An Equation For Net Income

Net profit: To calculate net profit for a venture , subtract all costs, including a fair share of total corporate overheads, from the gross revenues or turnover.

- Net profit = sales revenue â total costs

Net profit is a measure of the fundamental profitability of the venture. “It is the revenues of the activity less the costs of the activity. The main complication is . . . when needs to be allocated” across ventures. “Almost by definition, overheads are costs that cannot be directly tied to any specific” project, product, or division. “The classic example would be the cost of headquarters staff.” “Although it is theoretically possible to calculate profits for any sub-, such as a product or region, often the calculations are rendered suspect by the need to allocate overhead costs.” Because overhead costs generally don’t come in neat packages, their allocation across ventures is not an exact science.

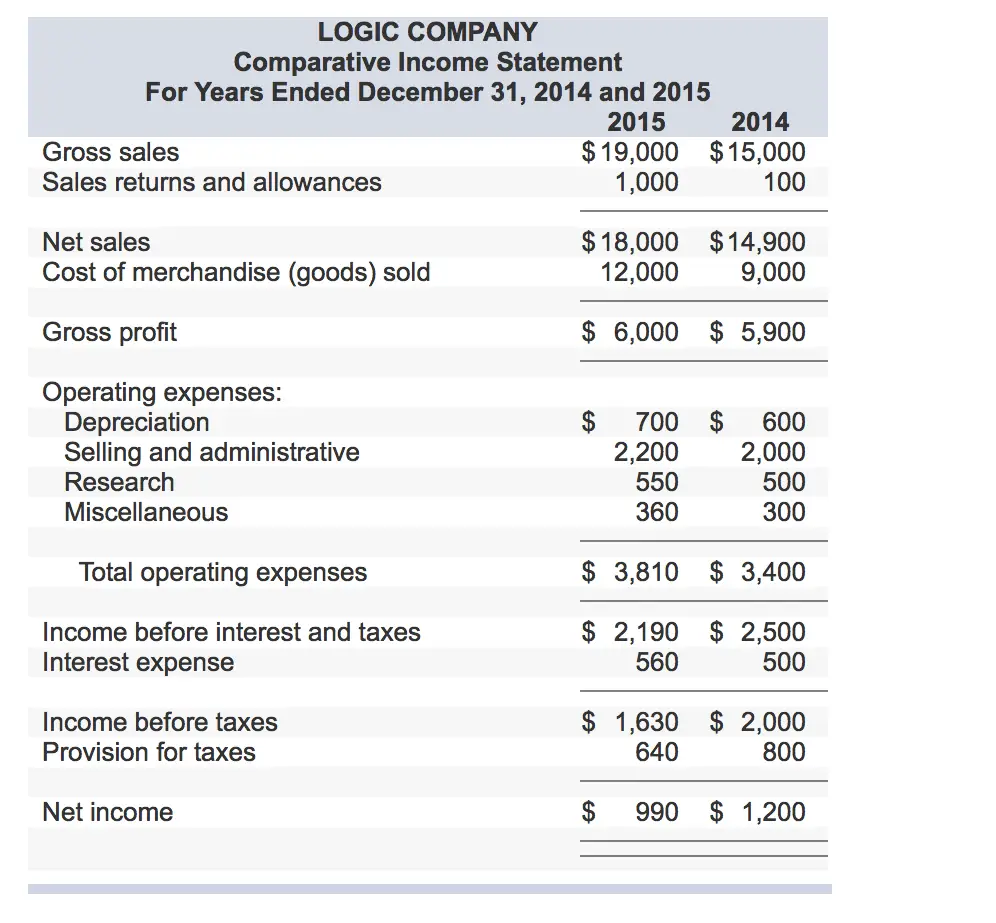

Net profit on a P & L account:

Another equation to calculate net income:

Form T661 Scientific Research And Experimental Development Expenditures Claim

For information on extended time limits for filing SR&ED prescribed forms due to COVID19, go to COVID-19 Ministerial Orders;and select Explanatory Note: Time Limits and Other Periods Act Income Tax provisions.

We publish Guide;T4088, Scientific Research and Experimental Development ;Expenditures Claim Guide to Form T661, which gives details on how to complete Form;T661. For more information, go to Scientific Research and Experimental Development .

File Form T661 if you carry on business in Canada and have incurred expenditures for scientific research and experimental development ;you carried on in Canada and for some salary or wage expenditures for SR&ED carried on outside Canada.

To avoid delays in processing, use the most recent version of Form;T661.

A corporation has to file Form T661 to identify an expenditure and support its characterization as SR&ED, as well as any claim preparer information.

If the corporation does not provide, in this way, information about the expenditure, it may not deduct that amount as an SR&ED expenditure.

If the corporation does not provide complete and accurate claim preparer information, a $1,000 penalty applies. However, the SR&ED claim will not be disallowed for this reason. When a SR&ED claim preparer participates in preparing the claim, the corporation and the SR&ED claim preparer are liable, together or separately, for the $1,000 penalty.

ReferencesSubsections 37, 149, 149, 162 and 248Regulation 2900

Why Net Income Is An Important Metric

When you look only at revenue, you’re not looking at the big picture costs of running a business or its profitability. Similar to how you can’t just look at your individual income to assess your personal financial wellbeing . It’s key to look at all expenses and get a clear idea of what money is coming in and what is going out.;

Net income can give you an overall idea of the health of a business, because it shows profits after all deductions are taken out. If there are major differences between gross and net income, it can be a warning sign. It could mean that expenses are too high, income is too low, or both.;

It’s important to note that net income is just one metric to look at and it can vary from business to business.;

” can change drastically from one business to another based on how they choose to fund their companies and assets. Net income also doesn’t include capital expenditures. A given business could have a pretty high net income relative to their earnings but in reality be hemorrhaging cash. If a company has really expensive debt their net income could be lower than their counterpart who is actually less profitable but has less debt,” explains Slemer.

Investors can review financial statements with net income to determine the financial health of a company they’re investing with.;

Net income is also relevant to investors, as businesses use net income to calculate their earnings per share .;

Also Check: How Much Tax Do You Have To Pay On Stocks

Financial Facts About Germany

The average monthly net salary in Germany is around 2 400 EUR, with a minimum income of 1 100 EUR per month. These figures place Germany on the 12th place in the list of European countries by average wage. Germany is not considered expensive compared to other European countries, the prices of food and housing being only slightly higher than the EU average. The country performs very well in many measures of well-being, ranking above the average in education, work-life balance, jobs, income, environmental quality, health, civic engagement, housing, and personal security.

Germany possesses one of the largest economies in the world and employs a social market economy. It has the largest national economy in Europe, the fourth-largest by nominal GDP in the world, and fifth by GDP. Germany has consistently been at the forefront of industrial leadership. The biggest German industries are: automotive, electrical engineering, transport and general engineering, mechanics, precision optics, and pharmaceutics.

Germany is open to immigration, being the second most popular immigration destination in the world, after the United States. According to independent.co.uk, three out of the ten best cities for quality of living are in Germany: Munich, Dusseldorf, and Frankfurt.

Net Income After Tax In Ratio Analysis

Net income after tax is often used in relation to other account balances to interpret the companys ability to generate profit. There are primarily two ways net income after tax is used in an analysis to interpret a companys profitability.

Firstly, through the calculation of return ratios, analysts can quantify a companys ability to generate profit given asset investments and equity financing.;Secondly, profitability can be assessed relative to revenues generated.

Read Also: How To Buy Tax Lien Properties In California

Determine Your Gross Annual Income

The very first step is to find your gross income, or the total amount of money you earn before deductions. It will serve as a solid foundation for calculating your net income. Find a previous pay period’s pay stub and locate your deductions, if there are any. It should list the full amount before deductions. That would be your gross pay for that period.

Next, find out when and how often you receive payment and multiply that figure by the gross pay. For example:

If you are paid $2,000 bi-weekly, multiply that number by 26.

Example:

Gross Pay x 26 = Gross Annual Income

$2,000 x 26 = $52,000

If you are not salaried or work irregular hours, you will need to add up each pay stub for the year. This will be the most viable method of obtaining an accurate depiction of your annual income.

If you worked more than one job throughout the year , ensure that you take all of them into account.

How To Calculate Your Net Paycheck

What is FICA, and why am I paying so much? If youve ever asked yourself this question while examining your paystub, heres your answer: FICA is an acronym that stands for Federal Insurance Contributions Act, the law that created Social Security. Your share of FICA includes employee contributions for Social Security and Medicare. Employers also pay a share of the FICA tax for each employee.

FICA is just one of many potential paycheck reducers that represent the difference between your salary, or gross pay, and the actual amount you take home, your;net pay.

Also Check: Should I Charge Tax On Shopify

Definition What Is Nopat

Both investors and creditors use this financial ratio to gauge how profitable a companys operations are and how able they are to pay shareholders and debt obligations. Typically, they only use this as a gauge because its not an exact measurement. The;accrual method of accounting;typically creates timing difference between when earnings are recognized for book purposes and when they are recognized for tax purposes. Thus, there is usually a difference between the actual money that can be distributed to;;and the amount calculated.

Analysts also use this calculation as a measure of operating efficiency since it calculates how profitable a companys operations are without considering its financing structure. For this reason, NOPAT is typically considered the most accurate measure of operating efficiency for leveraged companies. Analysts also tend to use this in other;free cash flowand economic value added calculations.

Lets take a look at how to calculate NOPAT and what equations are used.

Usage Explanations And Cautions

In addition to analyzing the underlying efficiency of a company and comparing it to peers, analysts also use it to calculate EVA or FCFF . Without going into the details of what these terms mean, it would suffice to understand these numbers are actively used by analysts to conduct company/business valuation exercise and M&A targeting of potential companies.

In the case of acquisition analysis, investors would like to understand the core operating efficiency of a company without the impact of debt on its books. This is important because once they acquire a company, they might replace the debt with their own capital. Hypothetically, if someone wants to acquire one of the two companies mentioned above and has to make the decision purely based NOPAT , they will go to Wal-Mart !

In conclusion, through this article, we have tried to introduce an important concept in finance for beginners. As you work your way through different concepts you can start noticing different patterns in the financial jigsaw puzzle and start getting the holistic picture.

Don’t Miss: When Is Sales Tax Due

Reducing Remuneration Subject To Income Tax

Certain amounts that you deduct from the remuneration you pay an employee, as well as other authorized or claimed amounts, can reduce the amount of remuneration;from which you deduct tax for the pay period. Reduce the remuneration by the following amounts before you calculate tax:

Do not subtractCPP contributions and EI premiums to determine the remuneration that requires tax deductions.

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Recommended Reading: How Much Is New York State Sales Tax

Dont Have Financial Statements

Financial statements are built from solid books, so try a bookkeeping service like Bench. Youâll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business.

How To Calculate Net Income After Tax

Calculating net income after tax involves deducting all expenses and costs from revenues in a given fiscal period. The expenses and costs are the following:

Cost of Goods Sold

The cost of goods sold is the carrying value of goods sold in a given period. Recording the cost of goods sold is dependent on the applied inventory valuation method. Generally accepted accounting principles GAAPGAAP, Generally Accepted Accounting Principles, is a recognized set of rules and procedures that govern corporate accounting and financial dictate that inventory can be valued via the specific identification method, average cost basis, or first-in-first-out method.

Selling, General, and Administrative Expense

SG&A expense consists of the direct costs, indirect costs, and overhead costs that are instrumental for the companys day to day operations. For example, commissions, salaries, insurance, and supplies are also examples of selling, general, and administrative expenses. Alternatively, the SG&A account is also referred to as operating expenses.

Depreciation

The acquisition of tangible assetsTangible AssetsTangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment. Tangible assets are like PP&E deteriorate with use and eventually wear out. Accountants try to best allocate this deterioration cost across the assets useful life in order to faithfully represent the assets value.

Interest Expense

Also Check: Can I File Old Taxes Online

Election Under Paragraph 88

Further to a winding-up of a subsidiary, the part of a non-capital loss, restricted farm loss, farm loss, or limited partnership loss incurred by the subsidiary is deemed to be the parent corporation’s loss for its tax year starting after the winding-up has begun.

Paragraph 88 allows the parent corporation to elect that this loss is deemed to be a loss from its tax year previous to the year mentioned above.

Tick box;190 if you are making an election under paragraph;88.

What Is The Formula For Common Stock

Earnings available for common stockholders equals net income minus preferred dividends. Net income, or profit, equals total revenue minus total expenses. Revenue is the money you earn selling products and services. Expenses are the costs you incur in the same period, such as rent, payroll, interest and income taxes.

Although preferred stockholders receive dividends before common stockholders, they do not share in the rest of the profits; only common stockholders do. A companys earnings available for common stockholders is the profit it has left over at the end of an accounting period after covering all expenses and paying dividends to preferred stockholders. Common stockholders pay close attention to this figure and to a companys earnings per share, or EPS, because these numbers represent their cut of the profits. When your small business generates strong earnings available for common stockholders and EPS, you potentially increase the value of your companys common stock. After cash dividends are paid, the companys balance sheet does not have any accounts associated with dividends.

Its also known as the book value of the company and is derived from two main sources, the money invested in the business and the retained earnings. Stockholders equity can be calculated by subtracting the total liabilities of a business from total assets or as the sum of share capital and retained earnings minus treasury shares.

You May Like: What Is The Tax In Georgia

Line 334 Farm Losses Of Previous Tax Years

On line;334, enter the farm losses you are carrying forward from previous years to reduce taxable income from line;330 of Schedule;4.

On line;340 of Schedule;3, enter the amount of the current-year farm loss, and on line;345, enter the previous years’ farm losses that you are using to reduce dividends subject to Part IV tax.

The total of those two amounts has to be entered on line;335 of Schedule;4 as the amount applied. For details, see Part;3; Farm losses.

References Paragraphs;111,;186, and;186

What Is Profit After Tax

Profit after tax can be termed as the net profit available for the shareholders after paying all the expenses and taxes by the business unit. The business unit can be any type, such as private limited, public limited, government-owned, privately-owned company, etc.

Tax is an integral part of an ongoing business. After paying all the operating expenses, non-operating expenses, interest on a loan, etc., the business is left out with several profits, which is known as profit before tax;or PBT. After that, the tax is calculated on the available profit. After deducting the taxation amount, the business derives its net profit or profit after tax .

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Line 332 Net Capital Losses Of Previous Tax Years

On line;332, enter the amount of net capital losses from previous years that you applied against taxable capital gain incurred in the year. This amount is the capital loss entered on line;225 of Schedule;4 that you multiply by;50%. See Part;2; Capital losses for details.

Note

A net capital loss can create a non-capital loss in the year you apply it, because the net capital loss is not limited to reducing the taxable income, but to reducing the taxable capital gain in that year.

References Paragraph;111

You May Like: How Can I Make Payments For My Taxes

Calculating Your Net Paycheck

Want to know what your paycheck will look like before you take a job? There is a way to figure out exactly how much youll have left after FICA, federal taxes, state taxes, and any other applicable;deductions;are removed. You need a few pieces of information in order to calculate your take-home pay:

- The amount of your gross pay.;If you earn a fixed salary, this is easy to figure out. Just divide the annual amount by the number of periods each year. If you are paid hourly, multiply that rate by 40 hours to determine your weekly pay.

- Your number of personal exemptions.;When you start a new job, you fill out a;W-4;form to tell your employer how much to withhold from your check.

- Your tax filing status.;There are standard federal and state tax deductions that vary depending on whether you are single, married filing jointly, married filing separately, head of household, or a surviving spouse.

- Other payroll deductions.;This category could include contributions to a 401 retirement plan, health insurance, life insurance, or a flexible spending account for medical expenses. It also may include union dues or any other garnishments that are taken from your wages. It helps to categorize these according to pre-tax and after-tax contributions, to deduct them from either your gross salary or after-tax calculation.