What Tax Forms Do Food Delivery Drivers File

As a self-employed, you have to fill in the T2125 form or attach it with your personal Income-tax return . T2125 form particularly is to calculate details on your earnings and your expenses during the year to CRA. The end product of that form is the net income, which is the taxable income. For example, if you made $10,000 as gross income on Uber Eats including your tips, and your deductions were $2000 and all the expenses were $4000, so your net income will be $10,000 $2000-$4000 = $4000, which is taxable income.

The next thing is What kind of expenses can you deduct.

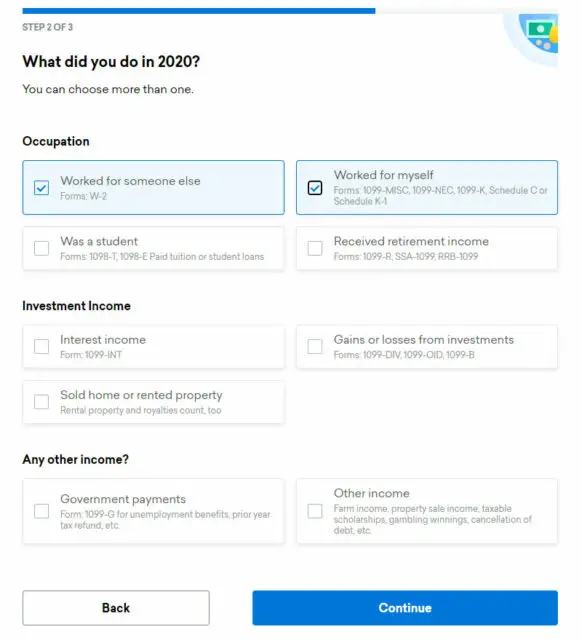

How Do I Report Uber On Turbotax

If youre already signed in to your TurboTax account and working on your return:

If You Only Do Food Delivery Gst Not Required

If youre a food delivery driver you must have an ABN, but you do not have to register for GST.

You may have heard that Uber drivers must register for GST, but that tax law only applies to people who drive passengers, not food. As a food delivery driver, normal tax rules apply, and you only need to register for GST if you earn more than $75,000 per year, which most drivers wont. So generally speaking, GST registration for UberEats is not required.

If you are not registered for GST then you do not have to lodge a BAS. BASs are only for people who are GST-registered, so it does not apply to UberEats or food delivery drivers .

You will need to declare your food delivery income and pay income tax on your end of year tax return. So keeping records of your expenses to reduce your tax bill is important. More on this below.

Recommended Reading: Are Tax Id And Ein The Same

What If I Only Drive Part

If youre doing rideshare part-time on top of another job, this deduction also only applies to your rideshare income and not the wages from your job.

For example, if you make $50,000 a year at a job that you get a W-2 from plus $5,000 from rideshare driving, then youd get an additional deduction of $1,000.

You May Like: Finding Your Ein Number

Local Tax Prep Office

Another option you have when filing your taxes is to go to a local tax preparation office. There are many popular franchises with trained accountants and tax preparers who can help file all your tax documents.

While the staff at local tax preparation offices are often trained and certified, all of them might not be accountants and their experience may be varied. Also, you probably wont get to choose who you work with to file your taxes unless you know someone personally and request to meet with them.

Recommended Reading: How To See My Past Tax Returns

Uber Eats Taxes: Your Complete Guide

Posted on – Last updated: December 14, 2022

Sponsored:

How do taxes work for Uber Eats independent contractors? What’s different about them, and how are they similar to ordinary taxes?

Let’s take a look at nine crucial concepts that will help you understand how Uber Eats taxes work. We’ll examine how things are different as a self-employed independent contractor and point the way to additional resources that will help you get the additional details you need.

Taxes for Uber Eats and other gig work don’t have to be a big mystery. They seem intimidating. However, if you avoid the topic, you could be stuck with a massive tax bill on tax day. That can lead to penalties and interest charges with the IRS. We’ll walk through the things you need to know to avoid tax trouble.

Independent contractor taxes are essentially business taxes. My years of managing finances for small companies, non-profits, and my own businesses forced me to understand these concepts. I felt I could use that experience, along with my five years delivering for Uber Eats and other gig companies to help make sense of taxes for fellow delivery drivers.

The beauty of delivering for Uber Eats is it’s a great way to make money. But whether we do this as a side hustle for some extra money or as full-time delivery drivers, we have to think about taxes at some point.

Introduction To Income Taxes For Ride

In accordance with the rules and regulations outlined by the Canada Revenue Agency , Uber drivers, Uber Eats, Lyft, Skip the dishes or other ride-sharing drivers are self-employed and are required to file their Canadian income taxes as being self-employed. That means that in addition to the usual income tax forms, the Income Tax and Benefits Return, you will need to report your self-employed income on Form T2125, Statement of Business or Professional Activities.

You May Like: Doordash On Taxes

Also Check: When Will Tax Returns Be Accepted 2021

Keep A Logbook Of Your Ubereats Driving

If you use your car for deliveries, you MUST have a valid ATO logbook if you want to claim your fuel and other car expenses. The logbook is required by the ATO as evidence of the percentage of car expenses you can claim.

Without a logbook, youll be restricted to the cents per kilometre method to claim your car deductions. This method allows you to claim a maximum of 5,000km at a set rate, so your total deduction is quite limited. Here are the rates:

- 2021-2022: the rate is 72 cents per km, so your maximum claim is 5,000km x 72c = $3,600

- 2022-2023: the rate is 78 cents per km, so your maximum claim is 5,000km x 78c = $3,900

If you only drive a little, then this might be fine for you, and its much easier to use the cents per km method rather than keeping a logbook and keeping all your fuel receipts. But if you drive a lot, this could be much less than your actual expenses, and result in a bigger tax bill.

Here are the essentials of keeping a logbook:

Our Free Uber Spreadsheet also includes an ATO-compliant Logbook Spreadsheet which does all the adding up for you and calculates your UberEats logbook percentage. It also includes an expense tracker spreadsheet to help you maximise your UberEats tax deductions.

If you prefer a physical paper logbook we recommend the Zions Pocket Logbook, which you can buy from Officeworks for under $7. Using an app is also fine, as long as you are still recording your odometer readings at the start and end of every trip.

Profits Added To Other Income Determine Your Income For Your Tax Form

Again, I go back to the thing about your profits are your income.

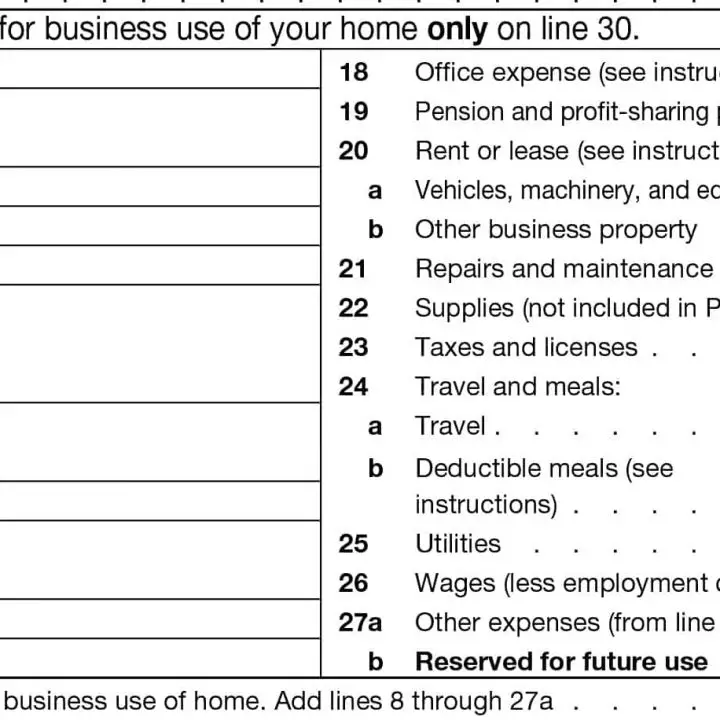

Now that you have put your income into the income in Schedule C, then added up your expenses in the expense part of Schedule C, the difference is your profit. That profit now becomes your income from your business.

If Uber Eats is your only source of income, that profit from Schedule C is the one thing that goes in the income side of your 1040 form.

If you have other forms of income such as investment income, W2 income, etc, all of that gets added up together with your business income to become your total income. This goes into line 9.

You May Like: How Much Taxes Deducted From Paycheck Mn

How Can I Write Off My Car Expenses

Once you have received the relevant 1099 forms, it’s important to compile a list of all your deductible business expenses. This information will be used to complete Schedule C, which describes your Uber Eats business’s income and losses. Your car-related expenses are likely to dominate your overall business expenses. You can deduct them using either by using the actual expense method or standard mileage method.

Wrapping Up: Is Uber Eats Worth It

Uber Eats is a convenient way to make some extra cash if you have the vehicle and the time to dedicate.

Though there are some problems that youll encounter, thats the case for any place of employment.

Overall, its worth it to drive for Uber Eats, and the sign-up process is quick and easy.

Whats more, you can drive for both Uber and Uber Eats if youre trying to maximize your profit.

Visit this website today to get started as an Uber Eats driver!

Don’t Miss: How To Do Crypto Taxes

Tracking The Mileage Deduction

Most food delivery apps DO NOT track how many miles youre driving when youre online. If you dont track them yourself, you will pay more in taxes. You can only use mileage deductions for cars.

There are two ways to track your mileage deduction. If you drive a car, you can choose between either the standard mileage or actual expenses method.

Tracking actual car, truck, and bike expense tax deductions is a more complicated method than using standard mileage. In addition to tracking your business and personal mileage, youll need to track all your car expenses, such as gas, repairs/maintenance, insurance, license fees, parking fees for business, tires, car washing, lease payments, towing charges, and auto club dues. In addition, you can deduct a portion of your car as business use and deduct the depreciation of your cars value. See the page for actual car expenses to learn more.

Deducting Personal Or Business Mileage That You Cant Prove

You need to be able to prove every penny that youre claiming. You wont have to submit that information upfront, but youd better be able to provide evidence when and if the IRS asks. Keep in mind, you cant take the standard deduction and deduct expenses as well. Choose one or the other.

The standard deduction includes wear and tear on your vehicle. If you claim the standard deduction, you cant also submit for having to replace your tires or the cost of your oil changes.

Don’t Miss: What Is The Property Tax In New York

Does Uber Eats Pay For Gas

Uber Eats lets you make money by completing food deliveries in your area. In this regard, its similar to driving for companies like DoorDash or Grubhub. But, Uber Eats doesnt pay for gas either. Once again, youre an independent contractor and are therefore responsible for handling your own operating expenses.

How Much Should I Set Aside For Taxes With Uber

The amount youll pay depends on the amount and types of other income you have, your filing status, the tax deductions and credits youre eligible to claim, and your tax bracket. A good rule of thumb is to set aside 25-30% of your net income to cover self-employment and income taxes.

Don’t Miss: How Do I Pay Estimated Quarterly Taxes

Does Uber Eats Keep Track Of Mileage

What miles can you track for your delivery for Uber Eats and others? In a nutshell, if its for your delivery work, you can track it. Here it is in a nutshell Any miles you drive on the way to pick up food, on the way to deliver, in between deliveries, or even while driving while looking for an order are claimable.

How Your Tax Impact Affects If You Get A Refund Or Have To Pay In

Like I said earlier, there’s so much more involved in your personal taxes. We can’t completely try to cover that.

Earlier I said there were three main parts of the tax filing process: Figuring out the taxable income, determining the tax bill, and applying credits and payments to that bill.

The tax impact calculator figures out how much higher the tax bill will be because of your business earnings. It doesn’t get into the payments and credits.

The higher the tax bill, either the more you pay in or less you get in refund. All that depends on your payments.

A tax credit acts like a payment. That’s different from a deduction, which only reduces taxable income.

Add up any money you had withheld from paychecks, any estimated payments you sent in, and your tax credits. If the total was more than your tax bill, you get a refund. If it’s less, you pay the difference.

It’s a little more complex than that, as some tax credits don’t lead to a refund, but you get the idea.

Think about it this way: Do you have an idea what you would normally get back without your independent contractor income? Or would you normally pay in?

That’s the part that gets changed by the tax impact.

If you’d normally get a $1,000 refund and your tax impact is $2,000, now you’d end up paying in $1,000 instead. If you’d normally get a $5,000 refund, that $2,000 tax impact would reduce that to $3,000.

You May Like: When Are Quarterly Estimated Taxes Due

Everything You Need To Know About Uber Income Tax And Hst

Uber is a ride-sharing platform that many vehicle owners have turned to for an income. From extra money during spare hours to full-time work, lots of people have found that driving for Uber is profitable . Not everyone who begins offering rideshare services on the platform, however, realizes that they effectively become their own business owner the minute they get paid for a ride.

When you begin driving for Uber, you assume the role of a business owner because you arent an employee of the platform. This isnt inherently a bad thing, but it does mean you can get into trouble if you mismanage certain aspects of your efforts. Specifically, there are financial items related to income tax and HST for Toronto Uber drivers to take care of or else theyll face penalties and consequences that could be difficult to get out of.

Heres a guide to income tax for Uber drivers and HST in Toronto.

Uber Eats Taxes: How To File Taxes For Uber Eats And Tax Forms

If you’re one of the thousands of Uber Eats drivers who started this year, it may be the first time that you became your own boss, setting your own working hours and making innumerable decisions to boost your business’s performance. It will also be the first time that you will have to file taxes for self-employment income.

Therefore, it is nothing new if you ask yourself, how to file taxes for Uber Eats? It turns out filling your taxes as an Uber Eats driver, just like Doordash Drivers and many other delivery services, can be a somewhat tricky business. Therefore, there are a number of important things that you must know to file your taxes accurately and, more importantly, to reduce your tax expense.

You May Like: How Will I Know If I Owe Taxes

How Do Food Delivery Couriers Count Income

You must report all income you earn, even if you dont receive any tax forms from GrubHub, Postmates, DoorDash, or UberEATS. This includes income from any source, no matter how temporary or infrequent. Since you may not receive a tax form for all income sources, its important to be able to track your own income.

If you do not report all income, you may run into problems with the IRS in the future. The IRS sometimes audits taxpayers based on tax returns from the past three tax years . An audit means that the IRS will review your financial records to make sure that income is reported correctly and that it matches what youve submitted on your tax return.

You will likely receive Form 1099-NEC from Grubhub, Postmates, and DoorDash if you earn more than $600 during the calendar year.

UberEATS reports income differently than the other platforms. You will likely receive Form 1099-NEC if you earn more than $600 in trip supplements, quests and bonuses, and referral fees.If you earned at least $20,000 and made at least 200 deliveries, you may also receive Form 1099-K.

Form 1099-K income will not be reduced by any fees or commission that UberEATS charges you. You will need to report these fees under your business tax deductions. Otherwise, you will pay taxes on more income than you should.

Sample 1099-NEC:

Sample 1099-K:

Cleaning Fees And Other Reimbursements

Cleaning fees, toll reimbursements, and similar payments are also part of your business income. They will be included on your 1099, and you should not subtract them when you enter your income on your tax return.

Dont worry, you wont pay taxes on cleaning fees or reimbursements that correspond to business expenses you had to pay.

You can separately deduct cleaning costs, tolls, and other expenses. When you calculate your net income, the income and deductions will cancel each other out.

The only way you would owe taxes is if you spent less than Uber reimbursed you. In that case, you made a profit and would have to pay taxes on the extra amount.

If it cost you more to clean your car than what Uber gave you, you can deduct your full costs and the extra deduction will offset some of your other income.

Don’t Miss: How Long Does It Take To Get Taxes Done

Do Uber Drivers Get A 1099

Uber drivers are described as self-employed individual “partners” and fall under 1099 tax rules. For driver services, this falls under 1099-K rules and any other payouts would land under the 1099-MISC rules. These other payouts could include referral fees, bonuses and more. You can procure your needed Uber driver tax information by logging into your Uber partner portal.