Heres How People Can Request A Copy Of Their Previous Tax Return

IRS Tax Tip 2021-33, March 11, 2021

Taxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesn’t have this information here’s how they can get it:

Do Minors Have To File Taxes

Minors will have to file taxes if their earned income is greater than $12,550 . If your child only has unearned income, then the threshold is $1,100 . If they have both earned and unearned income, then it is the greater of $1,100 or their earned income plus $350. If the minor is self-employed, they will have to pay Self-Employment Tax at and above $400.

How Much Tax Penalties Cost

There are two possible penalties you could pay if you owe back taxes:

-

A failure-to-file penalty when you file late. Itâs worth 5% of your unpaid taxes and it accrues each month until it reaches 25% of your unpaid taxes. If you are owed a refund from the IRS, you wonât have to pay this penalty.

-

A failure-to-pay penalty applies any time you donât pay your full tax bill on time. Itâs worth between 0.5% and 1% of your unpaid taxes, accruing each month until it reaches 25% of your unpaid taxes. You donât have to pay this tax if youâre getting a tax refund from the IRS.

If you continue not to pay your taxes, the amount you owe could come out of future tax refunds, and the IRS could even put a lien on your assets or property. Read more about the tax penalties for filing your taxes late.

Don’t Miss: Pastyeartax Reviews

Can I Still Amend My 2014 Tax Return

Generally, you must file Form 1040X within three years from the date you filed your original tax return or within two years of the date you paid the tax, whichever is later. Right now, you can amend your tax returns for 2014, 2015 and 2016. After April 15, 2018, you can no longer amend your 2014 tax return.

Filing To Recover Taxes Withheld

Some employers automatically withhold part of pay for income taxes. By filing Form W-4 in advance, children who do not expect to owe any income tax can request an exemption. If the employer already has withheld taxes, your child should file a return to receive a refund of all taxes withheld from the IRS.

To receive a refund, your child must file IRS Form 1040.

You May Like: Roth Ira Reduce Taxable Income

Reasonable Cause For Late Filing

As an alternative to submitting late returns under this delinquent filer program, you may instead request relief by attaching a statement to your delinquent return, signed by a person in authority, stating your reasonable cause for the untimely return. However, if the request is denied, you will receive a penalty notice and the return will no longer be eligible for this delinquent filer program.

How Can I Get My Old Tax Returns

How do I obtain past tax returns?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

Can you view your old tax returns online UK? So, how can you access this information? HM Revenue & Customs provides the information online. or paper originals will continue to be acceptable if you do not have access to the internet. These can be ordered by you by calling 0300 200 3310.

Can you look up old tax returns?

There are three ways to request a transcript: Visit the IRS website for instant online access to your transcript. . Use Form 4506-T.

Also Check: When Do You Do Tax Returns

Filing To Open An Individual Retirement Account

It might seem a little premature for your child to consider opening an individual retirement account the IRS calls it an individual retirement arrangementbut it is perfectly legal if they have earned income. By the way, earned income can come from a job as an employee or through self-employment.

If you can afford to, consider matching your child’s contributions to that IRA. The total contribution must be no more than the child’s total earnings for the year. That lets your child start saving for retirement but keep more of their own earnings. It also teaches them about the idea of matching funds, which they may encounter later if they have a 401 at work.

Efile Information: Ncfreefile And Efile For A Fee

The following lists of eFile provider websites have been approved for the preparation and online electronic filing of state and federal individual income tax returns. The product names and details* below are given by eFile providers and are subject to change. These lists are updated as new information or additional approved eFile products become available.

Read Also: Do I Have To Report Plasma Donations On Taxes

Individual Income Tax Filing

Filing electronically, and requesting direct deposit if youre expecting a refund, is the fastest, safest, and easiest way to file your return.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

What To Do If You Receive A Late Payment Notice

If you have received a notice from the Income Tax Department asking you to file your returns that go beyond 2 financial years, you can log on to www.cleartax.in to prepare your returns. You can then print this return and submit it to the Income Tax Office in your ward. Usually, a taxpayer files old returns as a response to an income tax notice. Until AY 2017-18, there was a time limit of 1 year for filing a revised return from the end of the relevant AY.

It is interesting to note that from the AY 2018-19, the time limit for filing a revised return made in the original return has been reduced. Currently, such a revision has to be done on or before the end of the relevant AY.

Read Also: Protesting Property Taxes In Harris County

When Your Child Must File

For income above a certain level, the tax rate of the parents will be used. Four tests determine whether a dependent child must file a federal income tax return. A child who meets any one of these tests in 2021 must file:

- If the child only has unearned income above $1,100

- If the child only has earned income above $12,550

- If the child has both earned and unearned income, and the child’s gross income is greater than either $12,550 or their earned income plus $350, whichever is less.

- The child’s net earnings from self-employment are $400 or more

Additional rules apply for children who are blind, who owe Social Security and Medicare taxes on tips or wages not reported to or withheld by the employer, or who receive wages from churches exempt from employer Social Security and Medicare taxes.

Where Do I Send Back Taxes

If the IRS mailed you a notice about your late taxes, you should mail your return to the address listed in that notice. Otherwise, where you mail your old tax returns depends on where you live and whether or not youâre including a payment with your return. The IRS instructions for Form 1040 of the year youâre filing for should also include the proper mailing addresses.

You May Like: License To Do Taxes

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

How Do I Amend An Old Tax Return

Use Form 1040X to amend a federal income tax return that you filed before. Make sure you check the box at the top of the form that shows which year you are amending. Since you cant e-file an amended return, youll need to file your Form 1040X on paper and mail it to the IRS. Form 1040X has three columns.

Also Check: How Much Are Taxes On Cable And Internet

How Do You Know If Youre Due A Tax Refund

Well, there are a billion ways to do this, and most of them are online. You can calculate it yourself , or you can use online software programs or service providers.

Some companies even offer free online estimations. You can get your full estimation with taxback.com.

Want to claim a tax refund from Canada?

Any specific tax questions? Comment below!

Read Also:

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

You May Like: Www.1040paytax.com Review

How Do I File A Return If Unemployed

You need to file ITR-1. Show interest on FD under the head income from other sources. Reconcile the amount of interest and TDS with Form 26AS/ Form 16A. Under the TAB e-file on the income tax login , you can select the option Prepare and submit online.

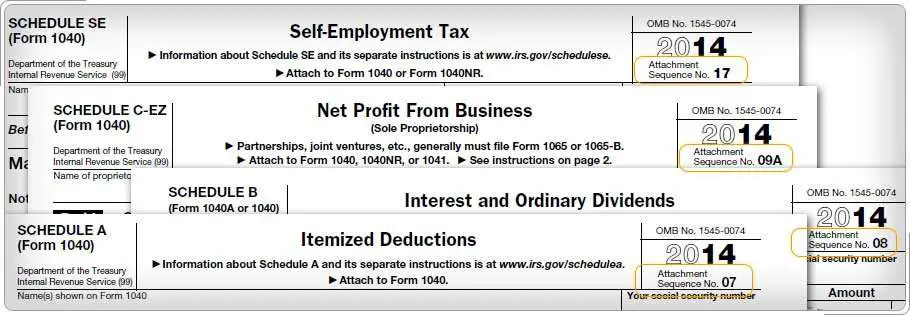

Download The Tax Forms You Need

Go to the IRS website to for the year you need to file. Forms can change from year to year, so be sure youre using the correct one. For example, the IRS significantly revised Form 1040, which is the main form for individual income taxes, in 2018. The new form replaced the old 1040, 1040EZ and 1040A versions, and moved a lot of information off the form and onto additional schedules.

Read Also: How Much Does Doordash Take In Taxes

When Your Child Should File

Your child should file a federal income tax return even though it isn’t required for the reasons above, if:

- Incomes taxes were withheld from earnings

- They qualify for the earned income credit

- They owe recapture taxes

- They want to open an IRA

- You want your child to gain the educational experience of filing taxes.

In the first two cases, the main reason for filing would be to obtain a refund if one is due. The others are income-dependent or based on taking advantage of an opportunity to begin saving for retirement or to begin learning about personal finance.

Notices For Past Due Tax Returns

You may receive one or more of the below notices if you have not filed your tax return.

If the IRS files a substitute return, it is still in your best interest to file your own return to take advantage of all the exemptions, credits and deductions to which you are entitled. The IRS will generally adjust your account to reflect the correct figures.

Understanding Your CP2566R NoticeWe previously sent you a CP63 notice informing you we are holding your refund until we receive one or more unfiled tax returns. Because we received no reply to our previous notice, we have calculated your tax, penalty and interest based on wages and other income reported to us by employers, financial institutions and others.

Understanding Your CP3219A Notice We received information that is different from what you reported on your tax return. This may result in an increase or decrease in your tax. The notice explains how the amount was calculated and how you can challenge it in U.S Tax Court.

Understanding Your LT3219B Notice This Statutory Notice of Deficiency notifies you of our intent to assess a tax deficiency and of your right to petition the U.S. Tax Court to dispute the proposed adjustments. We made these adjustments because we received information from third parties that doesnt match the information you reported on your return.

Also Check: Do You Claim Plasma Donation On Taxes

How Do I Get Old W2 From Previous Employer

If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return, you can order a copy of the entire return from the IRS for a fee. Complete and mail Form 4506, Request for Copy of Tax Return along with the required fee. Allow 75 calendar days for us to process your request.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Appeal Cook County Taxes

How Long Am I Liable If I Haven’t Filed Tax Returns In Past Years

At least six years, and possibly forever. While the government has only six years from the date the nonfiled return was due to criminally charge you with failing to file a tax return, there is no time limit for collecting taxes and assessing financial penalties for not filing. It is not until you actually do file a return that the audit time limit — three years — and collection time limit — ten years — starts to run.

As a practical matter, however, if you haven’t heard from the IRS in six years, you don’t need to worry too much about taxes owed on a nonfiled return. The IRS usually doesn’t go after nonfilers after six years — unless the IRS begins its investigation before the six years elapsed and you owe a large amount of taxes. After six years, the IRS frequently purges its computer files.

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

Also Check: Www.1040paytax

Minimize Penalties And Interest

The IRS can penalize you if you dont file a return or pay any tax you owe by the deadline. Generally, the penalty for not filing is more than the penalty for not paying. You may also be charged interest on any unpaid tax balance.

Filing your back taxes and paying anything you owe may help limit the amount of interest and penalties youre subject to for missing the deadline.

How Far Back Can You File Taxes In Canada

If you were required to file your taxes, you should file your taxes in full and on time. If you cannot file your taxes on time for whatever reason, you should take action and file them as soon as possible. The longer you wait, the more difficult your situation will become.

Whether your late tax filing is 1 year, 5 years or even 10 years past due, it is important to act and get compliant immediately. You might think that, if you dont have the money to pay your taxes, its best to not file, but this isnt the correct strategy to take. The CRA will not forget about you, and every day that goes by will end up costing you more money.

In fact, you should still file your taxes even if you do not owe any money. Filing taxes late when you dont owe Canada Revenue Agency any money is still a mistake. Many benefits will not be paid to you if you do not file. You could be missing out on benefits that you are entitled to receive if you do not file.

If youre behind filing your returns you should not simply go to a tax preparer and send in a batch of returns. Once you are behind, you will need to deal with professionals who have a high level of experience and who can negotiate with the CRA for you to become compliant. Late tax filing is a very serious tax problem that must be approached carefully. When filing past tax returns Canada Revenue Agency has a process that you should follow and programs that may make it easier to do so.

Read Also: Where Can I File An Amended Tax Return For Free