You Have Other Options

You can save considerably by purchasing tax preparation software instead if your tax situation isn’t very complicated. These programs have evolved considerably over the years and are set up to ask you specific questions, then prepare your return based on your answers and the data you input.

As of Dec, 2021, prices start as low as $19.95 for the H& R Block basic tax software. You can file a simple tax return for free with TurboTax, but any returns looking to maximize deductions would require its programs starting $39. There might be an extra cost for preparing state returns, however.

You can have your return prepared and filed for free through IRS Free File if your tax situation is very simple and basic, subject to some income limits. You can’t have more than $72,000 income, and some of the participating providers’ limits are even less than this. The Free File website can guide you to what’s available.

The IRS Volunteer Income Tax Assistance Program also provides free tax preparation for low-income taxpayers, as well as for the elderly, disabled, Native Americans, rural citizens, and those for whom English is a second language. There were more than 7,350 volunteer program sites across the U.S. as of March 2021.

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

In Order To File My Tax Return What Information Will My Accountant Require

It may be as simple as handing over your records to your accountant to complete your tax return calculations if you keep good records. Small businesses frequently fail to keep up with their bookkeeping, and your accountant may request that you produce all of your business receipts.

If you are unsure about your total income for the year, you must furnish records to aid in the calculation. Invoices, bank statements, pay in slips, and cash receipts are all examples of this.

Your accountant will need to know the following in order to complete appropriate tax returns:

- Your employment information if you worked during the same tax year, youll need your P45 or P60 to show how much tax youve previously paid.

- Any pension income if you receive a state pension, this will be stated on your notification letter if you receive a private pension, you will receive a certificate of the pension paid after the tax year ends.

- All income received, interest earned, and taxes deducted are listed in your self-employed or partnership business records.

- Any interest earned on investments is referred to as investment income.

- Any assets sold, purchased, or disposed of, as well as the values involved in each transaction.

Read Also: How Do Taxes Work On Doordash

Tax Preparer Fees And Tax Time Financial Products

Many Americans use tax preparers to file their taxes. In 2017, for example, just under 79 million Americans paid tax preparers to file returns. Over $323 billion was issued in tax refunds for 2017, with an average refund of $2,895.

For years, many tax preparers made money by selling financial products that take fees and interest from anticipated refunds. Until 2012, banks would partner with preparers to sell short-term, high-interest refund anticipation loans , which were repaid from anticipated refunds. RALs were often sold based on misleading tactics. In 2002, nearly 13 million Americans paid more than $1 billion in fees for RALs.

Regulators eventually cracked down on the practice, however, and banks stopped offering RALs between 2009 and 2012. Since then, tax preparers and financial firms have looked to fill the gap though a number of expensive services that prevent consumers from getting full tax refunds.

If you are considering using a tax preparer, you should learn as much as you can about the preparer and the services offered before you purchase.

How Much Does It Cost To Amend A Tax Return

There are no charges or fees for filing Form 1040X for amended returnsthe only expense is the postage fee when mailing the documents. So part of knowing how to amend taxes includes you printing out the form, signing it, and sending it via post. But if it turns out that you owe money to the IRS, youll need to pay interest and late fees on the money you owe.

| NOTE:If you receive an advanced premium tax credit through the marketplace, you must file Form 8962. If you dont know how to do this, you can use high-quality business tax software to guide you through the process. |

Read Also: Efstatus.taxactcom

Average Tax Preparation Fees

According to aNational Society of Accountants survey, in 2020 on average you would have paid $323 if you itemize your deductions on your tax return. Before you gulp, you can take some comfort in knowing that this generally includes both your state and federal returns. The average fee dropped to $220 if you didn’t itemize, which tells you something about how complicated and time-consuming the process of itemizing your deductions can be.

Be prepared to pay more if you show up for your appointment with receipts stuffed haphazardly in a cardboard box, or if you’re missing one or more important tax documents like that Form 1099 you received for interest income you earned during the year.

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

You May Like: How To Get A Pin To File Taxes

Does Everyone Need To File An Income Tax Return

OVERVIEW

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn’t exceed certain thresholds, then you don’t need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status.

Apple Podcasts | Spotify | iHeartRadio

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Recommended Reading: Plasma Donation Taxable

How Much Does It Cost To File Taxes

Many tax software programs have a free version, but you’ll be charged a fee if you upgrade to a paid plan. The tax programs we reviewed either have no cost for the free plans, or charge as low as $11.05 for federal filing plus $4.95 per state. However, the costs can add up fast with the more complex deluxe, premium and self-employed plans the most expensive is $170 for federal, plus $50 per state. If you want to add live tax support, the surcharge can be $35 to $100, plus state fees.

Don’t miss: Free vs. paid tax services: When to plan on paying for an upgrade

How Much Does It Cost To File Your Taxes With H& r Block

Tax prep companies frequently offer discounts on products early in the season. The prices listed in this article do not include any discounts. You can check the company’s website to see current offers. Check the site »

You can pay as little as $0 or as much as $231.98 to prepare and file your own federal and state returns online. The more options you need to add on, including multiple streams of income and/or deductions and you qualify for, the more expensive it will be to prepare your return with H& R Block. Similarly, the more expert help you enlist, the more you’ll pay.

H& R Block offers four main ways to prepare and file taxes: do-it-yourself online packages, the option to add Online Assist , downloadable computer software, and full service from a tax preparer. Each of these categories offers different price points, which are determined by which tax forms you need and how much help you want.

The DIY packages without expert help are the cheapest, since you’re filling out every form yourself. If you don’t qualify for the free version, these cost either $49.99, $69.99, or $109.99, plus $36.99 for a state return, not including discounts.

Also Check: Stripe Doordash 1099

How Long Does It Take For An Accountant To Do A Tax Return

Taxes adviser helps you to know how to take a risk, what steps need to be taken now and which steps ought to be deferred. Among people who reported their own taxes to the personal finance forum Bogleheads, an average of four hours or less was taken while completing their own taxes using online tax software.

Advantages Of Working With A Tax Professional

- Personal touch: Some people prefer working with another human when going through a complicated process like a tax return. This may be especially beneficial if your financial situation is complex.

- Year-round advice: If you work with the same tax professional each year, that person may be available throughout the year to give advice based on your specific situation.

- May offer IRS help: If you end up getting audited, a tax professional may be able to assist and possibly even mediate with the IRS on your behalf.

You May Like: Is Doordash A 1099 Job

What Does A Tax Preparer Do

Most tax preparers prepare, file, or assist with general tax forms. Beyond these basic services, a tax preparer can also defend a taxpayer with the IRS. This includes audits and tax court issues. However, the extent of what a tax preparer can do is based on their credentials and whether they have representation rights.

In a way, tax preparers are asked to serve two masters their clients and the IRS. They must assist their clients in complying with the state and federal tax codes, while simultaneously minimizing the clients tax burden. While they are hired to serve their client, they must also diligently remember their obligation to the IRS and not break any laws or help others file a fraudulent return.

How To Amend A Tax Return In 2022

Mistakes happeneven on tax returns. If youve made a mistake on your return, theres no reason to panic. You can rectify your miscalculation by filing an amended tax return. If you find yourself in this situation and you need to fix an error, you should first learn what an amended return is and how to amend a tax return.

Read Also: 1099 From Doordash

Obtain All The Required Forms

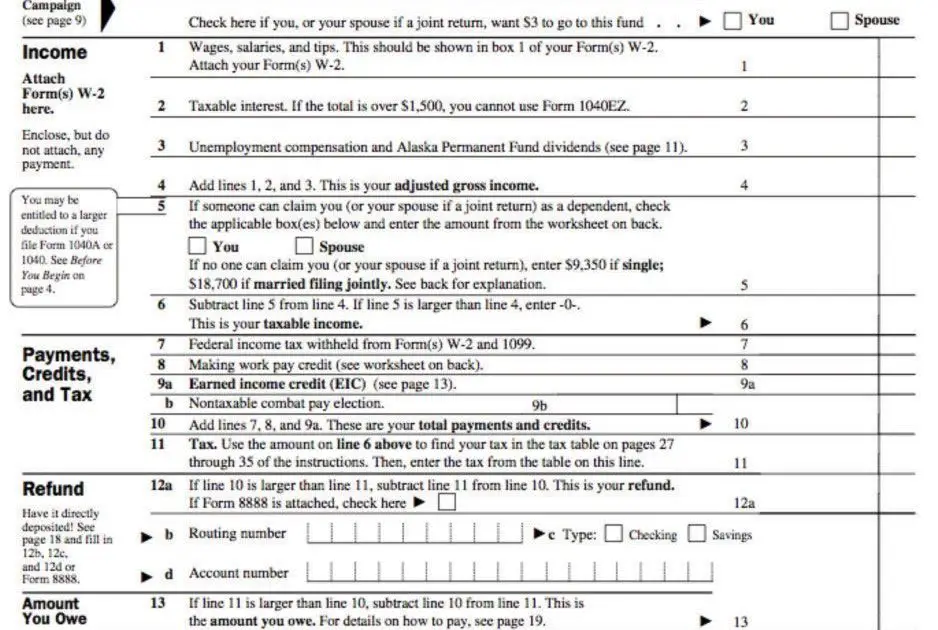

Tax returns are amended by filing Form 1040X, which serves to correct, add, or delete information on an already filed 1040 form. Sometimes you might need to obtain accompanying schedules for the 1040 form: Schedule A, Schedule B, Schedule C, and Schedule SE.

The 1040X form allows you to list your children as dependents, report forgotten income, and make several other changeseverything is clearly marked on the form. The tax return adjustment form can be found onlinesimply and print it. If youre filing to amend more than one tax return from previous years, youll need a form for each tax year youre filing to amend. If the correction youre filing to amend concerns reported items on a schedule, you must prepare a new schedule and send it with the 1040X. Regardless of the mistake on taxes already filed, Form 1040X doesnt require you to redo the entire tax returnyou need only to include items that have been subjected to changes.

B Hire And Work With A Tax Preparer

While it’s never been easier to do your own taxes using software, as your financial life gets more complex you might wonder if you’re missing something and should get someone to prepare and help file your taxes. If you have a business or a healthy side gig, or you just want help understanding all of the forms, you might seek out a professional’s guidance.

» Find a local tax preparer for free:See who’s available to help with your taxes in your area

If you don’t want to meet in person with a tax preparer, theres a way to file taxes without leaving the house. A secure portal lets you share documents electronically with a tax preparer. Typically, the preparer will email you a link to the portal, youll set up a password and then you can upload pictures or PDFs of your tax documents.

You May Like: Is Plasma Donation Taxable Income

How To File An Amended Tax Return

To file an amended return, you must submit a copy of your original tax return and any additional information related to the changes you made to the existing return. Its important to fix all errors on your tax return, even if it means that youll end up owing money to the IRS.

Here are situations for filing an amended return:

Incorrect Personal Information

Social Security numbers or the previous tax return sometimes call for an amendment.

Wrong Tax Filing Status

You may have filed as head of the household but dont qualify as such.

Wrong Number of Dependents

One of the reasons to amend tax return is a wrongfully listed number of dependents, especially if it affects the number of tax breaks, such as the Child Tax Credit, Earned Income Tax Credit , or the Health Coverage Tax Credit .

Forgotten or Wrongly Reported Income

Additional income also has to be reported. In case youve forgotten, for example, dividend income, you need to refile federal tax to avoid fines and penalties. You should also know that cryptocurrencies are taxable property and must be reported. If you have cryptocurrencies, it might be advantageous to use great crypto tax software to help you report them on your return.

Incorrect Tax Form

Individuals sometimes file their taxes on the wrong formthis needs to be rectified by filing the correct form.

Forgotten Deductions or Credits

To Itemize Or Not To Itemize

You might not have to torture yourself over the decision between itemizing and claiming the standard deduction. The Tax Cuts and Jobs Act effectively doubled the standard deduction for all filing statuses when it went into effect in 2018.

As of 2021, you’d need more than $25,100 in itemized deductions to make itemizing worthwhile if you’re married and you file a joint tax return . You’d be taxed on $5,100 more in income if you itemized and have only $20,000 in itemized deductions. That’s not even to mention the additional tax prep fee.

The standard deductions for other filing statuses are $12,550 if you’re single or if you’re married and filing separately , and $18,800 if you qualify as head of household .

Recommended Reading: Calculate Doordash Taxes

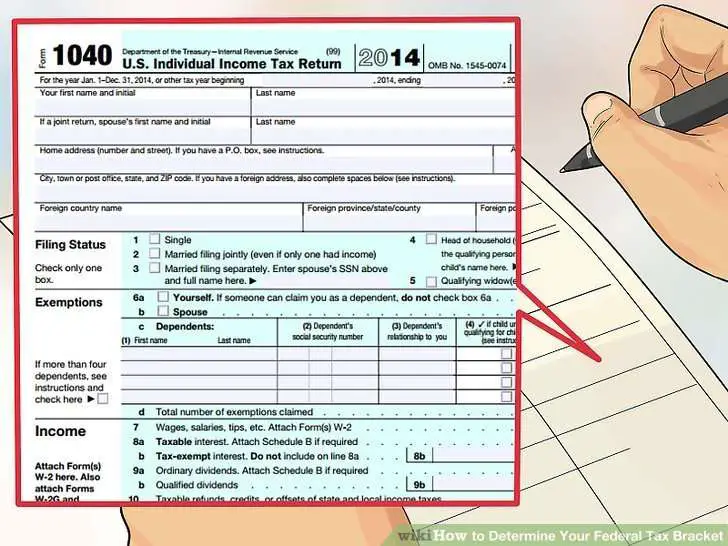

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Is H& r Block Really Free

Yes, the service is free for both federal and state if you are filing a simple tax return. It covers unemployment income, retirement income, W-2 income, and interest and dividend income. You can also take the Earned Income Tax Credit , child tax credit, and deductions like tuition and student loan interest.

Recommended Reading: H& r Block Early Access W2

List The Reasons For Filing The Amendment On The Form

- Additional schedules and forms: In some cases, when filing for an amendment, you must use Form 8949 to report incomefromsales and exchanges of capital assets that you previously forgot to include on your return. Schedule D often accompanies this form, which is used to report capital gains or losses.

- Filling out Form 1040X: The form has three columns: column A, column B, and column C. In column A, the number from the original tax return is entered, while the amended number is entered in column C. The difference between the two columns is recorded in column B, resulting in a balance due, tax refund, or no tax change.

If youre unsure as to how to amend taxes already filed, the 1040X form comes with instructions that guide you through the process of filling out the form and exactly where to send it. The taxpayer also needs to list all the changes made to the return. The year for which you are amending the return also needs to be prominently featured on the form. How far back can you amend tax returns? Three years.