Requirements To File If You’re A Dependent

People who are claimed as an adult or child dependent have to file a tax return in some situations. The trigger for filing is largely based on the amount of earned or unearned income the person had during the tax year.

Unearned income is taxable interest, ordinary dividends, and capital gains distributions essentially investment income. It also includes unemployment compensation, taxable Social Security benefits, pensions, annuities, and unearned income distributions from a trust.

Earned income is salaries, wages, tips, professional fees, and taxable scholarship and fellowship grants. Unearned income and earned income combined equals gross income.

Unmarried dependents are required to file a tax return if any of the following were true for 2021:

- Unearned income exceeded $1,100

- Gross income exceeded the greater of $1,100 or earned income plus $350

- Unearned income exceeded $1,100

- Earned income exceeded $12,550

- Gross income was at least $5 and spouse files a separate return with itemized deductions

- Gross income exceeded the greater of $1,100 or earned income plus $350

Quick tip: Taxpayers who claim a child who was under age 19 at the end of 2021 or a child who was a full-time student under age 24 can opt to include their dependent’s income on their return rather than having the child file their own return. If certain conditions are met, such as the child’s only income was from interest and dividends, including capital gain distributions, use Form 8814.

Income Tax Rates And Bands

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of £12,570.

Income tax bands are different if you live in Scotland.

| Band | |

|---|---|

| over £150,000 | 45% |

You can also see the rates and bands without the Personal Allowance. You do not get a Personal Allowance on taxable income over £125,140.

Estimated Distribution Of 2021 Income Taxes

| Individual income |

|---|

| 25.80% |

About 53% of Americans had an annual household income of less than $75,000 in 2019, according to the latest data from Statista. Median household income in the U.S. that year was about $68,700, according to the Federal Reserve Bank of St. Louis.

“The group not paying federal income taxes in any given year tend to be moderate income with children, as well as older people, who may not have earnings that they are paying tax on,” Maag said.

As for details of the credits: The child tax credit is enhanced for 2021 in several ways, including by raising the per-child payment to $3,000 from $2,000 for families with income below certain thresholds , with an extra $600 for children under age 6. Children age 17 also qualify for the first time.

Those child tax credits will be advanced via direct payments beginning in July.

The earned income tax credit for childless workers also has been expanded by boosting the maximum credit in 2021 for that cohort to $1,502 from $543, according to the Tax Foundation. The benefit would be realized when taxpayers file their 2021 returns in spring 2022.

The bill also raises the income level at which the earned income tax credit reaches its maximum, and changes the phaseout to begin at $11,610 instead of $5,280 for individual tax filers. The ages for qualifying for the credit also are changed for this year: The minimum age is 19 instead of 24 and the maximum age of 65 would be eliminated.

Read Also: Where To Find My Agi On Tax Return

How Much Can A Dependent Child Earn In 2021 Without Paying Taxes

Earned income only A child must file a tax return if their earned income is more than the standard deduction. For this year’s filing, the standard deduction for a dependent child is total earned income up to $12,550. Anything earned, as in worked, under this does not need to be registered, but anything over does.

How Do You File Taxes If You Get Paid In Cash

You may get paid in cash for a variety of services. These can be anything from tutoring, gardening, and snow removal, to building websites or babysitting. Regardless of what your cash-based income is, filing taxes is probably easier than you thought.

To file your cash-based income taxes, you follow the same procedure as you normally would for other income types. To file your tax return, you will want to request a Form 1099-MISC from your employer, if you dont already receive a W-2 form from them.

Even if you dont receive a 1099-MISC, you are still required to report the income. If you receive cash payments as part of a business, youll report the amount received on Schedule C attached to your Form 1040. If youre not in a trade or business, report the cash received on Line 21 of Schedule 1 attached to Form 1040.

Don’t Miss: How To File An Extension Online For Taxes

If Your Child Has Earned Income Only

A child who has only earned income must file a return only if the total is more than the standard deduction for the year. For 2022, the standard deduction for a dependent child is total earned income plus $400, up to a maximum of $12,950. So, a child can earn up to $12,950 without paying income tax.

Example: William, a 16-year-old dependent child, worked part-time on weekends during the school year and full-time during the summer. He earned $14,000 in wages during 2022. He didn’t have any unearned income. He must file a tax return because he has earned income only, and his total income is more than the standard deduction amount for 2022.

Filing Rules For Dependents

There are certain rules for dependents regarding their:

- Relationship to the taxpayer

- Support from the taxpayer

The IRS provides specifics around each requirement. For example, a potential dependent may meet the age requirement if theyâre under 19 years old, under 24 years old and a full-time student, or any age with a permanent disability.

If a dependent has a job and earns money, they could be required to file and pay taxes for income above a certain amount. That could include:

- Earned income from a job where they received a salary, hourly wages or tips

- Unearned income from things like investment dividends, investment interest or unemployment benefits

Not all dependents may be required to file, but it could be beneficial if they paid income taxes or qualify for tax credits, for example.

Recommended Reading: Where To Find Paper Tax Forms

How Much Tax Do You Pay On Hobby Income

If your activity is classified as a hobby, you will have to report any income you make from that hobby on your personal tax return, Form 1040, on Schedule 1, line 8, Other Income. The income reported will be subject to income tax but not subject to self-employment tax as it would be if it were …

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

You May Like: How Many Years Can I Go Back And File Taxes

Other Tax Filing Requirements

âOkay,â youâre saying to yourself, âI donât make enough to have to pay taxes! That means Iâm done, right?â

Not necessarily. Youâll still need to file if:

- You owe Social Security or Medicare tax on tips you didn’t report to your employer, or on wages you received from an employer who didn’t withhold these taxes

- You owe uncollected Social Security, Medicare, or railroad retirement tax on tips you did report to your employer

- You owe taxes on on group-term life insurance coverage over $50,000

- You owe recapture taxes

- You received Archer MSA, Medicare Advantage MSA, or health savings account distributions

- You had wages of $108.28 or more from a church or qualified church-controlled organization thatâs exempt from employer Social Security and Medicare taxes

- You, your spouse, or a dependent received advance payments from the health coverage tax credit

Here’s Who Needs To Make A Payment

Taxpayers who earn or receive income that is not subject to tax withholding such as self-employed people or independent contractors should pay their taxes quarterly to the IRS.

In addition, people who owed tax when they filed their current year tax return often find themselves in the same situation again when they file the next year, so they may want to consider making estimated tax payments. Taxpayers in this situation often include:

- Those who itemized in the past but are now taking the standard deduction

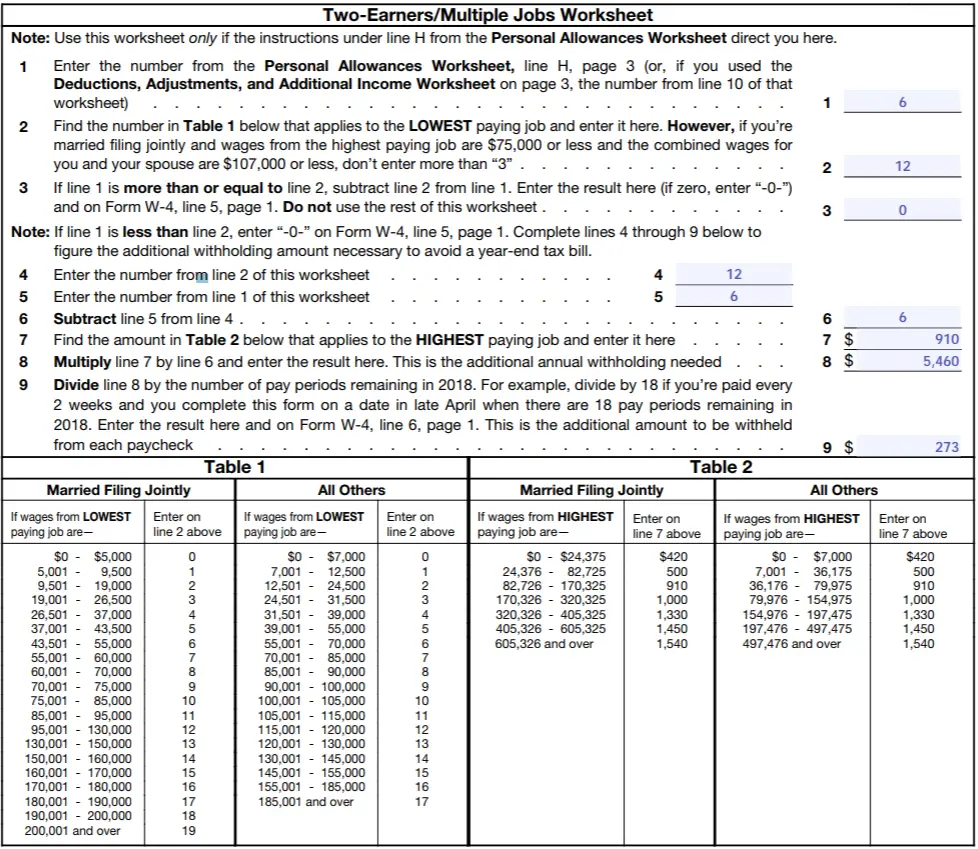

- Two wage-earner households

- Employees with non-wage sources of income such as dividends

- Those with complex tax situations

- Those who didn’t increase their tax withholding

You May Like: How To Claim Mileage On Taxes

Carry Over Tax Credits And Deductions

When you file your tax return, non-refundable tax credits are not paid to you as a refund.

However, refundable tax credits and deductions can be payable to you in the applicable tax year.

Some tax credits or deductions may be applied to a previous year or carried forward to a future year.

An example of this type of tax deduction is the capital gains deduction.

Who Needs To Pay Tax

Students working while studying may need to pay Income Tax and National Insurance. This page can help you find out:

- if you need to pay Income Tax and National Insurance

- what happens if you work in the holidays – in the UK or abroad

- how to register if you are self-employed

- who to contact if you are a foreign student working in the UK

You May Like: Can I Get My Past Tax Returns Online

Income Thresholds For Taxpayers 65 And Older Are Higher

If you are at least 65 years old, you get an increase in your standard deduction. You also get an increased standard deduction if:

- Or your spouse is also at least 65

- Or if your spouse is blind

The largest standard deduction would be for a married couple that are both blind and both over 65 years old.

Having a larger standard deduction can allow you to have more income than someone under age 65 and still not have to file a return. TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

You May Like: What Form To Use To File Taxes

Use Tax On Out Of State Purchase Payments

Use tax is a 6.25% tax paid on out-of-state or out-of-country purchases that are used, stored or consumed in Massachusetts and on which no Massachusetts sales tax was paid.

Unlike the 6.25% sales tax, which is collected by sellers, use tax is generally paid directly to the state by the purchaser.

Individual use tax is due by April 15th of the following year after your purchase. Learn more.

How Much Can You Earn Without Paying Tax

Filing taxes is undeniably, the most daunting task for most individuals and businesses. Yet, taxes are not something you can decide whether or not to pay. However, you can still catch hold of methods that help you make tax payments simpler.

Based on your income, age, and the status of filing, you can have it a lot easier to know if you have to pay taxes, and how much. Lets dive into these aspects to estimate how much exactly you will be paying ultimately.

Read Also: Who Qualifies For Ev Tax Credit

Refunds And Credit Of Overpayments

When you pay more taxes than the amount of taxes determined to be due an overpayment may be generated on your account. An overpayment may also be generated if you are entitled to a refundable credit that exceeds the amount of tax due. Additionally, when you file an amended return or an abatement application to reduce the amount of tax due, and you previously paid more than what is now shown as due, an overpayment may be generated.

An overpayment claimed on a return may be applied as a credit for your next years estimated tax or you may request that it be refunded to you. An overpayment may also be offset or intercepted by the Department of Revenue and applied to another liability. However, often an overpayment is refunded directly to you.

Most refunds are claimed on an original return and will be issued automatically by the Department. For e-filed returns the turnaround time is about 6 weeks but for paper returns it could take up to 10 weeks. You must claim your refund or credit within a certain time period, as further detailed below. Also, the Department of Revenue must issue refunds within a certain time period or pay interest on the amount of the refund. This page contains important information on the time limitations for claiming a refund and on the calculation of interest.

Visit Refunds and credit of overpayments to learn more.

How Much Can You Earn Before Paying Tax In Canada

First of all, we would like to warmly welcome you to our site. Here you will definitely be going to have the best information about how much you can earn before paying tax in Canada 2020.

After reading this article properly we hope you will understand and everything that you should know before paying the taxes in Canada in a better way. Here are the best facts you will for sure going to learn from this fully informative article.

Basically, in Canada, there is a very simplistic rule for paying taxes, the more money you will earn the more income taxes you have to pay. Before paying the tax you would have to calculate Canadian income tax and it totally depends upon your income. If the income is increasing then the taxes will also increase and vice-versa.

There are two primary types of taxes in Canada:

- Provincial Taxes

You May Like: Where Can Seniors File Taxes For Free

How Much Can A Small Business Make Before Filing Taxes

All corporations are required to file a tax returneven if the business doesnt generate any income for the tax year. This includes LLCs that elect to be taxed as a C-Corp or S-Corp. If your business is a partnership, LLC, or sole proprietorship , the self-employment threshold appliesand you must file a federal income return and pay self-employment tax on any income above $400.

The type of tax return you file will depend on your business structure:

- Sole proprietorship: Form 1040 and Schedule C

- Partnership: Form 1065

- C Corp or S Corp: Form 1120

- LLC: Dependent on tax election

Deduction For Qualified Business Income

For owners of pass-through enterprises, the IRS now offers the qualifying business income deduction, or QBI deduction, in addition to small company tax deductions. If you are eligible, the QBI deduction enables you to take a further 20% off your small business revenue.

The QBI deduction is not accessible for C companies your small business must be a pass-through tax entity.

Recommended Reading: How To File An Amended Tax Return Turbotax

How Much Can Pensioners Earn

From 1 July 2019 you can earn up to $300 a fortnight if youre still working and you will not have this amount included in your income test for the Age Pension. This amount is known as a work bonus. The work bonus amount can be accumulated up to an amount of $7,800. You dont need to apply to have this done.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How To Do Llc Taxes Yourself