Property Tax Payment Options

We encourage you to pay your taxes and utilities online or via telephone banking.

Our customer service team is happy to assist you over the phone or via email if you have any questions.;For property tax and utility information, call 604-591-4181 or email;.

You can also mail your payment to City Hall or pay;in person. Appointments to pay in person are encouraged to avoid wait times.;

Paying Through Your Mortgage Company

If you’re paying your property taxes through your mortgage company, claim your Home Owner Grant online by the due date, to avoid late penalty fees.

You are responsible for communicating with your mortgage company and managing this service to ensure the balance owing is paid by the due date to avoid late penalty charges.

Avoid The Line Pay Online

Using your MyPropertyAccount you can register your property tax, utilities and dog licensing accounts for eBilling. Pay via online or phone banking with your financial institution.;;

Sign up for eBilling

Log in to MyPropertyAccounts and change your bill delivery method to email by May 1st of the year to get your bill online.

Recommended Reading: What Tax Bracket Are You In

Online By Payment Card

You can now pay property taxes online with MasterCard, VISA, American Express , Interac; Online, MasterCard Debit or Visa Debit.

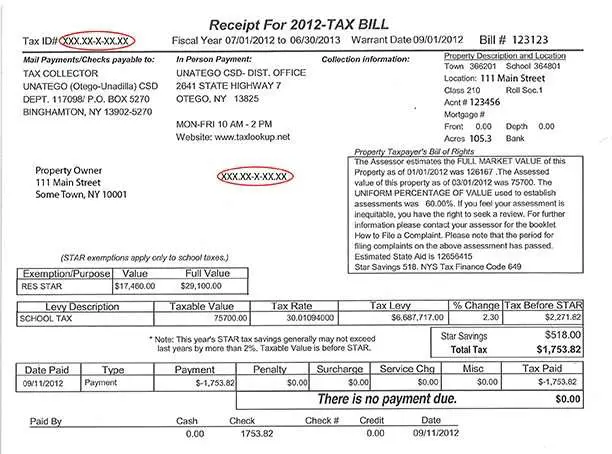

- You will require the 19 digit property tax roll number.;View sample tax bill

- Interac Online, MasterCard Debit and Visa Debit allow you to pay online using money from your bank account. If your bank doesnt offer Interac Online it likely offers either Mastercard or Visa Debit.;Interac Online Frequently Asked Questions.

- A service fee;is applied by the service provider, Paymentus Corporation.

Go to the Paymentus website to make a property tax payment by payment card.; Please verify that you are in the secure site by ensuring that the web address starts with https and is;

If you choose to make an online property tax payment with a credit card, Interac;Online or ;Debit you may do so at any personal or public internet access point.

How Often Is My Property Reassessed

Cook County is reassessed triennially, which means one-third of the county is reassessed each year. This year, the south suburbs will be reassessed. The City of Chicago will be reassessed in 2021. The northern suburbs will be reassessed in 2022. Your property may also be reassessed if there are significant changes due to a permit application, property division, demolition, or other special application.

Also Check: Can You File Missouri State Taxes Online

How To Pay Your Surrey Property Taxes Online

Pay by Pre-Authorized Pre-Payment Plan

Put money towards;next year’s;Annual Utilities and Property Taxes with a monthly withdrawal from your financial institution with the Pre-Authorized Pre-Payment Plan . With PAPP, you’ll start paying your;taxes for 2021.

The pre-payment plan will accumulate 10 monthly withdrawals from your bank account, interest prescribed by the Province, and apply the funds towards your:

- annual utilities balance in February, due April 2 , and

- property taxes balance in May.

Be sure to get familiar with the;payment withdrawal dates;and details to avoid penalties. In particular, mark the July manual payment date in your calendar.

Metered utilities are not covered by PAPP. See your;metered utilities payment options, or learn about the auto-debit payment plan.

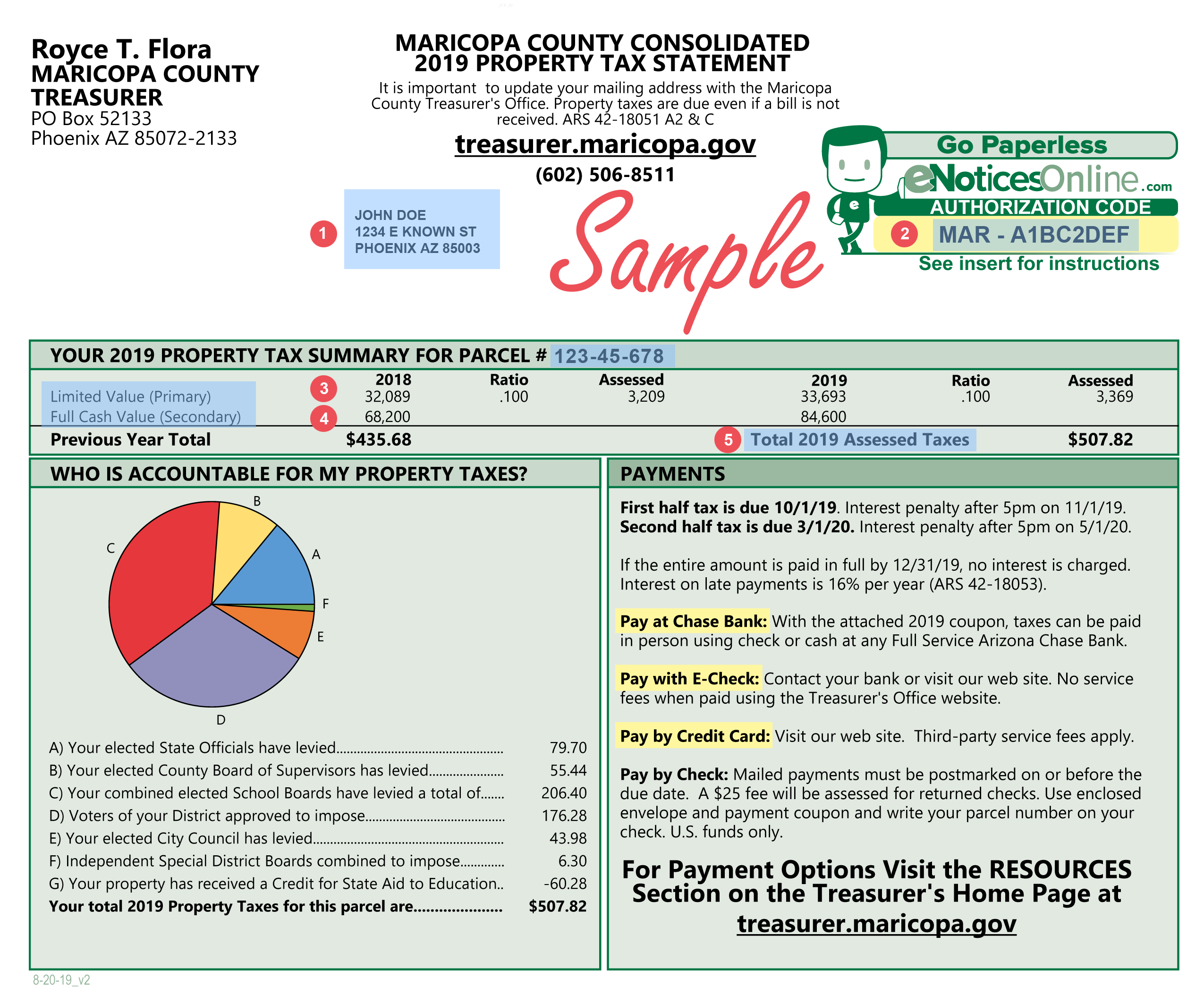

How Is My Assessment Used To Calculate My Property Taxes

Property taxes are used to pay the levies set by local taxing bodies. Your assessed value;determines your share of those levies relative to the total assessed value of your area. The levies and the total assessed value of an area determine your local;tax rate.

After the assessor determines the Fair Market Value of your home, the Assessed Value of your home is calculated.;For residential property owners, the assessed value equals 10% of the fair market value of the home. For most commercial property owners, the assessed value is 25% of the fair market value. This level of assessed value is the taxable amount of the property, as determined by Cook County ordinance.

Then the;State Equalization Factor/Multiplier; is applied to the assessed value;and this creates the;Equalized Assessed Value; for the property.

Any Exemptions;earned by the home are then subtracted from the EAV. Then the Tax Rate is applied to the tax levies for your community. Once those levies are added up, the total is the amount of property taxes you owe.

After any qualified property tax exemptions are deducted from the EAV, your;local tax rate;and levies are applied to compute the dollar amount of your property taxes. Please remember: each Tax Year’s property taxes are billed and due the;following;year. For instance, 2019;taxes are billed and due in 2020.

| $100,000 |

Recommended Reading: How To Appeal Property Taxes Cook County

If My Assessment Increases Does That Mean That My Tax Bill Will Increase

Not necessarily. The assessed value of your property is only one factor in determining your property taxes. Your total tax levy, set by local taxing bodies like schools, is an important factor in setting your tax rate.;

Your propertys assessed value, tax rate, and exemptions will be used to calculate the second installment of the property tax bill you receive the following year. Property tax bills are sent;by the Cook County Treasurer.

We have more information available on how our property tax system works here. To learn more about exemptions that can reduce your tax bill and file an application, visit our Exemptions section.

If I Believe The Information On This Notice Is Incorrect How Do I Appeal

If the characteristics listed for your home are wrong, if you think your home is worth less than the fair market value on this notice, or if you think there is information about your home that was not taken into account, you can file an appeal of your assessment.

Appeals can be filed with our office or with the Cook County Board of Review. Please see our Appeals section for information on how and when to file an appeal with our office. Visit cookcountyboardofreview.com for information and deadlines about appeals with their office.

Read Also: What Is Tax Liabilities On W2

Secured Property Taxes Terms

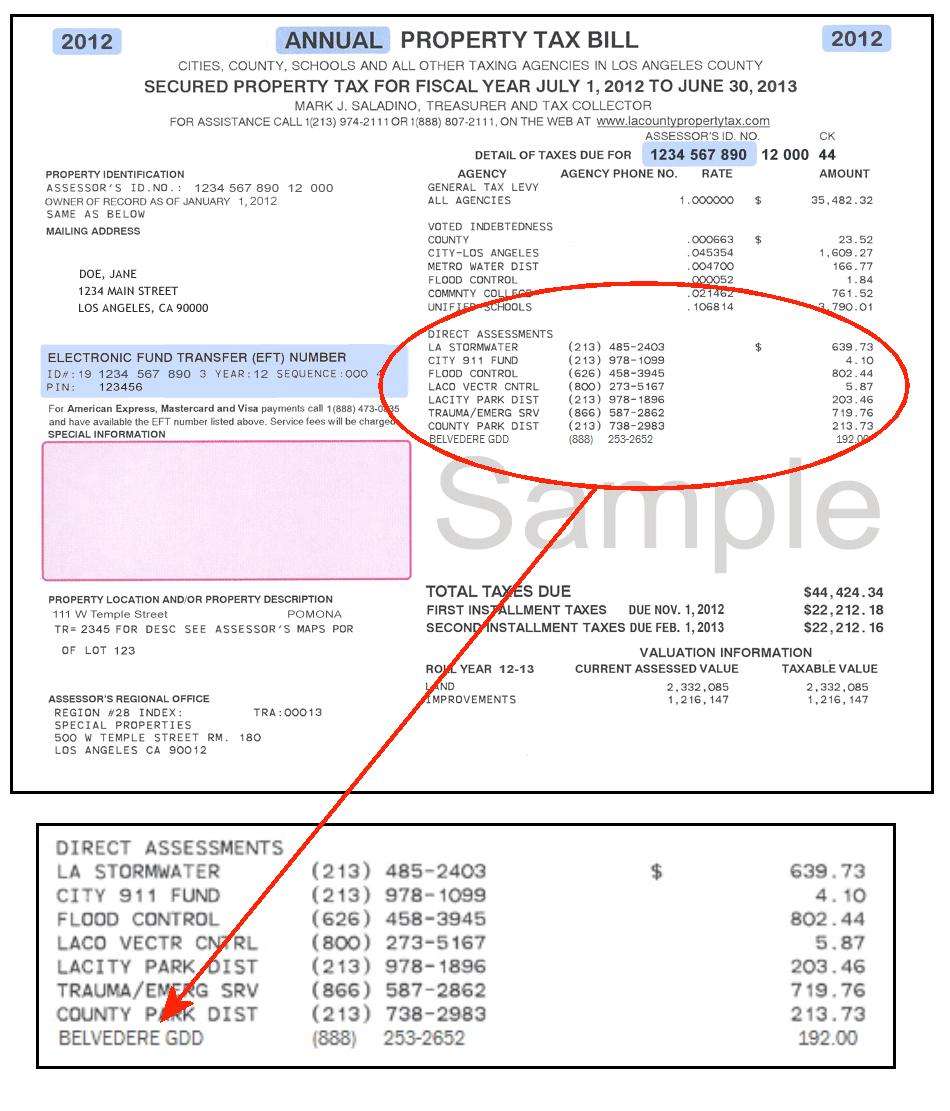

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property; the allowance of an exemption that was previously omitted; the correction of a Direct Assessment placed on the property from a municipality or special district; or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

What Is The Difference Between My Assessment Notice And My Tax Bill

Your reassessment notice usually arrives once every three years after your township has been reassessed. Our schedule of reassessment mailing dates can be found here along with corresponding appeal dates. It does not require any action on your part though you may appeal if you believe the assessment is too high .

Your annual tax bill comes from the County Treasurers Office in two installments: the first installment is due in March, and the second installment is due in August.;

Your reassessment will affect the second installment tax bill the following year. So if your reassessment notice arrives in 2020, the tax bill reflecting this assessment will arrive in July of 2021. Any appeals of your reassessment value will be reflected in the second installment tax bill the following year.

You May Like: Do You Have To Do Taxes For Doordash

Is Your School District Or Local Government Collecting More In Taxes This Year

To determine whether the taxing jurisdiction is collecting more or less in taxes compared to last year, look at the percentage change from prior year of the tax levy.

Your tax bill also has the tax rates for each taxing jurisdiction. Changes in the tax rate between years are not accurate barometers of changes in the amount of taxes being collected.

How The Tax Is Calculated

Property tax is calculated based on the:

- general municipal tax rate and any additional municipal tax rates for special services provided by your municipality

- property value

Municipal tax rate

Municipal tax rates are established by your municipality and can vary, depending on the type of property you own.

Each year, municipalities decide how much they want to raise from property taxes to pay for services and determine the tax rate based on that amount.

To learn about the tax rates in your municipality, contact the finance or treasury department of your local municipality. Some municipalities may have a property tax calculator available on their website.

Education tax rate

Education taxes help fund elementary and secondary schools in Ontario. Education tax rates are set by the provincial government.

All residential properties in Ontario are subject to the same education tax rate. The education tax rates can be found in Ontario Regulation 400/98.

Don’t Miss: When Is Sales Tax Due

Residential Property Characteristicsvalidation Forms Newnouveau

To ensure property assessments are fair and equitable, The City of Winnipeg Assessment and Taxation collects, verifies and updates property characteristics regularly. This is achieved using a variety of means; municipal permit information, building plans, real estate listings, digital orthographic or satellite photography, interviews with property owners, photography, site inspections, etc.

The Assessment and Taxation Department has recently implemented a data collection process that involves gathering property characteristic and sales data through questionnaires mailed to homeowners. Property owners receiving these questionnaires can return them by mail or email or call 311 to request to speak to one of our valuation staff to assist with completing the form. The information collected will be used to verify or update our property records.

Under provisions of the Manitoba Municipal Assessment Act, property owners receiving this form are requested to reply within 21 days.

Is Your Assessment Accurate

It is important to bear in mind that tax bills arrive after your opportunity to request a reduction in your assessment. When your town or city publishes the tentative assessment roll, you should check the assessment, full value, and exemptions for your property. Using that information and a basic knowledge of the value of your home, you can determine if you are fairly assessed. To learn more visit Overview of the assessment roll.

This information could help you to contest your assessment next year. The following information on your tax bill can help you determine if you are assessed fairly:

- total assessed value,

- uniform percentage of value at which parcels in the community assessed,

- full market value of your parcel,

- If the full value is higher than your estimate of the value of your property, you may be over-assessed,

- Full market value x uniform percentage of value = total assessed value.

You May Like: Who Can I Call About My Tax Refund

Relationship Between Property Values & Taxes

- Prior to the economic downturn, property values were increasing annually, reaching a high of $58 billion in assessed value in fiscal year 2009.

- In addition, new construction was added to the rolls each year, also increasing the assessed value to be taxed.

- Both these helped keep the tax rate down.

Payment Before The Penalty Date

It is your responsibility to make payment on or before the tax due date. If you need your tax account balance and/or your roll number to make your payment on or before the due date to avoid late payment penalties, call 311 or 403-268-CITY if calling from outside Calgary.

Submitting the property tax document request and/or waiting for the documents to be delivered does not change the due date of the original bill – penalties will not be waived.

Recommended Reading: How To Pay My Federal Taxes Online

Have You Recently Moved Or Purchased A New Property

The Education Property Tax Credit and EPTC Self-Declaration Form

If you have recently moved, purchased a new property or do not receive the EPTC credit on your 2020 property tax statement, you will need to complete and return a Self-Declaration form to the City of Winnipeg prior to March 15, 2021 in order to receive the EPTC for 2021 on your 2021 property tax statement. The 2020 EPTC must be claimed via your 2020 income tax filing.

Please refer to the following link for more details on the .

Paying At The Automatic Banking Machine

Pay through the ABM at your bank. Keep your receipt for your payment records.

Pay by Mail

Mail your cheque or money order payment and remittance stub with;Home Owner Grant;application completed, if eligible.

Make cheques payable to City of Surrey and;include your folio number;on the cheque.;Post-dated cheques are accepted. Make sure the cheque is dated on or before the property tax due date.

Send in your payment a minimum of;3 days before;the property tax due date. We must receive your payment by or before the July;2 due date. If your mail is lost or delayed, and does not arrive by the due date, you;may receive a penalty charge.If your payment cannot be processed due to an error on a cheque, insufficient bank funds or a returned item you will be charged a late payment penalty.;

Read Also: Do You Need To Claim Unemployment On Taxes

Look Up Your Property Tax Bill

Use multcoproptax.com to look up your property tax bill/statement. You can view copies of your bill back through 2018. You can see property value and tax information back through 2008. To get a copy of your bill;before 2018, contact Customer Service via phone, email, or chat.;

Tax Receipts And Statements

The City will issue residents a receipt for property tax payment, record of payment or duplicate tax statement upon request.

- Refunds are processed on a first in, first out basis

- Please allow four to six weeks to process

- Should your refund be as a result of an Assessment reduction an application will be sent to you automatically upon processing your reduction. Please do not complete or submit a separate refund form.

Don’t Miss: Should I Charge Tax On Shopify

Property Tax: Document Request For Registered Property Owners Only

The property tax document request allows current registered property owners to request a printed copy of the most recent property tax bill and a property tax statement of account.

For property tax documents 2019 and prior or to request documents for multiple years, call 311 or 403-268-CITY if calling from outside Calgary.

1. Email / electronic copies – If you prefer electronic copies of your tax documents sent to you by email, or 403-268-CITY if calling from outside Calgary.

2. Mail / print copies – Click on the request button at the bottom of this page. The documents will be prepared within 7 days and then mailed via Canada Post to the owners at the mailing address of record, as registered at Alberta Land Titles.

A property tax statement of account contains:

- the legal description of the parcel,

- the last assessed value on which taxes were levied,

- transaction details from January 1, 2020, to the date the statement is created, and

- the current account balance.

The property tax statement of account is often used as a payment receipt.

A property tax bill contains:

- property details,

- municipal and provincial tax details.

The annual property tax bill covers the period of January 1 to December 31.

Which Payment Method Is Best For Me

My payment is due today:

Online, telephone or in-person payments made via your financial institution that are completed before your banks cut-off time if it is before your due date will be reflected as payments made on time. Check with your financial institution to find out the cut-off time applicable to you.

Online payments by card through Paymentus made on weekdays do not have a cut-off time until 10PM. This means payments made on a due date before 10PM via Paymentus should be reflected as payments made on time.

I want a payment receipt:

You will receive a physical receipt when paying in-person at one of our Client Service Centres and an electronic confirmation when paying online by card.

I want to pay online:

You can pay your property tax bills;online by payment card.

I am house-bound:

You can pay via your financial institution online or by telebanking, online by payment card, through our PAD plan or by mail.

I have no computer:

You can pay via your financial institution in-person or by telebanking, through our PAD plan, by mail or by dropping off a chequeat one of the secure payment drop-boxes located outside the main entrance of the Kanata Client Service Centre at 580 Terry Fox Drive or the Orleans Client Service Centre at 255 Centrum Boulevard.

Read Also: Where To Find Real Estate Taxes Paid