argued, so far unsuccessfully, for a Congressional adoption of this physical presence nexus test.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Sales Tax Generally Depends On The Ship

When selling online, you first need to determine if you are required to collect sales tax from buyers in your buyerâs state. Next, you need to determine the sales tax rate at the buyerâs location.

There are over 10,000 sales tax jurisdictions in the United States. And the sales tax rate you charge depends on your buyerâs shipping address. For example, the sales tax rate in Atlanta, GA is 8.9%, but the sales tax rate just outside the city limit is 7%. To collect sales tax when selling online, you must determine if your customer lives within the Atlanta city limits or outside them.

If your customer lives in Atlanta proper, youâd charge them 8.9% sales tax. But if they live outside the city limits, youâd only charge 7%.

Sales Tax By States In 2019

To demonstrate the diversity of sales taxes in the United States, you can find more details about the applied sales taxes in U.S. states in the following table. Besides, you can check when the different states introduced the sales tax and if there is an exemption or reduced rate on sales of food.

| State |

|---|

Recommended Reading: Where’s My Refund Ga State Taxes

General Sales Taxes And Gross Receipts Taxes

General sales taxes are taxes on goods and services purchased by consumers. The tax is a calculated as a percentage of the retail price and added to the final purchase price paid by the consumer. General sales taxes are separate from selective sales taxes on specific purchases such as alcohol, motor fuel, and tobacco.

The Census Bureau includes revenue from gross receipts taxes in its revenue totals for either general sales taxes or “other selective sales taxes.” A gross receipts tax is also a tax on sales, however, the tax is paid by the seller and is levied on each business’s total sales over a given time period .

How much revenue do state and local governments raise from general sales taxes and gross receipts taxes?

State and local governments collected a combined $411 billion in revenue from general sales taxes and gross receipts taxes, or 12 percent of general revenue, in 2018. General sales taxes provided less revenue than property taxes and roughly the same amount as individual income taxes. Additionally, state and local governments collected $200 billion from selective sales taxes, or 6 percent of general revenue, in 2018.

|

State and Local Sales Tax Revenue, 2018 |

Data:

What are gross receipts taxes and which states levy them?

How much do general sales tax rates differ across states?

Data: View and download each state’s general sales tax rate and local general sales tax rates

Do sales taxes apply to online purchases?

Sales Tax Nexus Is Just A Fancy Legalese Way To Say Significant Connection To A State

If you, as an online retailer, have nexus in a state, then that state considers you on the hook for charging sales tax to buyers in the state.

Youll always have sales tax nexus in your home state. However, certain business activities create sales tax nexus in other states, too.

Ways to Have Sales Tax Nexus in Different States

- A location: an office, warehouse, store, or other physical presence of business.

- Personnel: an employee, contractor, salesperson, installer or other person doing work for your business.

- Inventory: Most states consider storing inventory in the state to cause nexus even if you have no other place of business or personnel.

- Affiliates: Someone who advertises your products in exchange for a cut of the profits creates nexus in many states.

- A drop shipping relationship: If you have a 3rd party ship to your buyers, this may create nexus.

- Selling products at a trade show or other event: Some states consider you to have nexus even if you only sell there temporarily.

- Economic nexus: You exceed a state-mandated dollar amount of sales in a state, or you make over a certain state-mandated number of transactions in a state.

You May Like: Can Home Improvement Be Tax Deductible

Central Board Of Direct Taxes

The Central Board of Direct Taxes is an apex body which is in charge of administration of taxes in the country. It is a statutory authority and functions under the purview of the Central Board Revenue Act of 1963. It is a division of the Ministry of Finance, working under the ambit of the Department of Revenue.

Composition of Central Board of Direct Taxes:

The Central Board of Direct Taxes is composed of the following members.

- Chairman

- Member

Functions:

The Central Board of Direct Taxes looks after all issues and matters relating to the levy and collection of direct taxes in the country.

- It provides necessary inputs to frame policies for direct taxes

- It is in charge of the administration of direct tax laws in collaboration with the Income Tax Department.

- Processes and investigates complaints related to tax evasion.

How To Find Sales Tax In Your Area

To find the sales tax in your city, you can go to your states official government website, locate the page for its department of revenue or revenue services, and search for tax rate information. Sales tax can vary by country, county, state, and city, plus they can change often.

Make sure to keep up to date on important things like taxes! Being aware of your past, present and future finances is important in managing a functional budget. To learn more, check out this course on personal finance.

You May Like: Is Past Year Tax Legit

The Role Of Competition In Setting Sales Tax Rates

Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions rates. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas, such as from cities to suburbs. For example, evidence suggests that Chicago-area consumers make major purchases in surrounding suburbs or online to avoid Chicagos 10.25 percent sales tax rate.

At the statewide level, businesses sometimes locate just outside the borders of high sales-tax areas to avoid being subjected to their rates. A stark example of this occurs in New England, where even though I-91 runs up the Vermont side of the Connecticut River, many more retail establishments choose to locate on the New Hampshire side to avoid sales taxes. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant. At one time, Delaware actually used its highway welcome sign to remind motorists that Delaware is the Home of Tax-Free Shopping.

State and local governments should be cautious about raising rates too high relative to their neighbors because doing so will yield less revenue than expected or, in extreme cases, revenue losses despite the higher tax rate.

Stay Informed On Sales And Use Tax

Join the Sales Tax Institute mailing list and get updates on the latest news, tips, and trainings for sales and use tax.

By submitting this form you are agreeing to join the Sales Tax Institutes mailing list so the Sales Tax Institute can send you email notifications including our monthly newsletter, monthly sales tax tips digest, information about upcoming courses and sales tax resources. Submitting this form will add your email to our mailing list. We will never share or sell your info. to view our privacy policy.

Read Also: Www.myillinoistax

State Sales Tax Revenues Up 194 Percent Over Last Year

The majority of November sales tax revenue is based on sales made in October.

“November sales tax collections once again reached a new monthly high,” Comptroller Glenn Hegar said. “Texas continues to see growth in taxable sales in every major economic sector.”

“Sales tax remittances from the construction, manufacturing and wholesale trade sectors had substantial growth compared to last year, indicating increased economic activity in the state despite continuing supply chain or labor shortage issues,” he added.

Hegar also said increased drilling drove higher collections from the oil and gas mining sector, though it still remains significantly below pre-pandemic levels.

He said the retail sector continues to perform strongly, with receipts from electronics and appliance stores showing the sharpest increase compared to a year ago. Home improvement and furniture and home furnishing stores also showed double-digit gains.

“The restaurant and service sectors continued their high growth compared to a year ago as Texans increasingly return to enjoying food and activities away from home,” Hegar said. “Receipts from the information sector also had strong growth over a year ago.”

Here is how individual sectors performed:

Motor vehicle sales and rental taxes $518 million, up 25 percent from November 2020, up 23 percent from November 2019.

Motor fuel taxes $334 million, up 3 percent from November 2020, up 2 percent from November 2019.

What Is Sales Tax In Indiana

Sales Tax. How much is Indianas sales tax? Indianas sales tax is seven percent.

How much is Indiana sales tax?

- The state general sales tax rate of Indiana is 7%. Indiana cities and/or municipalities dont have a city sales tax. Every 2021 combined rates mentioned above are the results of Indiana state rate . There is no county sale tax for Indiana.

Recommended Reading: Efstatus.taxact