Sales Tax In The United States

As mentioned before, most of the states in the U.S. apply a single-stage retail sales tax with different rates and scopes: there are 46 different sales taxes with distinct exclusions. As Schenk and Oldman pointed out, the relatively high diversity in the enacted tax law in various states have several economic implications:

- Business conducted on a nation-wide scale need to devote substantial resources to comply with many states and local sales taxes. It increases the complexity and administrative costs related to businesses.

- As most of the services are not subject of sales taxes, the total tax base is shrinking due to the expanding trend of electronic services and the increase in the sharing economy .

- Tax evasion is expanding as the current sales tax system inefficiently tax most cross-border and mail order shopping by consumers.

These issues become more relevant if we take into consideration the significant contribution of sales taxes to state revenues and the current transformation of the economy. It is not surprising then that recent studies have begun to address these problems and examine the possibility of a nation-wide introduced federal VAT or another consumption-based tax which may coexist with the state-level sales tax.

Tax Included & How To Back Out Sales Tax

This article provides a workaround for including tax in the prices of inventory items. To get started, update sales prices for your items to add the relevant tax amount, and organize items into departments that represent each tax rate. Because ShopKeep does not officially support tax-inclusive pricing or VAT, you will need to manually calculate the estimated amount of tax collected at the register.

IMPORTANT: Before continuing, be aware that by using this workaround:

Additional Example Of The Sales Tax Calculation

Now let’s assume that total amount of a company’s receipts including a 7% sales tax is $32,100. The true sales will be S, and the sales tax will be 0.07S. Therefore, S + 0.07S = 1.07S = $32,100. The true sales, S, will be $30,000 . The sales tax on the true sales will be 0.07 X $30,000 = $2,100. Our proof is $30,000 of sales + $2,100 of sales tax = $32,100. In general journal form the accounting entry to record this information is: debit Cash $32,100; Sales $30,000; Sales Tax Payable $2,100.

Also Check: Where To Find Real Estate Taxes Paid

Why A Reverse Sales Tax Calculator Is Useful

A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

Most states and local governments collect sales tax on items that are sold in stores. For some individuals, knowing how much sales they paid is essential for filling out correct tax returns and receiving monetary credit for overpaid sales tax. This is especially beneficial if you have to list your out-of-state purchases to you current state of residence and the taxes paid on those purchases.

To use our Reverse Sales Tax Calculator, you can visit our website or put the calculator on your own website with our widget code. Our widget is even customizable so that you can match the background and text colors to the layout of your website.

How To Calculate Sales Tax On Almost Anything You Buy

- It’s not hard to calculate sales tax.

- However, it’s much more complicated to figure out the exact tax rate, since it varies by state and by purchase amount.

- Visit Business Insider’s homepage for more stories.

When you buy something in the US, you almost always pay more than the sticker price.

That’s because of sales tax, which can vary by state or city but is generally about 4% to 8% of the item’s retail price, imposed when you check out of brick and mortar stores, online retailers, and restaurants.

Sales tax in the US is determined at the state level. There are five states that do not impose a sales tax: New Hampshire, Oregon, Montana, Alaska, and Delaware. The remaining 45 states and Washington DC all have a sales tax, which varies depending on the product and service for sale.;

Popular Articles

If you’re shopping in most US states and you want to know how much you’ll be paying in total before you check out, here are steps you can take to calculate the sales tax.

Don’t Miss: What Is Tax Liabilities On W2

Central Sales Tax Act 1956

The Central Sales Tax Act governs the taxation laws in the country, extending to the entire country and contains the rules and regulations related to sales tax. This Act allows the Central Government to collect sales tax on various products. The Central Sales Tax is payable in the state where the particular goods are sold.

How To Calculate Sales Tax Backwards From Total

Whether you’re trying to get back to the pre-tax price of an item as part of a word problem or calculating the sales tax backwards from a receipt in your hand, the math is the same. You’ll need to know the total amount paid and either the amount of tax paid, which will let you calculate the tax rate, or the tax rate, in which case you can calculate the amount of tax paid.

Recommended Reading: How Can I Make Payments For My Taxes

New Jersey Sales Tax Calculator

You can use our New Jersey Sales Tax Calculator to look up sales tax rates in New Jersey by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

New Jersey has a 6.625% statewide sales tax rate,and does not allow local governments to collect sales taxes. This means that the applicable sales tax rate is the same no matter where you are in New Jersey.

Simplify New Jersey sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

New Jersey Sales Tax Rates by Zip Code:

Need an updated list of New Jersey sales tax rates for your business? Download our New Jersey sales tax database!

© 2021 SalesTaxHandbook. All rights reserved. Usage is subject to our Terms and Privacy Policy.

SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency

Does Shopify Automatically Calculate Sales Tax

Fortunately, Shopify automatically collects sales tax for you, from wherever you tell it to even if you have sales nexus in more than one state. To turn on sales tax collection in Shopify, simply go to Settings > Taxes. The Shopify Tax Manual quickly and thoroughly walks you through setting up sales tax.

Read Also: How Much Is New York State Sales Tax

Central Board Of Direct Taxes

The Central Board of Direct Taxes is an apex body which is in charge of administration of taxes in the country. It is a statutory authority and functions under the purview of the Central Board Revenue Act of 1963. It is a division of the Ministry of Finance, working under the ambit of the Department of Revenue.

Composition of Central Board of Direct Taxes:

The Central Board of Direct Taxes is composed of the following members.

- Chairman

- Member

Functions:

The Central Board of Direct Taxes looks after all issues and matters relating to the levy and collection of direct taxes in the country.

- It provides necessary inputs to frame policies for direct taxes

- It is in charge of the administration of direct tax laws in collaboration with the Income Tax Department.

- Processes and investigates complaints related to tax evasion.

Importance Of Sales Tax:

The money of sales tax is used by the government for the countrys development and economic growth. It is used to provide free public services to the community. This money is used to make more public parks, schools, roads, bridges and recreational places. The government also uses these funds of the tax to maintain already established public places. It is used to pay the salaries of various government workers such as police, army or to pay those people who came to collect garbage at your doorstep daily. It is therefore not wasted as the government is using for the betterment of a country.

Read Also: How To Pay My Federal Taxes Online

How To Calculate Sales Tax With Our Online Sales Tax Calculator

As you can see, this is precisely the same as how you calculate percent increase… or if you want to find out the pre-tax price while using our calculator, simply input the gross price and the sales tax rate to perform the reverse sales tax calculation!

Besides, it’s quite likely that you’ll find our , and calculators handy as well, especially if your job is in any way related to sales.

How Do You Add 6% Sales Tax

Calculating sales tax on a product or service is straightforward: Simply multiply the cost of the product or service by the tax rate. For example, if you operate your business in a state with a 6% sales tax and you sell chairs for $100 each, you would multiply $100 by 6%, which equals $6, the total amount of sales tax.

Don’t Miss: What Is The Tax In Georgia

Taxes On Your Receipt

If you have a printed receipt from a store, its likely theyve already separated out the amount charged in sales tax for you. Some stores will print what the sales tax percentage is in that locale as well. If you see a receipt with Tax 1 and Tax 2, the store is probably differentiating tax rates that go to two different government bodies; for example, city and state, or county and state. You can turn to a tax rate calculator for help.

As the team at Thomson Reuters explains, businesses are required to keep track of the taxes they collect, so whether or not taxes are shown together or separate usually depends on the method a business is using to sum up and track their taxes charged. Some systems use the register and receipt, while others might use a spreadsheet.

References

Step Two: Calculate The Sales Tax On Products For Sale

Find the total cost of products including the sales tax of the city in which is it sold.

- Input the total cost of the product or service being sold, and the total sales tax rate from step one.

* NOTE: Sales tax rates differ depending on the circumstances of the sale. If youre selling goods or services across state lines, you may not be required to collect sales tax. For more information, check out our Sales Tax Guide for Small Businesses.

Also Check: Do You Need To Claim Unemployment On Taxes

Add 100 Percent To The Tax Rate

Add 100 percent to the sales tax rate. The 100 percent represents the whole, entire pre-tax price of the item in question; when you add it to the tax rate, you get a total percentage that represents the pre-tax price plus the tax. So if the sales tax in your area is 8 percent, you have:

100 + 8 = 108 percent

Want To Learn More About Taxes

To find out the key steps and concepts involved with sales tax compliance, check out our comprehensive guide: Sales Tax for Small Businesses. Here youll learn how to get a seller’s permit, why you may want a resale certificate, and also the circumstances that require your business to collect sales tax from long-distance customers.

Read Also: Can I File Old Taxes Online

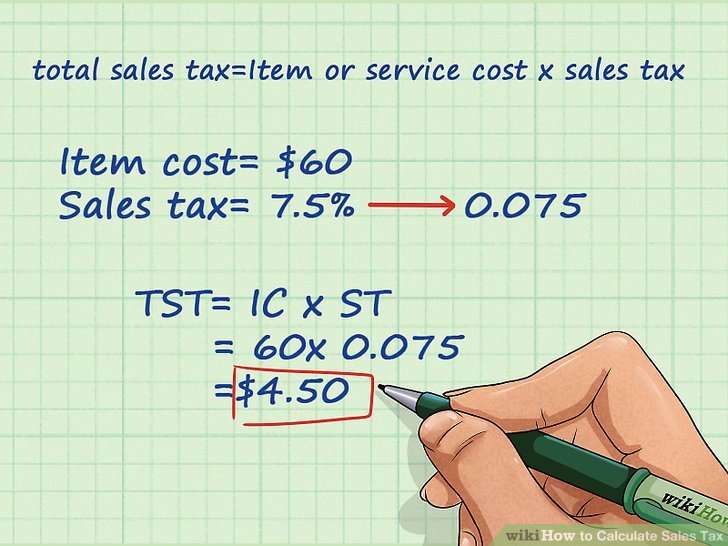

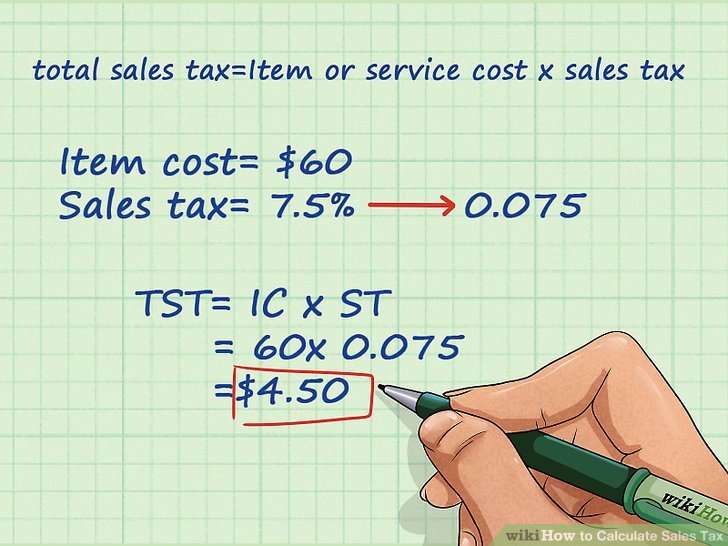

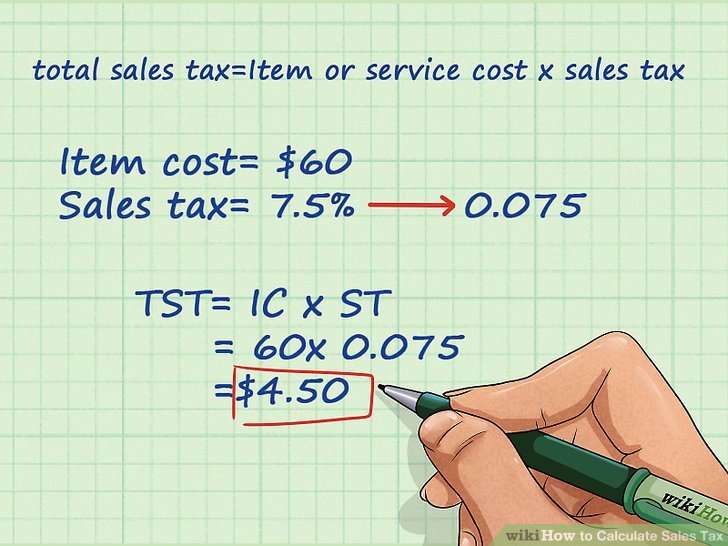

How Do You Calculate Sales Tax

Youll need to add the entire amount if your government, province, and city collect sales tax separately. You can use this formula to calculate your sales tax.

- Total sales tax = total sales x sales tax rate.

The value you pay for sales tax depends on the rate you get for your products or services and how much taxpayers spend on them.

Multiply Retail Price By Tax Rate

Nailing down the rates is much more complicated than the actual math used to determine how much sales tax you’ll be paying that’s just a simple percentage.

Let’s say you’re buying a $100 item with a sales tax of 5%.

Your math would be simply: x = .

That’s $100 x .05 =$5.

Since you’ve figured out the sales tax is $5, that means the total you’ll pay is $105.

Recommended Reading: Can You Change Your Taxes After Filing

What Is The Sales Tax Formula

The sales tax formula is used to determine how much businesses need to charge customers based on taxes in their area. State and local governments across the United States use a sales tax to pay for things like roads, healthcare and other government services. Sales tax applies to most consumer product purchases and exists in most states.

The sales tax formula is simply the sales tax percentage multiplied by the price of the item. It’s important for businesses to know how to use the sales tax formula so that they can charge their customers the proper amount to cover the tax. For consumers, it’s good to know how the sales tax formula works so that you can properly budget for your purchases.

How Does It Work

Sales tax is also known as trust tax, as the seller collects the tax from customers and passes it on to the government. According to sales tax regulations,

any business must pay the sales tax as per legal binding by the government if t it has a nexus in a state. The nexus can be defined as a brick-and-mortar store, affiliate, employee, or another kind of presence.

Traditionally, the retail store owners only charge retail sales tax to the consumers or buyers of a good or service. It works like this because the modern supply chains are complex, and goods pass through different stages and players across a supply chain. Each player completes his part of tax documentation to transfer sales tax liability to the liable person or party.

For instance, if we take an example of a leather wallet. The leather wallet you purchase at a store has gone through so many stages. The animal farmer sold the cowhide to a leather manufacturer. He is not the end-user of the product. Therefore, he will need to get a reselling certificate from the government to prove it. The leather goes to the wallet manufacturer.

He will also get a resale certificate. Finally, the retailer selling the wallet in a showcase of his store will be passing the wallet to the end-user. The end-user is the person who either consumes the good, passes it to someone else who is his dependent, or as a gift.;

Nexus

Read Also: How To Buy Tax Lien Properties In California

How To Do The Reverse Tax Calculation

How to calculate sales tax percentage from the total?To calculate the sales tax backward from the total, divide the total amount you received for the items subject to sales tax by 1 + the sales tax rate. For example, if the sales tax rate is 5%, divide the sales taxable receipts by 1.05.

You can calculate the amount of tax paid if you know the total post-tax price for the purchased item and measured tax rate. This method can calculate the tax paid by determining it backward to analyze monetary compensation paid as sales tax.

Adding 100 percent to the tax rate

In this case, you can calculate the total amount of tax paid by adding 100% to the total sales tax rate. This hundred percent is synonymous with the pre-tax amount of the product purchased. This whole amount will get you the total percentage that symbolizes or highlights the items pre-tax amount and the tax when added to the tax rate. For example, if an item has a sales tax of around 5%, you will get 105%.

Conversion to decimal form

To convert an amount to the decimal form, you can divide the tax-paid rate by hundred. For example, if the total amount was 105%, you can divide by a hundred, giving you 1.05.

Division of post-tax price with decimal

Subtraction of pre-tax price from the total or post-tax price

What Goods Are Exempt From Sales Tax

In all states of the US, some certain goods and services are exempt from sales tax. These goods and services include:

- Necessities like food, medicine, clothing

- Healthcare and educational goods

- Products sold to resellers

If we talk about New York, the following goods and services are exempt from sales tax:

- Groceries

However, there might be local sales taxes in these states too.

Recommended Reading: How To Calculate Net Income After Taxes