The Legality Of Filing Without Your W

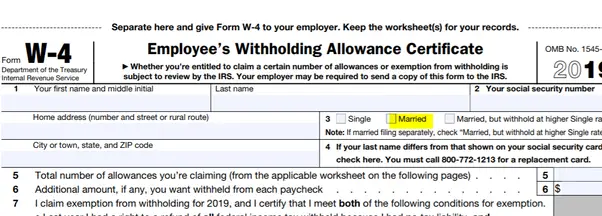

Technically, it is possible to legally file taxes without your W-2 if you file electronically, but in order to do your taxes correctly you will need the information contained in your W-2. This includes the following:

- Your employers identification number

- Your employers name and address

- Your total wages, including tips and any other compensation

- Amount of federal income tax withheld

- Your social security wages and tips

- Social security tax withheld

- State income tax withheld

- Any local income taxes withheld

When you file electronically, you are not required to submit a copy of your W-2 itself, but will only need to enter the information from it. However, it is recommended to keep your W-2 in a safe place in case you need to produce it in the future, such as in the event of an audit, or for other purposes such as background checks.

Keep in mind that your employer should have filed a W-2 form with the Social Security Administration by the end of January and the SSA will have shared this information with the IRS, so if the numbers you enter differ from what your employer reported, you could end up with an audit on your hands.

In the event of an audit, you will need to produce documents, to prove your income and withholding. In such an event, you could end up with legal difficulties if you cant show that the numbers you entered were in good faith.

My Former Employer Was Acquired By Another Company Who Has My W

If you get hired by the new company, they are responsible for providing you with your W-2 for the whole year.

If you left your job when the company changed hands, the original company is responsible for sending you your W-2.

If neither company sends you the form, contact the new owner and ask about next steps. Your original employer should have been reporting data to the IRS each quarter so the IRS might be able to help as well.

What To Do If You Cant Find Your W 2 Form

The W 2 form is usually mailed to you or made accessible online by the company you work for. If the form is lost, missing, or you cant find it online, contact your employer immediately. Its a good idea to call the IRS if you dont receive the W2 by mid-February.

In the worst-case scenario, you can fill out Form 4852 and attach it to your tax return. The substitute wage and tax statement allows you to input the same details. A tax extension is another possibility and buys you more time.

Your best bet is to file on time. If the W 2 arrives later, and the information is different from your estimates provided, Form 1040X can be filled out to correct any discrepancies, and amend the previous years tax return.

Also Check: Can You File Taxes Online

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

What Is Form 1099

Prior to tax year 2020, 1099-MISC included reporting miscellaneous income and nonemployee compensation. Beginning tax year 2020, nonemployee compensation must be reported separately on a newly developed form: 1099-NEC. 1099-MISC still exists it is now used for truly miscellaneous income like royalties, rents, prizes/awards, crop insurance, etc.

Treasury requires 1099-MISC state copy filing per MCL 206.707. Treasury has the authority to require 1099-NEC state copy filing per Internal Revenue Code .

Don’t Miss: How Much Taxes To Pay On Stocks

Do I Get An Automatic Extension If My W

Unfortunately, even if your W-2 took longer to get to you, you must still file or request an extension by the deadline in April, usually the 15th. Filing an extension gives you an additional six months to complete your return. If you are waiting for your W-2 or other forms and the tax deadline is approaching, filing an extension may be a good idea.

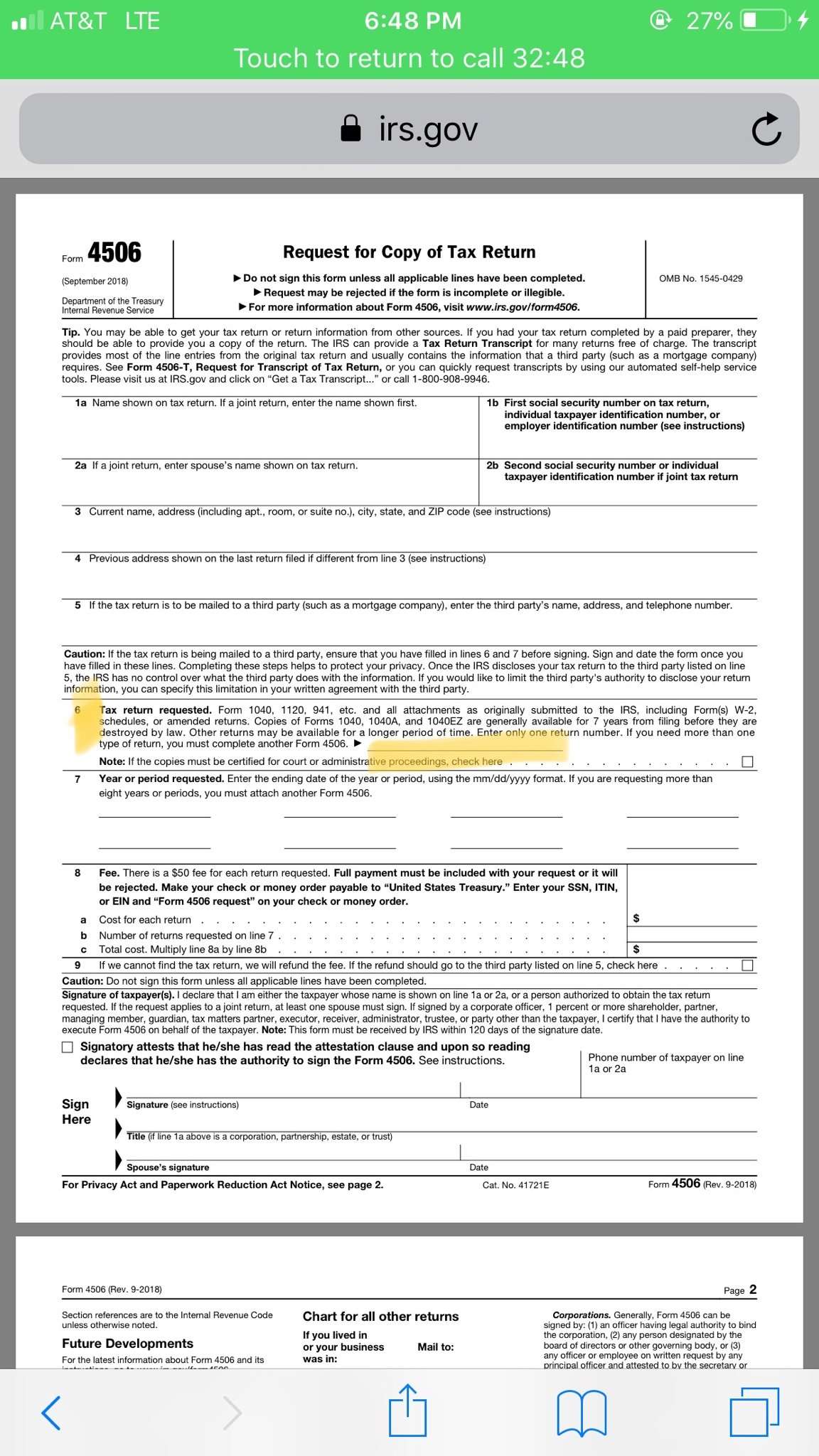

What Is A 4506

Use Form 4506-T to request a transcript of previously filed tax returns free of charge. It contains most of the line items on your full return and is widely accepted by most lenders. Mortgage lenders and student loan lenders, for example, will often ask you to fill out this form to verify your income. With COVID-19 delaying processing of paper forms at the IRS, an easier and faster option is the IRS online Get Transcript tool.

Best for:People who need a transcript of their tax return free of charge.

Don’t Miss: How To File 2016 Taxes

Q: What Are Credit Karma Tax Security Practices

- We use 128-bit or higher encryption to protect the transmission of your data to our site

- We maintain physical, electronic and procedural safeguards of taxpayer information that comply with applicable law and federal standards

- We have a dedicated on-site security team, plus independent third-parties who regularly assess our site for vulnerabilities

- We require a phone number and text SMS or voice/call verification when using Credit Karma Tax®

- We support Two-Factor Authentication with the Google Authenticator app

Get Started Filing Your Prior Year Tax Return Today

There are several roads available to you for tracking down a copy of your W-2. While contacting your employer is the quickest and cheapest way, the IRS route may be more reliable and less of a burden to you.

Once you receive the copy of the W-2, you can then use the information provided and start filing the prior year tax return.

Read Also: How Can I Check My Income Tax Refund Status

I Received A W2c After I Filed My Taxes Do I Need To File This W2c This Year Or Can I File This W2c In The Next Tax Year

It depends. You need to know what specifically was corrected on the W-2. If the correction does not have to do with income or withholding amounts, it is likely that you only need to keep the form for your records. If the W-2c changes information on your tax return, however, you will need to file an amended return for this year’s tax year. While you are not required to do so by April 17, 2018 , if you owe additional tax, if you don’t pay the additional tax by April 17, 2018, then interest will accrue on the tax due until paid off. Please see this FAQ on how to prepare the amended return :

To Get Prior Tax Year Information

You may request a transcript of your New York State wage and withholding totals for a previous year. Once we verify your identity, we will mail you a New York State wage and tax transcript for each employer who reported wage and tax information to us. The information will include the following:

- tax year

Don’t Miss: Is Heloc Interest Tax Deductible

How Can You Tell If Youre An Employee Or Independent Contractor

Beyond tax forms, the IRS says the difference between an employee and an independent contractor lies in control of the working relationship. Caregivers have to come to a familys home on the days theyre told to come, work the hours theyre told to work and follow the procedures that the family feels are best to care for their loved ones, says Tom Breedlove, Sr. Director of Care.com HomePay. Because the family is in control of these details, theyre a household employer and their caregiver is their employee.

Someone who is an independent contractor lets a family know when they are free to work and comes when it is convenient for them to do so. They would complete a job on their terms and usually have several other families they are working with simultaneously. They also have the ability to find other workers to fill in for them if they are unable to work, which employees are almost never allowed to do.

Use Irs Form 4852 To File Your Return

If you still don’t receive the W-2 you need from your employer, you may prepare a substitute W-2 yourself to file with your tax return. To do this, you must complete and file with your return IRS Form 4852, Substitute for Form W-2 or Form 1099-R. The IRS automatically sends you a copy of this form along with a letter containing instructions when you make a phone call as described in Step #2 above.

To complete Form 4852, you’ll need to list your total wages, tips, and other compensation you received from the employer, as well as the amount of taxes it withheld from your pay and sent to the IRS. You can use your pay stubs to figure this out. This is why it’s a good idea to always save your pay stubs.

If you receive the missing or corrected Form W-2 after you filed your return and you discover you made a mistake on your Form 4852 that you need to correct, you’ll need to file an amended tax return for the year using Form 1040X, Amended U.S. Individual Income Tax Return. Your amended return can take the IRS up to 16 weeks to process. So, if you’re owed a refund, it may be delayed.

Also Check: How To Avoid Federal Taxes

Why Would There Be Withholding On A 1099

The IRS determines if a person or business paying compensation to another person or business has an employee or contractor relationship. Generally, the type of income statement form issued depends on the relationship . As it relates to income tax, an employee relationship requires an employer to withhold on wages in a contractor relationship, the worker is responsible for their own income tax. Michigan follows these federal guidelines. For guidance on determining of you have an employee or contractor relationship with someone who works for you, refer to IRS Publication 15, Employers Tax Guide and the Michigan Unemployment Insurance Agency Fact Sheet 155.

Generally, a contractor can request withholding from their pay. The business receiving contractor services could agree to withhold on the contractors behalf.

How To File Taxes Without A W

Its that time of year again.

The deadline for employers to provide W-2 forms to their employees is February 1, 2021. . But sometimes, for various reasons, employers do not provide W-2s. In some cases, a business has had to close its doors and has chosen not to pay for its former employees to receive W-2s. So, whats a taxpayer to do?

Don’t Miss: How Can I Pay Tax Online

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Find Out What To Do If You Have Problems With Your W

By Stephen Fishman, J.D.

Employers are supposed to provide all their employees with a copy of a completed IRS Form W-2, Wage and Tax Statement, by January 31. This form is used to report wages, tips, and other employee compensation to the IRS and state tax agencies, as well as the amount of employee Social Security and income tax withheld. You need this form to complete your tax return. By the way, failure to receive a W-2 from your employer does not excuse you from filing your income tax return, nor does it extend the deadline for filing.

What should you do if you don’t get your W-2 by January 31 or it contains information that is wrong? Don’t worry, this is a common problem. Some employers have lousy bookkeeping, or your employer may have gone out of business or been acquired by another firm. If you moved, your employer may not have your new address. The IRS has a three-step approach you should follow.

Read Also: How Much Do I Need To Make To File Taxes

What Is A 941 Form

Use Form 941, also titled Employers Quarterly Federal Tax Return, if youre an employer, to report income taxes, Social Security tax or Medicare tax withheld from employees paychecks and to pay the employers portion of Social Security or Medicare tax. Youll need to fill this out four times a year by these deadlines: April 30, July 31, Oct. 31 and Jan. 31.

Best for:Employers.

How Will This Affect My Taxes

Workers pay a 15.3% FICA tax, which is used to fund Social Security and Medicare. As an employee with a W-2, you pay 7.65%, and your employer pays the other 7.65%.

As a contractor with a 1099-MISC, however, youre responsible for the full 15.3% of the self-employment tax, and you can deduct the one half of the self-employment tax on your personal tax return .

While your tax return is more complicated as a freelancer, you gain flexibility and autonomy, and a greater degree of control over the work you do.

The new tax law puts new limits on some business expenses, including meals, entertainment, and transportation costs. However, the Tax Cuts and Jobs Act lowers tax rates for seven income tax brackets, which means that taxpayers will have a lower tax liability on each dollar of taxable income.

The limits on business expenses will increase taxable income, while lower tax rates will reduce the tax liability on a given amount of income. These changes will produce a variety of outcomes for taxpayers, depending on your personal situation.

As an example, the deduction for state and local taxes is now limited. Taxpayers cannot claim more than a $10,000 deduction for the aggregate of property taxes and either income or sales taxes. As a result, individuals in states with a high rate of state taxes will have their deductions limited, and their tax liabilities will be higher.

Also Check: What Is The Pink Tax

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

What Is The Minimum Amount For An Employee To File A W

As an employee, you should always include your Form W-2 with your tax return when you file. If you file electronically, this might include copying the information into an electronic form rather than attaching the actual form.

All of your wage income is potentially taxable, so you should include all of your W-2s when you file. You cant ignore wages under a certain amount, and the proper way to enter them is to include each W-2 separately.

Note that in some cases, you may not be required to file a tax return. This is usually when your total income is less than the standard deduction.

Also Check: Are Nonprofit Organizations Tax Exempt

Not Every Taxpayer Receives A Form W

Freelancers and independent contractors receive Form 1099-NEC, another kind of informational return for non-employee compensation. This form is new for tax year 2020 as all income earned by independent contractors or freelancers in prior years was reported on Form 1099-MISC.

There are other types of 1099 returns for investment income like capital gains, dividends and interest all of which count as income.